Triple Dragon Funding Review 2026 – Passives Income with gaming?

Triple Dragon Funding*, or TD Funding for short, may be a new platform, but the company behind it is well established and has been a solid lender on the Debitum platform for years. Like many other lenders before it, it has now developed its own platform to grant loans to investors without an intermediary marketplace.

This has several advantages, but also disadvantages for us, which we will discuss in detail in the following article. I have been investing in Triple Dragon loans on Debitum for years, so I didn’t have to think twice about starting an investment here as well. A newly launched platform comes with the usual bonuses that sweeten the deal, which in this case were 2% cashback from the platform and 1% via an advertising link. In addition, with Triple Dragon Funding, we are investing in a platform with no real connection to the Baltic States.

And as always, I invested myself before writing this post. Since 2026, my minimum investment before publishing a detailed post on my blog has been at least EUR 10,000, so I started with this amount on TD Funding as well. This allows me to show you not only the theory, but also my real experiences as an investor.

You can find additional tutorials on the homepage of the English section of my blog.

Sign up for Triple Dragon Funding now and get +1% cashback!*

(The extra 1% applies to all investments made in the first 60 days. In addition, there is an extra 2% cashback until March 2, 2026. Details here.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Triple Dragon Funding?

- Triple Dragon Funding Review – All important data at a glance

- Registration for investors

- Triple Dragon Funding Review: How does the platform work?

- Is there an Auto Invest

- Is there a secondary market?

- In which countries can you invest?

- What projects can you invest in on Triple Dragon Funding?

- What are the costs on Triple Dragon Funding?

- What is the return on Triple Dragon Funding?

- When will the first interest payments on Triple Dragon Funding be made?

- What is the minimum investment amount on Triple Dragon Funding?

- Does Triple Dragon Funding offer a buyback guarantee?

- Is there an app for Triple Dragon Funding?

- Can you invest money in other currencies?

- How exactly do taxes work on Triple Dragon Funding?

- Is there a tax statement on Triple Dragon Funding?

- Is investing with Triple Dragon Funding risky?

- How does Triple Dragon Funding earn money?

- Is Triple Dragon Funding profitable?

- What happens if Triple Dragon Funding becomes insolvent?

- How reputable is Triple Dragon Funding?

- How secure is Triple Dragon Funding?

- Are there defaults on Triple Dragon Funding?

- Is there deposit protection on Triple Dragon Funding?

- Is Triple Dragon Funding crisis-proof?

- Advantages and disadvantages of Triple Dragon Funding

- Conclusion of my Triple Dragon Funding review

What is Triple Dragon Funding?

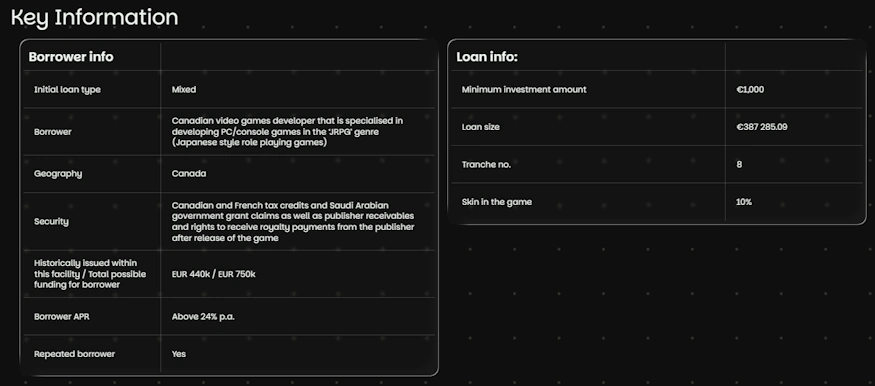

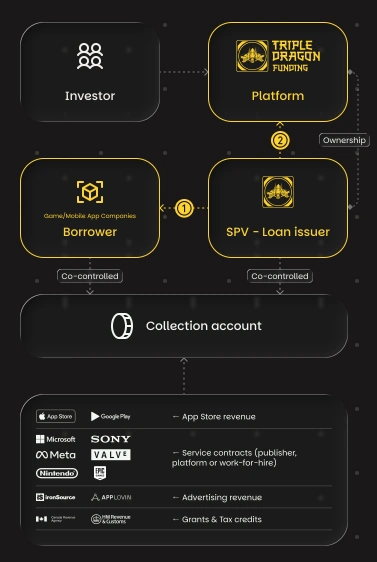

Triple Dragon Funding is a crowdlending platform operated by British financing specialist Triple Dragon. Triple Dragon was founded in London in 2016 and specializes in financing for developers and publishers of video games and mobile apps. Through the platform (which is based in Luxembourg), investors can invest in secured corporate loans that Triple Dragon grants to game developers. Receivables from large tech companies such as Google, Apple, Amazon, and even government tax credits serve as collateral for the loans.

Triple Dragon thus acts as a lender in the gaming sector and enables private investors to participate in the financing of these projects. Until now, investments have been made in the form of asset-backed securities (ABS) – bundles of corporate loans – via the P2P platform Debitum and now directly via Triple Dragon Funding (tdfunding.eu).

Triple Dragon Funding thus offers access to an absolute niche market: short-term business loans in the gaming sector with double-digit returns, secured by payment claims from app and game sales. Triple Dragon itself was founded by experienced industry experts and has also attracted institutional investors as financiers over the years, which speaks for the seriousness of the business model. In addition, as mentioned at the beginning, they have been active on Debitum for many years. Over time, they have financed over 1,000 loans with a total value of over EUR 35 million.

The most important features of the new platform at a glance:

- Daily interest credit from day one, currently advertised at 14% p.a.

- Daily compound interest effect

- Investments possible from EUR 1,000.

- Investment in secured business loans (secured by receivables from renowned companies such as Google, etc.)

- Early exit function (meaning you can exit your investments before the maturity date)

Triple Dragon Funding is a WLS platform

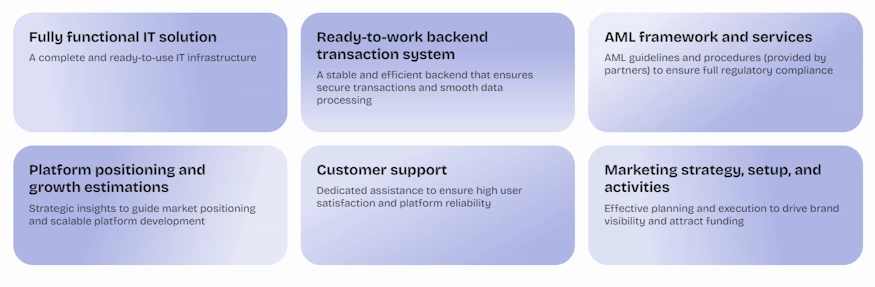

Triple Dragon Funding is based on the platform technology of White Label Solutions, a subsidiary of Ventus Energy Group. Following the success of its own energy investment platform, Ventus Energy founded this separate entity with the aim of developing and providing technical support for customized financing platforms for external customers. Triple Dragon Funding is White Label Solutions’ third customer after Devon & Asterra Estate, with more to follow.

It therefore uses the same technical basis as the other two platforms – including infrastructure, transaction processing, AML compliance, and marketing and support systems. Nevertheless, Triple Dragon Funding is also a completely independent company. The visual and technical similarity results solely from the shared technology stack, not from any organizational connection with any of the other platforms mentioned.

In my opinion, this actually provides an additional layer of security for investors, because the White Label Solutions team has been familiar with the P2P market for at least as long as I have, and not every request to build a platform is accepted. They always check who is behind the request and whether the corresponding financing concept would have a chance on the market. Otherwise, there would only be disadvantages for White Label Solutions.

Triple Dragon Funding Review – All important data at a glance

Before we go into the details of the Triple Dragon review, here is the most important data for you in one place.

| Started: | 2025 (parent company already on the market since 2016) |

| Company Headquarters: | Luxembourg, operating as Triple Dragon Funding S.a.r.l., parent company founded in the UK |

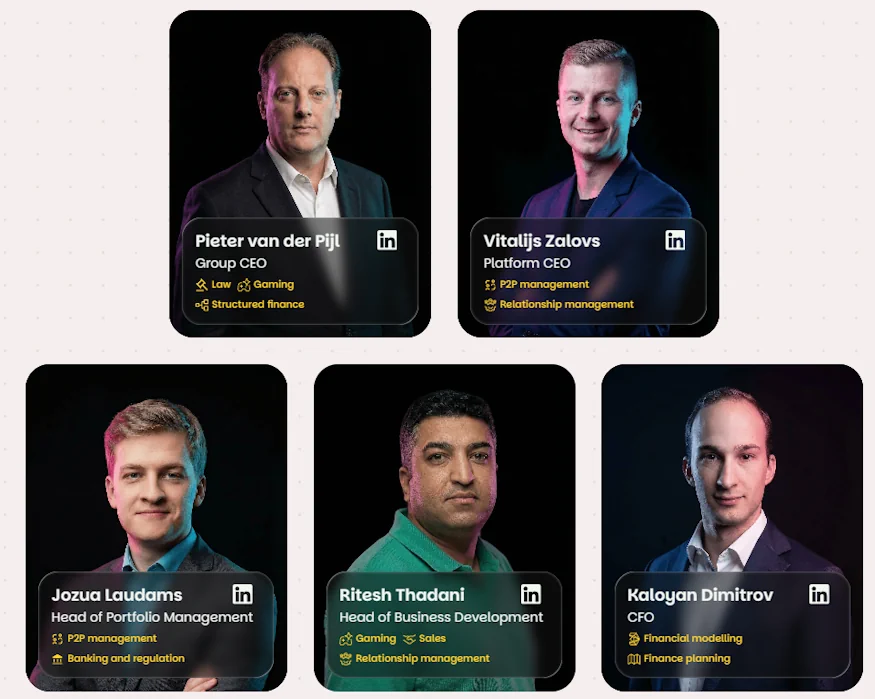

| CEO / Corporate management: | Vitalijs Zalovs, involved from the start (previously CEO of Esketit) |

| Regulated: | No (but license application in Luxembourg in planning) |

| Assets under Management: | approx. EUR 30 million |

| Financed Loan Volume: | Over EUR 50 million |

| Number of Investors: | No figures available yet, as it has just started. |

| Return on Investment: | No average available yet, but current projects are listed at 14%. |

| Buyback guarantee: | Yes, and each project is also backed by real values. |

| Minimum investment amount: | 1,000 EUR |

| Auto Invest: | No |

| Secondary Market: | No (however, early exit from the project is possible after 6 months via an early exit option). |

| Issue of a tax certificate: | Yes |

| Investor loyalty program: | Not yet |

| Starting bonus: | Yes, 1% of the invested amount for the first 60 days via this link*. |

| Rating: | Included in the Premium Rating, further information available in the public rating. |

| Community Voting: | not yet rated |

| Last annual report: | No annual report has been published yet due to the age of the company. |

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Triple Dragon Funding

Registration for investors

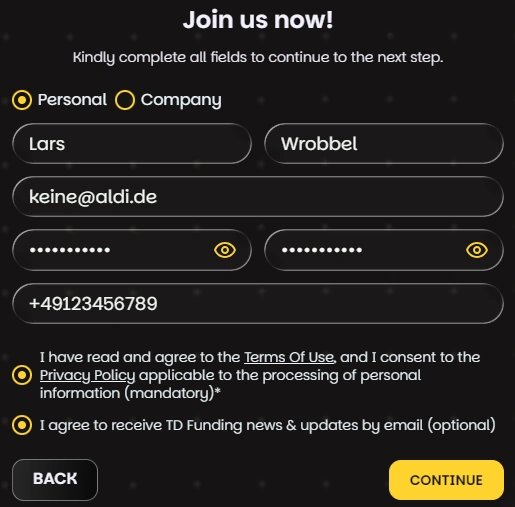

Registering on Triple Dragon Funding is not particularly complicated. It consists of the following steps:

- Create an account by entering your email address and password.

- Verify your identity (e.g., with your ID card) in less than a minute.

- Enter your personal data later on.

You can also register with your company if you have one and want to invest through it. After registering and making a deposit, you are then ready to invest in your first forestry projects.

Triple Dragon Funding Bonus

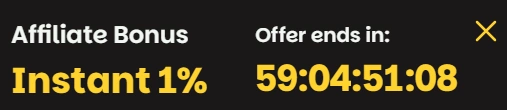

Via my link*, you will receive 1.0% cashback on all investments you make in the first 60 days after registering. The bonus will be credited immediately after the investment.

From time to time there are also limited-time bonus promotions at Triple Dragon Funding. These are always listed promptly in my P2P platform comparison. After registering, you should see a large banner in your account with a timer counting down. This tells you that the registration via my link has worked.

If you use my link, you do not need to enter a referral code when registering!

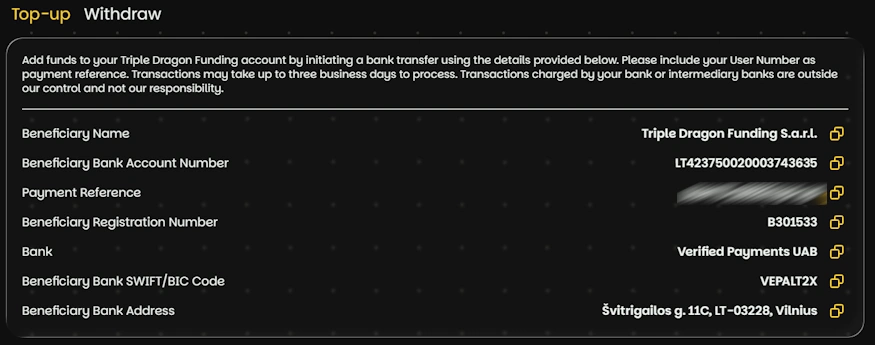

How do I deposit money?

Depositing money is, as always, the easiest step in investing. In your dashboard, click on “Top-up / Withdraw” and you will be taken directly to the deposit screen. Here you can then transfer money to the account stored there.

Please note that the transfer must come from a personal bank account. This account will also be verified for subsequent withdrawals.

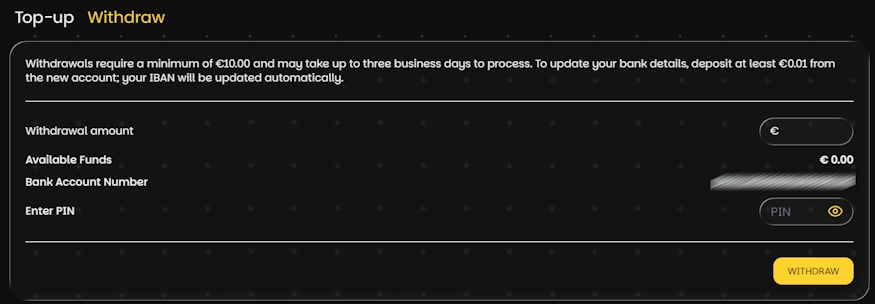

How do I withdraw money?

If you want to withdraw capital or excess interest from Triple Dragon Funding, follow the same steps under “Top-up/Withdraw,” but this time select “Withdraw” at the top.

There is no fee for withdrawing funds. Funds can only be withdrawn to a bank account that belongs to you. If you want to register a new account for withdrawals, you must make a new deposit from a new personal account. Funds can be withdrawn from EUR 10.

Can I also deposit and withdraw by credit card?

At the moment, you cannot use credit cards for deposits and withdrawals. These must be made with a bank account. Depositing via a bank account is also used for identification purposes.

However, if you use Wise or Revolut, you can top up these accounts by credit card if you wish. You can then carry out the transfer to Triple Dragon Funding via this.

Triple Dragon Funding Review: How does the platform work?

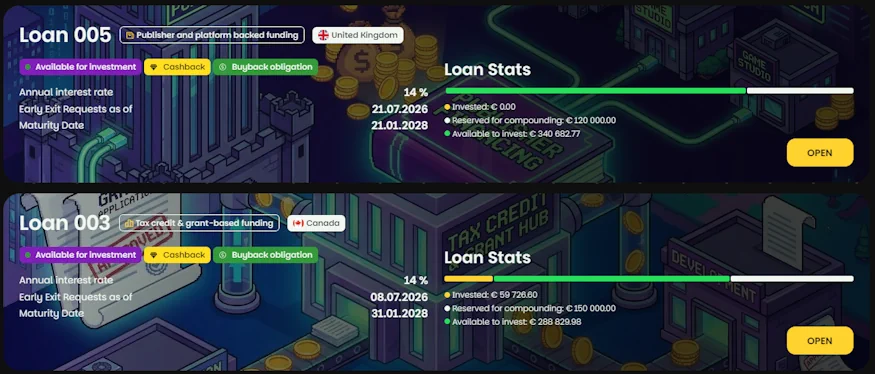

After registering with Triple Dragon Funding, you can use the “Invest” button to view existing offers and conduct your research. Investors manually select projects that are publicly presented with a few key facts.

The project details are as comprehensive as those for Ventus Energy, Asterra Estate, or Devon. You will learn the most important details, something about the borrower, the collateral, and how the investment works in concrete terms.

Two points in particular deserve positive mention:

- Triple Dragon Funding always has a stake in the loans itself (the corresponding “skin in the game” amount is disclosed in each project).

- Conflicts of interest are disclosed clearly and transparently.

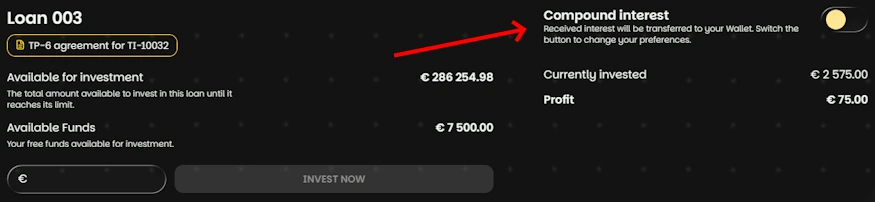

Once you have decided on a project you want to invest in, you must confirm that you have understood everything and then you can invest. You can also decide whether the interest should be reinvested directly in the same project or whether you want it paid out. As with all other platforms, I choose the payout option. You can decide and set this individually for each project.

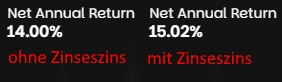

This decision is not insignificant, as it has a huge impact on your return, as you can clearly see in the following screenshot.

After you make your investment, interest accrues daily in your account, just like with Bondora Go & Grow or Monefit SmartSaver. Only at a slightly higher interest rate.

Tip! If you would like to have any cashback paid out (this is normally added to the investment amount) and plan to invest more than EUR 1,000, you should first make the minimum investment (EUR 1,000), then disable compounding, and only then invest the rest. In this case, the cashback will be credited to your available funds and will NOT go into the project.

Example: Deposit EUR 10,000, invest EUR 1,000, turn off compounding, invest another EUR 9,000, and the cashback of EUR 9,000 can be paid out immediately.

Is there an Auto Invest

Since there will only be a very small number of projects on the platform, there is no Auto Invest feature on Triple Dragon Funding. I also doubt that we will see this in the future.

Is there a secondary market?

There is no secondary market on Triple Dragon Funding. Similar to Ventus Energy, Devon, and Asterra Estate, however, you do not have to hold the projects until maturity. There is a minimum term after which you can withdraw your capital (the minimum term depends on the respective project).

This works by having your claim purchased by another investor as soon as they invest in the project. So there must be a certain amount of demand for you to exit the project. Triple Dragon will not provide any interim financing.

Please note: If you take advantage of early exit, part of the bonus you received will be deducted. Depending on the project, you will find the relevant conditions in the project profile. So you cannot cheat Triple Dragon Funding here, as was often the case with Ventus Energy in the beginning. There are therefore definite financial advantages to holding the projects until the end of their term.

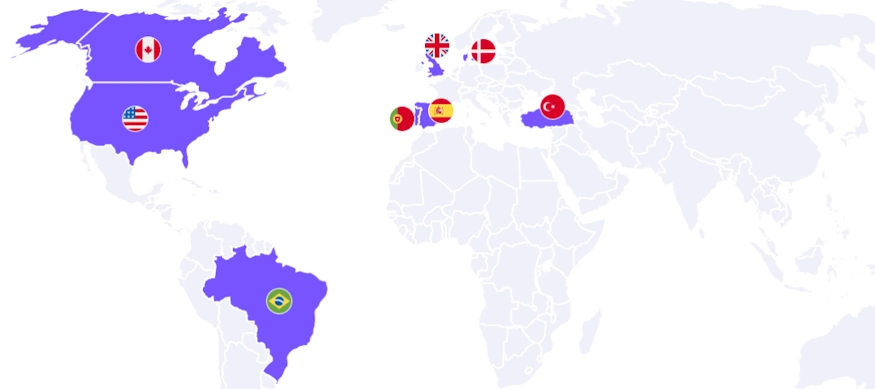

In which countries can you invest?

Triple Dragon has borrowers in various jurisdictions:

- United Kingdom

- Canada

- USA

- Brazil

- Denmark

- Portugal

- Spain

- Turkey

You can see exactly where you are investing in the project profiles. Currently, there are only loans from Canada and the UK, which is also the company’s focus. Other regions may be added in the future.

What projects can you invest in on Triple Dragon Funding?

At Triple Dragon Funding, you invest exclusively in business loans in the gaming and app sector. Specifically, Triple Dragon finances projects from game developers, app studios, publishers, and, in some cases, service providers in the gaming industry. The funds are used, for example, for:

- User acquisition campaigns (marketing budget to attract new players)

- Working capital for ongoing development projects

- Bridge loans until payments from platforms arrive

- or Project financing for new games

Typically, borrowers already have revenue from their games or receive secure expected payments (e.g., app store revenue, advertising revenue, government subsidies), which Triple Dragon pre-finances.

As an investor, you do not invest in consumer loans, but always in B2B projects (business loans). The risk/opportunity profile is therefore different from that of traditional P2P loans. You participate in the growth financing of tech companies. Other types of projects (real estate, consumer loans, etc.) are not offered on Triple Dragon Funding and are not planned.

What are the costs on Triple Dragon Funding?

Investing on Triple Dragon Funding is free at all levels.

What is the return on Triple Dragon Funding?

The return you can earn on Triple Dragon is extremely attractive and even more attractive than if you invest through Debitum. This is mainly because you no longer have a marketplace in between, which logically also wants to make money. Currently, you can invest at a base interest rate of around 14%. If you also take advantage of cashback promotions, you can earn even more. You can see my own returns for each year in the statistics.

Incidentally, the margin in this business is high! Borrowers are charged around 24%.

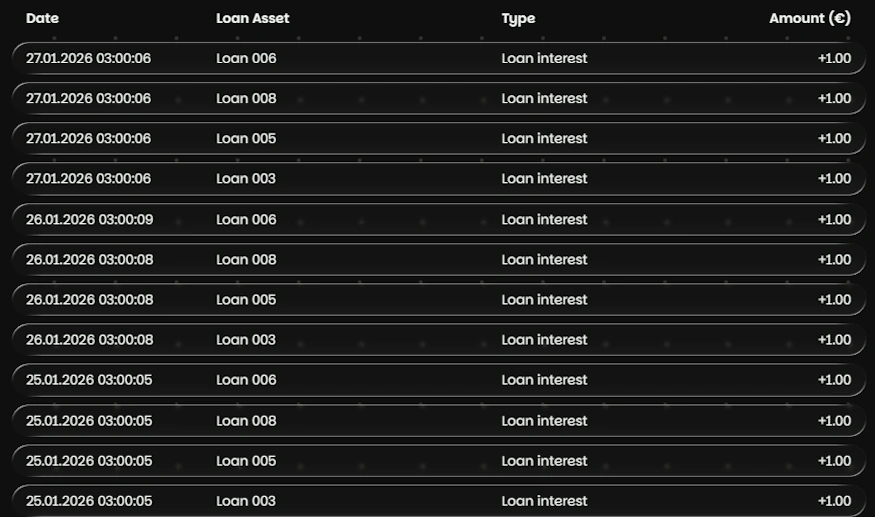

When will the first interest payments on Triple Dragon Funding be made?

Triple Dragon Funding works exactly the same way as the other WLS platforms. You will receive your first interest payments one full day after making your investment, i.e. after approximately 24–48 hours. From then on, you will receive daily interest payments for the project you have invested in.

What is the minimum investment amount on Triple Dragon Funding?

The minimum investment amount on Triple Dragon Funding is a respectable €1,000. I think the reason for this is the experience of White Label Solutions, which uses the same rate for Ventus Energy, Asterra Estate, and Devon. The aim here is to ensure that the company does not work with very small investors, as experience has shown that they require the most support.

Does Triple Dragon Funding offer a buyback guarantee?

Triple Dragon advertises a 90-day buyback guarantee provided by the underlying special purpose vehicle (SPV) TD Funding 2025 Limited. This is to be promptly provided with EUR 5 million in capital from the parent company in order to secure the buyback guarantee accordingly.

However, as always, it should be clear that you can lose your entire invested capital, even if there is a buyback guarantee! This is because the guarantee is only as good as the guarantor behind it.

Is there an app for Triple Dragon Funding?

No, Triple Dragon Funding does not currently offer an app for smartphones.

Can you invest money in other currencies?

No, on Triple Dragon Funding you invest exclusively in euros. There is also no currency risk within the projects.

How exactly do taxes work on Triple Dragon Funding?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

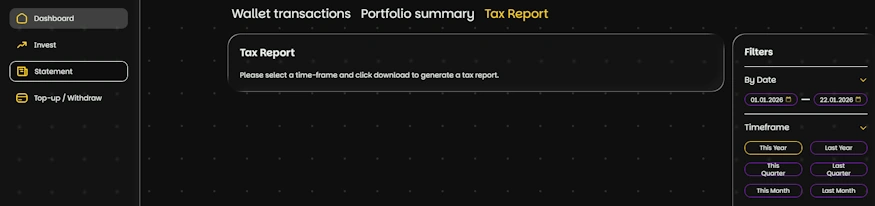

Is there a tax statement on Triple Dragon Funding?

Yes, Triple Dragon Funding already provides tax certificates. You can find them in the “Statements” section under the “Tax Report” tab. Here you can generate a document for the relevant period.

Is investing with Triple Dragon Funding risky?

I can’t draw many conclusions from my experience with Triple Dragon so far, as I have only recently become active on the platform. However, we are dealing with a company that has been around for about 10 years. This is a huge advantage over other start-up P2P platforms, where you initially invest “blindly.” Nevertheless, when investing in P2P loans, you can always lose your entire invested capital. You not only need to understand this fact when reading this report, but also acknowledge it at the beginning of your investment on the platform.

How does Triple Dragon Funding earn money?

Triple Dragon Funding is merely an extension of Triple Dragon itself. Therefore, the platform does not generate any revenue itself, but is financed by the group behind it.

Triple Dragon generates its revenue primarily through interest rate differentials and fees from borrowers. When Triple Dragon grants a loan to a game developer, an interest rate is agreed upon (e.g., 25% p.a.). Investors receive a slightly lower interest rate (e.g., 14% p.a.), and the spread between the two remains with Triple Dragon as income. This interest margin model is typical for credit intermediaries.

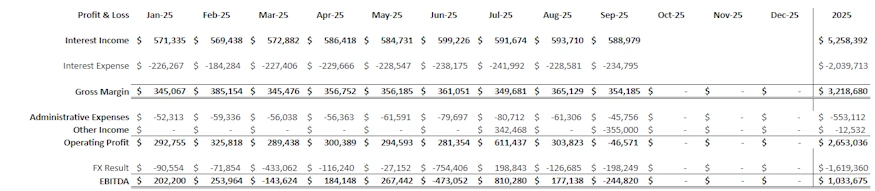

Is Triple Dragon Funding profitable?

Since Triple Dragon Funding is only the money collection point, the platform does not have to operate profitably. It is much more important that the parent company (Triple Dragon) operates profitably, and according to my latest information, it does. Current figures can be viewed here.

What happens if Triple Dragon Funding becomes insolvent?

If something happens to the platform, this will not initially affect your investments, which will continue to run. The financed receivables can be realized depending on how much is still owed by the borrowers. However, these funds would most likely flow into the insolvency estate, and the corresponding costs would then have to be deducted. In addition, delays and possible losses are possible if individual developers do not pay.

Otherwise, as is usual in the event of insolvency, an insolvency administrator will take over the settlement of the remaining projects and payments and distribute the funds accordingly. We know from past experience that insolvency proceedings are lengthy and opaque. Triple Dragon’s insolvency is therefore a potential risk to your money!

How reputable is Triple Dragon Funding?

Triple Dragon Funding looks extremely reputable to me. The company has been in existence since 2016 and has experienced founders from the fields of finance and law (including a former Baker McKenzie lawyer and private equity experts). It operates in a clearly defined market segment (gaming finance) and has already convinced institutional investors. According to the Debitum platform, for example, Triple Dragon has received equity capital from “several market-leading institutions.” This signals trust at a professional level.

In addition, Triple Dragon is a lending partner of this regulated P2P (Debitum), which also speaks for its seriousness.

On the other hand, Triple Dragon Funding itself is not yet a regulated financial institution in the traditional sense (it operates under an exemption). This means that the platform is not directly subject to financial supervision. However, this may change in the future, as the company is clearly striving for regulation.

It is also noteworthy that the company was able to bring former Esketit CEO Vitalijs Zalovs onto the team, who also has years of P2P experience from his career at Mintos and is no newcomer to the scene. This also clearly speaks for a reputable investment platform.

How secure is Triple Dragon Funding?

The receivables from large, financially strong companies (Apple, Google, etc.) serve as good collateral. However, tax credits and subsidies are also set as collateral according to the project profiles, which is rather unusual. This means that even if a borrower defaults, there is still valuable collateral that can be used. The collateral is also always very generously valued and always amounts to at least 120% of the outstanding loan amount. In addition, there is a buyback guarantee after 90 days of default.

The SPV structure also increases security, as investor funds are legally separate from Triple Dragon’s own funds and other liabilities.

Nevertheless, I would like to reiterate, so that even the last reader understands, that an investment in P2P loans can lead to a total loss despite all the collateral. You invest at your own risk!

Are there defaults on Triple Dragon Funding?

Triple Dragon Funding reports a write-off amount of less than 1% on its website for a loan portfolio of over EUR 50 million. After 10 years in the lending business, this is an exceptionally good figure.

Is there deposit protection on Triple Dragon Funding?

No, there is no deposit protection. Your funds on the platform and invested funds are exposed to a default risk.

Is Triple Dragon Funding crisis-proof?

No platform is completely crisis-proof! This also applies to Triple Dragon Funding. The parent company was already active during the COVID-19 pandemic and the war in Ukraine. Neither had any negative effects on the company.

Advantages and disadvantages of Triple Dragon Funding

Before we come to a final conclusion about the platform, here is a summary of the pros and cons based on my experience with Triple Dragon Funding.

Disadvantages

- The platform is not (yet) regulated.

- There may be project delays or a market slump.

- Relatively high entry barrier (EUR 1,000).

- No audited annual reports.

Advantages

- Attractive interest rates of up to 14%.

- Daily interest accrual.

- No geographical connection to the Baltic states (risk in Russia).

- Loans are backed by strong collateral.

- Early exit possible.

- No withholding tax.

- Long track record of the parent company.

Conclusion of my Triple Dragon Funding review

In my opinion, Triple Dragon Funding is an exciting but naturally speculative addition to the P2P portfolio. However, it is nowhere near as speculative as FF Forest or similar platforms. We are investing in a proven business model here. What I find particularly interesting is the fact that we are essentially operating completely outside the Baltic region and investing in countries that are not normally considered for P2P lending (currently Canada and the UK).

Basically, it’s a combination of things that couldn’t have happened better. We have a successful lender who has been active on another P2P platform (Debitum) for years. We have a 10-year-old company. We have a CEO who already has a lot of industry experience through Mintos and Esketit. And we have White Label Solutions, a software team in the background whose products are already familiar to many investors and which work well.

So for me, it was never really a question of whether or not to get involved here, because I am already invested in Debitum in Triple Dragon loans. Now I have an even more attractive opportunity to do so. It will be extremely exciting to follow the progress of this platform.

Is there a Triple Dragon forum for discussions?

There is an official Telegram channel that interested investors can join.

Is there a Triple Dragon Funding bonus or a referral program at the beginning?

Yes, if you register via a link on this blog, you will receive a bonus of 1% of the capital invested in the first 60 days. The credit will be issued immediately after your investment.

I would be grateful if you would use my links as a token of appreciation for this free contribution. There are no disadvantages for you, only advantages.

Sign up for Triple Dragon Funding now and get +1% cashback!*

What alternatives are there to Triple Dragon Funding?

The only platform that currently offers an alternative is Debitum. Here, too, you can invest in Triple Dragon loans. The advantage is the regulated framework, while the disadvantage is the lower interest rates. Otherwise, there are no other opportunities in the industry to invest in gaming loans.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Triple Dragon Funding Review – Passive Income with Gaming?

Triple Dragon Funding may be a new platform, but the company behind it is well established. Claims against large, financially strong companies (Apple, Google, etc.) serve as good collateral. This offers attractive double-digit returns.

5