Debitum Review 2026 – Regulated and more than 15% interest?

On this website you will find my Debitum review to date (formerly Debitum Network). I’ve been invested in the P2P platform myself since early 2019 with several thousand euros and it’s one of the more underrated P2P platforms in my portfolio. In 2024, however, the platform has become much more attractive. Here you can find out everything you need to know about the Latvian-based P2P lending platform and what you need to know to get started.

I’ve met the team from Debitum Investments, which is the real brand name, many times myself. Be it on site at conferences in the Baltic States or virtually for an interview. But apart from that, this is also a platform with whose CEO I have already exchanged ideas personally on several occasions. But let’s take a look at what Debitum is all about.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Debitum?

- All important data at a glance

- Registration for investors

- How does Debitum work?

- The Debitum Auto Invest

- In which countries can you invest?

- Which loans can you invest in on Debitum?

- What costs are incurred on Debitum?

- How high is the return on Debitum?

- Will I also receive interest on late loans?

- What is the minimum investment amount on Debitum?

- Does Debitum offer a buyback guarantee?

- Is there an app for Debitum?

- Is there a Secondary Market?

- Can you invest money in other currencies?

- How exactly do taxes work on Debitum?

- Is there a tax statement on Debitum?

- Debitum risk

- Debitum in crisis situations

- Advantages and disadvantages of Debitum

- Conclusion of my Debitum review

What is Debitum?

Before we go into the details, let’s start with a brief summary. Debitum Investments is a P2P marketplace from Latvia. Similar to Mintos, it offers loans from third parties for investment. The platform itself merely acts as a kind of “man-in-the-middle” and transfers your investments to the right places.

Unlike Mintos, however, they specialize in business loans and not consumer loans. In addition, I can say from my previous Debitum experience that they place a very high value on only having lenders on board who are reputable and stable.

Debitum offers loans from various European countries via its lenders. These include the UK, for example, where it is otherwise rare to be able to invest via a platform from the Baltic States. All loans on Debitum are provided with a buyback obligation.

To give you an insight, I have attached a presentation from the Finfellas online conference, where their former CEO talks a little more about the business. Much of it is still relevant today.

All important data at a glance

Before we go into the details of the Debitum review, here is the most important data for you in one place.

| Founded: | 2018 |

| Headquarters: | Riga, Latvia, operating as SIA DN Operator |

| CEO: | Anatoly Putna, CEO since 2025 |

| Regulated: | Yes (through the FCMC in Latvia since 2021) |

| Assets under Management: | Approx. 56,1 million euros |

| Financed Loan Volume: | Approx. 174,5 million euros |

| Number of Investors: | Approx. 30,300 (registered investors, active number unknown) |

| Yield: | 14.83% on average according to official platform data |

| Buyback Guarantee: | Yes |

| Minimum Investment Amount: | 10 EUR |

| Auto Invest: | Yes |

| Secondary Market: | No |

| Issuance of Tax statement: | Yes, in the form of a bank statement |

| Investor Loyalty Program: | Yes (from EUR 6,000, there is a gradual increase of up to 2% in return) |

| Starting Bonus: | es, 1% cashback after 30 days via this link*. |

| Rating: | Position 6 | Refer to the public rating. |

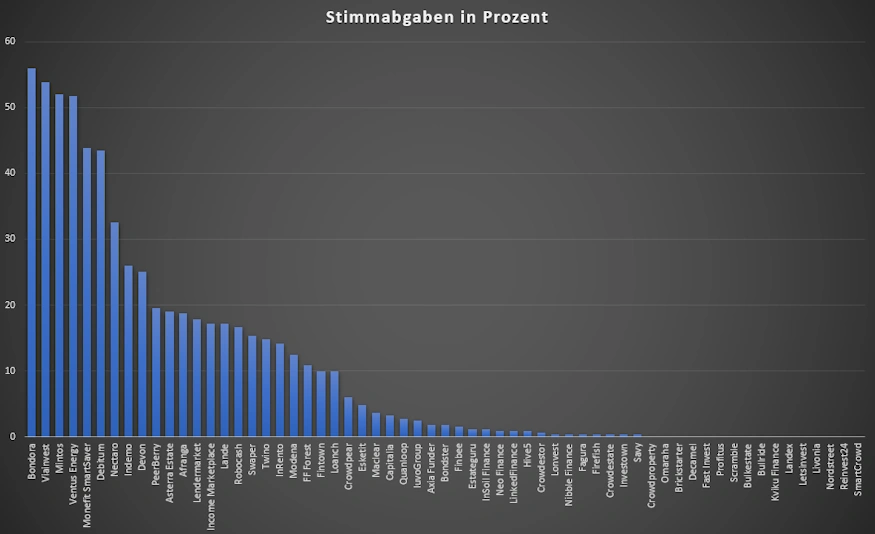

| Community Voting: | 6th place out of 61 | See results (in German). |

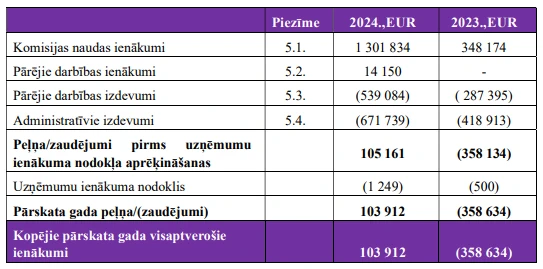

| Last Financial Report: | Annual report 2024 (audited) |

Debitum experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2024, Debitum took 6th place out of 61 with 43,5% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Debitum

Registration for investors

Registering on the platform is not particularly complicated. You can register both as a private investor and as a company.

Once you have registered, you are ready to invest in P2P loans on the platform, provided you have made the first deposit and identified yourself. You will need your identity card or passport to verify your identity.

In addition to verification, there are also other levels of identification, depending on how much you invest. A questionnaire must also be completed to confirm that you understand what you are investing in.

By the way, always pay attention to bonus promotions of the platforms to get advantages. You can find a constantly updated list of all bonuses in my P2P platform comparison.

Debitum Bonus

In the first 30 days, investors receive 1.0% bonus interest on their investments through me. (Term of the investments at least 90 days). The investments must be made within the first 60 days. Please use this link* to support the work of this blog. No referral code needs to be entered when using the link!

From time to time there are also time-limited bonus promotions at Debitum. These are always listed promptly in my P2P platform comparison.

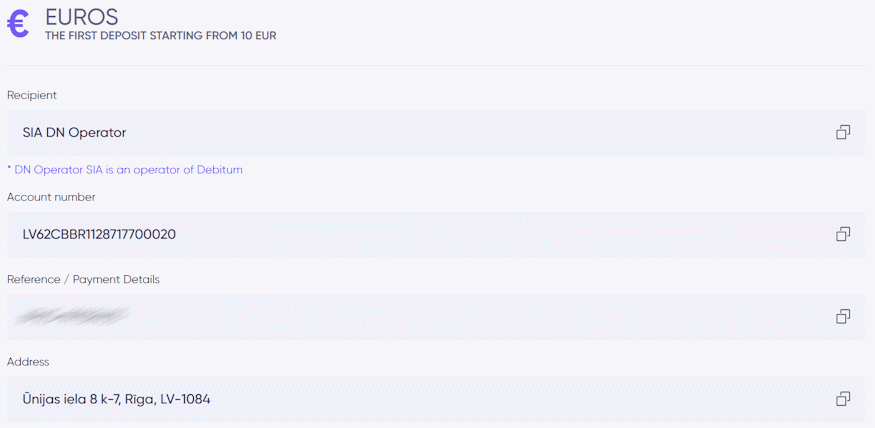

How do I deposit money?

Depositing money is, as always, the easiest step when investing. You will see a “Deposit” button in your account. If you click on this, you will be shown transfer details that you can use.

For example, you can create an order template with your bank. I have also done this with many other platforms. Please note that the first transfer must come from a personal bank account. The bank account used will then be verified for subsequent payouts.

How do I withdraw money?

If you want to withdraw capital or excess interest from the P2P platform, you can use the “Withdraw” button under “Overview” at the bottom. You will not be charged a fee for withdrawing funds.

Investors can only withdraw funds to the bank account from which the deposit was made. If you wish to register a new account for withdrawal, you must make a new deposit from a new personal account. You can also use several accounts in parallel for withdrawals, but you will have to register them once.

Can I make deposits and withdrawals by credit card?

Yes, you can also deposit to your Debitum account using a credit card (Visa & Mastercard) as well as Google and Apple Pay. However, please note that a 1% service fee will be charged. For example, if you deposit EUR 1,000, EUR 1,010 will be debited from your credit card.

The Debitum Auto Invest

You can tell Debitum’s automatic portfolio builder exactly which countries & interest rates you want to invest in and it is very easy to configure.

You can set the following things:

- Name of the portfolio

- Sum of the portfolio

- Exclusion of already invested ABS

- Interest rate

- Maturity

- Maximum amount per ABS

- Loan originator

- Minimum amount that should remain uninvested.

However, the highlight is probably the “Auto withdrawal” feature, which allows you to withdraw interest earned on a monthly basis. This takes your investment even further in the direction of “passive income”. But you can only use this feature once you have invested at least EUR 10,000.

In which countries can you invest?

Debitum currently offers loans from 3 different countries, in detail these are

- Latvia

- Estonia

- and Great Britain

In my opinion, the UK in particular makes the platform very attractive, as it is rare to invest from the Baltic States. You can find a current list of all lenders on Debitum itself here.

I am also sure that we will see even more opportunities on the marketplace in the future.

Which loans can you invest in on Debitum?

Those who invest in P2P loans here generate their returns exclusively with business loans. This is the area in which the platform specializes and we won’t see anything else here in the future.

It should be noted that you are investing in asset-backed securities (ABS) on Debitum due to regulation. These are basically several loans combined into a loan bundle with corresponding information documents that are specified by the regulation. If you would like to know more about asset-backed securities, you can delve deeper at Debitum.

In addition to ABS, there are also bonds (notes). The difference to ABS is that the buyback obligation is no longer carried by the lender, but by the issuer’s shareholders.

Debitum’s loan originator page provides comprehensive information on lenders and their instruments and should always be checked for the latest information. Here is a brief summary:

- Evergreen Capital: This lender from Estonia provides financing offers for small and medium-sized enterprises (SMEs) in Estonia.

- Triple Dragon: A London-based lender that focuses on flexible financing solutions and working capital for developers and publishers of mobile apps and video games. Receivables from companies such as Google, Apple and Amazon serve as collateral.

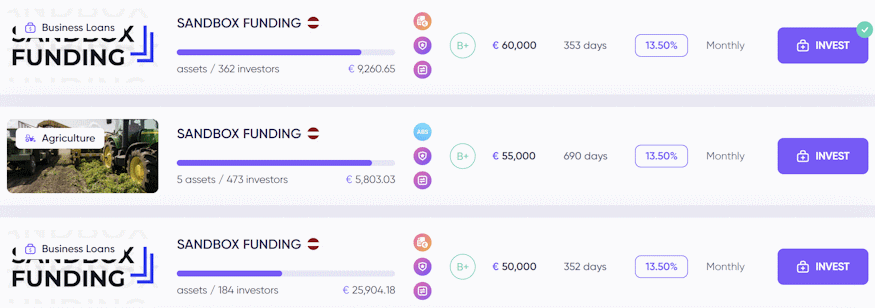

- Sandbox Funding: Founded by Debitum shareholders, this initiative was created to support lenders with smaller volumes (50,000 euros to 200,000 euros) before they become active on the platform independently.

- Juno Finance: A Latvian lender specializing in loans for SMEs in the forestry and agricultural sectors.

- Foresto: This company, also active in the forestry and agricultural sector, specializes in the acquisition and merger of small to medium-sized forestry properties in Latvia.

- Bono House: This company focuses on the development of residential projects and assembly construction.

What costs are incurred on Debitum?

There are no fees for investors on the investment or other actions on the platform.

How high is the return on Debitum?

The return you can earn on the platform was initially between 8 and 10%, which was not comparable to the “possible” returns on platforms like Mintos. But in recent years, the return has increased significantly and you can now find ABS with up to 15% on the platform.

You can always see the exact monthly returns in the table at the beginning of this article. My own historical return can be viewed via the statistics (in German).

Will I also receive interest on late loans?

Yes, in some cases you will also receive interest on late payments. You can see whether and how much default interest the different lenders pay in the respective loan itself.

What is the minimum investment amount on Debitum?

You must invest EUR 10 per loan on the platform in order to be able to invest.

Does Debitum offer a buyback guarantee?

Yes, the P2P platform and its lenders offer a buyback guarantee or commitment. However, since we are trading on a marketplace here, the buyback guarantee is only as good as the lender’s finances

So keep an eye on the lenders! Unfortunately, this is not so easy with Debitum, as most lenders do not publish any financial reports.

In general, all ABS assets are secured by collateral from the companies that make up the underlying pool. Depending on the sector, this can be

- Invoices

- receivables from companies

- future income

You can find out how the individual ABS are structured for each loan originator.

Is there an app for Debitum?

No, the P2P platform does not offer an app to manage the loans in your own portfolio.

Is there a Secondary Market?

No, Debitum does not currently offer a secondary market.

Can you invest money in other currencies?

No, here you always invest in euros.

How exactly do taxes work on Debitum?

The platform withholds 5% withholding tax, otherwise it doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Is there a tax statement on Debitum?

There is no real tax statement, but you can create an account statement that contains the most important information. You can do this by creating the desired filter under “My balance” on the right-hand side. You can then easily download the document.

Debitum risk

From my Debitum experience, the Latvian P2P platform is extremely stable. This is mainly due to its very careful selection of lenders, which I have already reported on.

Nevertheless, earning interest can be over faster than you would like. We already know this from other platforms. So a loss can never be ruled out!

How does Debitum earn money?

The P2P platform’s income comes from the brokerage commissions for the loans brokered by the connected lenders. In addition, the lenders also pay a fee for being allowed to be on the marketplace at all.

Similar to Mintos, you are the “man in the middle” here and earn money from the marketplace model.

What happens if Debitum becomes insolvent?

Should Debitum become insolvent, the rights of investors to their claims and bonds would continue to exist regardless of the status of the Debitum platform.

Due to Debitum’s license, the insolvency proceedings would be regulated and supervised by the Latvian Central Bank. The appointed liquidator or administrator would assume the duties of the board of directors.

In addition, uninvested investor funds are protected, allowing small investors to receive compensation of 90% of the permanent loss, up to a maximum of EUR 20,000. However, nobody knows whether and how the whole thing works in practice, as there has never been a case like this.

How reputable is Debitum?

I personally rate them as reputable. They have done a good job in the past and answer many questions in direct contact and the team is always approachable. However, there are still some scam allegations regarding the launch of the platform with an ICO (Initial Coin Offering).

The main issue here is that a lot of money was collected and the coin used (the DEB) has hardly any value today. Since nobody knows the 100% truth about this story, I don’t want to give a general assessment, but it’s something to bear in mind.

I don’t know what happened back then, but I do know that they have a different business model today than they did at the time of the ICO and that the current management no longer has any points of contact with it. I therefore consider this point to be uncritical for my own investment.

In addition, Debitum Investments has held an investment brokerage license issued by the Latvian Central Bank since September 2021. This means that the platform is also subject to the requirements of the MiFID II Financial Markets Directive, among others. This can be seen as a strong sign of a reputable platform.

How secure is Debitum?

I think the P2P platform is safe because of its concept. They have high requirements for loan originator. For example, they have to finance 10% to 30% of the loans with equity (skin in the game). Since obtaining the IBF license in Latvia, they have to meet even more stringent legal requirements.

However, you must never forget that investing in P2P loans is generally associated with a high level of risk! As always, it is therefore advisable to only invest money that you are not reliant on in case of doubt.

Is there deposit protection on Debitum?

No, certainly not. Debitum is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on the platform are exposed to a high risk of default.

Are there defaults on Debitum?

There are usually defaults on every P2P platform, and this is also the case here. However, the default rate is not publicly visible and, due to the concept of a marketplace in combination with the buyback guarantee, you as an investor will not be aware of this.

Unless a lender gets into difficulties. This happened a few years ago with Aforti Finance. However, the company was removed from the marketplace earlier than other P2P platforms and investors were paid out of their own pockets. Thanks to the early detection of the problems, the damage to Debitum was minimal.

There was also a lender in Ukraine, which logically defaulted at the start of the war in 2022. This lender could repay the money, but payment channels are still disrupted due to martial law in Ukraine. I am also affected here with EUR 3,000.

Debitum in crisis situations

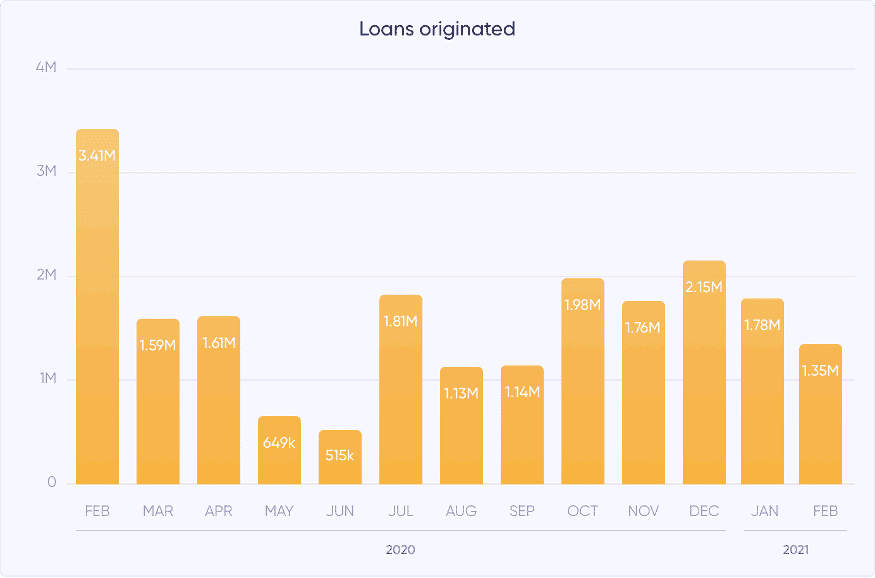

Debitum weathered the Covid-19 crisis well, but there were disruptions during the Russia-Ukraine war.

Debitum during the Covid-19 crisis in 2020

Like many others, the P2P platform had its first test in 2020 when coronavirus swept the world. However, Debitum did not have any significant problems during the crisis.

Those who were invested here were therefore able to continue generating passive income happily. As with most platforms, the volume of new P2P loans fell at the beginning of 2020, but the volume normalized a few months later. However, as the company is active in the area of corporate loans, it was very cautious, which was certainly not negative.

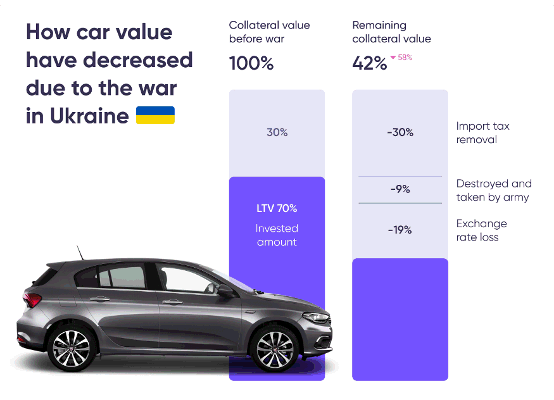

Debitum during the war in Ukraine in 2022

Unfortunately, the situation was very different during the war in Ukraine in 2022. The Ukrainian part of the lender Chain Finance was affected. Due to the so-called “force majeure”, the portfolio was virtually frozen until the war was over.

As it is not yet clear when this will be, the whereabouts of the loans are also unclear. However, the portfolio still has value and investors will not suffer a total loss. In addition, there is already a fixed repayment plan that will start as soon as martial law ends.

Advantages and disadvantages of Debitum

Before we come to a final conclusion about my Debitum review, here is a summary of my pros and cons.

Disadvantages

- There are still scam allegations against the platform. This is always unpleasant for investors.

- You know very little about the affiliated lenders. You can only dream of proper financial reports.

- As a marketplace, you are always dependent on a party that you cannot fully control, namely the lenders.

- The platform has very few lenders, which could have disadvantages in terms of proper diversification.

Advantages

- We invest in corporate loans here, not consumer loans. In most cases, these also have real collateral.

- The loans have a repurchase obligation.

- The marketplace concept allows you to spread your investment across many different countries and companies via a single access point.

- Passive income via full automation is possible.

- So far no problems with lenders and therefore no loss of capital (apart from the Ukraine war, which was not Debitum’s fault).

- Debitum is a regulated P2P platform with audited financial reports.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Conclusion of my Debitum review

When I saw the P2P platform for the first time, I wasn’t really enthusiastic about it. My goal is to generate passive income with as little effort as possible. However, the company was initially very complicated with its own cryptocurrency and the investment was also extremely difficult to use. When the course change came in 2019 and a new interface was introduced, I took the plunge and invested a little more money.

It hasn’t been a bad decision to date. Even though these are not classic P2P loans, such as Bondora, but corporate loans. Since receiving the license in 2022, things have gone up another notch in my perception. A windy crypto startup has become a regulated financial institution with a solid performance.

You also have to consider the risk aspect here. The platform ran completely smoothly even during the Covid-19 crisis. The selection of lenders on Debitum is one of the best in the industry. They were only unlucky with Ukraine, but they could probably do very little about that themselves.

Is there a Debitum forum where you can exchange ideas?

There are various places where you can exchange ideas with other investors and gain Debitum experience. The first address for this is the international Debitum Telegram Community.

Is there a bonus or refer a friend program to start on Debitum?

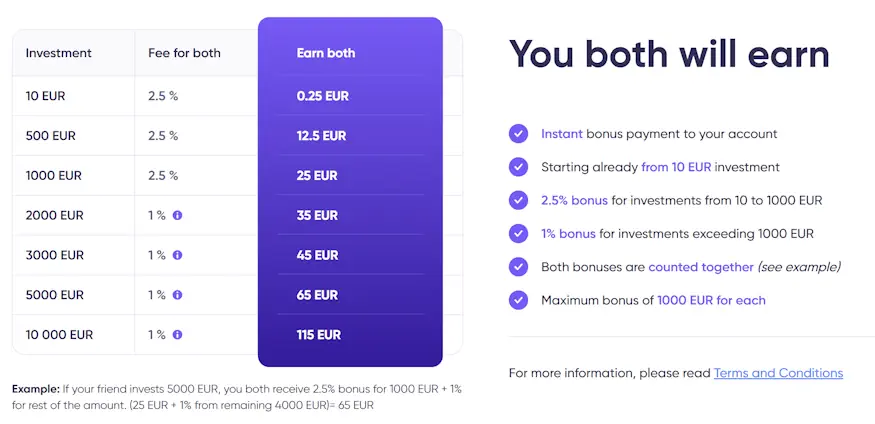

You can refer friends on Debitum. You and your friend can be credited up to EUR 1,000, depending on the amount invested. My code is “0F5EM” (without quotation marks) if you want to use it.

What alternatives are there to Debitum?

Debitum only grants corporate loans. In a direct comparison, platforms such as Bondora or Estateguru are therefore out of the question here. Maclear from Switzerland or Capitalia from Latvia. With both, however, you have to deal with the projects more than you have to with Debitum. Passive income is certainly something else.

However, Debitum is also a marketplace, so Mintos or Income Marketplace would also be alternatives to look at.

But there is also an opportunity to invest in business loans outside continental Europe with Linked Finance.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Debitum Review 2026 - Regulated and more than 15% return?

Debitum Review: Here you can find everything you need to know about the Latvian P2P platform ✚ my personal experience.

4