Robocash review 2024 – 11.8% sustainable return?

You can find my Robocash review on this website. I’ve been invested in the P2P platform since the beginning of 2017 and it was one of the underestimated “underdogs” in my portfolio for a long time. Here you can find out everything you need to know about the Croatian-based P2P lending platform to get started.

I visited the Robocash team (official spelling Robo.cash) in Russia in 2021. I saw the locations Kemerovo, Novosibirsk & Moscow. My Robocash experience on site gave me much more confidence in my investment on the platform. I currently hold a portfolio of just under EUR 20,000 there.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

What is Robocash?

Robocash is a P2P lending platform based in Croatia. The majority of the team is based in Kemerovo & Novosibirsk (Russia) and operates from there. Unlike Mintos, Robocash is not a marketplace! Even if the structure of the lenders makes it appear so.

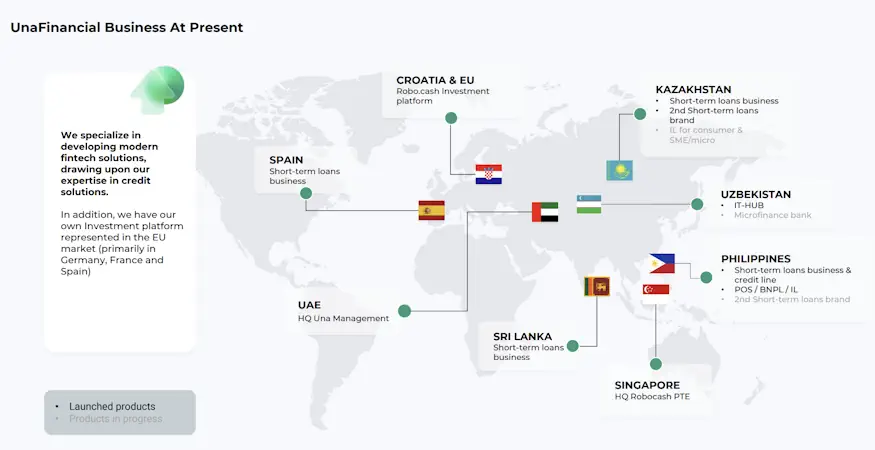

The P2P platform offers some of the loans of its Singapore-based and international parent company UnaFinancial online. UnaFinancial was founded in 2015 (back then still the Robocash Group), has over 1,500 employees and is active in 7 different geographical destinations. The P2P platform is therefore more of a classic P2P provider like Bondora. Most of the loans on the platform are consumer loans, but business loans are also available on a small scale.

UnaFinancial & the associated lending platform are now considered an experienced combination in the industry that has proven itself over the last few years. So if you want to invest here & collect interest, you’re probably not doing much wrong for the time being. Even if they are less of a “loudspeaker” in the industry and are not as good as others in terms of external presentation.

Robocash Review – All important data at a glance

Before we go into the details of the Robocash review, here is the most important data for you in one place.

| Started: | 2017, the parent company UnaFinancial (formerly Robocash Group) has been founded in 2015. |

| Company Headquarters: | Zagreb, Croatia, registered as Robocash d.o.o |

| CEO: | Sergey Sedov, founder of the company |

| Regulated: | No |

| Assets under Management: | Approx. 80.1 million euros |

| Financed Loan Volume: | More than 1 billion euros |

| Number of Investors: | Approx. 38,700 |

| Return on Investment: | Up to 11.8% possible |

| Buyback guarantee: | Yes (after 30 days) |

| Minimum investment amount: | 1 EUR (however, you must deposit at least 10 EUR) |

| Auto Invest: | Yes |

| Secondary Market: | Yes |

| Issue of a tax certificate: | Yes |

| Investor loyalty program: | Yes (up to 0.8 percent higher return) |

| Starting bonus: | No |

| Rating: | Place 5 | Refer to the public rating. |

| Last annual report: | Audited & published in 2023 (for inspection). |

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide + 3.15% on overnight money –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.25 – 9.96% return and 0.25 cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Robocash

The lates news from Robocash

Registration for investors

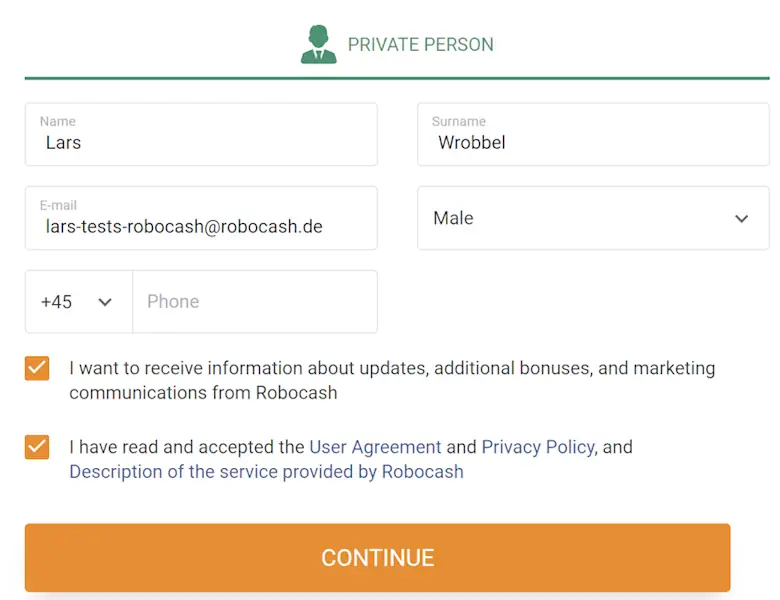

Registering on the platform is not particularly complicated. However, you can only register as a private individual, not as a company.

Once you have registered, you are ready to invest in P2P loans on the platform, provided you have made the first deposit and identified yourself. You will need your identity card or passport to verify your identity. By the way, always keep an eye out for bonus promotions from the platforms to give you an advantage. You can find a constantly updated list of all bonuses in my P2P platform comparison.

How do I deposit money?

Depositing money is, as always, the easiest step when investing. You will see a “Add Funds” button in your account. If you click on this, you will be shown transfer details that you can use.

For example, you can create an standing order with your bank. This is how I have done it with many platforms. Please note that the first transfer must come from a personal bank account. This will also be verified for subsequent payouts.

As an investor, you have a deposit limit of EUR 25,000 per month. Larger one-off investments are therefore not possible and you may have to spread them over several months. However, the total investment amount is unlimited.

How do I withdraw money?

If you would like to withdraw capital or excess interest from the P2P platform, you can use the “Withdraw funds” button in your dashboard at the bottom right. You will not be charged a fee for withdrawing funds.

Investors can only withdraw funds to the bank account from which the deposit was made. If you wish to register a new account for withdrawal, you must make a new deposit from a new personal account.

How long does the deposit take?

Based on my own Robocash experience, the deposit to the platform’s account takes approx. 1 – 2 days. However, if you use services such as Revolut*, the transfer is often faster.

How does Robocash work?

Now let’s move on to the questions about investing on the P2P lending platform from Croatia with Russian roots. I can answer many questions directly from my previous Robocash experience, as I have been serving the group’s borrowers for several years. In general, it should be noted that the platform (once set up) is very easy to use.

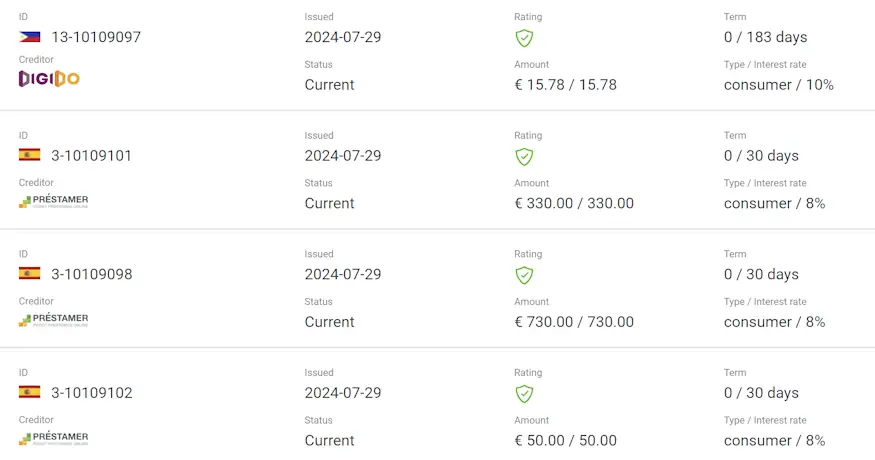

After registering on the platform, you can start investing your money. However, you can only do this automatically. As an investor, you do not have the option of investing manually. But you can at least view the loans in the list of loans.

For a passive investor like me, focusing exclusively on automatic investments is of course a dream.

The Robocash Auto Invest

You can tell Robocash’s automatic portfolio builder exactly which countries & interest rates you want to invest in. You can invest automatically from as little as EUR 1.

You can also create several different Auto Invest strategies so that you can manage your portfolio in an even more focused way. You can then see all your strategies, the invested loan amount and the interest amount in the overview.

With Robocash Auto Invest you have 5 income options:

- Balance = Your funds are credited back to your investor balance after the term.

- Payout = From EUR 50 (invested funds + interest), returning funds are transferred directly to your bank account. Perfect for an automated and short investment!

- Reinvest full amount = All funds are reinvested directly and you don’t have to do anything else.

- Reinvest principal amount = Interest is credited to your balance, but the invested amount is reinvested.

- Send to other portfolio = If you want to send the repayments of an Auto Invest to a specific other portfolio, you can do this here.

In which countries can you invest?

Here you invest in loans from the company UnaFinancial, which is active in many countries. Robocash currently offers loans from five different countries, including

- Kazakhstan

- Spain

- Singapore (with over 70% the largest share)

- Sri Lanka

- and the Philippines

Incidentally, Singapore is extremely rare in the P2P scene. However, it should be noted that these loans are not traditional loans, but business loans that are provided directly to the UnaFinancial Group for the expansion of its Asian business.

The parent company UnaFinancial also grants loans in other countries, but these are not yet connected to the platform. We may therefore be able to expect further markets in the future.

Since the start of the war in Ukraine, UnaFinancial has focused more on the Asian region and the opportunities there. There was also an exciting presentation on the reasons for this at the Finfellas Conference 2023 in Riga, where the Robocash team was present.

Which loans can you invest in on Robocash?

Those who invest in P2P loans here generate most of their returns with loans from the consumer sector. Borrowers take out loans directly from the parent company, which are listed on the platform and in which we as investors can invest money. However, there are also some business loans that you can invest in.

What are the costs on Robocash?

There are no fees for investors on the investment or other actions on the platform.

What is the return on Robocash?

The return you can earn on Robocash is decent. The P2P platform is currently offering over 11%. My own return is over 13.5%.

The reason for the slight upward breakout is that I was one of the first investors on the P2P platform to invest in loans from Kazakhstan and, at the time, Russia. At the beginning, the interest rates here were significantly higher than they are today. Robocash also offers a loyalty program for investors. Depending on the total amount you invest, you receive up to 0.8% more return in 2 stages. I now also use the program myself.

Will I also receive the interest on late loans?

Yes, Robocash pays you interest on all overdue days in the amount of the loan interest rate as soon as the buyback guarantee event occurs.

What is the minimum investment amount on Robocash?

You have to spend EUR 10 per loan on the platform to be able to invest.

Does Robocash offer a buyback guarantee?

Yes, the P2P platform offers a buyback guarantee. If the borrower is 30 days overdue with their payment, the loans are repaid including the interest accrued up to that point.

Is there an app for Robocash?

No, Robocash does not offer an app to manage the loans in your own portfolio. However, a smartphone app is included in the development plan for the next few years, according to my latest information.

Is there a secondary market?

Yes, Robocash has a simple secondary market with no premium or discount option. You can buy P2P loans on the secondary market (via Auto Invest). It is also possible to sell the loans. Simply select a loan under “My investments” and sell it.

Can you invest money in other currencies?

No, here you always invest in euros.

How exactly do taxes work on Robocash?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Is there a tax statement on Robocash?

There is a proper statement for the tax office, should you need it. You can download it in the “Account statement” section. Here you then create a “New statement” and select the type “Tax report”. The unfortunate thing is that the download is an editable Word file and not a protected PDF.

Is investing with Robocash risky?

From my Robocash experience, the Croatian P2P platform with Russian roots is one of the most stable on the market. I’ve been invested here since 2017 and there have been a few turbulent times since then, but they were overcome without you noticing much.

Nevertheless, earning interest can be over faster than you’d like. We already know this from other platforms. So a loss can never be ruled out!

How does Robocash earn money?

The P2P platform’s income comes from the lending business of its parent company UnaFinancial. To be more precise, money is earned from every P2P loan issued. This is through the spread between the interest rate that UnaFinancial charges borrowers and the interest rate for which their loans are financed on the Robocash investment platform, for example.

The platform itself therefore makes no profit, as its main purpose is to raise funds to finance the loans issued. Of course, some costs are incurred (e.g. marketing, HR, taxes, etc.). To cover these costs, the lenders represented on the platform pay referral fees, and these fees depend on the amount of loans referred. This is the only source of income for the platform.

What happens if Robocash becomes insolvent?

If the P2P platform gets into financial difficulties or has to file for insolvency, the company will probably be wound up and existing loans will continue to run. A further distinction must be made here as to whether insolvency will affect the P2P platform itself or the parent company.

However, due to the strong partner in the background, insolvency of the P2P platform itself is practically impossible. However, should the parent company become insolvent, this will result in lengthy proceedings lasting many years.

Is Robocash profitable?

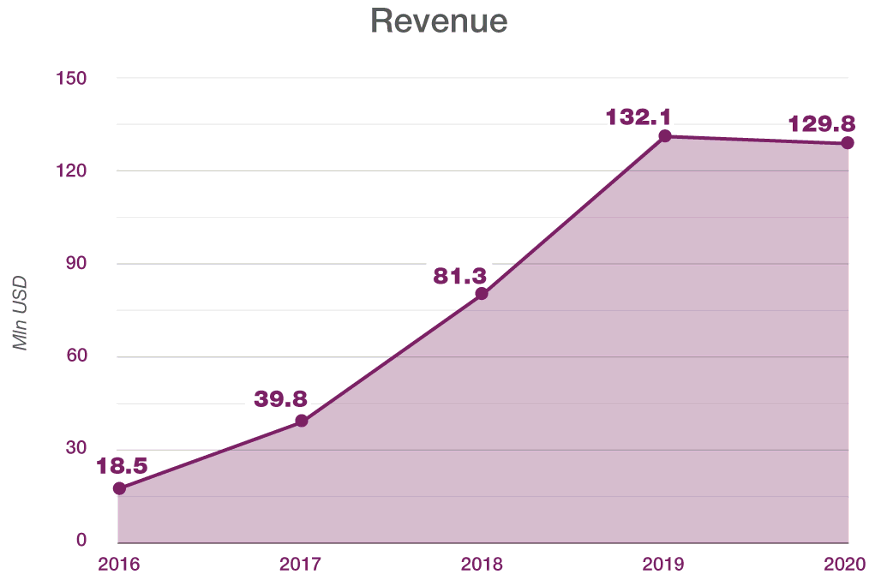

No conclusions can be drawn here about the P2P platform itself, as it does not publish any annual reports. However, UnaFinancial, the loan originator in the background, has been operating profitably for years, with one exception.

They regularly publish their audited annual reports, which are also publicly available. Even the crisis year 2020 ended with a net profit of over 23 million euros. As you can see, even if Robocash looks quite inconspicuous, the company is operating in completely different dimensions than many of its competitors.

The exception took place in 2022, due to the war in Ukraine. There was a retroactive separation from the Russian lender Zaymer, which meant that 2021 ended with a loss. However, this set an important course for the future.

How reputable is Robocash?

Due to the fact that the P2P platform is closely linked to the parent company, which has been on the market for years, it can be assumed that we are dealing with a reputable platform. In addition, the group’s reports are audited by an external body.

I myself mistakenly considered Robocash to be untrustworthy for a long time due to its public image. However, that changed over the years as an investor.

How secure is Robocash?

The Croatian P2P platform is one of the safer P2P platforms. However, you must not forget that investing in P2P loans is generally associated with a high level of risk! It is therefore advisable to only invest money here that you are not reliant on in case of doubt.

Is there deposit protection on Robocash?

No, definitely not. Robocash is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on the platform are exposed to a high risk of default.

Are there defaults on Robocash?

There are usually defaults on every P2P platform, and this is also the case here. However, the default rate is not publicly available. When I asked the company itself, they told me that the default rate across the entire group of companies was around 10-15% over the last 2 years.

Robocash experiences in crisis situations

Robocash investors have come through the crisis relaxed so far.

Robocash during the Covid-19 crisis 2020

In my own experience, Robocash was well prepared for the crisis. Although it faced the same problems as every other platform (more withdrawals than deposits, fewer loans, etc.), it was able to get through them well thanks to solid finances. Although 2020 was not a new record year, it ended on a very positive note.

Robocash during the Ukraine war in 2022

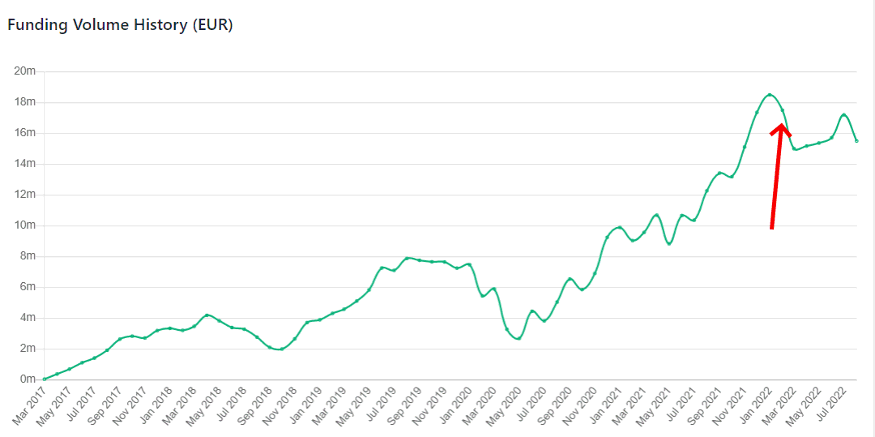

The Ukraine crisis was of a different caliber for Robocash, as part of the team is based in Russia. Investors were unsettled and the platform’s loan volume immediately collapsed after the start of the war of aggression in Ukraine, but recovered relatively quickly after investors realized that Robocash has no direct payment channels via Russia and is internationally oriented.

Advantages and disadvantages of Robocash

Before we come to a final conclusion of my Robocash experience, here is a summary of my pros and cons.

Disadvantages ➖

- The website and the translation are not really up to date..

- Company based in Croatia, loans scattered across Kazakhstan and other countries. The team is based in Russia, a structure that does not always inspire confidence.

- UnaFinancial is behind all loans. So you only have one loan originator here.

- On the secondary market, you have no opportunity to improve your return through discounts. Whining at a high level!

- Robocash is not regulated.

Advantages ➕

- With UnaFinancial, the company has a partner behind it that has been operating profitably for almost 10 years.

- With an average interest rate of over 11%, investors are very profitable here and can make a good return.

- You will even be able to place sums larger than EUR 10,000 on the platform without any problems.

- All loans have a buyback guarantee.

- I consider the UnaFinancial team to be very experienced, if you look at the founder’s history alone. There are no beginners working here.

Conclusion of my Robocash review

When I started investing on the P2P platform in 2017, I thought it was more of a joke than an investment. When I looked at platforms like Mintos or Estateguru in comparison, they were much more professional. However, this opinion changed over the years.

At some point, there were annual reports, the loans gradually went through without any problems and the platform gained my trust. After I visited them in Russia in 2021, I decided to upgrade the P2P platform to the highest loyalty level at the time (EUR 25,000).

However, due to the current rapid growth, you have to keep an eye on the annual reports and follow the information carefully if you seriously want to invest here permanently. Should there ever be problems with the P2P platform, it is advantageous to recognize this in advance due to the structure.

Is there a Robocash forum for discussions?

There are various places where you can interact with other investors and gather Robocash experiences. The primary destination for this is the international investors group on Telegram where you can engage in discussions as well as an info channel from Robocash itself.

Is there a Robocash bonus or a referral program at the beginning?

You can refer friends to Robocash. You and your friend will receive 0.5% cashback after 31 days. However, the maximum bonus is only 10 euros per person. To activate the bonus for both parties, the referred friend must invest 500 euros or more.

What alternatives are there to Robocash?

Robocash is a classic P2P lending platform. Comparable alternatives with a similar concept in this area would be the relatively young platforms Moncera, Lendermarket & Esketit. Here, too, we have a P2P platform in the foreground and larger corporate groups in the background.

Other alternatives are the Latvian platforms Twino & Viainvest, which have been on the market for much longer. You can find more alternatives in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Robocash vs. Mintos

Many people keep asking me how certain platforms compare to Mintos and whether they are an alternative. In my eyes and based on my experience with Robocash so far, the two platforms are not comparable.The reasons for this are simple:

- Mintos is a marketplace and has over 60 lenders, such as UnaFinancial is one, in its portfolio.

- So if the parent company UnaFinancial has problems with the loans, ALL your P2P loans on the platform will most likely be affected.

- If the same scenario happens on Mintos, only part of your portfolio will be affected.

So you see, it’s a diffcult comparison. Based on my own Robocash review, however, you can use the platform as a wonderful supplement.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.