Bondora Review 2026 – What you need to know about the P2P platform

On this website you will find my Bondora review to date. Bondora is the largest single position in my P2P portfolio with over EUR 100,000. I’ve been investing here since 2015, so I know what I’m talking about.

I’ve also visited them in person several times. Here you can find out everything you need to know about the Estonian P2P platform to get started. If you liked the report, you can get 5 EUR in Bondora starting credit from me. Thank you for your support!

Do you already have Bondora experience yourself or is there any information missing or outdated in this report? If so, I would be grateful if you could leave a comment. You can also find more P2P loan experiences on my blog.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What ist Bondora?

- All important data at a glance

- Registration for investors

- How does Bondora work?

- What is Bondora Go & Grow?

- Is there a secondary market?

- In which countries can you invest?

- In which loans can I invest on Bondora?

- What are the costs on Bondora?

- What is the return on Bondora?

- What is the minimum investment amount on Bondora?

- Does Bondora offer a buyback guarantee?

- Is there an app for Bondora?

- Can I also invest money in other currencies?

- Is there also a Refer a Friend program?

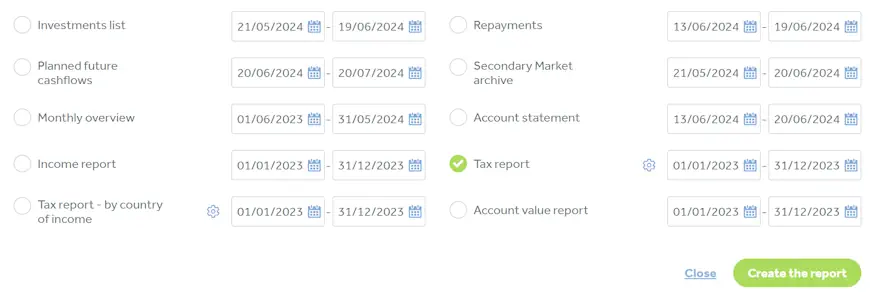

- How does the taxation work for Bondora?

- Is there a tax certificate on Bondora?

- Problems and solutions in dealing with Bondora

- Bondora Risk

- Bondora in times of crisis

- Advantages and disadvantages of Bondora

- Conclusion of my Bondora review

What ist Bondora?

Before we go into the details, let’s start with a brief summary. Bondora is a P2P lending platform from Estonia and is one of the oldest investment platforms of its kind. On Bondora, borrowers can take out loans for up to 60 months and you as an investor can invest in these loans and receive interest.

Over the years, Bondora has increasingly developed into a “one-click investment” with the flagship product Bondora Go and Grow.

All important data at a glance

Before we go into the details of the Bondora review, here is the most important data for you in one place.

| Started: | 2009 |

| Company Headquarters: | Tallinn, Estonia, registered as Bondora Capital OÜ |

| CEO: | Pärtel Tomberg, involved since its establishment |

| Regulated: | Not as a platform, but as a credit provider by the Estonian Financial Supervision Authority |

| Assets under Management: | Over EUR 500,000 |

| Financed Loan Volume: | Over EUR 1.93 billion |

| Number of Investors: | Over 505.000 (registered investors, active number unknown) |

| Return on Investment: | Fixed 6.00% interest with the Go & Grow product |

| Buyback guarantee: | No |

| Minimum investment amount: | 1 EUR |

| Auto Invest: | Yes |

| Secondary Market: | Yes |

| Issuance of a tax certificate: | Yes |

| Investor loyalty program: | No |

| Bondora Bonus: | 5 EUR (Pick up here*) |

| Rating: | Place 14 | Refer to the public rating |

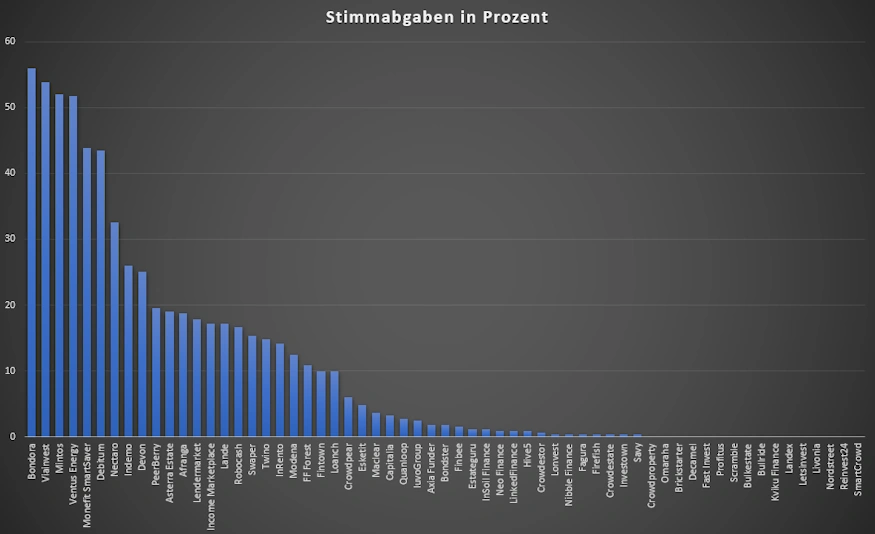

| Community Voting: | 1th place out of 61 | See results (in German). |

| Latest annual report: | Last audited & published in 2024 (for inspection). |

Bondora experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Bondora took 1th place out of 61 with 55,9% of all votes, which can be considered a very good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Bondora

Registration for investors

Registering on Bondora is quick and easy. Just enter your e-mail address, your first and last name and your telephone number and you’re in. You will need the latter for the SMS pin for withdrawals. However, your identity will be verified later on.

After registering and making a deposit, you are ready to invest in your first exciting projects on the platform.

Bondora Bonus

Instant credit of EUR 5 after registration. Will be retained if at least 50 EUR are invested within the first 30 days. Use this link* to support the work of this blog.

From time to time there are also time-limited bonus promotions at Bondora. These are always listed promptly in my P2P platform comparison.

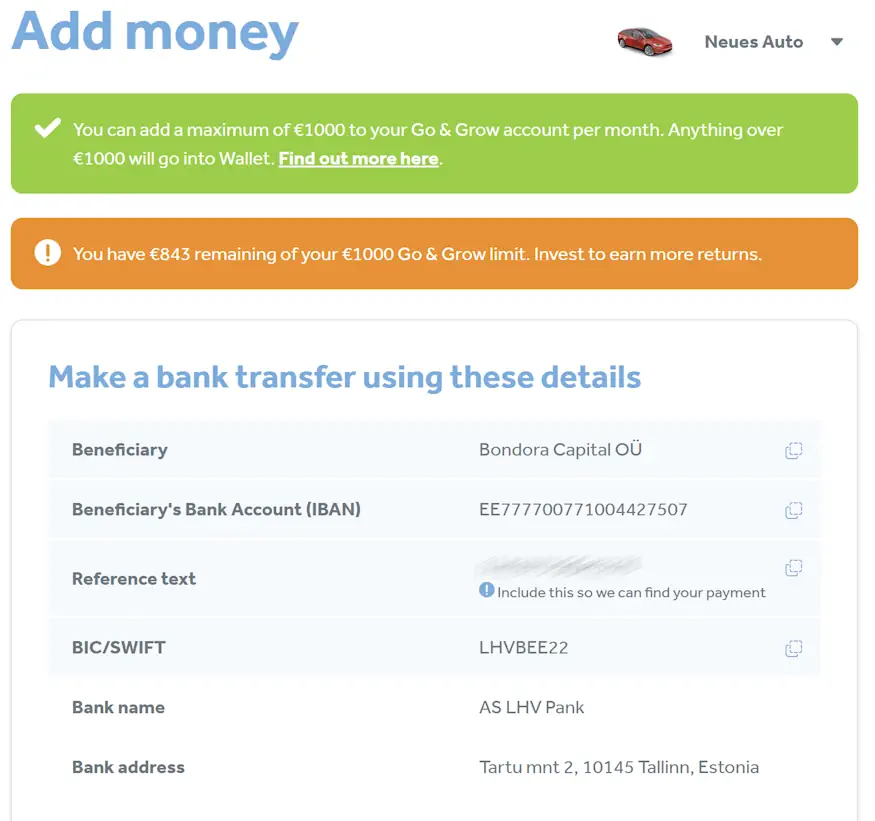

How do I deposit money?

Depositing money is child’s play. You will see an “Invest” button in your account. If you click on this, you will be shown transfer details that you can use. For example, I created an order template with my bank for this purpose. You can also transfer directly to the Go & Grow accounts.

How do I withdraw money?

If you have money in your “wallet”, you can withdraw money to your account here using the “Withdraw” button. What’s nice about Bondora is that they support instant withdrawals. So if you request a payout and your bank supports instant transfers, you’ll have the money in your account within seconds.

How long does the deposit take?

According to my personal Bondora experience, the deposit is extremely fast. As a rule, the funds are in your virtual wallet on the same day or one day later at the latest. Of course, it all depends a bit on your bank. I usually use Revolut* and the money is in my account within seconds.

Can I make deposits and withdrawals by credit card?

At the moment you cannot use credit cards for deposits and withdrawals. These must be made with a bank account.

How does Bondora work?

On Bondora you originally had 4 options as an investor to build up a portfolio:

- Bondora Go & Grow: the platform’s most popular and simplest product with a fixed interest rate of 6.00%. We will come to this later.

- Bondora Portfolio Manager: Here, you invested with ready-made settings and were able to achieve higher returns. But also less if things went against you.

- Bondora Portfolio Pro: similar to Portfolio Builder, but you had more setting options. But it was also much more complex.

- Bondora API: an open interface to which other external programs can connect. Not for beginners.

I myself started with Portfolio Builder. However, when the Go & Grow product came out, I switched to it completely. This decision was largely based on 3 things:

- On my Bondora experience up to this point. I trust the company far more than many others.

- In the development of my portfolio. Over the years, predictability and security have become more important to me than returns.

- The optimization of my time. I prefer passive investment to active investment. Even if it comes at the expense of returns.

And as expected, Bondora discontinued the Portfolio Manager and Portfolio Manager Pro products at the beginning of 2023. 99% of the volume now runs via Bondora Go and Grow.

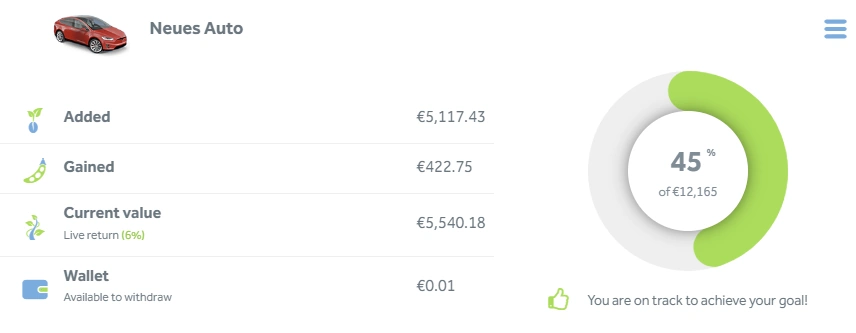

What is Bondora Go & Grow?

To keep it short. Bondora Go & Grow is the simplest product on the P2P market. As an investor, you simply deposit money here and the first interest is paid into your account the next day.

You also have daily availability of your money. Behind this is a huge loan portfolio with well over 100,000 loans. The key points:

- Direct liquidity, you can withdraw your money at any time.

- Tax only due on payout, otherwise no credit! Disclaimer: I am not a tax consultant!

- It’s extremely easy for beginners, deposit and you’re done.

- Can be used free of charge, there is only a flat EUR 1 withdrawal fee.

- The product feels like a daily deposit account, but beware! It is not.

I have written a detailed guide to Bondora Go & Grow.

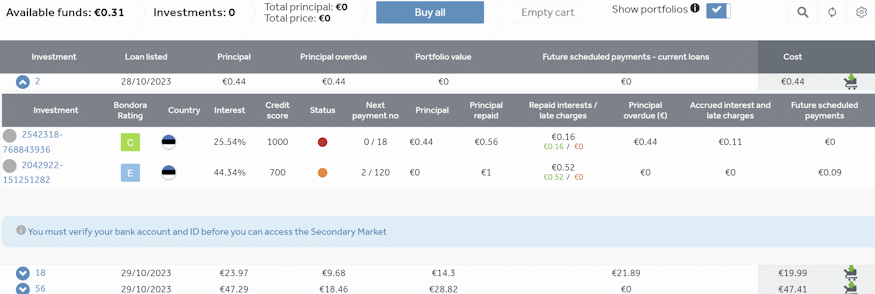

Is there a secondary market?

Bondora probably has the most extensive secondary market of all P2P platforms currently on the market. You can buy and sell loans here with both a discount and a premium and thus significantly improve your return. The disadvantage is, of course, that this is not automatic and you have to spend a lot of time here.

Please note that you cannot use a secondary market if you use Bondora Go & Grow, as you are investing in a pool of loans and therefore do not have individual loans to sell. After the focus on a fully automated platform in 2023, trading on the secondary market no longer makes sense for me, as it is a discontinued product.

The Bondora secondary market.

In which countries can you invest?

On Bondora, you normally invest in loans from

- Estonia

- Lithuania

- Latvia

- Finland

- Denmark

- and the Netherlands

During the corona crisis, however, the decision was made to only continue serving the domestic market (Estonia). In the meantime, however, the other markets have also been reopened and lending is running completely normally.

Further countries are planned, which will continue to strengthen the Go & Grow portfolio.

In which loans can I invest on Bondora?

Anyone invested in Bondora loans earns their returns exclusively from consumer loans. I can’t imagine that this will ever change.

What are the costs on Bondora?

At Bondora, investors do not pay any fees on their investment. Only the borrowers do. However, there is a withdrawal fee of one euro.

What is the return on Bondora?

With the Bondora Go & Grow product, you have a fixed interest rate of 6.00% (formerly 6.75%).

What is the minimum investment amount on Bondora?

On almost no other P2P platform can you start with as little money as here. Bondora offers investing from EUR 1.

Does Bondora offer a buyback guarantee?

No, the P2P platform from Estonia does not offer a buyback guarantee, but this is not necessary given the product offering.

Can I also invest money in other currencies?

No, here you always invest in euros.

Is there also a Refer a Friend program?

Yes, there is. If you are invested on Bondora, you can also refer friends. Both you and your friend will then be credited EUR 5, provided that at least EUR 50 is invested by the referred person.

How does the taxation work for Bondora?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Problems and solutions in dealing with Bondora

As always, problems occur here and there. I’ll show you how you might be able to fix them.

How do I get my money out of my wallet in Bondora Go and Grow?

There are currently 2 ways to get money into your Go and Grow account and earn interest:

- By transferring money from your bank account.

- By activating the “Auto Transfer” option in your Go and Grow account.

So if you have your money in your wallet, you currently only have the second option. According to my Bondora experience, the available money is withdrawn within a few hours after activation. From this point on, it then generates its 6.00% interest.

What are the partial payouts at Bondora?

Partial payouts were introduced for the first time during the 2020 coronavirus crisis. The reason for this was the increased demand for payouts on the platform. Investors who are invested in loans need to understand that they will continue to run. It doesn’t matter whether you want your money or not.

Bondora therefore limited payouts for around two months in order to protect the loan portfolio. A sensible and correct measure at the time. Since then, there have never been any partial payments again.

What are the deposit limits?

Once the initial scare of the pandemic was over, investors flocked back to P2P lending. However, Bondora had now tightened its restrictions and was only issuing loans in Estonia and no longer in Spain and Finland. Due to the limited supply and increasing demand for Go & Grow, a portfolio limit was introduced.

This meant that you were temporarily allowed to pay a maximum of EUR 400 per month into Go & Grow (not including interest). For example, if you wanted to invest EUR 12,000 on Bondora, you would have needed 30 months to do so. This limit was abolished again in 2025.

Bondora Risk

From my Bondora experience, the Estonian P2P platform is one of the most stable on the market. I have been investing here since 2015 and since then there have been some turbulent times that Bondora has mastered. Nevertheless, earning interest can be over faster than you’d like. We already know this from other platforms.

How does Bondora make money?

The Estonian P2P platform mainly earns money by borrowers taking out loans. There are contract fees, administration fees and a number of special services, such as the borrower product B-Secure, which allows borrowers to act more flexibly. However, they pay a price for this.

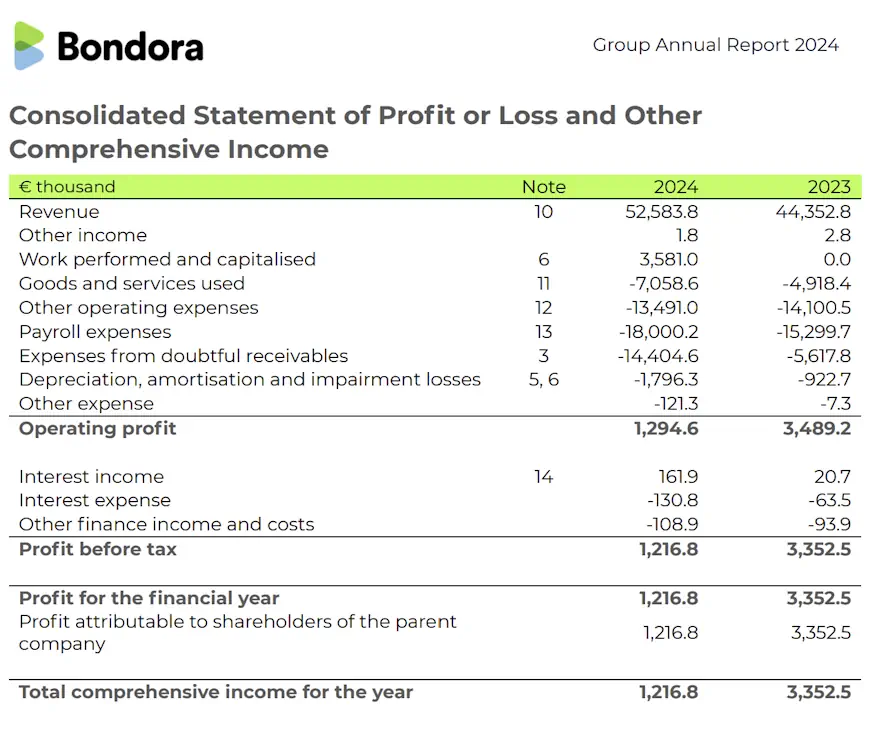

Is Bondora profitable?

Yes, Bondora is one of the few P2P platforms that operates profitably and has been doing so for years. Enclosed is an excerpt from the 2024 annual report and the corresponding balance sheet. You can check the numbers yourself here.

What happens if Bondora goes bankrupt?

Should this happen to Bondora, all business activities will be discontinued immediately. Any funds in your virtual wallets will be paid out. The loans will of course continue, as they cannot simply be terminated.

However, a third party will take over the further processing. All these steps are planned by Bondora itself and can be read here under point 10 at any time. Mintos and other P2P platforms have similar hedging scenarios.

How reputable is Bondora?

Bondora is a registered lender in several European countries. In Estonia, the platform is supervised by the Estonian Financial Supervision Authority.

How secure is Bondora?

The Estonian P2P platform is one of the safer P2P platforms. However, you should not forget that investing in P2P loans is generally associated with a high level of risk. It is therefore advisable to only invest money here that you are not reliant on in case of doubt.

Is there deposit protection on Bondora?

No, Bondora is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on Bondora are exposed to the risk of default.

How secure is Bondora’s portfolio?

Again and again, there are reports from long-time Bondora users that they incur losses as soon as they stop investing. Based on this, they assume that the company’s portfolio is of poor quality. In order to avoid this situation altogether, my Bondora experience has led me to use the Go & Grow feature completely for years, even though it is of course based on the same portfolio.

To shed some light on this, I worked temporarily with the Latvian company SneakyPeer to investigate the portfolio. SneakyPeer was specialized in investigating P2P platforms in depth and so the insights into the Bondora portfolio were also very exciting!

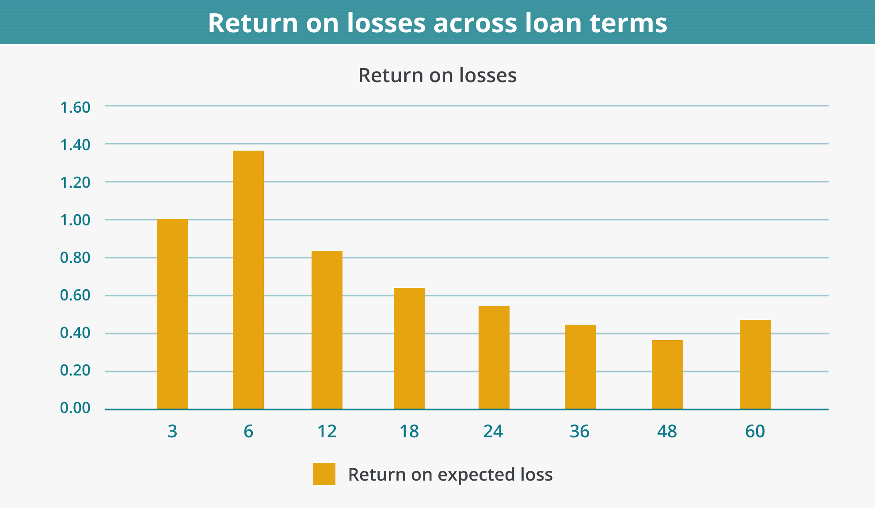

The default rate on Bondora

The data set that was reviewed included the loans on Bondora as of January 5, 2021 from 157,000 individual loans, from which SneakyPeer took 37,000 for a sample, which they believe is an optimal sample size.

The results: The default rate just passed the 47% mark, meaning that almost half of the loans defaulted across all countries, all ratings and all maturities. 30.12% of loans granted in Estonia defaulted, 56.78% of Finnish loans and 69.5% of Spanish loans. AA-rated loans performed best, with 17.31% in default. The worst performers were F and HR – with 43.98% and 74.42% respectively. Looking at the maturity dates, loans with a 6-month term (16.58%) performed best, followed by loans with a 3-month term (23.15%) and 12-month terms (30.52%).

Bondora in times of crisis

Bondora was founded in 2009, right in the middle of the first financial crisis. They went through a second one in 2020 and the Ukraine war came in 2022. There is therefore no P2P platform that is more crisis-tested than Bondora.

How has Bondora performed during the Covid-19 crisis?

In my experience, Bondora was better prepared for the crisis than pretty much any other platform. Although they faced the same problems, they had already developed concepts in advance to get through the crisis unscathed. Such as partial payments, for example.

What impact did the war in Ukraine in 2022 have on Bondora?

Like the entire world, Bondora was briefly in a state of shock when Russia invaded Ukraine. However, the panic subsided immediately when nothing happened and, unlike the Covid-19 crisis, there were no partial payouts this time either. Bondora continued to operate as normal.

Advantages and disadvantages of Bondora

Before we come to a final conclusion of my Bondora review, here is a summary of my advantages and disadvantages.

Disadvantages

- Unlike with Mintos, with Bondora you only have one major lender.

- There is no buyback guarantee.

- Compared to other P2P platforms, Bondora has a fairly low historical return.

- Bondora is not particularly transparent, even after many years.

Advantages

- Bondora has a long track record and is one of the oldest companies in the industry.

- The company has mastered the previous crises well.

- Bondora is one of the few profitable P2P platforms.

- Daily interest payments and predictability with Bondora Go & Grow.

- If you use banks like N26*, the payout will be in your account within seconds.

- Tax advantage if you use Go & Grow.

Conclusion of my Bondora review

If you want to invest in P2P loans quickly and easily, you can’t get around the Estonian platform. Its Go & Grow product offers investors over 100,000 loans for no more than EUR 1 with just one click.

Even in 2025, no other P2P platform can offer you that. You can usually only invest from EUR 10 per loan. The whole thing is topped off with many years of experience and a well-coordinated team, which I have already visited several times.

It is very interesting to see that the faces hardly change over the years. In my opinion, this is a good sign of a stable and satisfied team and even if it has already been mentioned, it is worth pointing this out again separately in the conclusion. Because this is also one of the main reasons why I entrust so much money to the platform.

Is there a Bondora forum where I can exchange ideas?

There are various places where you can interact with other investors and gather Crowdpear experiences. The primary destination for this is the international investors group on Telegram where you can engage in discussions.

My Bondora experience on site

I have visited the P2P platform several times now. Most recently in November 2019 as part of my P2P Lifestyle project. We spent a whole two weeks at the company, had our own desks and conducted interviews with the team.

We were even able to attend the birthday of CEO Pärtel Tomberg. You can watch a summary of the time in this video (mostly in English):

You can find more videos about the company, the associated interviews etc. in the associated playlist.

What is interesting is that a lot is done for the employees to make them feel at home. There are weekly massages, monthly leisure activities and many other things that employees enjoy there. When you see something like this, you are of course particularly happy to invest in the portfolio, because ultimately the success of a company depends on the team.

Is there a starting bonus on Bondora?

Yes, there is one! You will be credited a total of 5 EUR when you start on Bondora and support the information collections on my blog. Thank you for your support, because I also receive a commission for this, which I can use to continue running the blog and gain more Bondora experience for you.

What alternatives are there to Bondora?

Bondora is a classic P2P lending platform, but over the years it has focused on full automation. From my Bondora experience, alternatives on the market that I am also invested in are Twino & Viainvest.

The Latvian platform Mintos offers a slightly different concept, but much larger. Monefit SmartSaver is a fully automated product that is very similar to Bondora Go & Grow. All relevant data is compared in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Bondora or Mintos?

Many investors ask themselves which of the two platforms is better. Well, as already mentioned, the concepts are different. While Mintos is a global marketplace with around 70 lenders, on Bondora you only invest in loans from one company. Namely Bondora itself.

While Bondora is considered a very safe and stable company, the same cannot necessarily be said of the lenders on Mintos. So with Mintos, you will most likely lose more money. However, for this supposed risk, you also receive a higher return and are more broadly diversified.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Bondora Review 2026 - Most reputable platform in the industry?

On this website you will find my personal Bondora experience ✚ everything you need to know about the Estonian P2P platform.

5