Asterra Estate experiences 2026 – Up to 15% interest daily?

Asterra Estate is a new real estate financing platform that operates in one of the fastest-growing regions in Latvia and builds houses for private owners. I visited them before the launch to have the concept explained to me, talk to various employees from the company, and, of course, take a look at the properties in question.

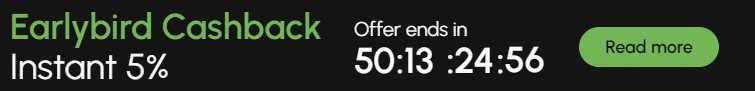

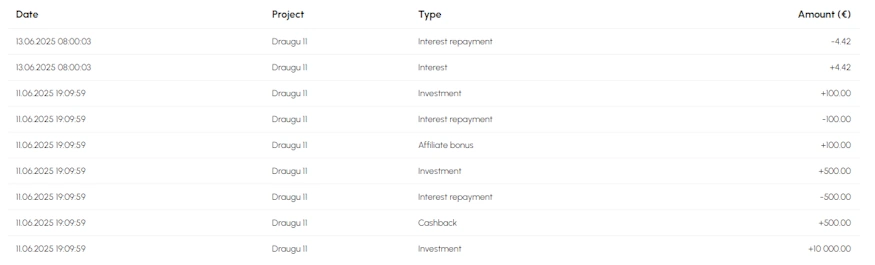

After clarifying the key data for myself, I will start aggressively with EUR 10,000, similar to what I did with Devon and many others before. Because, as always, the initial conditions are fantastic. Annual returns of 15% at the start, daily interest payments, and optional compound interest. And on top of that, a generous 5% + 1% cashback, which I didn’t want to miss out on.

You can find additional tutorials on the homepage of the English section of my blog.

(Bonus conditions: You will receive 1% cashback on all your investments during the first 90 days and an immediate credit. (+4% cashback until April 30, 2026, information here)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Asterra Estate?

- Asterra Estate Review – All important data at a glance

- Registration for investors

- Asterra Estate Review: How does the platform work?

- Is there an Auto Invest

- Is there a secondary market?

- In which countries can you invest?

- What projects can you invest in on Asterra Estate?

- What are the costs on Asterra Estate?

- What is the return on Asterra Estate?

- What is the minimum investment amount on Asterra Estate?

- Does Asterra Estate offer a buyback guarantee?

- Is there an app for Asterra Estate?

- Can you invest money in other currencies?

- How exactly do taxes work on Asterra Estate?

- Is there a tax statement on Asterra Estate?

- Is investing with Asterra Estate risky?

- Advantages and disadvantages of Asterra Estate

- Conclusion of my Asterra Estate review

What is Asterra Estate?

Asterra Estate is a new P2P platform that allows private investors to invest in Latvian real estate projects. Like Devon, it is also a client of White Label Solutions, a company that builds P2P platforms.

Key features at a glance:

- Daily interest credit from day one.

- Returns of up to 15%.

- Daily compound interest effect.

- Loan terms of up to 5 years with the option of early exit.

- Real estate in the background that serves as collateral.

- Additional security through group guarantee.

- High cashback (5 + 1%) at the launch of the platform.

What exactly is Asterra Estate all about?

Let’s get into the details. Specifically, let’s start with the development of a residential project in Ādaži, near Riga. Investors co-finance the project phases and receive a fixed interest rate of up to 15% p.a. over several years. I took a look at the site, and basically, an entire small town is to be built. 136 plots on 36 hectares of land. The necessary utilities (electricity, water, etc.) have already been installed, and most of the roads between the plots have already been built. So it’s not a greenfield project, even though there’s still a lot of greenfield left.

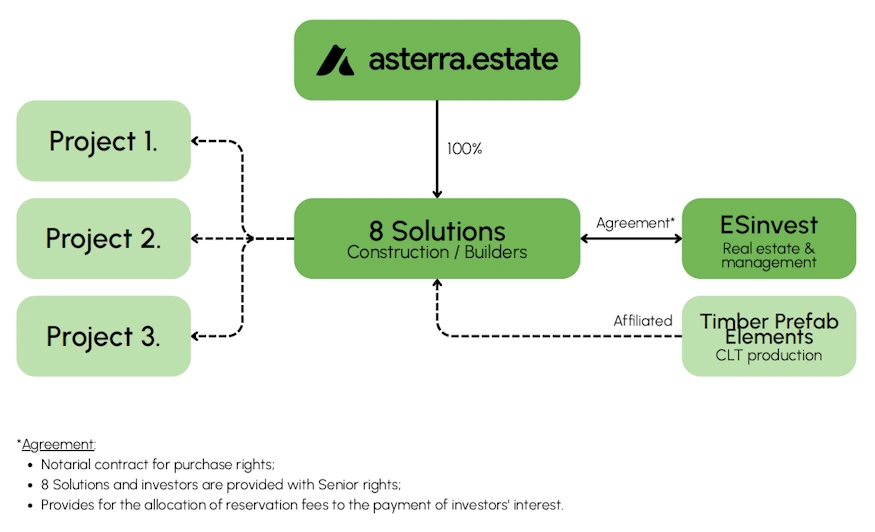

Until now, the company has been completely self-financed, but more money is now needed to complete the project in Ādaži more quickly. To this end, loans have been taken out from Capitalia, among others, which is an extremely good reference (we will come back to this later). Behind the platform is the project company Asterra Estate OÜ, which also owns 8 Solutions (the project company), which has an agreement with the original company ESinvest, which has been in existence since 2016. In addition, there is the company Timber Prefab Elements, which specializes in CLT construction. However, as quickly became clear on site, the entire structure essentially belongs to a single entrepreneurial family led by entrepreneur Edgars Putnis and his partner Elina Sniezane. As always, this has the usual advantages and disadvantages.

More about Ādaži

When considering investing here, it is essential to familiarize oneself with the Ādaži region and understand why such a project may be a good idea there. Ādaži not only has beautiful nature and is located directly on the Latvian river Gauja, but it is also home to the largest potato chip factory in Latvia (no joke). It is also home to a Latvian army base, where a Canadian contingent of over 1,000 soldiers has been stationed since 2017 (part of NATO Battlegroup Latvia). These soldiers naturally need somewhere to live.

The region is also only a few kilometers from the capital Riga, making it perfect for commuters who want to live in the countryside. In addition, the Gauja National Park is in the immediate vicinity and the first beautiful beach is only a 20-minute drive away. I have tested it myself. Furthermore, there is an international school, King’s College Latvia, and I heard that there will be 11 parallel classes in the next school year at the elementary school there. This is a record in Latvia and clearly shows the interest in the region.

Ādaži combines proximity to the city, natural beauty, potential for appreciation (real estate values are rising 5-10% per year), and demand—it is precisely this combination that makes the region particularly attractive to both investors and homeowners and makes it one of the fastest-growing regions around Riga!

Why does Devon look like Ventus Energy & Devon?

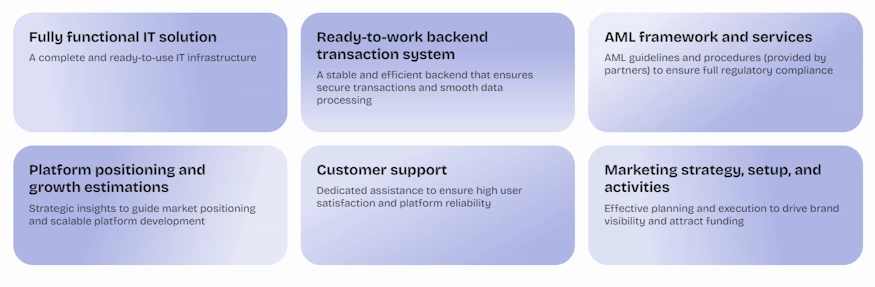

Like Devon, Asterra Estate is based on the platform technology of White Label Solutions, a subsidiary of the Ventus Energy Group. Following the success of its own energy investment platform, Ventus Energy founded this separate unit with the aim of developing customized financing platforms for external customers and providing technical support. Asterra Estate is White Label Solutions’ second customer, with more to follow.

Asterra Estate was also built as part of this white label offering and therefore uses the same technical basis as the other two platforms – including infrastructure, transaction processing, AML compliance, and marketing and support systems. Nevertheless, Asterra Estate is also an independent company and has nothing to do with Ventus Energy. The visual and technical similarity results solely from the shared technology stack, not from an organizational connection.

In my opinion, this provides an additional layer of security for investors, because the White Label Solutions team has known the P2P market at least as long as I have, and not every request to build a platform is accepted. They always check who is behind it and whether a corresponding financing concept would have a chance on the market. Otherwise, there would only be disadvantages for White Label Solutions.

Asterra Estate Review – All important data at a glance

Before we go into the details of the Asterra Estate review, here is the most important data for you in one place.

| Started: | 2025 |

| Company Headquarters: | Riga, Latvia, but operating as Asterra Estate OÜ in Estonia |

| CEO / Corporate management: | Edgars Putnis, there from the start |

| Regulated: | No |

| Assets under Management: | approx. EUR 6.6 million |

| Financed Loan Volume: | approx. EUR 6.6 million |

| Number of Investors: | approx. 900 (active investors) |

| Return on Investment: | 15.81% according to official information from the platform. |

| Buyback guarantee: | Yes, there is a payment obligation that takes effect after 90 days. |

| Minimum investment amount: | 1.000 EUR |

| Auto Invest: | No |

| Secondary Market: | No (but early project exit possible) |

| Issue of a tax certificate: | No |

| Investor loyalty program: | Not yet |

| Starting bonus: | Yes, 1% of the amount invested via this link* (immediate credit, active for 90 days). |

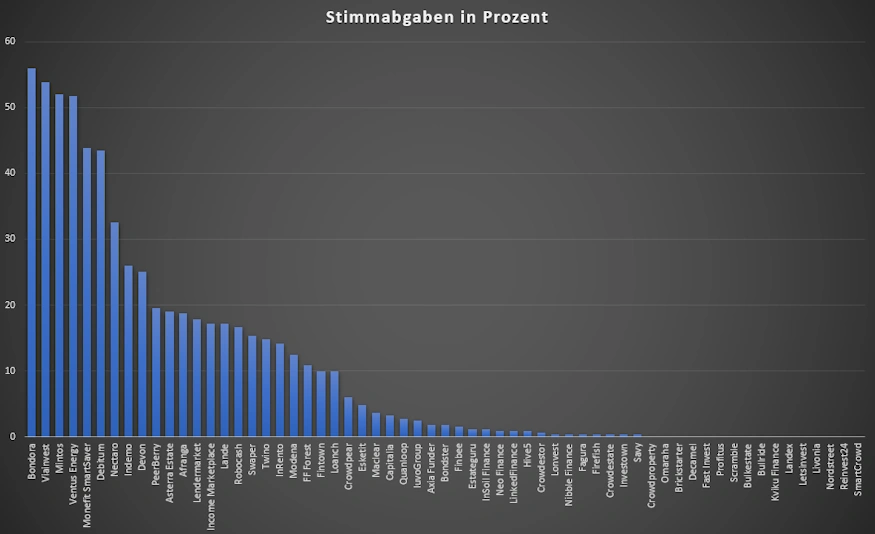

| Rating: | Place 22 | Refer to public rating. |

| Community Voting: | 11th place out of 61 | See results (in German). |

| Last annual report: | No annual report published to date due to the company’s age. |

Asterra Estate experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Asterra Estate took 11th place out of 61 with 19.0% of all votes, which can be considered as a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Asterra Estate

Registration for investors

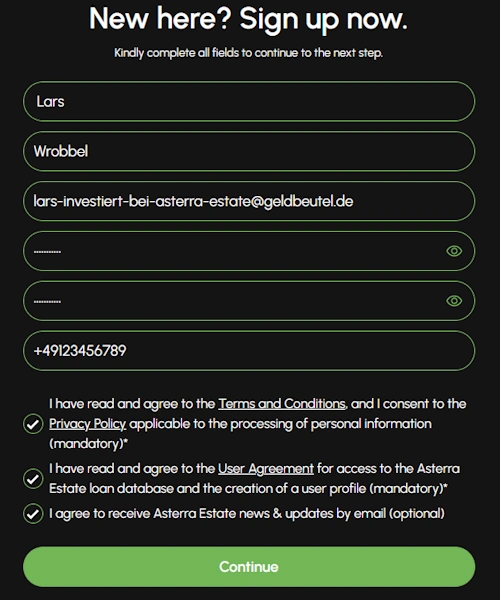

Registering on Asterra Estate is not particularly complicated. It consists of the following steps:

- Create an account by entering your e-mail address and password.

- Enter your personal data.

- Verification of your identity (e.g. with your identity card).

You will soon be able to register with your company if you have one and want to invest through it. As of today, this is not yet possible. After registration and payment, you are then ready to invest in your first real estate projects.

Asterra Estate Bonus

Via my link* you will receive 1.0% cashback on all investments you make in the first 90 days after your registration. The bonus will be credited immediately after the investment.

From time to time there are also limited-time bonus promotions at Asterra Estate. These are always listed promptly in my P2P platform comparison. After signing up, you should also see a large banner in your account with a timer running down. This tells you that the registration via my link has worked. If this is not the case, simply get in touch using the contact form.

If you use my link, you do not need to enter a referral code when registering!

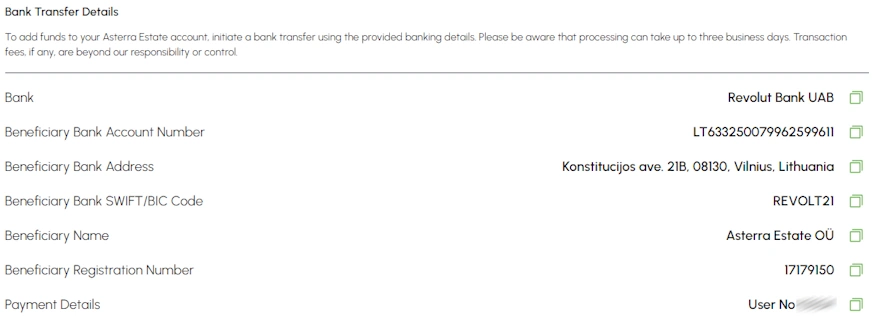

How do I deposit money?

As always, depositing money is the easiest step when investing money. In your account, click on “Deposit / Withdrawal” and you will be taken directly to the deposit screen. Here you can then transfer money to the account stored there.

Please note that the transfer must come from a personal bank account. This will also be verified for subsequent payouts.

How do I withdraw money?

If you want to withdraw capital or surplus interest from Asterra Estate, you also go via “Deposit / Withdrawal”, but then select “Withdrawal” in the tabs at the top.

You will not be charged a fee for withdrawing the funds. The funds can only be withdrawn to a bank account that belongs to you. If you wish to register a new account for withdrawal, you must make a new deposit from a new personal account. Funds can be withdrawn from EUR 10.

How long does the deposit take?

Based on my own Asterra Estate experience, the deposit to the platform’s account takes approx. 1 – 2 days. However, if you use Revolut* or Wise*, for example, the transfer is sometimes available more quickly. Since Asterra Estate uses Revolut itself, this is probably the fastest option.

Can I also deposit and withdraw by credit card?

At the moment, you cannot use credit cards for deposits and withdrawals. These must be made with a bank account. Depositing via a bank account is also used for identification purposes.

However, if you use Wise or Revolut, you can top up these accounts by credit card if you wish. You can then carry out the transfer to Asterra Estate via this.

Asterra Estate Review: How does the platform work?

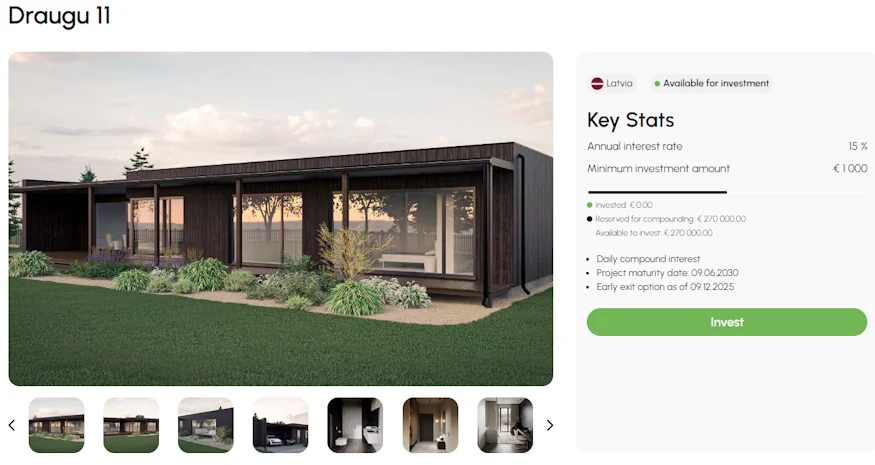

After registering with Asterra Estate, you can use the “Invest” button to view existing projects and carry out your research. Investors manually select projects that are presented publicly with key facts and financial data.

The construction projects are usually relatively large, so it is worth reading up on the projects in detail.

In addition to the summary of the project, there is a whole range of other interesting information. Including the market situation, key financial figures and evaluation reports. So you can read in depth here.

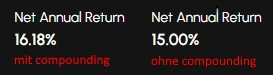

You can also decide whether the interest should be reinvested directly in the same project or whether you want to have it distributed. I opted for the latter because of the initial amount and to see if everything works. It’s also cool that you can decide and set this individually for each project. The interest starts on the day after your investment and is paid daily.

This also increases the interest rate of the projects immensely, which you can see transparently on the portfolio page.

After your investment, the interest is credited to your account daily, just like with Bondora Go & Grow or Monefit SmartSaver. Only at a slightly higher interest rate.

Hint! If you would like to have a possible cashback paid out (this is normally added to the investment amount) and intend to invest more than EUR 1,000, you should first make the minimum investment (EUR 1,000), then switch off compounding and only then invest the rest. In this case, the cashback will be credited to your available funds and will NOT go to the project.

Example: Deposit EUR 10,000, invest EUR 1,000, switch off compounding, invest a further EUR 9,000 and the cashback on the EUR 9,000 can be paid out directly.

Is there an Auto Invest

Since there will only be very few projects on the platform and investors should also deal with these, there is no Auto Invest on Asterra Estate. I also doubt that we will see this in the future.

Is there a secondary market?

There is no secondary market for Asterra Estate. However, similar to Fintown or of course Ventus Energy & Devon, you do not have to hold the projects until the end of the term. There is a minimum term after which you can withdraw your capital (the minimum term depends on the respective project, in the example above already in December 2025).

The way this works is that your claim is bought up by another investor as soon as they invest in the project. So there has to be a certain demand for you to get out of the project. Asterra Estate will not provide any interim financing.

Attention! If you use the early exit option, part of the bonus you received will be deducted again. Depending on the project, you will find the relevant conditions in the project profile. So you cannot cheat Asterra Estate here, as often happened with Ventus Energy in the beginning.

In which countries can you invest?

At Asterra Estate, you can only invest in the domestic market of Latvia and, as explained above, currently only in the popular region of Ādaži. However, it is of course possible that further projects from other regions will be added at a later date.

What projects can you invest in on Asterra Estate?

At Asterra Estate, you provide the company with money through a senior rights loan, which is used for real estate development.

Currently, you can invest in the ongoing development of the village in Ādaži described above. This mainly involves:

- Land development (parceling, infrastructure)

- House construction with CLT wood modules

The investments are project-related and are processed building by building, and there are clear terms and fixed interest rates.

What are the costs on Asterra Estate?

Investing on Asterra Estate is free at all levels.

What is the return on Asterra Estate?

The returns you can generate on Asterra Estate are attractive for development projects. This is mainly due to the growth prospects of the Ādaži region, which promises high increases in value. Some of the projects offer annual returns of 15%. If you also take advantage of cashback promotions, even more is possible. You can see my own returns for each year in the statistics.

Another exciting feature is that you can lock in your return for several years, but still have the option to exit early. This can be done either:

- If the early exit option can be exercised (usually six months after the investment)

- When the security is sold (depending on the time of sale of the security). Here, you can exit the loan agreement directly or exercise the option to extend it. In this case, a new security is pledged.

Then, starting in 2026, there will be the opportunity to further increase returns with the Loyalty Program. In a total of four tiers, loyal investors can earn up to 1.5% more.

What is the minimum investment amount on Asterra Estate?

The minimum amount for an investment on Asterra Estate is an impressive EUR 1,000. I think the reason for this will be the experience of White Label Solutions, who use the same rate on Ventus Energy and Devon. This is to ensure that they are not working with super-small investors, as experience has shown that these are the ones who require the most support.

Does Asterra Estate offer a buyback guarantee?

Asterra Estate offers a payment obligation after 90 days. In principle, projects in which you invest can be canceled. However, Asterra Estate will repay the basic amounts and interest in any case, as long as it is possible. However, if this is no longer the case, even the nice payment obligation is of no use! So, as always, you can lose all your invested capital.

Is there an app for Asterra Estate?

No, Asterra Estate does not currently offer an app for smartphones.

Can you invest money in other currencies?

No, on Asterra Estate you invest exclusively in euros. There is also no currency risk within the projects.

How exactly do taxes work on Asterra Estate?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Is there a tax statement on Asterra Estate?

There is currently no tax certificate for Asterra Estate. However, this is currently under development and will be available by the end of 2025 at the latest.

Is investing with Asterra Estate risky?

I cannot deduce much from my Asterra Estate experience so far, as I have only recently become active on the platform. In addition, Asterra Estate still has little track record, so we can only speculate about many things.But of course, we have ESinvest in the background, which has been around for many years and has certainly made its mark.

How does Asterra Estate earn money?

Asterra earns money on several levels:

- through reservation fees for the houses.

- through the sale of building plots.

- through affiliated companies (e.g., ES Studio, 8 Solutions) through planning and construction services.

I am not aware of whether the platform itself also charges administrative fees – it is likely cross-financed by the project company. In addition, things can also be financed with rents from other already completed projects of the affiliated companies (if necessary at all).

Is Asterra Estate profitable?

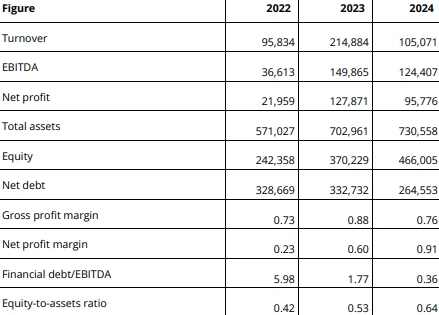

Asterra Estate itself is irrelevant here due to its group structure and as a pure financing vehicle. Basically, ESinvest is important in the current setup. Even though I have the original Latvian financial statements here, the crowdfunding platform Capitalia has done the work for us and presented them nicely. ESinvest partially financed one of the first houses (EUR 170,000) on this platform, so logged-in investors can get a comprehensive insight into the financial figures there.

For those who are not registered there, it should be noted that ESinvest has been profitable in all the figures available there (2022–2024), as you can see in the screenshot below. In addition, ESinvest received a B rating with 80 out of 100 points, which is considered “low risk.” The following main risks were defined here:

- Delays may occur during the construction phase of the project.

- Although the market value of the collateral has been carefully reviewed and evaluated, the realizable value of the collateral may be lower than expected under extreme circumstances.

- Unexpected obstacles and additional costs may arise during the implementation of the project.

Incidentally, another house, the Putni vacation property, which also belongs to ESinvest and generates steady rental income, was financed by Signet Bank. This is also a very good and reputable institution.

My research also shows that the development of the village in Ādaži has so far been financed entirely by the company’s successful real estate activities. To date, 1.4 million euros have been invested in the development of the land and the construction of the first two houses.

What happens if Asterra Estate becomes insolvent?

If something happens to the platform, this will not affect your investments for the time being and they will continue to run. In the event of insolvency, an insolvency administrator will take over the settlement of the remaining projects and payments and distribute the funds accordingly. After that, successful recovery depends on the following factors:

- Whether you have securitized collateral

- How high the realizable value of the real estate is (whether plots/houses can be sold)

- What our ranking is (we are first in line here)

We know from past experience that insolvency proceedings are lengthy and not very transparent. So, if Asterra Estate goes bankrupt, there’s a potential risk to your money! But we’ve got the advantage of being backed by a bigger company, which could cushion the blow of bankruptcy.

How reputable is Asterra Estate?

The platform was founded by an existing project developer with real estate projects. The members of the management team all have a proven track record and can be found on LinkedIn. The financing of previous projects through reputable partners such as Signet Bank and Capitalia is a good prerequisite for the platform itself. By saving on credit costs, the platform can be made more attractive to private investors and thus offer higher interest rates.

How secure is Asterra Estate?

The security of investments in Asterra Estate is based on several levels. First, the entire cost of a project is never financed by credit. 10% is always paid out of pocket, meaning that only a maximum of 90% is financed. This ensures that Asterra Estate is also involved in every loan.

In addition, Asterra Estate offers an internal guarantee that takes effect in the event of a default by the project company. This guarantee obliges Asterra Estate to reimburse the loan amount within 90 business days of maturity. This security creates trust, especially in a phase where the platform is still relatively young.

In addition, the platform ensures transparency through detailed project information, clear schedules, and comprehensible construction progress reports. It should also be noted that the loans granted this time are not pure mezzanine loans, but loans with senior rights (not senior loans!). This is not really subordinated, but also not senior. Structurally, the whole thing works as follows:

- The agreement between 8 Solutions and Esinvest grants 8 Solutions priority mortgage rights.

- 8 Solutions is a wholly owned subsidiary of Asterra Estate.

- Asterra Estate provides a group guarantee for all projects.

This means that there is no increased risk of subordination. All risks can also be reviewed here.

Are there defaults on Asterra Estate?

No, there have been no defaults at Asterra Estate to date. I am also not aware of any problems relating to ESinvest, nor have I found any.

Is there deposit protection on Asterra Estate?

No, there is no deposit protection. Your funds held and invested on the platform are exposed to a default risk.

Is Asterra Estate crisis-proof?

No platform is completely crisis-proof! However, ESinvest has probably been through quite a few crises, but obviously this has not resulted in them ceasing to exist today.

Advantages and disadvantages of Asterra Estate

Before we come to a final conclusion about the platform, here is a summary of my pros and cons based on my Asterra Estate experience.

Disadvantages

- The platform is not regulated.

- There may be project delays or a market slump.

- High entry hurdle (EUR 1,000).

- Very young company with a poor track record (as a platform).

- Annual reports not publicly accessible.

Advantages

- Attractive interest rates of up to 15%.

- Daily interest and compound interest effect.

- Group guarantee from ESinvest.

- All properties are secured by first-rank collateral.

- Solid track record from other reputable financiers.

- Early exit possible.

Conclusion of my Asterra Estate review

As with most other platforms since my initial investment in Fintown 2024, I am also starting aggressively with Asterra Estate, investing EUR 10,000 from the very beginning. Here, too, I am aware that this is a new platform and that this always entails a certain amount of risk. However, as always, I am also aware that the conditions of a platform will never be as good as they are at launch, which is why I don’t want to miss this opportunity.

Here, too, I refer to the “law of the first project,” which states that new projects require special care. In addition, Asterra Estate, just like Devon, once again pre-selected by white label solutions, which are naturally interested in having a long-term paying customer and not a platform that disappears after a year.

What also convinced me personally was the meeting on site. The story sounds logical to me, and through the opportunity to contact various management members, I was able to ask questions about things that were not clear to me before. In fact, I even briefly considered buying one of the houses myself and had initial calculations done. However, this would have affected the expansion of my other Baltic investments due to a fairly high one-time investment in the house, which is why I ultimately decided against it. But postponed is not canceled.

As always, my decision does not have to be your decision. My P2P portfolio is now worth half a million euros, and I would have compensated for a possible loss within a few months. With an increasing portfolio value, I can therefore take a more aggressive approach, but that does not mean that I am willing to lose money. I believe I have done my homework here. You are responsible for your own decisions.

Is there a Asterra Estate forum for discussions?

Asterra Estate has an own telegram channel. However, this is not open to the public, but only to registered investors. After your registration, you will get an access link in the first few days to start the discussion with other fellow investors.

Is there a Asterra Estate bonus or a referral program at the beginning?

Yes, if you register via a link on this blog, you will receive 1% of the capital invested in the first 90 days as a bonus.

I would be grateful if you would use my links in appreciation of this free contribution. There are no disadvantages for you, only advantages.

What alternatives are there to Asterra Estate?

The Czech platform Fintown, or rather the “sister platform” of Asterra Estate Devon, also from White Label Solutions, offers a good alternative with a similar financing structure. A platform with the same functionality can be found at Ventus Energy, which has already been mentioned several times, even though the projects here are not real estate projects. You can find more alternatives in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Asterra Estate Review 2026 - Up to 15% p.a.

Detailed Asterra Estate review for real estate projects with daily interest payments. Find out how you can benefit from double-digit returns.

4.5