Ventus Energy Experience 2026 – Fast returns with double-digit yields and daily payouts

Ventus Energy is a platform specialising in sustainable energy production that was launched in 2024. It is not for the extremely small wallet, but is certainly very interesting. The first projects from the energy sector were listed with 18% returns and daily interest payments. Sounds crazy? Yes, there are certainly elements that confirm this, but we’ll come to that later.

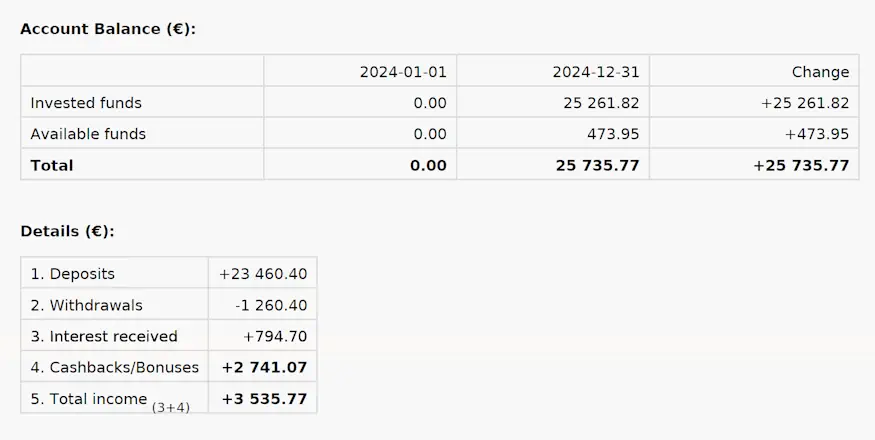

After the launch of the platform, I immediately took EUR 10,000 and invested it. Experience has shown that the first projects on a platform are always the ones that are maintained most carefully and there was an additional 5% “early bird” cashback + 1% cashback for registration. I didn’t have to be asked twice and immediately collected 600 EUR bonus for the 10,000 EUR.

Of course, I carefully evaluated the project for myself beforehand, which should be a prerequisite for every investor. I am now invested much higher and also a shareholder of Ventus Energy.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Ventus Energy?

- Ventus Energy Review – All important data at a glance

- Registration for investors

- Ventus Energy Review: How does the platform work?

- Is there an Auto Invest

- Is there a secondary market?

- In which countries can you invest?

- What projects can you invest in on Ventus Energy?

- What are the costs on Ventus Energy?

- What is the return on Ventus Energy?

- What is the minimum investment amount on Ventus Energy?

- Does Ventus Energy offer a buyback guarantee?

- Is there an app for Ventus Energy?

- Can you invest money in other currencies?

- How exactly do taxes work on Ventus Energy?

- Is there a tax statement on Ventus Energy?

- Is investing with Ventus Energy risky?

- How does Ventus Energy earn money?

- Is Ventus Energy profitable?

- What happens if Ventus Energy becomes insolvent?

- How reputable is Ventus Energy?

- How secure is Ventus Energy?

- How does Ventus Energy ensure that its business model works?

- Are there defaults on Ventus Energy?

- Is there deposit protection on Ventus Energy?

- Is Ventus Energy crisis-proof?

- Advantages and disadvantages of Ventus Energy

- Conclusion of my Ventus Energy review

What is Ventus Energy?

Ventus Energy was founded in Estonia in 2024, but operates out of Riga, Latvia. The platform acquires and develops regulated energy infrastructure companies in the renewable energy, utilities and sustainability sectors. It is currently the only platform with this type of business model on the market.

In principle, power plants are bought or built and their operation is optimised or made operational so that they are able to generate an ongoing cash flow. The money for this is to come from private investors like us, among others (but not only).

The company is currently focusing entirely on Latvia, where the first power plant was acquired in 2024. More are to be launched in 2025. Ventus Energy owns 100% of the projects and does not work with external companies.

The concept is similar to that of Fintown with the Vihorev Group in the background, except that here the group is also the same platform (no separate companies). This has advantages in terms of risk, because while Fintown has a separation in the event of insolvency, Ventus Energy is liable with the entire group assets.

Ventus Energy Review – All important data at a glance

Before we go into the details of the Ventus Energy review, here is the most important data for you in one place.

| Started: | 2024 |

| Company Headquarters: | Riga, Latvia, but trading as Ventus Energy OÜ in Estonia |

| CEO: | Henrijs Jansons, there from the start |

| Regulated: | Not as a platform, but the energy market and therefore power plant production are. |

| Assets under Management: | Approx. 79,0 million EUR |

| Financed Loan Volume: | Approx. 91,7 million EUR |

| Number of Investors: | Approx. 5.600 (active investors) |

| Return on Investment: | Currently approx. 17.6% according to the platform’s official statistics. |

| Buyback guarantee: | Yes, Ventus Energy has a payment obligation that takes effect after 90 days. |

| Minimum investment amount: | 1.000 EUR |

| Auto Invest: | No |

| Secondary Market: | No (but early project exit possible) |

| Issue of a tax certificate: | Yes |

| Investor loyalty program: | Yes, the first 100 investors receive 2% extra interest from EUR 100,000 investment + loyalty program up to 1%. |

| Starting bonus: | Yes, 1% of the amount invested after 60 days via this link* (immediate credit). |

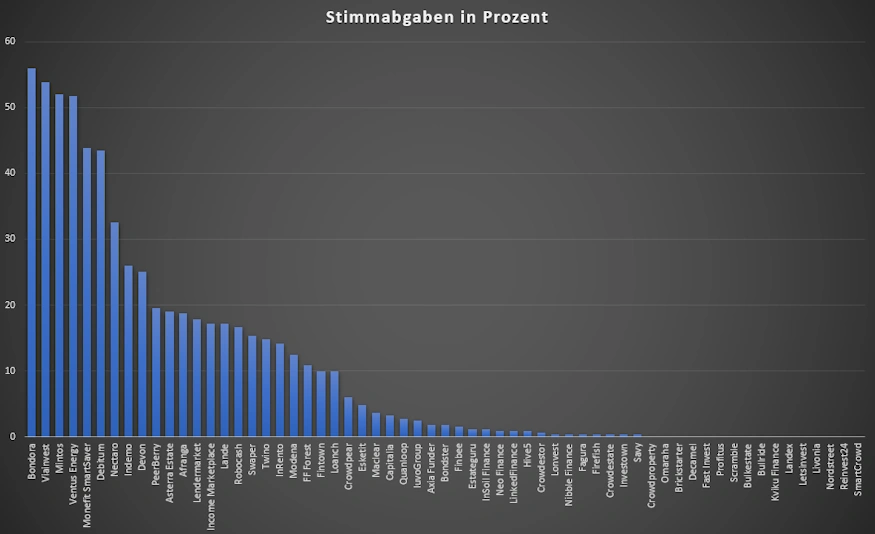

| Rating: | Place 16 | Refer to the public rating. |

| Community Voting: | 4th place out of 61 | See results (in German). |

| Last annual report: | No annual report published to date due to the company’s age. |

Ventus Energy experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Ventus Energy took 4th place out of 61 with 51.7% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Ventus Energy

Registration for investors

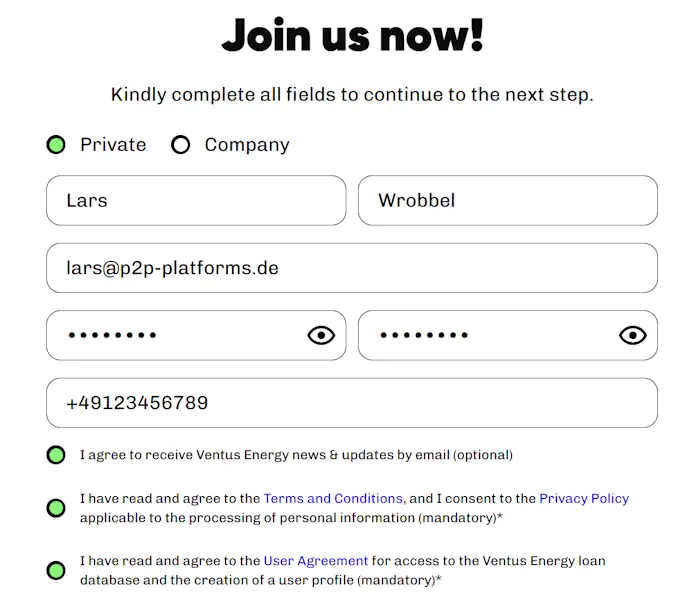

Registering on the platform is not particularly complicated. It consists of the following steps:

- Create an account by entering your e-mail address and password.

- Enter your personal data.

- Verification of your identity (e.g. with your identity card).

You can also register with your company if you have one and want to invest through it. After registration and payment, you are then ready to invest in your first energy projects.

Ventus Energy Bonus

Via my link* you will receive 1.0% cashback on all deposits you make in the first 60 days after your registration. The bonus will be credited immediately after the investment.

From time to time there are also limited-time bonus promotions at Ventus Energy. These are always listed promptly in my P2P platform comparison. After signing up, you should also see a large banner in your account with a timer running down. This tells you that the registration via my link has worked, as in the example below. If this is not the case, simply get in touch using the contact form.

If you use my link, you do not need to enter a referral code when registering!

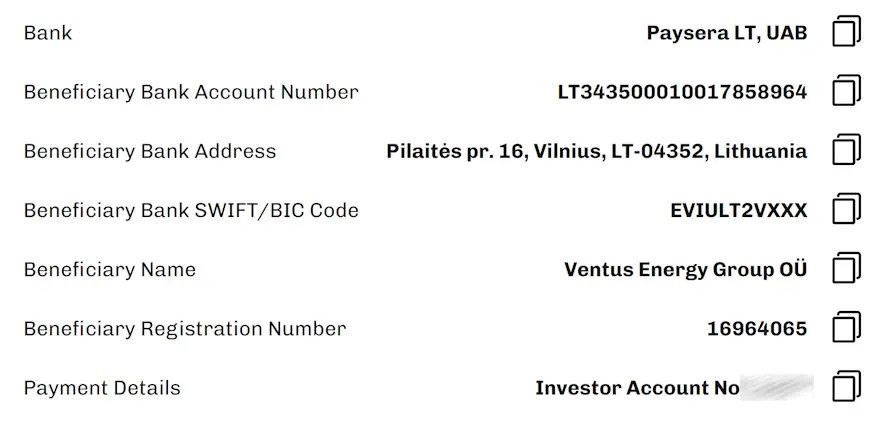

How do I deposit money?

As always, depositing money is the easiest step when investing money. In your account, click on “Deposit / Withdraw” and you will be taken directly to the deposit screen. Here you can then transfer money to the account stored there.

Please note that the transfer must come from a personal bank account. This will also be verified for subsequent payouts.

How do I withdraw money?

If you want to withdraw capital or surplus interest from Ventus Energy, you also go via “Deposit / Withdraw”, but then select “Withdraw” in the tabs at the top.

You will not be charged a fee for withdrawing the funds. The funds can only be withdrawn to a bank account that belongs to you. If you wish to register a new account for withdrawal, you must make a new deposit from a new personal account. Funds can be withdrawn from EUR 10.

Ventus Energy Review: How does the platform work?

After registering with Ventus Energy, you can use the “Invest” button to view existing projects and carry out your research.

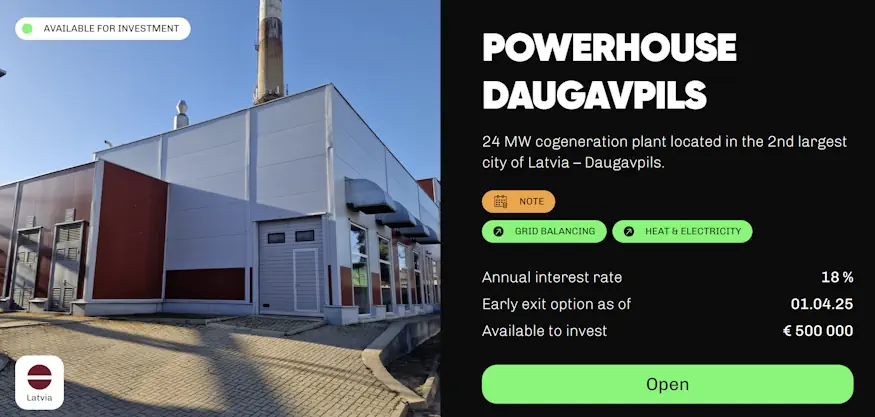

There won’t be too many opportunities to invest; after all, we’re talking about power plants here and not personal loans for televisions in Kazakhstan. It is therefore worth reading up on the projects in detail.

In addition to the financial prospects of the project, there is also a whole range of technical documentation, evaluation reports, links to various participating institutions and photos. Anyone who is really interested in the subject can read in depth.

You can also decide whether the interest should be reinvested directly in the same project or whether you want to have it paid out. Due to the initial sum and to see if everything works, I decided in favour of the latter. It’s also cool that you can decide and set this individually for each project.

This also increases the interest rate of the projects immensely, which you can see transparently on the portfolio page.

After your investment, the interest is credited to your account daily, just like with Bondora Go & Grow or Monefit SmartSaver. Only at a slightly higher interest rate.

Hint! If you would like to have your cashback paid out (this is normally added to the investment amount due to compounding) and intend to invest more than EUR 1,000, you should first make the minimum investment (EUR 1,000), then switch off compounding and only then invest the rest. In this case, the cashback will be credited to your available funds and will NOT go to the project.

Example: Deposit EUR 10,000, invest EUR 1,000, switch off compounding, invest a further EUR 9,000 and the cashback on the EUR 9,000 can be paid out directly.

Is there an Auto Invest

Since there will only be very few projects on the platform and investors should also deal with these, there is no Auto Invest on Ventus Energy. I also doubt that we will see this in the future.

Is there a secondary market?

There is no secondary market for Ventus Energy. However, similar to Fintown, you do not have to hold the projects until the end of the term. There is a minimum term after which you can withdraw your capital (the minimum term depends on the respective project, in the example above already in April 2025).

The way this works is that your claim is bought up by another investor as soon as they invest in the project. So there has to be a certain demand for you to get out of the project. Ventus Energy will not provide any interim financing.

In which countries can you invest?

You can only invest in Ventus Energy on the Latvian domestic market.

What projects can you invest in on Ventus Energy?

On Ventus Energy, you provide the company with money via a mezzanine loan, which is used for the construction, purchase, modernisation and operational expansion of power plants. This takes place on the platform in the form of notes (bonds).

These short-term bonds are issued by the respective legal entity for which the bond is intended (the power plant). This is wholly owned by the Ventus Energy Group.

According to Ventus Energy, the bonds offered will be issued in accordance with the Latvian Law on the Market for Financial Instruments. Detailed information about the bonds can be found in the respective project descriptions.

What are the costs on Ventus Energy?

Investing on Ventus Energy is free at all levels.

What is the return on Ventus Energy?

The return you can earn on Ventus is enormous. It is usually between 17 and 18% p.a. If you also take advantage of the regular cashback promotions, much more is possible. You can read about my own returns for the individual years in the statistics (German).

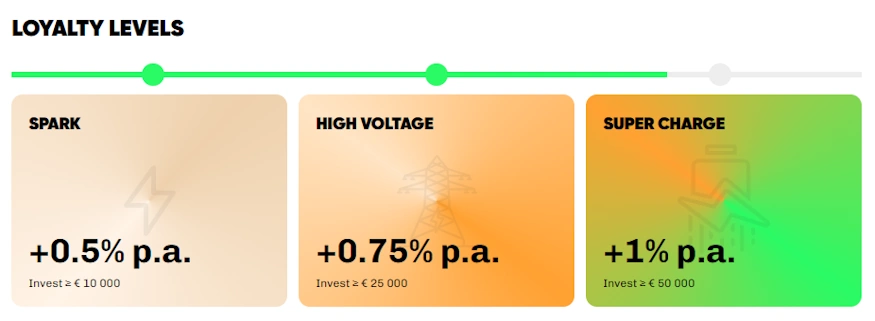

Since 2025, there has also been a loyalty program that allows you to enjoy additional benefits once you reach a certain amount. The tiers are as follows:

- For a total investment of EUR 10,000 or more, you will receive an additional 0.5% p.a.

- For a total investment of EUR 25,000 or more, you will receive an additional 0.75% p.a.

- For a total investment of EUR 50,000 or more, you will receive an additional 1.0% p.a.

What is the minimum investment amount on Ventus Energy?

The minimum amount for an investment in Ventus Energy is an impressive EUR 1,000. From conversations with the company, I learnt that they want to make sure that they do not work with super-small investors, as in their experience these cause the greatest support effort.

Does Ventus Energy offer a buyback guarantee?

Ventus Energy offers a payment obligation after 90 days. In principle, projects in which you invest can be defaulted. However, Ventus will repay the basic amounts and interest in any case, as long as it is possible. If this is no longer the case, even the nice payment obligation is of no use! So, as always, you can lose all your invested capital.

Is there an app for Ventus Energy?

No, Ventus Energy does not currently offer an app for smartphones.

Can you invest money in other currencies?

No, on Ventus Energy you invest exclusively in euros. There is also no currency risk within the projects.

How exactly do taxes work on Ventus Energy?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Is investing with Ventus Energy risky?

I cannot deduce much from my Ventus Energy experience so far, as I have only recently become active on the platform. In addition, Ventus Energy still has little track record, so we can only speculate about many things.

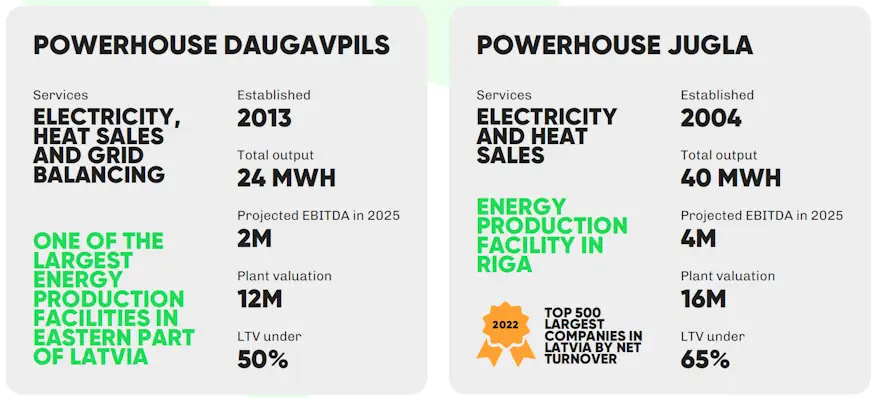

How does Ventus Energy earn money?

Financing is provided by the power plants that have been put into operation. There is currently one of these in Riga, which I attended the opening of myself. In addition, the owners also finance the business with their own money.

Each additional power plant increases the Group’s income, which also makes the platform more secure. Further operating projects are expected in 2025.

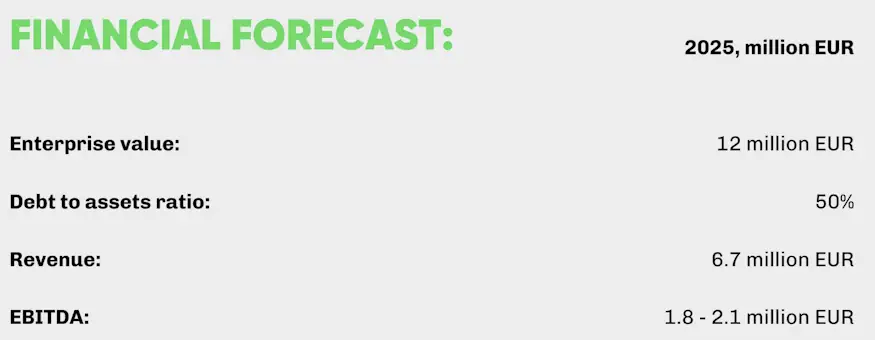

Is Ventus Energy profitable?

Ventus Energy has only just started, so there are no business results yet, only projections for the future. This also means that there is no profitability. However, it should be noted that the entire business model depends on the successful operation of the power plants.

What happens if Ventus Energy becomes insolvent?

If something happens to the platform, this will not affect your investments for the time being and they will continue to run. In the event of insolvency, an insolvency administrator will then take over the processing of the remaining projects and payments and distribute the funds accordingly.

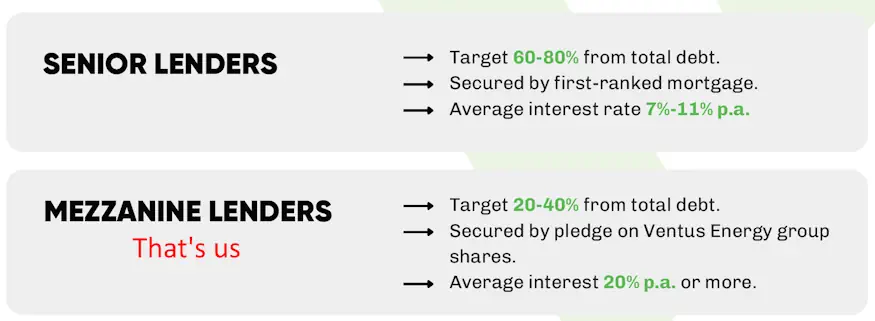

It is also important to know that there are 2 types of investors on Ventus Energy. The “senior lenders” outside the platform (e.g. banks) and the “mezzanine lenders” within the platform (that’s us). Mezzanine investors are not at the top of the “food chain” in the event of insolvency. But they do get a higher return.

We know from past experience that insolvency processes are lengthy and lack transparency. An insolvency of Ventus Energy is therefore a potential risk for your money!

How reputable is Ventus Energy?

Ventus Energy is a new platform with a professional team behind it. However, one person stands out who has not exactly stood for seriousness in the past. The Crowdestor CEO Janis Timma. He has repeatedly been accused of using investors’ money to finance high-risk third-party projects that then collapsed like a house of cards during the Covid-19 pandemic.

However, Janis Timma comes from the energy sector, has 12 years of experience in the field and the energy projects on Crowdestor (Crowdestor Flex) were a great success as far as I know. He is also the owner of a fully operational biomass power plant in Riga, which I myself saw from the inside years ago. Furthermore, Ventus Energy does not finance projects from third parties, but the company itself has control over all power plants.

Jani’s role at Ventus Energy is that of a CDO (Chief Development Officer). He is responsible for the search for favourable offers and for the grid balancing/heat generation strategy.

It should also be noted that the energy business in Latvia is highly regulated and that Janis Timma does not run the company alone, but is managed by Henrijs Jansons, a demonstrably capable CEO. Everyone is free to make their own judgement on this point. For me personally, this is not a stumbling block and there is not just black and white.

In December 2025, a report was published on a private blog that made various accusations against Ventus Energy. The company has strongly questioned these accusations and also alleged that this is part of a negative PR campaign, as a server was hacked at the same time and the article spread unnaturally quickly and was even sent to the CEO’s elementary school friends. In addition, three months earlier, I myself was demonstrably blackmailed with a publication in order to stop my reporting on Ventus Energy.

The company announced measures to have the allegations refuted by an external third party. This promise was kept and all accusations were refuted.

How secure is Ventus Energy?

It is not yet possible to draw any conclusions about the safety of Ventus Energy, as the track record is still very thin. Although the energy business in Latvia is regulated, various factors could of course lead to the power plants’ operating calculations no longer functioning and not achieving a positive result. For example, certain raw materials could become more expensive, etc.

It is therefore important that the power plants run profitably, as they are responsible for ensuring that bonds can be repaid to us investors and also banks. As private investors are subordinated, we would be the first to run into problems if the bill no longer adds up. But well, you can’t get decent two-digit returns without risk, that should hopefully be clear. Here you are investing in a vision of the future, among other things.

How does Ventus Energy ensure that its business model works?

Ventus Energy has specialised in 3 areas to ensure that the power plants run cleanly.

- Energy sales: The Group’s power plants are regulated electricity and heat producers in Latvia. They trade the electricity they produce on the leading electricity market in Europe – the Nord Pool exchange. Ventus Energy’s customers are large electricity consumers and/or traders, which ensures a stable and predictable income stream.

- Grid balancing: As renewable energies are often unpredictable, they increase the pressure on the grid to maintain a constant balance between supply and demand. This makes grid balancing increasingly important worldwide. The companies of the Ventus Energy Group are part of the grid balancing market.

- Heat generation: The power plants are connected to the municipal heating network of the respective region and there are contracts with the relevant local institutions for the long-term provision of services (for example, the Daugavpils power plant is connected to the district heating system of the municipality of Daugavpils).

Are there defaults on Ventus Energy?

No, there have not yet been any failures on Ventus Energy. I am also not aware of any problems with the projects currently in operation.

Is there deposit protection on Ventus Energy?

No, there is no deposit protection. Your funds held and invested on the platform are exposed to a default risk.

Is Ventus Energy crisis-proof?

No platform is completely crisis-proof! Ventus Energy has not yet experienced a crisis and was only founded after Covid-19 and the war in Ukraine.

Advantages and disadvantages of Ventus Energy

Before we come to a final conclusion about the platform, here is a summary of my pros and cons based on my Ventus Energy experience.

Disadvantages

- With Janis Timma, a person is on board who is generally not regarded as serious.

- The platform is not regulated.

- Subordinated mezzanine loans.

- High entry threshold (EUR 1,000).

- Very young company with a short track record.

Advantages

- Ventus Energy manages 100% of its own projects.

- Even if the platform is not regulated, the energy business itself is highly regulated.

- Daily interest payment, which can also be reinvested directly if required.

- Focus on sustainable energy generation.

- High returns possible that are significantly above sector level.

- Early exit possible.

Conclusion of my Ventus Energy review

The first Ventus Energy year went very well! The first power plant is also running smoothly and is now generating an extremely stable 18% return with daily interest payments. In the meantime, many more projects have been added.

When I was introduced to the project, I was quickly convinced (which I rarely am). That’s why I got in directly with a rather unusual starting amount, similar to Fintown, where I only started investing in 2024 (my investment there is also already over EUR 10,000).

The only stumbling block for me was Crowdestor founder and CEO Janis Timma, who I have known for years now. His Crowdestor platform was largely a failure for many investors and also a negative investment for me, but you shouldn’t label him as such.

He comes from the energy sector and has a high level of expertise here, and with Ventus Energy you have everything in your own hands. This is one of the reasons why the Crowdestor-Flex projects, which were mainly focussed on the energy sector, went extremely well and I know investors who made an outrageous amount of money from them.

I was also impressed by the ex-CEO of Debitum, Henrijs Jansons, who I have also known for years. Under his leadership, the Debitum platform has become successful again and I think he also has what it takes to make Ventus Energy successful. I see my investment here as a high-risk investment due to the age of the company and am prepared to lose it, but I assume that the decision was a good one. We will see.

However, my decision to invest here should in no way be taken as a recommendation. As always, you are responsible for your own actions and my decisions do not have to be your decisions!

Is there a Ventus Energy forum for discussions?

There is a closed Telegram group for investors. You will automatically receive access after registration.

Is there a Ventus Energy bonus or a referral program at the beginning?

Yes, if you register via a link on this blog, you will receive 1% of the capital invested in the first 60 days as a bonus.

I would be grateful if you would use my links in appreciation of this free contribution. There are no disadvantages for you, only advantages.

What alternatives are there to Ventus Energy?

The only alternative to Ventus Energy is Crowdestor’s Flex projects. However, as these will certainly no longer be continued due to the reestablishment of Ventus Energy, there is basically no exactly identical alternative. The concept and the projects are currently unique in the industry. You can find more alternatives in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Ventus Energy Review 2026 - 18% with energy projects

Detailed Ventus Energy experience for sustainable crowdfunding energy projects. Find out how you can benefit from double-digit returns.

5