Peerberry Experience 2025 – The most trusted P2P platform for many investors

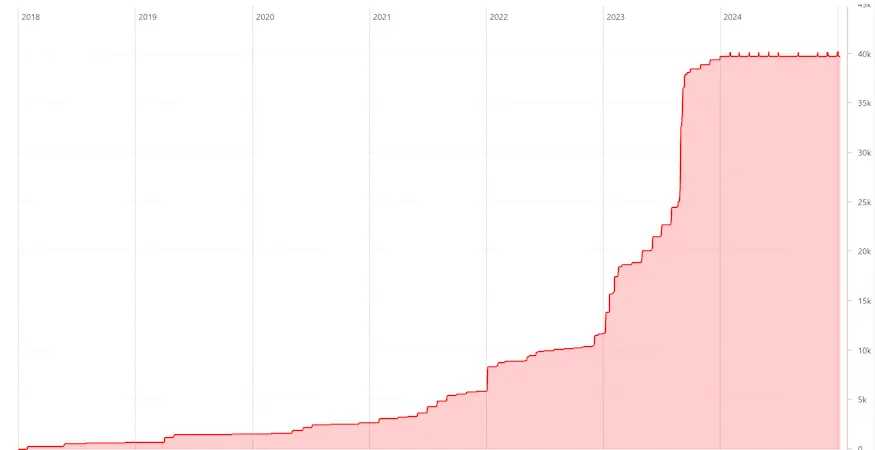

On this website you will find my personal PeerBerry review. I have been invested there since 2018 and was probably one of the first investors on the platform, so I can pass on a lot of experience to you. I’m still there today and have now invested EUR 40,000 and collected over EUR 10,000 in interest. On this page you can find out everything about the P2P lending platform based in Croatia.

Incidentally, I have already met the PeerBerry team myself on one or two occasions. For example, they visited INVEST in Stuttgart and I was also on site in Vilnius in 2023. But let’s take a look at what PeerBerry is all about.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is PeerBerry?

- PeerBerry Review – All important data at a glance

- Registration for investors

- How does PeerBerry work?

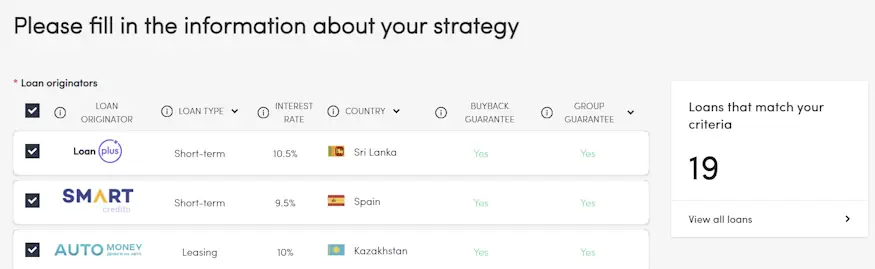

- The PeerBerry Auto Invest

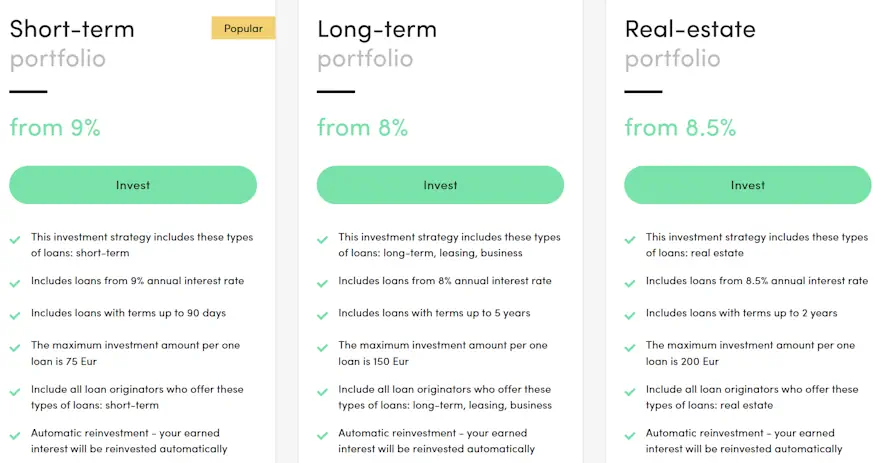

- The PeerBerry strategies

- Is there a secondary market?

- In which countries can you invest?

- Which loans can you invest in on PeerBerry?

- What are the costs on PeerBerry?

- What is the return on PeerBerry?

- What is the minimum investment amount on PeerBerry?

- Does PeerBerry offer a buyback guarantee?

- Is there an app for PeerBerry?

- Can you invest money in other currencies?

- Will I also receive the interest on late loans?

- How exactly do taxes work on PeerBerry?

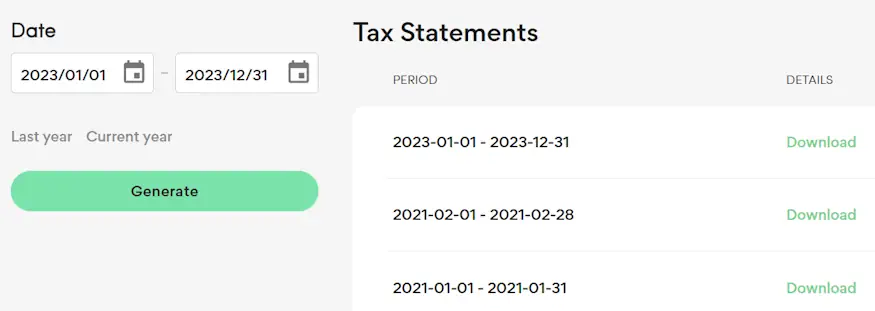

- Is there a tax statement on PeerBerry?

- Problems and solutions

- PeerBerry Risk

- PeerBerry experiences in crisis situations

- Advantages and disadvantages of PeerBerry

- Conclusion of my PeerBerry review

- PeerBerry vs. Mintos

What is PeerBerry?

PeerBerry is a P2P marketplace from Croatia. Similar to Mintos, loans from third parties are offered for investment here. The platform itself merely acts as a kind of “man-in-the-middle” and transfers your investments to the right places.

Unlike Mintos, however, a single major lender supports the platform significantly. This is the Aventus Group, which incidentally used to be a loan originator on Mintos years ago. The Aventus Group works closely with the platform. So it only appears to be a marketplace, as around 50% of loans are granted by the group behind it.

PeerBerry is owned by two private investors, Igoris Trofimovas (also a member of the board) and Ivan Butov, who have no active roles in the company. On PeerBerry you can invest in short-term consumer loans, real estate loans, business loans and leasing loans.

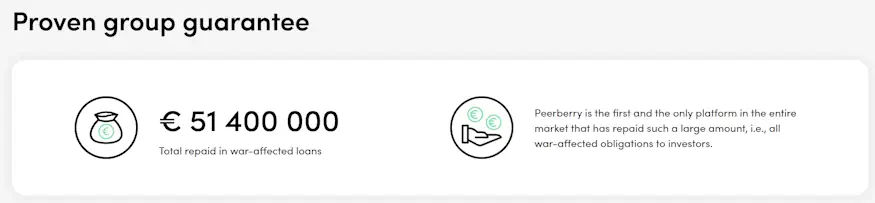

From my prior PeerBerry experience, I can say that they also place a very high value on only having loan originators on board who won’t drop out at the slightest economic breeze.

PeerBerry currently has around 10 employees, operates from the Lithuanian heart of Vilnius (i.e. not from Croatia where it is based) and offers loans from many different countries for P2P investments via its loan originators.

PeerBerry Review – All important data at a glance

Before we go into the details of the PeerBerry review, here is the most important data for you in one place.

| Started: | 2017 |

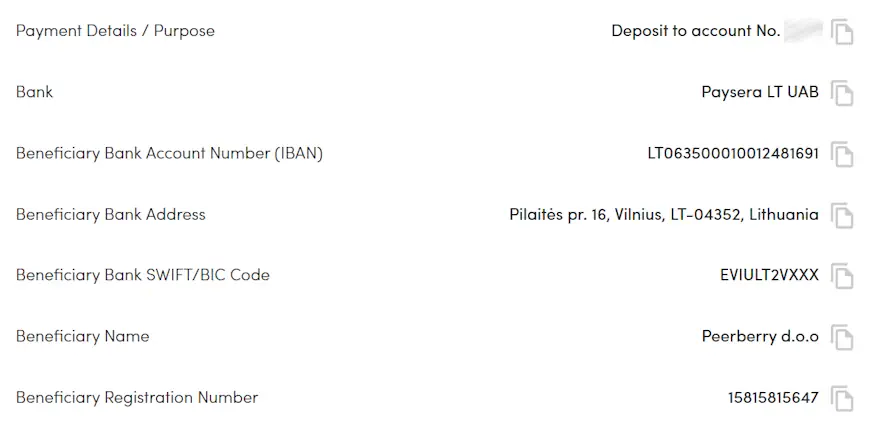

| Company Headquarters: | Zagreb, Croatia, registered as PeerBerry d.o.o |

| CEO: | Arunas Lekavicius, since 2019 |

| Regulated: | No |

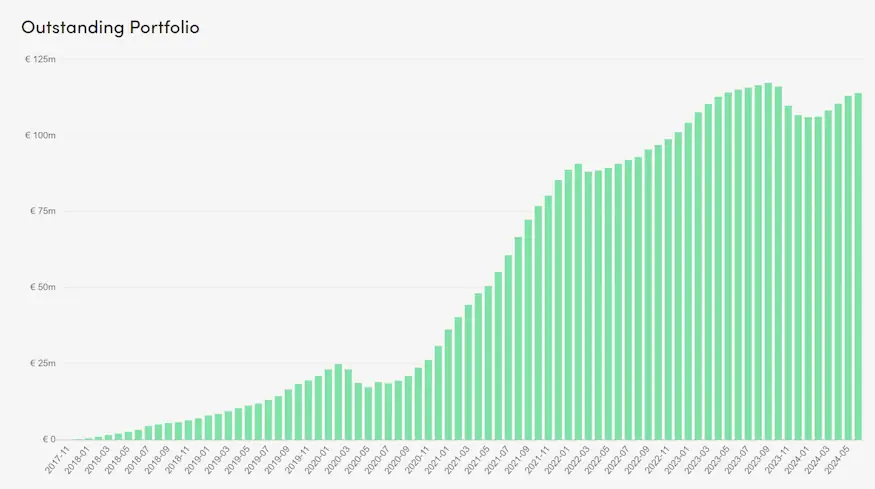

| Assets under Management: | Approximately 114.9 million EUR |

| Financed Loan Volume: | Approximately 3,19 billion EUR |

| Number of Investors: | Approximately 110.000 (Registrations, active number unknown) |

| Return on Investment: | 11,07% according to official information on the website. |

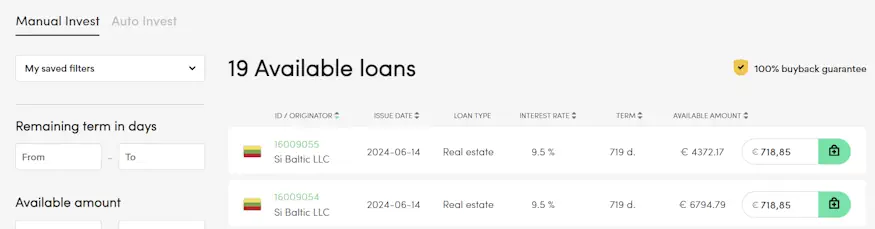

| Buyback guarantee: | Yes |

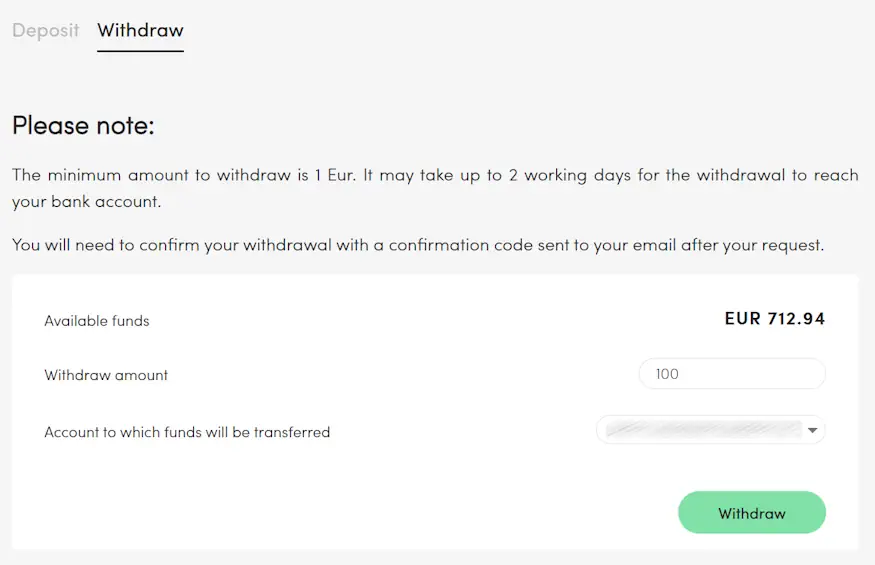

| Minimum investment amount: | 10 EUR (50 EUR with Auto Invest) |

| Auto Invest: | Yes |

| Secondary Market: | No |

| Issue of a tax certificate: | Yes, report in the form of a PDF is available |

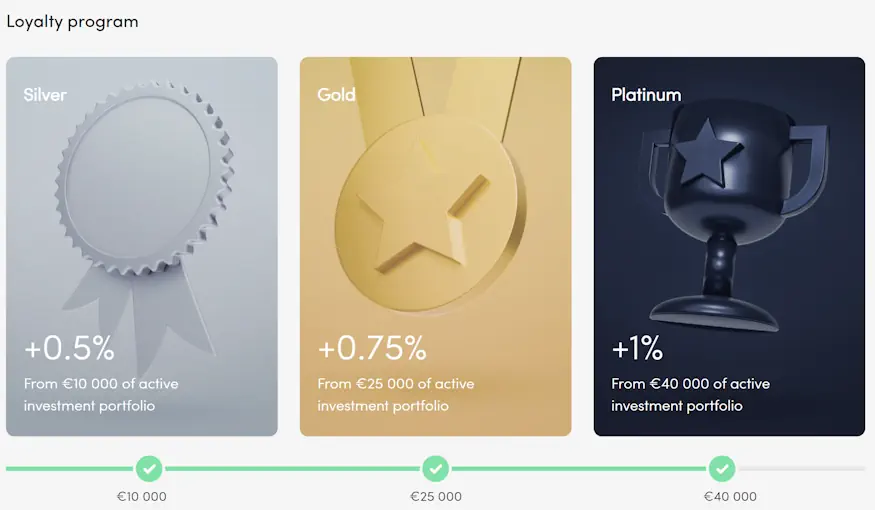

| Investor loyalty program: | Yes (loyalty categories) |

| Starting bonus: | Yes, there is a PeerBerry bonus of 0.5% cashback in the first 90 days. Get it here* |

| Rating: | Place 13 | Refer to the public rating. |

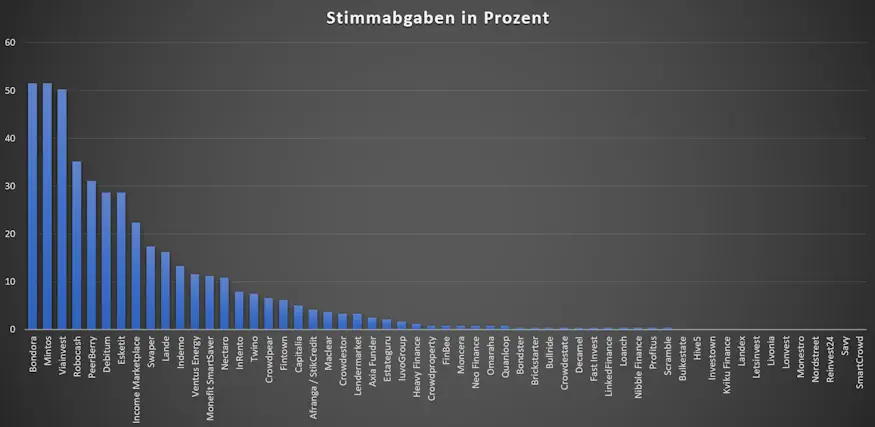

| Community Voting: | 5th place out of 57 | See results (in German). |

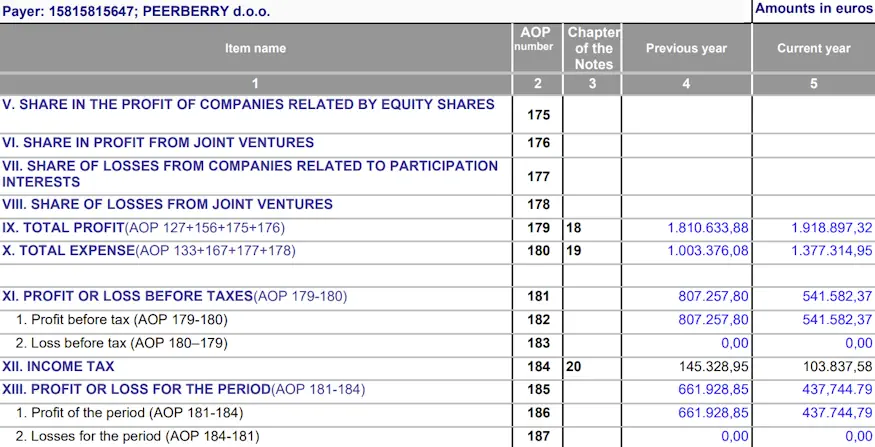

| Last annual report: | Unaudited, last published for the year 2023 |

PeerBerry experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2024, PeerBerry took 5th place out of 57 with 31.1% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

Peerberry Review 2025 - The favorite of P2P investors

On this website you will find my personal Peerberry review and many years of experience ✚ 0.5% PeerBerry bonus as cashback!

4.99