Peerberry Experience 2026 – The most trusted P2P platform for many investors

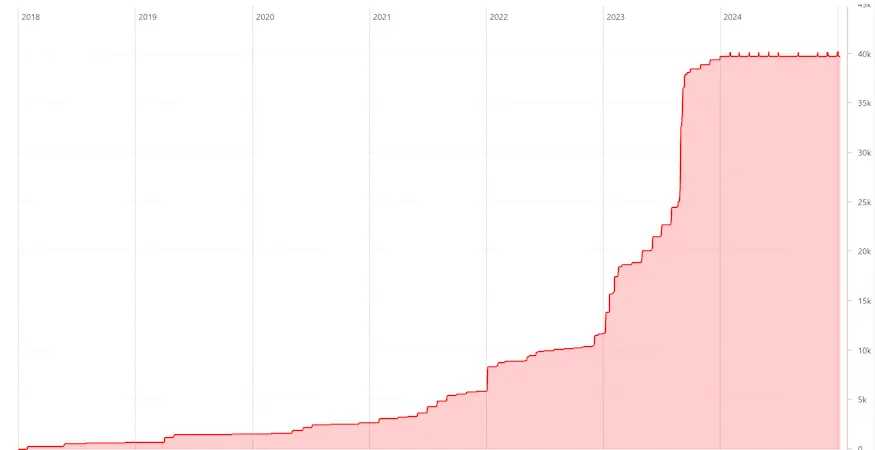

On this website you will find my personal PeerBerry review. I have been invested there since 2018 and was probably one of the first investors on the platform, so I can pass on a lot of experience to you. I’m still there today and have now invested EUR 40,000 and collected over EUR 10,000 in interest. On this page you can find out everything about the P2P lending platform based in Croatia.

Incidentally, I have already met the PeerBerry team myself on one or two occasions. For example, they visited INVEST in Stuttgart and I was also on site in Vilnius in 2023. But let’s take a look at what PeerBerry is all about.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is PeerBerry?

- PeerBerry Review – All important data at a glance

- Registration for investors

- How does PeerBerry work?

- The PeerBerry Auto Invest

- The PeerBerry strategies

- Is there a secondary market?

- In which countries can you invest?

- Which loans can you invest in on PeerBerry?

- What are the costs on PeerBerry?

- What is the return on PeerBerry?

- What is the minimum investment amount on PeerBerry?

- Does PeerBerry offer a buyback guarantee?

- Is there an app for PeerBerry?

- Can you invest money in other currencies?

- Will I also receive the interest on late loans?

- How exactly do taxes work on PeerBerry?

- Is there a tax statement on PeerBerry?

- Problems and solutions

- PeerBerry Risk

- PeerBerry experiences in crisis situations

- Advantages and disadvantages of PeerBerry

- Conclusion of my PeerBerry review

- PeerBerry vs. Mintos

What is PeerBerry?

PeerBerry is a P2P marketplace from Croatia. Similar to Mintos, loans from third parties are offered for investment here. The platform itself merely acts as a kind of “man-in-the-middle” and transfers your investments to the right places.

Unlike Mintos, however, a single major lender supports the platform significantly. This is the Aventus Group, which incidentally used to be a loan originator on Mintos years ago. The Aventus Group works closely with the platform. So it only appears to be a marketplace, as around 50% of loans are granted by the group behind it.

PeerBerry is owned by two private investors, Igoris Trofimovas (also a member of the board) and Ivan Butov, who have no active roles in the company. On PeerBerry you can invest in short-term consumer loans, real estate loans, business loans and leasing loans.

From my prior PeerBerry experience, I can say that they also place a very high value on only having loan originators on board who won’t drop out at the slightest economic breeze.

PeerBerry currently has around 10 employees, operates from the Lithuanian heart of Vilnius (i.e. not from Croatia where it is based) and offers loans from many different countries for P2P investments via its loan originators.

PeerBerry Review – All important data at a glance

Before we go into the details of the PeerBerry review, here is the most important data for you in one place.

| Started: | 2017 |

| Company Headquarters: | Zagreb, Croatia, registered as PeerBerry d.o.o |

| CEO: | Arunas Lekavicius, since 2019 |

| Regulated: | No |

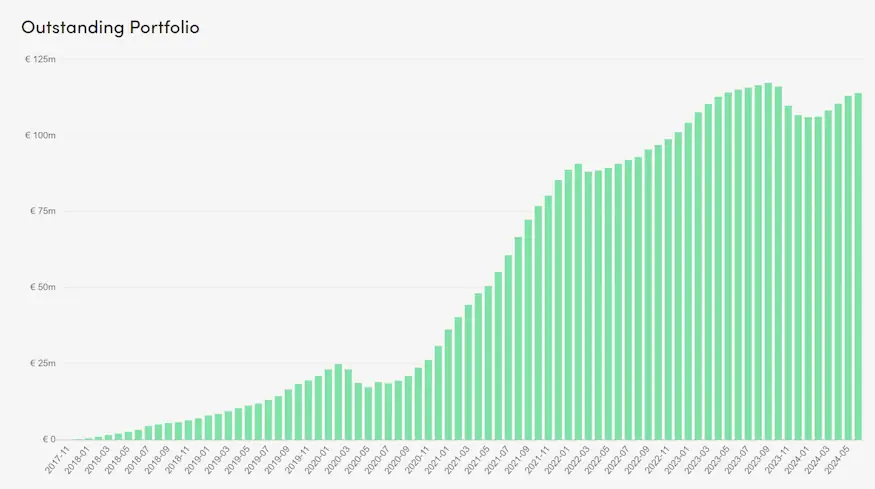

| Assets under Management: | Approximately 118.1 million EUR |

| Financed Loan Volume: | Approximately 3,29 billion EUR |

| Number of Investors: | Approximately 115.400 (Registrations, active number unknown) |

| Return on Investment: | 11,05% according to official information on the website. |

| Buyback guarantee: | Yes |

| Minimum investment amount: | 10 EUR (50 EUR with Auto Invest) |

| Auto Invest: | Yes |

| Secondary Market: | Yes |

| Issue of a tax certificate: | Yes, report in the form of a PDF is available |

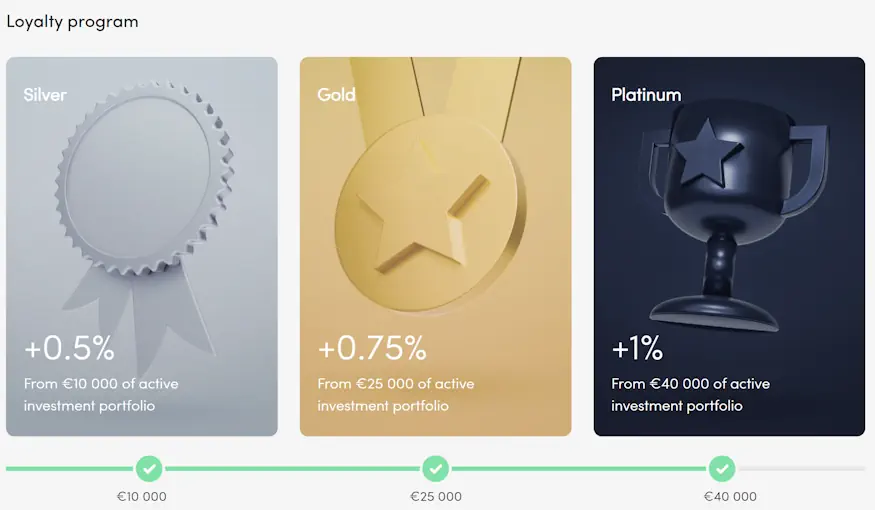

| Investor loyalty program: | Yes (loyalty categories) |

| Starting bonus: | Yes, there is a PeerBerry bonus of 0.5% cashback in the first 90 days. Get it here* |

| Rating: | Place 13 | Refer to the public rating. |

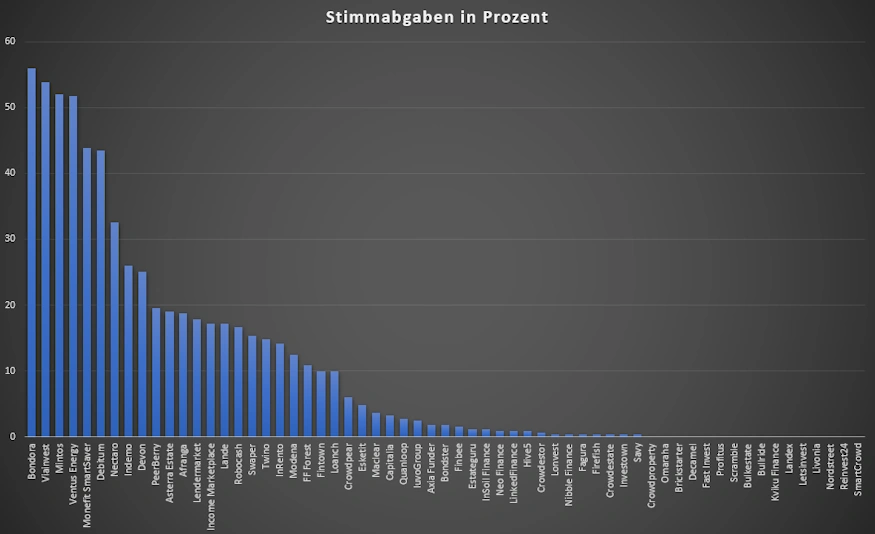

| Community Voting: | 10th place out of 61 | See results (in German). |

| Last annual report: | Unaudited, last published for the year 2024 |

PeerBerry experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, PeerBerry took 10th place out of 61 with 19.6% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of PeerBerry

Registration for investors

Registering on the platform is not particularly complicated. You can register both as a private investor and as a company. After registering, you are ready to invest in P2P loans on the platform, provided you have made the first deposit and identified yourself. You will need your identity card or passport to verify your identity.

By the way, always look out for bonus promotions on the platforms before you sign up to gain advantages or a PeerBerry bonus. In PeerBerry’s case, you get 0.5% extra interest* on your investments in the first 90 days. You can find a constantly updated list of all bonuses in my P2P platform comparison.

PeerBerry Bonus

Via my link* you will receive 0.5% extra interest on all investments you make in the first 90 days after your registration. If there are any time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

How do I deposit money?

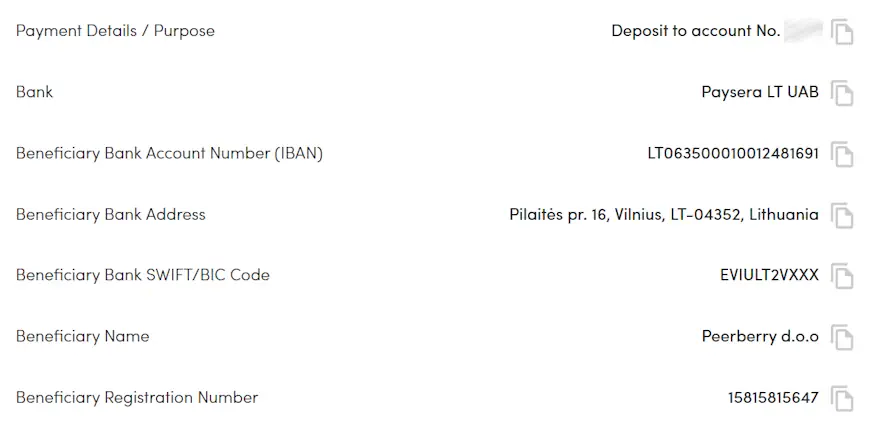

Depositing money is, as always, the easiest step when investing on P2P platforms. In your account, you will see a menu item “Deposits / Withdraw” at the top. If you click on this, you will be shown transfer details that you can use.

For example, you can create an order template with your bank. I have also done this with many other platforms. Please note that the first transfer must come from a personal bank account. The bank account used will then be verified for subsequent payouts.

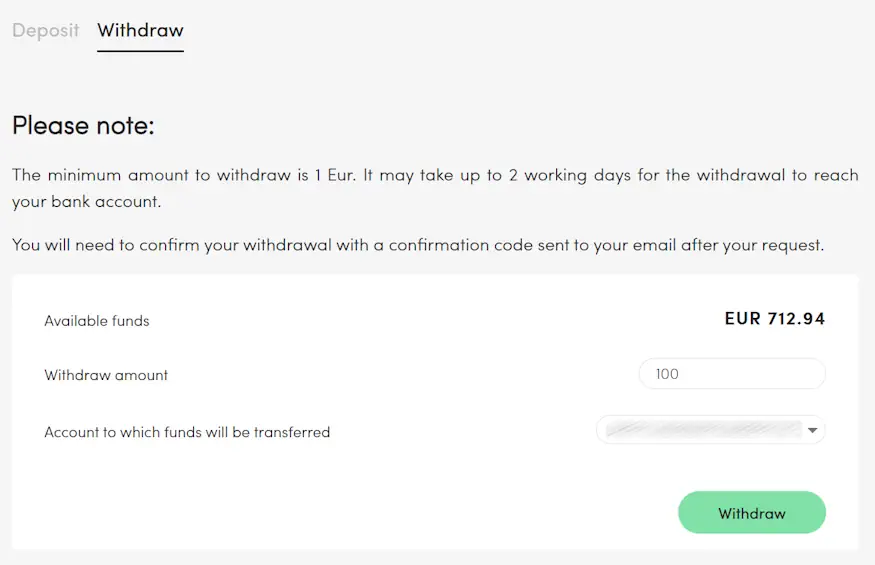

How do I withdraw money?

If you want to withdraw funds or excess interest from the P2P platform, you can use the same button as for depositing, but then switch to the “Withdraw” section. You will not be charged a fee for withdrawing funds.

Investors can only withdraw funds to the bank account from which the deposit was made. If you wish to register a new account for withdrawal, you must make a new deposit from a new personal account. You can also use several accounts in parallel for withdrawals, but you will have to register them once.

How long does the deposit take?

Based on my own PeerBerry experience, the deposit to the platform’s account takes approx. 1 – 2 days. However, if you use services such as Revolut* or Wise*, the transfer is often faster. In my case, the money is usually available in the PeerBerry account immediately.

How does PeerBerry work?

After registering on the platform, you can start investing in P2P loans. You can do this both manually and automatically.

As an advocate of passive income, I naturally focus on automated investments, even if this does not always work in the case of PeerBerry (see Problems & Solutions section).

The PeerBerry Auto Invest

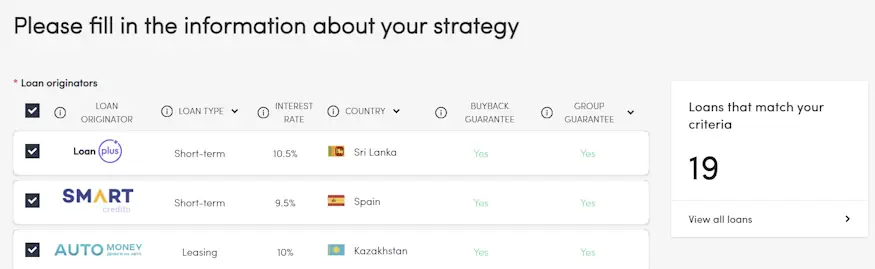

You can tell PeerBerry’s automatic portfolio builder exactly which countries & interest rates you want to invest in and it is very easy to configure. In principle, it works very similarly to the Mintos Auto Invest, but is a little easier to configure.

Once the PeerBerry Auto Invest has been configured, it appears in the overview, where you can see exactly what it is doing. You can also create several Auto Invest strategies. For example, I only have a single Auto Invest for all countries and lenders, which I can adjust if necessary. The war in Ukraine in 2022 showed just how important this can be, especially at a geographical level.

The PeerBerry strategies

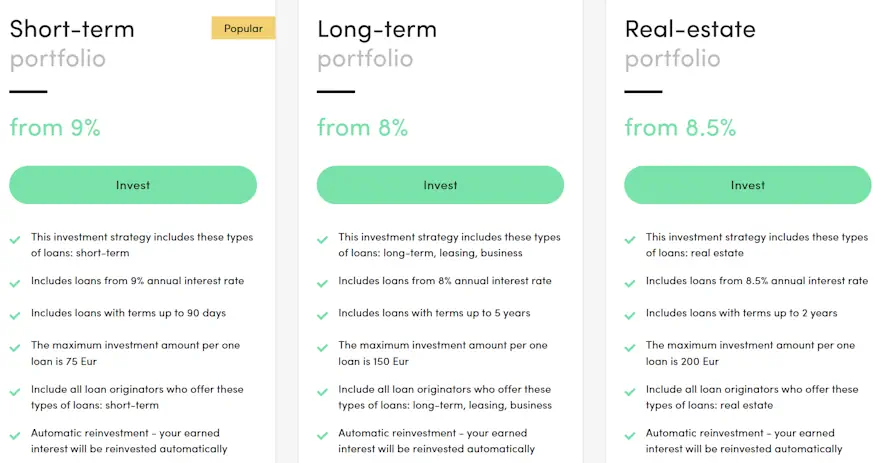

You can also use the automatic PeerBerry strategies, of which there are 3 in total. This starts your investment with a click and predefined parameters, which are as follows:

- Short-term Portfolio: only short-term loans from 9% interest that do not run for longer than 90 days and EUR 75 maximum investment per loan.

- Long-term Portfolio: only long-term, leasing and business loans from 8% interest, with a term of up to 5 years and a maximum investment of EUR 150 per loan.

- Real Estate Portfolio: only real estate loans from 8.5% interest with a term of up to 2 years and a maximum investment of EUR 200 per loan.

I have not yet used the strategies myself and therefore cannot pass on any PeerBerry experiences at this point.

Is there a secondary market?

Yes, since 2026, PeerBerry has had a secondary market that you can use to quickly liquidate your portfolio (if necessary).

In which countries can you invest?

Loans from many different countries are currently offered on the platform. In detail, these are currently

- Philippines

- Romania

- Kazakhstan

- Moldiva

- Spain

- Sri Lanka

- Czech

- Kenya

- Inida

- South Africa

- Mexico

- Columbia

- Poland

- Nigeria

- and Lithuania

I’m sure we’ll see more options on the marketplace in the future, so this list will continue to grow. You can always get an up-to-date overview on the PeerBerry loan originator page.

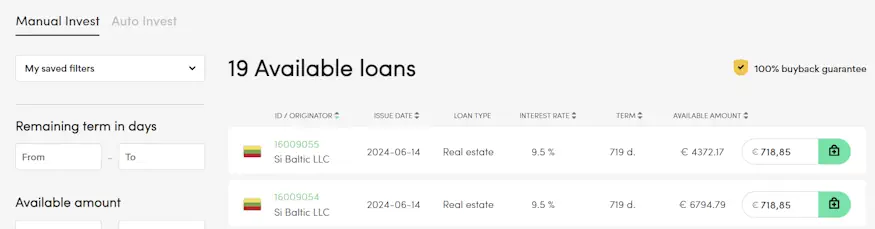

Which loans can you invest in on PeerBerry?

Those who invest in P2P loans here generate around 70% of their returns with real estate loans and business loans. The rest is made up of short-term consumer loans, long-term loans and leasing loans. So you are mainly active in the “real estate” & “business” sector.

What are the costs on PeerBerry?

There are no fees for investors on the investment or other actions on the platform.

What is the return on PeerBerry?

The return you can earn on the platform is historically over 11% and is absolutely competitive with platforms such as Bondora or Mintos.

You can always see the current return in the table above. My returns are usually much higher because I have been with PeerBerry for a long time and PeerBerry has had higher interest rates in the past. I also actively use the loyalty program.

What is the minimum investment amount on PeerBerry?

You only have to spend EUR 10 per loan on the platform to be able to invest. This is therefore within the usual range for consumer loan platforms. You can also invest EUR 10 on Twino, for example.

However, if you use Auto Invest, please note that the minimum amount rises to EUR 50, but this is not a problem, as you do not achieve any additional protection on PeerBerry with a minimum diversification at loan level anyway.

Does PeerBerry offer a buyback guarantee?

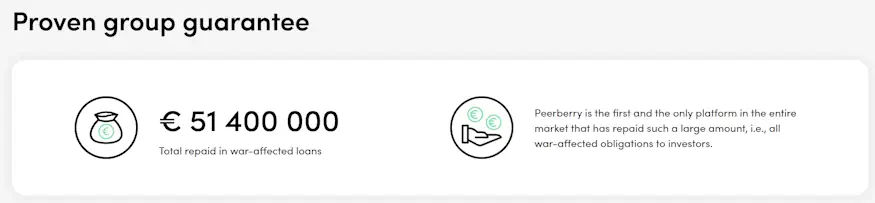

Yes, the P2P platform offers a buyback guarantee for all loans. Surprisingly, even real estate loans are covered by the guarantee. PeerBerry also offers group guarantees. So if, for example, a loan originator of the Aventus Group defaults, the Aventus Group will take responsibility. At least that’s the theory.

Personally, I don’t believe much in the group guarantee, as it hasn’t worked for other P2P platforms in the worst-case scenario anyway, as the group itself has gone bankrupt. However, PeerBerry showed during the Ukraine war that you can rely on it. Please note that not all loan originators offer a group guarantee.

To help you, I have an overview for you here, which you can verify on the loan originators overview page. BG stands for buyback guarantee, GG for group guarantee.

| Loan originator | BG | GG |

|---|---|---|

| Aventus Group | Ja | Ja |

| GoFingo | Ja | Ja |

| Lithome | Ja | Nein |

| SIBgroup | Ja | Nein |

| Litelektra | Ja | Ja |

Can you invest money in other currencies?

No, here you always invest in euros.

Will I also receive the interest on late loans?

Yes, you also receive the full interest for late projects. Unlike with Mintos, however, this is completely independent of the loan originator.

How exactly do taxes work on PeerBerry?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

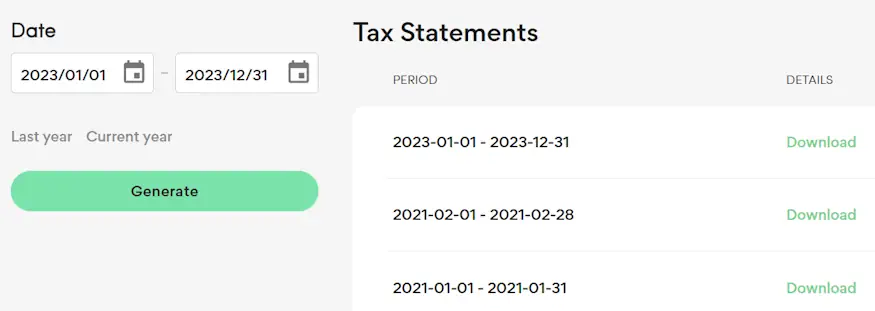

Is there a tax statement on PeerBerry?

Yes, PeerBerry offers a proper tax statement as a download that you can generate yourself. The statement is provided as a PDF and contains all the important data for the tax office. You can find it in the “Account statement” section.

Problems and solutions

As always, problems occur here and there. I’ll show you from my PeerBerry experience how you can perhaps fix the known ones.

There are no loans available on PeerBerry, what can I do?

Unfortunately, due to the popularity of the P2P platform, all loans are usually sold out. This is referred to as the PeerBerry Cash Drag. If you use Auto Invest, you often only get long-term loans, which usually have lower interest rates and ultimately lack geographical diversification.

In my experience, a “semi-automatic” system can help here. In other words, a combination of automatic and manual investments. Since the P2P loans on PeerBerry usually always appear in the same time window (namely between 6 and 11 a.m.), this is possible without any problems.

There are also 2 tools that can help you with this:

- The Beyond P2P Telegram Bot: Once set up, it notifies you of new loans on the platform via smartphone.

- The Investoren-Community auf Telegram: Often faster than the bot, there is now a separate channel for announcements that you can also use.

With these two tools and a little time, you should never have Cashdrag on PeerBerry again.

PeerBerry Risk

In my experience with PeerBerry, the Croatian platform has been very investor-oriented in recent years. Especially in the crisis year of 2020, it performed excellently and continued to grow strongly despite the crisis. It also managed the Ukraine war in 2022 and the resulting losses very well.

Nevertheless, earning interest can be over faster than you would like. We already know this from other platforms. So a loss can never be ruled out!

How does PeerBerry earn money?

PeerBerry’s only income is the commission earned from the loan originators. The amount of the commission fee is variable and depends on the product, the country and the size of the lender’s company. According to research, the commission fee varies between 1% and 5%.

What happens if PeerBerry becomes insolvent?

If PeerBerry were to cease operations, what would happen is not clearly defined publicly. However, shutting down the platform itself would have no impact on the current loans. An insolvency administrator would probably be called in to wind down the platform.

There is also a group guarantee. If, for example, one of the loan originators goes bankrupt or is no longer able to operate for other reasons, the Group itself will step in. This is what happened in the Ukraine war in 2022.

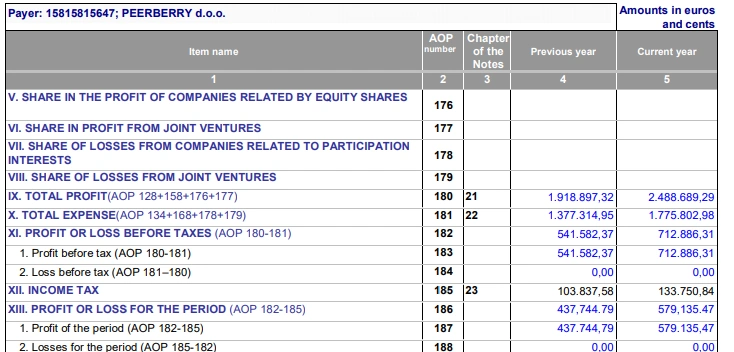

Is PeerBerry profitable?

According to its own statements, the company is profitable. However, the platform itself does not have any audited annual reports. Some of the lenders in the background, on the other hand, have audited annual reports, which is often a prerequisite for operating in the respective countries. Here is an excerpt from the 2024 annual report.

How reputable is PeerBerry?

Due to the strong structure of the Aventus Group in the background and the very constant and transparent communication towards the investors, we can assume that we are dealing with a good and reputable P2P platform with PeerBerry.

Through my contacts with the P2P platform over the years, I have been able to gain many insights and certain employees are extremely involved in Telegram groups to explain issues to investors.

How secure is PeerBerry?

I think the P2P platform is safe as long as the Aventus Group is doing well. However, you must never forget that investing in P2P loans is generally associated with a high level of risk! Therefore, as always, it is advisable to only invest money here that you are not dependent on in case of doubt.

Is there deposit protection on PeerBerry?

No, definitely not. PeerBerry is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on the platform are exposed to a high risk of default.

Are there defaults on PeerBerry?

There are usually defaults on every P2P platform and this is certainly the case here. However, the default rate is not publicly visible and the concept of the buyback guarantee means that you as an investor do not know about it. The platform advertises that it has never lost a loan.

PeerBerry experiences in crisis situations

As an investor in PeerBerry, you got through the coronavirus flash crash in March 2020 in a relaxed manner! The Ukraine war in 2022 was more challenging.

PeerBerry during the Covid-19 crisis 2020

PeerBerry did not have any significant problems during the crisis. Those who were invested here were therefore able to happily continue generating passive income. Although, as with most platforms, the volume of new P2P loans fell at the beginning of 2020 and people wanted to withdraw their funds, the volume normalized a few months later.

PeerBerry during the Ukraine war in 2022

The war in Ukraine hit PeerBerry much harder than the Covid-19 pandemic. The Ukrainian lenders were no longer able to continue working normally due to the war, while the Russian lenders were affected by the sanctions. A total of almost EUR 50 million was on fire. However, PeerBerry worked out a 24-month repayment plan and also set up an independent committee of investors to monitor the repayment.

Ultimately, no investor in PeerBerry has suffered a loss to date and all promises have been kept. The outstanding repayments were credited to the investors’ accounts month by month and all repayments were completed in 2024.

Advantages and disadvantages of PeerBerry

Before we come to a final conclusion about the platform, here is a summary of my pros and cons.

Disadvantages

- Investors often think that PeerBerry is a broadly diversified marketplace due to its structure. But they are very attached to the success of the Aventus Group.

- There is no audited annual report of the platform itself and therefore no simple and quick way to check the financial situation of the company.

- The company is currently unregulated.

- Normally, demand is higher than supply, which can lead to cash drag.

Advantages

- Stable profits since the start of my investment.

- All loans have a buyback guarantee.

- The marketplace concept allows you to spread your investment across several countries and companies.

- Passive income via complete automation is possible.

- No capital loss for investors so far (not even during the crises).

Conclusion of my PeerBerry review

PeerBerry is one of the winners of the corona crisis. It has benefited from the fact that there have never been any known problems on the P2P platform. However, as we all know, these can come faster than you think. Despite all the euphoria, investors should still be careful with their investments. The Ukraine war in 2022 showed that things can turn out differently. But even this situation could be overcome.

For many investors in our community, everything seems too good to be true and it is precisely then that you should pay particular attention to your money. However, there is nothing to be said against building up a portfolio with PeerBerry and observing and continuously improving it.

I myself have now collected over EUR 10,000 in interest. Nevertheless, the P2P platform is a challenge in terms of the high demand. Without a loyalty level, it will hardly be possible to place your money at more than 8.5% in 2025.

Moreover, my personal contact with the company has always been outstanding. They always take the time to answer questions from the community and are not afraid to answer all investor questions personally and to hang around in the communities themselves.

Is there a PeerBerry forum for discussions?

There are various places where you can interact with other investors and gather PeerBerry experiences. The primary destination for this is the international investors group on Telegram where you can engage in discussions.

Is there a PeerBerry bonus or a referral program at the beginning?

Since October 2021, you can no longer refer friends on PeerBerry. As is so often the case, the bonus system was exploited by shady investors who used it to harm PeerBerry. However, you can also get a regular 0.5% bonus interest as a PeerBerry bonus for the first 90 days via my link.

What alternatives are there to PeerBerry?

A reasonable and much larger alternative could be Mintos. The marketplace concept is a little more alive here (Mintos is not tied to a single large lender). However, if that doesn’t bother you at all, Twino, Viainvest or Robocash are also worth considering.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

PeerBerry vs. Mintos

Many people keep asking me how some platforms perform against Mintos and whether they are an alternative. In my eyes and from my PeerBerry experience so far, the two platforms are not really comparable. The reasons for this are simple:

- Mintos is a real marketplace and has over 60 lenders, whereas PeerBerry’s fortunes are strongly controlled by the Aventus Group.

- So if the Aventus Group has problems with the loans, PeerBerry probably also has a serious problem. Due to the structure of the group, however, this case is rather unlikely, as many lenders working under the Aventus Group would have to have problems at the same time.

- If the same scenario happens on Mintos, only part of your portfolio will be affected.

From my own PeerBerry experience, however, you can use Mintos as a great supplement.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Peerberry Review 2026 - The favorite of P2P investors

On this website you will find my personal Peerberry review and many years of experience ✚ 0.5% PeerBerry bonus as cashback!

4.99