Viainvest Review 2026 – Solid 13% Investment?

Want to know if Viainvest is the right P2P platform for your investment? Perfect! I’ve been successfully investing with Viainvest since the beginning of 2017 and the Latvian platform is now one of my absolute favorites. In this article, I share my personal experiences and show you everything you need to know to get started smoothly.

What makes Viainvest particularly interesting: I’ve never lost money so far, I know the team personally, and I was able to take a look behind the scenes. To this day, the platform enjoys my complete trust – and for good reason, as you’ll find out in a moment.

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Viainvest?

- Viainvest Review – Everything at a glance

- Registration and initial Viainvest login

- How does Viainvest work?

- The Viainvest Auto Invest

- The Viainvest Strategies

- Is there a secondary market?

- In which countries can you invest?

- Into which loans can you invest on Viainvest?

- What costs are incurred on Viainvest?

- What is the return rate on Viainvest?

- Is there a buyback guarantee at Viainvest?

- What is the minimum investment amount on Viainvest?

- Is there an app for Viainvest?

- Can you invest money in other currencies?

- Will I also receive interest for delayed loans?

- How does the taxation work for Viainvest?

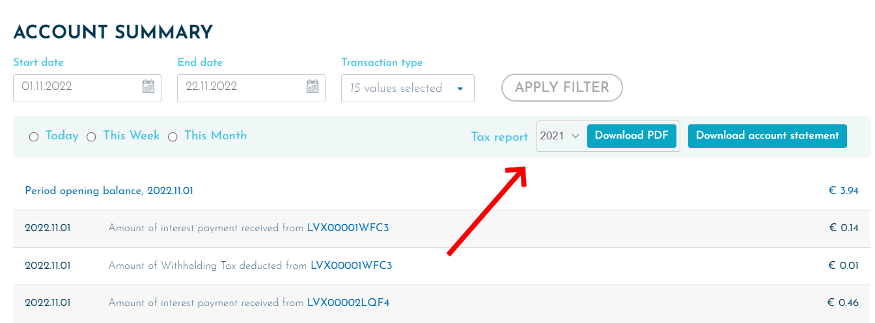

- Is there a tax certificate available on Viainvest?

- Issues and solutions from my Viainvest Review

- Viainvest Risk

- Viainvest in times of crisis

- Pros and Cons of my Viainvest review

- Conclusion of my Viainvest Review

What is Viainvest?

Viainvest is a regulated P2P lending platform from Latvia. Unlike Mintos, however, it is not a marketplace. Viainvest offers a portion of the loans from its parent company, Via SMS Group. The Via SMS Group has been in operation since 2009. Therefore, the P2P platform can be considered a rather traditional P2P provider. The majority of loans on the platform are consumer loans.

The combination of Via SMS Group and the Viainvest platform is regarded as a highly experienced partnership in the industry, which has proven itself over the past years. If you want to invest here and earn interest, you’re probably making a good choice.

Viainvest also operates under the supervision of the Latvian Central Bank and holds an IBF license, which allows them to issue asset-backed securities.

Viainvest Review – Everything at a glance

Before we delve into the details of my Viainvest review, here are the key facts all in one place for you.

| Founded: | 2016, parent company Via SMS established since 2009 |

| Headquarters: | Riga, Latvia, registered as SIA Viainvest |

| CEO: | Eduards Lapkovskis, since inception |

| Regulated: | Yes (by the Central Bank of Latvia) |

| Assets under Management: | Approx. EUR 58,7 million |

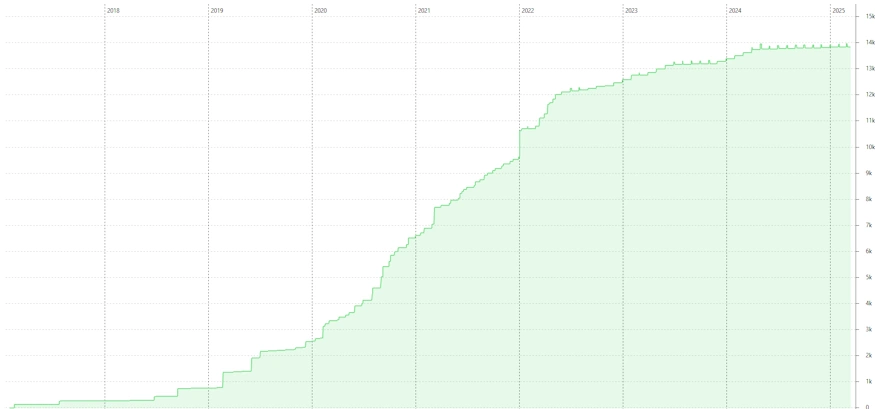

| Funded Loan Volume: | Approx. EUR 723,4 million |

| Number of Investors: | Approx. 46,400 (registered investors only, active number unknown) |

| Return: | up to 13,3% |

| Buyback Guarantee: | Yes |

| Minimum Investment: | 50 EUR |

| Auto Invest: | Yes |

| Secondary Market: | No |

| Issuance of Tax Certificate: | Yes |

| Investor Loyalty Program: | No |

| Starting Bonus: | Yes, 1% cashback after 90 days through this link*. |

| Rating: | Place 10 | Refer to public rating. |

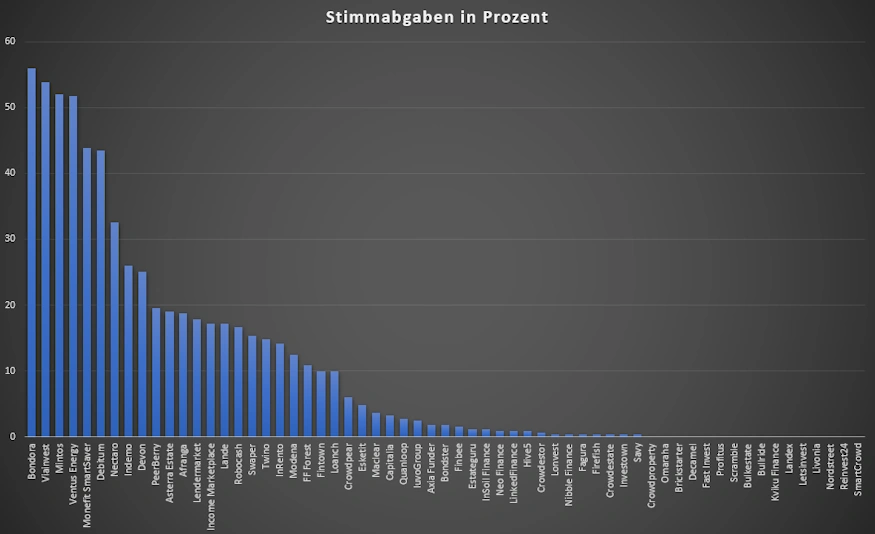

| Community Voting: | 2nd place out of 61 | See results (in German). |

| Last Financial Report: | Last audited report published for the year 2024. (view) |

Viainvest experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Viainvest took 2nd place out of 61 with 53.8% of all votes, which can be considered an almost perfect result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Viainvest

Registration and initial Viainvest login

The registration process on the P2P platform is not particularly complicated. However, you will need some information, as the P2P platform places a strong emphasis on ensuring investors are uniquely identified. This is known as KYC (Know Your Customer). The registration process includes:

- Entering your name, email, password, etc.

- Finally, identity verification is conducted.

- Carrying out a product suitability test.

- You may need to provide proof of the source of deposited funds through bank statements.

After registration, you are ready to invest in P2P loans on the platform once you have made your initial deposit. By the way, always keep an eye out for platform bonus promotions to gain advantages. You can find a continuously updated list of all bonuses in my P2P platform comparison.

Viainvest Bonus

Via my link* you will receive 1.0% cashback on all investments you make in the first 90 days after your registration. If there are any time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

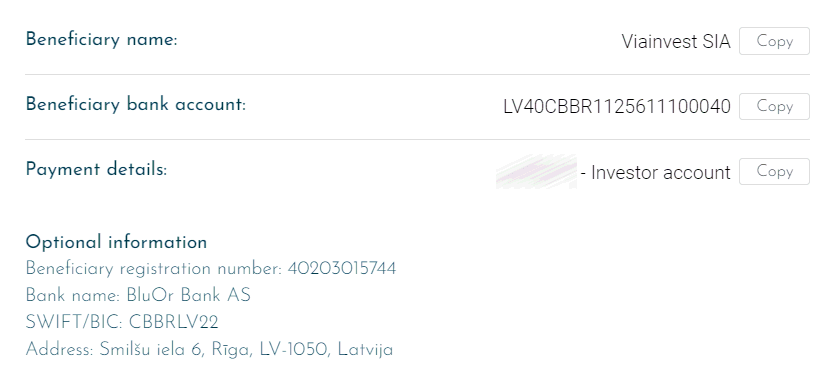

How do I deposit money?

Depositing money is, as always, the easiest step when investing. In your account, you’ll see a “Add Funds” button. When you click on it, you’ll be shown transfer details that you can use.

For this purpose, you can create a payment template at your bank. That’s how I’ve done it for many other platforms as well. Please note that the first transfer must come from a personal bank account. This account will also be verified for future withdrawals.

How do I withdraw money?

If you want to withdraw capital or excess interest from the P2P platform, you can use the “Withdraw Funds” button located at the top right of your account summary. There is no fee for withdrawing funds.

Investors can only withdraw funds to the bank account from which the initial deposit was made. If you wish to register a new account for withdrawals, you’ll need to make a new deposit from the new personal account.

How long does the deposit take?

Based on my Viainvest review, depositing funds into your Viainvest account usually takes around 1 to 2 days. However, if you use services like the free Revolut account* or oder Wise*, the transfer is often faster.

How does Viainvest work?

After registration, you have three options for investing your money.

- You can invest manually through the primary market.

- The semi-automated Auto Invest builds your portfolio.

- Or you can use the platform’s automatic strategies where you don’t have to do anything at all.

As a passive investor, I would prefer the automatic options here for the sake of time. Additionally, the loans on the platform can sometimes get filled so quickly that it’s challenging for individual investors to generate returns if you want to invest manually.

By the way, on Viainvest, you’re not directly investing in loans, but rather in loan bundles that even have their own ISIN (International Securities Identification Number). On the platform, they are referred to as “Asset Backed Securities“. However, in practical terms, this doesn’t make a difference for you.

The Viainvest Auto Invest

With Viainvest’s automatic Portfolio Builder, you can precisely specify the countries and interest rates you want to invest in. The following aspects are important in my view when configuring it:

- Portfolio size

- Investment amount per loan bundle

- Interest rate

- Duration of each investment

- Loan originator, with a focus on the country of origin

- Buyback guarantee

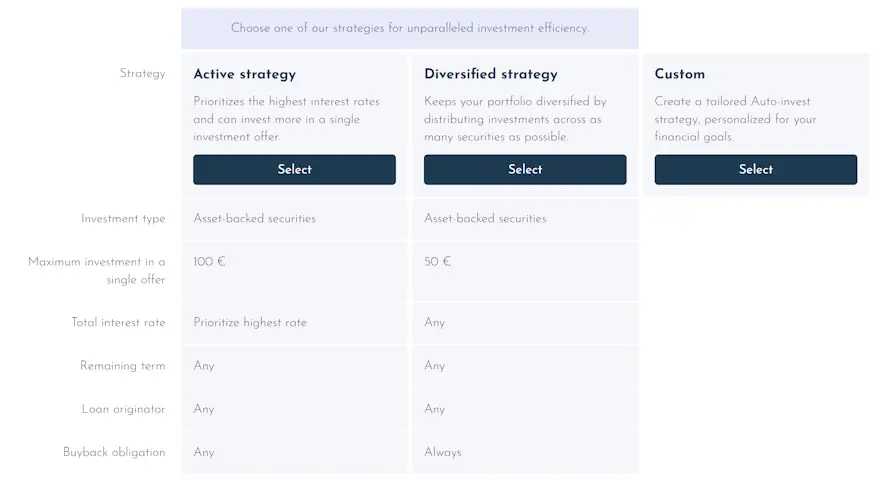

The Viainvest Strategies

In 2023, Viainvest introduced two fully automated strategies. In this case, you only need to make a selection, and Viainvest takes care of the rest. You have the choice between the Active and Diversified strategies.

- Active Strategy: Designed to achieve the highest interest rate. (Note: This also includes securities without a buyback guarantee).

- Diversified Strategy: Designed to distribute your money across as many securities as possible.

The Custom Strategy mentioned additionally refers to the traditional Auto Invest, as described above.

Is there a secondary market?

No, Viainvest does not currently offer a secondary market, as you may be familiar with from many other platforms. You also do not have the option to exit your investments prematurely. However, there are exceptions! For instance, the larger business loans that the platform occasionally offers often come with an “Early Exit” option.

However, a completely new interface has been in development since 2023, which is also expected to include a secondary market. The exact release date for this new interface is not yet clear.

In which countries can you invest?

Here, you invest in loans from the Via SMS Group, which is active in many countries. Currently, Viainvest offers loans from the following diverse countries:

- Latvia

- Sweden

- Czech Republic

- Romania

Into which loans can you invest on Viainvest?

Investors who participate in P2P lending here generate their returns primarily through loans in the consumer sector. Borrowers directly take out loans from Via SMS Group, which are listed on the platform and in which we, as investors, can invest our money.

These loans are bundled into so-called “Asset Backed Securities,” or ABS for short. Each loan bundle also has its own ISIN (International Securities Identification Number). ABS typically have a duration of 3 – 12 months, but there can also be other durations.

Occasionally, there are also business loans on the platform. For instance, the establishment of the company’s credit business in the Philippines was financed through a loan from its own investors.

What costs are incurred on Viainvest?

There are no fees for investors on the investment or other actions on the platform.

What is the return rate on Viainvest?

The return you can earn on Viainvest is respectable. You can find the current average values monthly updated in the table above. My own historical return is over 12 percent as of today. You can see the current figures of my own portfolio in my statistics.

Is there a buyback guarantee at Viainvest?

Yes, the P2P platform offers a buyback guarantee. If the borrower is 60 days overdue with their payment, the loans, along with the accrued interest up to that point, will be repaid. However, this does not apply to the business loans that are occasionally listed on the platform. However, these business loans usually have real collateral, which is ultimately more valuable.

What is the minimum investment amount on Viainvest?

You need to invest 50 EUR per loan bundle or Asset Backed Security on the platform.

Is there an app for Viainvest?

Well, for Viainvest, there was a (in my opinion) very clean and good smartphone app. It wasn’t as good as Mintos, but it was sufficient to handle the most important tasks. However, in 2021, it was temporarily discontinued due to the focus on regulation.

Can you invest money in other currencies?

No, here you always invest in euros.

Will I also receive interest for delayed loans?

Yes, investors always receive interest for the entire period during which their funds are invested in the loan. This also applies to delayed payments.

How does the taxation work for Viainvest?

The platform withholds 5% withholding tax, otherwise it doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Issues and solutions from my Viainvest Review

As always, there are occasional issues that arise. I’ll show you how you might be able to resolve them.

The Auto Invest isn’t investing!

A so-called demand imbalance can occasionally occur. This happens when there are more investors looking to invest in P2P loans than there are available P2P loans. Smaller platforms can experience this from time to time. In general, you have two options:

- Withdraw your funds

- Wait

According to my personal Viainvest review, situations like these are often temporary. I have never withdrawn my funds in such cases. Moreover, usually, enough other investors do so, and after a while, there should be enough loans available again.

One approach that has helped me several times with Viainvest, in particular, is to recreate the Auto Invest settings.

IT issues on Viainvest

Even though Viainvest is one of the most established P2P platforms, it’s also known for its sometimes significant IT problems. When they underwent regulation in 2022, they completely missed adapting their software, and they spent weeks dealing with corrections and updates.

From my experience, the best approach here is to simply wait and not bombard support with emails. Generally, they are aware of their mistakes and work to fix the issues as quickly as possible.

It’s also important to understand that the IT department is responsible not only for platform development but also for developing all IT solutions within the group, such as the websites of loan originators.

Viainvest Risk

According to my Viainvest review, the Latvian P2P platform is one of the most stable in the market. I’ve been invested here since 2017, and there have been some turbulent times since then, but they were managed successfully. However, earning interest can come to an end quicker than one would like. We’ve seen this happen on other platforms. So, a loss is never completely ruled out!

How does Viainvest make money?

The P2P platform’s main source of revenue comes from the lending activities of its parent company, Via SMS Group. More precisely, they earn money through referral fees for each issued loan.

Additionally, the parent company also provides payment solutions like VIALET, which also contribute to their revenue. Other sources of income include fees, penalties, and more.

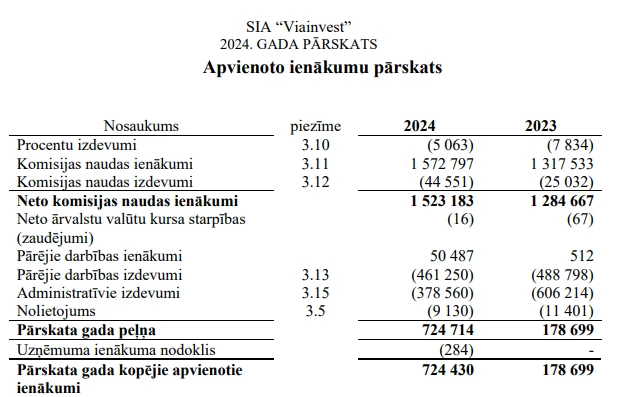

Is Viainvest profitable?

While in the past, you could only rely on the financial reports of Via SMS Group, Viainvest now publishes its own reports. According to the latest report from 2024, they are profitable. Unfortunately, the 2024 report is only available in Latvian.

What happens if Viainvest goes bankrupt?

In the event that the P2P platform encounters financial difficulties or has to declare bankruptcy, the company will likely be wound down, and existing loans will continue to run. It’s important to differentiate here whether the insolvency affects the P2P platform or its parent company.

Due to the strong backing from the parent company, the bankruptcy of the P2P platform itself is unlikely. However, if the parent company were to go bankrupt, it would lead to a lengthy and years-long legal process.

How reputable is Viainvest?

Due to the close connection between the P2P platform and the Via SMS Group, which has been in the market for years, it can be assumed that we are dealing with a reputable platform here. Furthermore, I have personally met the platform’s team on multiple occasions and do not get the sense that they have any malicious intentions (I’ve encountered far different situations).

Additionally, the P2P platform has been strictly regulated and regularly monitored in Latvia since 2022. This should provide investors with enough confidence to start an investment with Viainvest.

How secure is Viainvest?

The Latvian P2P platform is among the safer P2P platforms. However, you must not forget that investing in P2P loans is generally associated with high risks! Therefore, it is advisable to invest only money that you can afford to lose if needed.

Is there a deposit insurance on Viainvest?

No, definitely not. Viainvest is not a bank and therefore does not fall under any European deposit insurance. All funds you invest on the platform are exposed to a high risk of default.

Viainvest in times of crisis

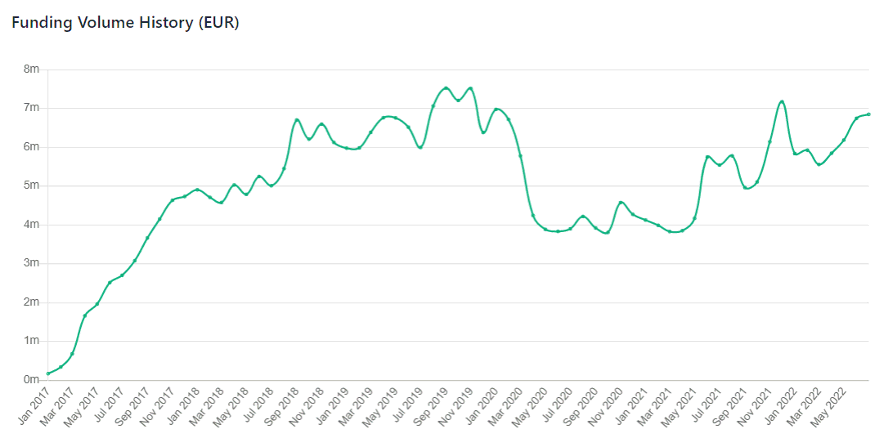

As an investor in Viainvest, you sailed through the Corona flash crash in March 2020 with ease! Even the Ukraine conflict in 2022 had little impact on the platform.

Viainvest during the Covid-19 crisis in 2020

According to my own experiences, Viainvest was well-prepared for the crisis. While facing similar challenges as other platforms (more withdrawals than deposits, fewer loans, etc.), they managed to navigate through these issues due to their solid financials. After a brief downward trend, they managed to recover and move upwards again.

Viainvest during the Ukraine War in 2022

Unlike some other P2P platforms, Viainvest doesn’t have Russian or Ukrainian loan portfolios. Therefore, during the Ukraine crisis, Viainvest investors continued to earn money. Of course, there could still be issues for the platform due to side effects like high inflation, unemployment, etc. However, that hasn’t occurred so far.

Pros and Cons of my Viainvest review

Before we reach a concluding assessment of the platform, here’s a summary of the pros and cons based on my Viainvest review.

Cons

- IT is not Viainvest’s strong suit, as evidenced by the recent transition to Asset Backed Securities.

- There are relatively few loans available on the platform, which can lead to “Cash Drag” issues.

- You pay withholding tax on Viainvest.

- All loans are provided by the Via SMS Group, meaning you have only one loan originator.

- Due to the absence of a secondary market, you have no option to exit your investment prematurely.

Pros

- Having the backing of Via SMS Group, a partner that has been operating profitably for over 10 years.

- With an average interest rate well above 10%, investors can be quite profitable and achieve a good return here.

- The website is super simple and user-friendly.

- All loans come with a buyback guarantee.

- Viainvest or Via SMS Group provide borrowers from relatively low-risk countries.

- Regulated P2P platform with audited financial reports.

Conclusion of my Viainvest Review

If you’re looking for a simple and stable P2P platform, Viainvest is a solid choice. While the loan offering might not be as extensive as platforms like Mintos, you can sleep much more peacefully knowing that a strong corporate group is behind the scenes.

I’ve been invested there for years and have grown my own investment into the five-digit range. I trust the platform’s team to manage my money well in the future.

However, it’s important to keep an eye on the financial performance of both the group and the platform. These figures change year by year and aren’t so generous that you can make big leaps (at least not currently). If dark clouds start appearing on the horizon, you’ll need to decide how much risk of total loss you’re willing to carry.

Another aspect is Viainvest’s IT. Various situations in the past (such as recent regulation) have shown that extensive IT adjustments usually end up in absolute chaos. As an investor, you need to be patient and weather through these situations.

My Viainvest Review (On-Site)

I have met the Viainvest team numerous times. I visited them for the first time with my business partner and friend Kolja Barghoorn in 2018 when we traveled to the Baltics as kind of pioneers to visit several P2P platforms. Since then, much has changed, and I recently met the team at the Finfellas Conference in 2023, as well as visited their office a month later.

Is there a Viainvest forum where you can exchange information?

There is an international group of investors on Telegram where you can engage in discussions.

Is there a bonus or referral program for inviting friends to join Viainvest?

No, currently there is no referral program on Viainvest. However, through my link, you will receive an additional 1% cashback on all your investments after 90 days, making it a perfect start for your own Viainvest review.

What are the alternatives to Viainvest?

Viainvest is a classic P2P lending platform. Similar alternatives with a similar concept in this area would be the platforms Lendermarket and Esketit. These platforms also focus on P2P lending with larger corporate backing. Another alternative is the Latvian platform Twino, which has been in the market for quite some time and even collaborates with Viainvest, or PeerBerry, one of the largest P2P lending platforms in Europe.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Viainvest vs. Mintos

I am often asked how certain platforms compare to Mintos and whether they are alternatives. In my opinion, both platforms are not directly comparable. The reasons for this are simple:

- Mintos is a marketplace with over 60 loan originators in its portfolio, similar to Via SMS Group.

- If Via SMS Group encounters problems with loans, it is highly likely that ALL your P2P loans on Viainvest will be affected.

- If a similar scenario occurs on Mintos, only a portion of your portfolio will be affected.

As you can see, it’s an “apples and oranges” comparison. However, based on my own Viainvest review, you can still use the platform as a complementary option.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Viainvest Review 2026 - Solid 13% Investment?

On this website, you will find my personal Viainvest review ✚ all the essential information you need to know about the P2P platform.

4.5