Mintos Review 2026 – Collect high returns with P2P loans

Mintos is one of the oldest P2P platforms in my P2P portfolio and it was also one of the first P2P platforms I wrote about here on the blog in 2015. On this website you can find my Mintos review.

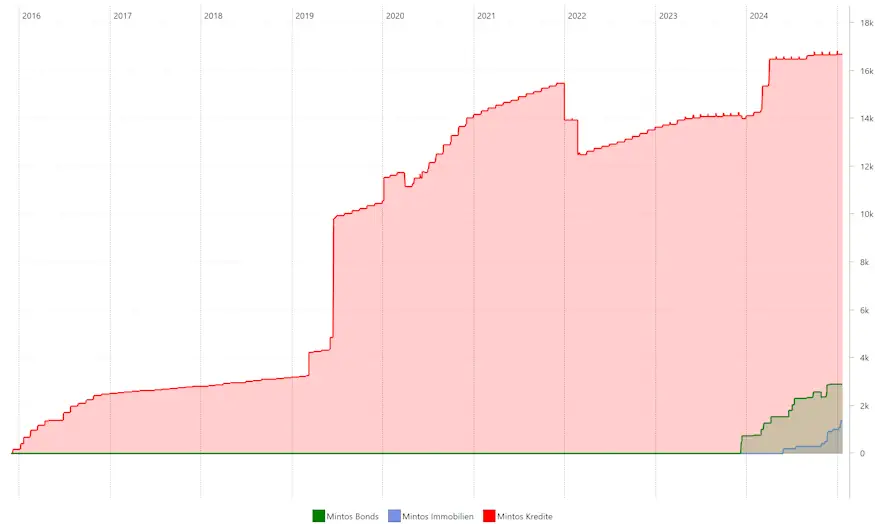

My portfolio value at Mintos is in the mid five-digit range and I plan to expand it further in the long term. The P2P platform from Latvia has come a long way in the years since it was founded and is now the largest P2P marketplace in the world, which slowly developed into a multi-asset platform. On this page you can find out everything you need to know about the Latvian platform to get started.

You can find additional tutorials on the homepage of the English section of my blog.

(An extra bonus of EUR 500 is available until January 31, 2026. Details here.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Mintos?

- Mintos Review – All Data at a Glance

- Investor Registration

- How to deposit Funds

- How does Mintos work?

- Automated Mintos strategy

- The Mintos Auto Invest (Custom Loans)

- Manual investment

- Mintos Bonds

- Mintos ETFs

- Mintos Real Estate

- Mintos Smart Cash

- Is there a Secondary Market?

- In which countries can you invest?

- Which loans can you invest in on Mintos?

- What is the Mintos Risk Score?

- Are there also independent ratings?

- What costs are incurred on Mintos?

- How high is the return on Mintos?

- What is the minimum investment amount on Mintos?

- Does Mintos offer a buyback guarantee?

- Is there an app for Mintos?

- Is there a Mintos share?

- Can you invest money in other currencies?

- Will I also receive the interest on late loans?

- How exactly do taxes work on Mintos?

- Is there a tax certificate on Mintos?

- Mintos Review: more about the risk

- How does Mintos earn money?

- Is Mintos profitable?

- What happens if Mintos becomes insolvent?

- How reputable is Mintos?

- How safe is Mintos?

- Are there defaults on Mintos?

- Is there deposit protection on Mintos?

- How did Mintos fare during the Covid-19 crisis in 2020?

- How did Mintos fare during the Ukraine war in 2022?

- Is Mintos resistant to crises?

- What exactly happened with the Mintos crowdfunding?

- Advantages and disadvantages of Mintos

- Conclusion of my Mintos Review

What is Mintos?

Unlike Bondora or Twino, Mintos is a so-called P2P marketplace. This means that Mintos does not grant P2P loans itself, but lenders listed on Mintos, who in turn grant the loans. Mintos merely connects the investors to the lenders, who are often called loan originators.

The lenders also offer the popular buyback obligation, where the lender buys back the loan if the borrower is late in their loan payments. However, my personal Mintos experience shows that this has not always worked reliably.

As an investor here you can invest globally and make returns, however a marketplace also has its pitfalls and as your portfolio grows you will need to spend some time here to build a secure portfolio. To help you with this, check out our P2P rating, where lenders are also listed.

Mintos Review – All Data at a Glance

Before we delve into the details of my Mintos review, here are the key facts conveniently compiled for you in one place.

| Founded: | 2015 |

| Headquarters: | Riga, Latvia, registered as AS Mintos Marketplace |

| CEO: | Martins Sulte, since inception |

| Regulated: | Yes (by the FCMC in Latvia) |

| Assets under Management: | Approx. 528,1 million euros (just loans), over 800 in total. |

| Financed Loan Volume: | Approximately 12,3 billion euros |

| Number of Investors: | Over 700,000 (registered investors, active number unknown) |

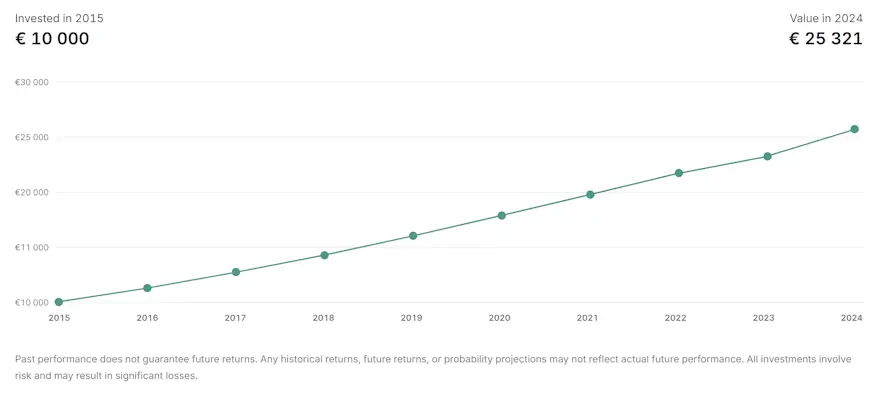

| Yield: | 8.8% in average according to the official platform data (since 2018) |

| Buyback obligation: | Yes |

| Minimum Investment Amount: | 50 EUR |

| Auto Invest: | Yes, at Mintos it’s called “Custom Loans.” |

| Secondary Market: | Yes |

| Issuance of Tax statement: | Yes |

| Investor Loyalty Program: | No |

| Starting Bonus: | Yes, there is a 25 EUR bonus for investments of 1,500 EUR or more. Register here*! |

| Rating: | Position 2 | Refer to the Platform Rating |

| Community Voting: | 3rd place out of 61 | See results (in German). |

| Last Financial Report: | Last audited report published for the year 2024. |

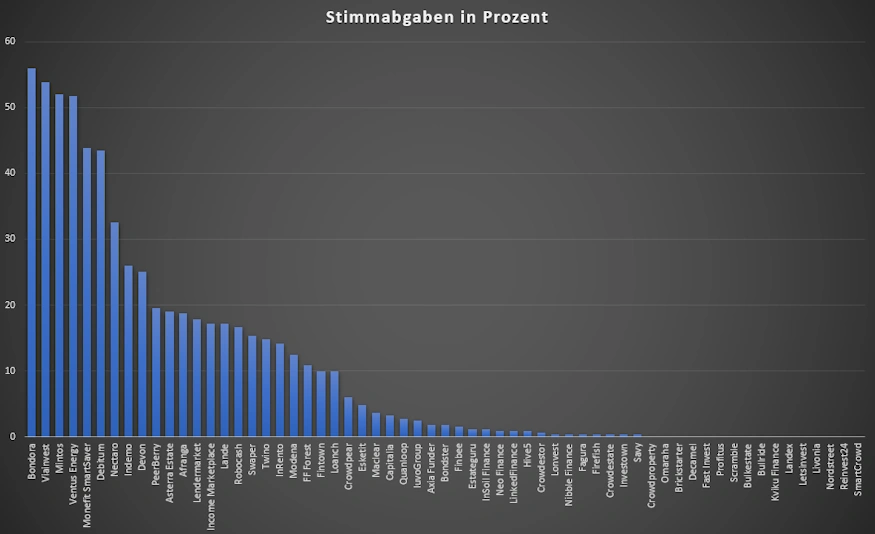

Mintos experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Mintos took 3rd place out of 61 with 52.0% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Mintos

Investor Registration

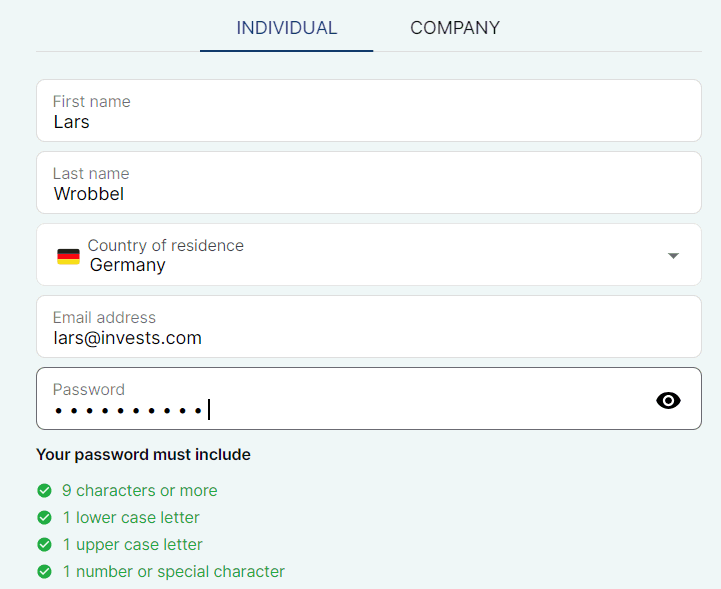

Registration on the P2P platform is not particularly complicated and consists of the following steps:

- Creating an account by entering your email address and password.

- Entering your personal data.

- Verification of your identity (e.g. with your ID card).

At Mintos you can also register as a company. After registration and deposit you are ready to invest in P2P loans.

Mintos bonus

At Mintos, you will receive a EUR 25 starting bonus if you invest at least EUR 1,500 within the first 30 days (excluding SmartCash). Use this link* to do so. You can find a constantly updated list of all bonuses in my P2P platform comparison.

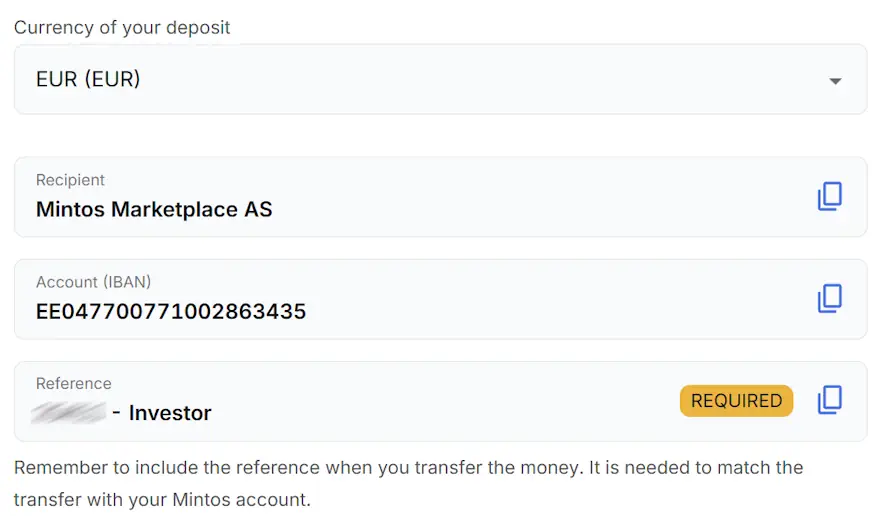

How to deposit Funds

Depositing money is, as always, the easiest step in investing money. In your account you click on your balance at the top and then on ” Add money”. Then, after selecting the desired currency, you will be shown the transfer data that you can use. For example, I have created an transfer template for this at my house bank.

Please note that the first transfer must come from a personal bank account. This will also be verified for later payouts. By the way, you can deposit more than 4 different currencies on Mintos.

How to withdraw money

If you want to withdraw capital or excess interest from the P2P platform, you also have to go to the account balance. Then click on “Withdraw money”.

You will not be charged a fee for withdrawing funds. The funds can only be withdrawn to the bank account from which the deposit was made. If you wish to register a new account for withdrawal, you will need to make a new deposit from a new personal account.

Can I deposit and withdraw with a credit card?

Yes, since May 2025 you can also deposit on Mintos by credit card. However, a 2% fee applies to all deposits.

How does Mintos work?

After registering with Mintos, you generally have 3 options for investing your money in loans.

- Via the automated Mintos strategy.

- You can set up your own Mintos Auto Invest (Custom Loans).

- Or you can invest completely manually on the primary or secondary market.

By the way, don’t be confused by the term “debt securities”. That’s what the loan bundles are now called after Mintos was regulated in 2022. Sometimes they are also referred to as Mintos Notes.

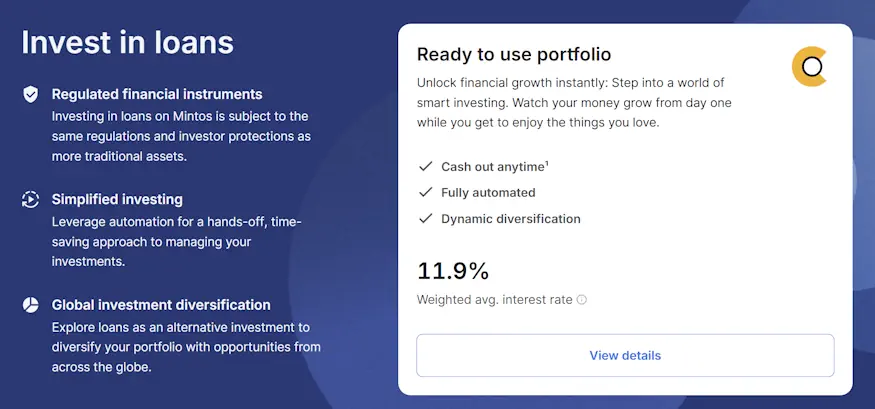

Automated Mintos strategy

With the automated strategy (Mintos Core), you don’t have to do anything at all.You activate it and then only need money in your account. However, you pay a 0.39% management fee for this service.

With the ready-made strategy, Mintos determines the distribution of your funds according to a fixed algorithm and you are globally diversified with just one click.

You can also withdraw your funds at any time (depending on market conditions). The sale usually takes place within a few minutes, depending on the demand from other investors at the time.

You can only sell loans with a share of less than 20% in delayed loans. If a loan security in your strategy has a higher proportion of late loans, you can only receive the money directly as soon as this proportion is reduced or the buyback is triggered. However, you can also sell the loans manually on the secondary market.

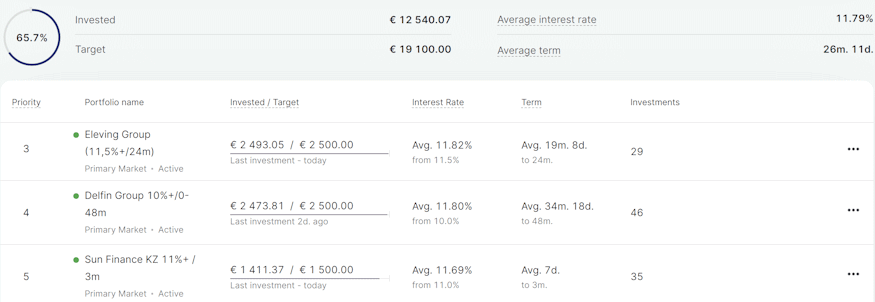

The Mintos Auto Invest (Custom Loans)

Mintos Auto Invest, on the other hand, is different (called Custom Loans at Mintos). You can tell the automatic portfolio builder exactly which countries and interest rates you want to invest in. You can even invest in more than one of them.

After many Mintos experiences, I only use the Mintos Auto Invest here, for which there is also a separate guide on my blog (in German). The Auto Invest is a complex instrument, which would go beyond the scope of this article.

After some time, I also discovered that the key to a successful investment strategy on Mintos lies in choosing the right lenders. That’s why the lenders are also evaluated in our rating, which should also help my readers. The rating is updated quarterly. For those who want more, there is the Premium section.

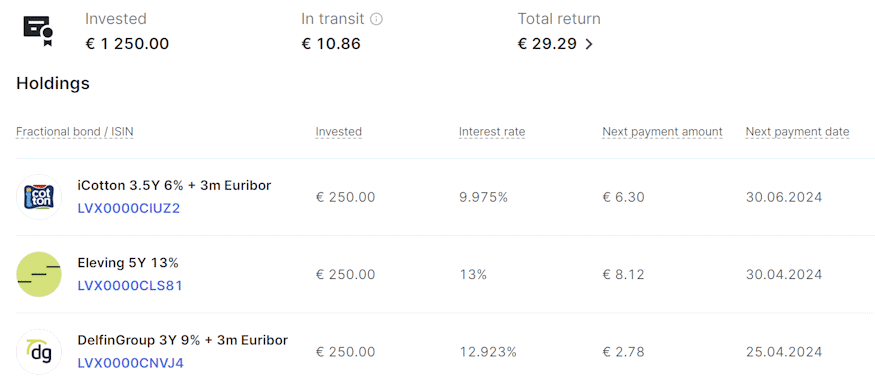

Mintos Bonds

Since 2023, you also have the option of investing in Mintos Bonds. Mintos bonds are nothing more than corporate bonds. The big advantage here is the easy access to the bonds. You can invest in them from as little as EUR 50 and the purchase process is the same as for loans.

As Mintos bonds have a slightly longer term than loans, you have the opportunity to secure higher returns for a longer period of time. Corporate bonds are also considered a relatively safe investment, as they generally have to be repaid before all other parties receive anything (depending on the structure of the bond).

I also added the Mintos bonds to my portfolio in 2023. Comprehensive instructions will follow, as this would go beyond the scope of this article.

What is the difference between bonds and notes?

Basically, you are investing in two different asset classes with different characteristics. With notes, you invest in loans to private individuals or small companies. In the case of bonds, you invest in corporate bonds issued by a company

To give you a better overview, I have summarized them in a short table.

| Feature | Notes | Bonds |

|---|---|---|

| Cash flow through | Repayments by borrowers. | profits of the company. |

| Interest payment | Based on different schedules of different loans. | Regular intervals based on a single underlying bond. |

| Repayment | This varies, as a rule part of the capital is repaid with each installment. | Depending on the bond, repayment on maturity is common. |

| Maturity | From a few months to several years. | Usually 3 to 5 years |

| Risks | Default of the borrower, default of the lending company, market risk, interest rate risk, currency risk and liquidity risk. | default of the bond issuer, the market risk, the interest rate risk, the inflation risk and the liquidity risk. |

Mintos ETFs

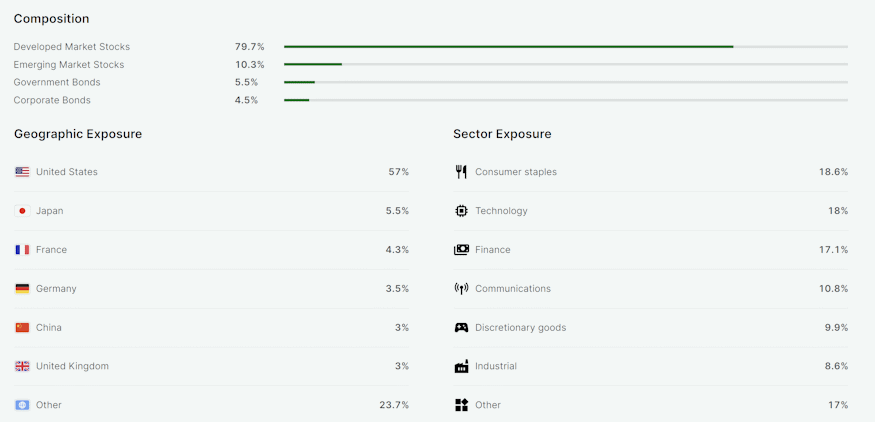

You have also been able to invest in ETFs on Mintos since 2023. The advantage of Mintos ETFs is that you don’t have to worry about anything and you can liquidate your portfolio at any time. Everything is based on your personal risk profile. Here, too, you can invest from as little as EUR 50.

For example, 90% of the Mintos Core Portfolio is invested in global equities. The remaining 10% is invested in European bonds, which serve as a low-risk buffer but still have the potential to increase in value. ETFs are a whole topic in themselves and are not discussed further here on the blog. However, you can customize the portfolio in 4 different levels.

I myself have a self-managed ETF and equity portfolio and therefore do not use Mintos ETFs. However, they may be of interest to some investors.

What is the difference between a self-managed ETF portfolio and Mintos ETFs?

Unlike with bonds, Mintos competes with brokers such as Scalable Capital* or TradeRepublic* for the favor of customers with ETFs. Here, too, you can manage your ETFs yourself or have them managed (Scalable Wealth)

To help you understand the differences between self-management and management by Mintos, here is a table with the most important points. It is important to note that many Mintos points basically also apply to most other robo advisors.

| Feature | Own ETF management | ETFS managed by Mintos |

|---|---|---|

| Investment approach | Requires investors to stay informed about market trends and the performance of their chosen ETF. The decision when to buy, hold or sell is at the sole discretion of the investor. | Mintos takes care of all aspects of portfolio management, including market analysis, ETF selection and transaction timing, so the investor doesn’t have to do a thing. |

| Time and effort | Considerable time spent on research, monitoring and realignment. | Simplified investment process, ideal for passive investors. Saves time and reduces effort. However, you also learn less. |

| Portfolio composition | Requires knowledge of the principles of asset allocation. Investors must actively decide on the proportion of individual ETFs. | Automated portfolio construction according to predefined investment objectives and risk profiles. No need for constant adjustment by the investor. |

| Neugewichtung des Portfolios | Frequent manual rebalancing may be necessary, especially in volatile markets. Additional transaction costs may be incurred. | Automatic rebalancing for investment and withdrawal activities. Efficient compliance with predefined ETF quotas without additional costs. |

| Understanding the costs | You have to deal with different fee structures. | A transparent fee structure with no administration fees charged by Mintos. |

| Minimum investment | In order to achieve true diversification, higher initial investments are generally required. This may not be feasible for investors with limited capital. | Affordable entry with a minimum investment of just €50. Enables diversified investing for most budgets as you can invest in fractions of ETFs. |

| Risk management | Individual risk assessment required for each ETF. Potentially unbalanced risk due to incorrect selection. | Designed to meet the investor’s risk tolerance and objectives. It happens completely automatically. |

Mintos Real Estate

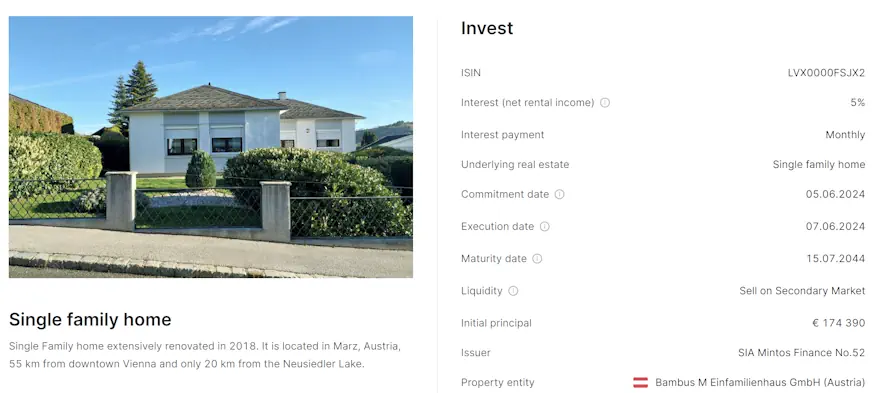

In 2024, the platform created another way to invest your money. Namely, in properties that have already been rented out in order to participate in the rent. Mintos thus offers the opportunity to own a rental property without having to take care of it. Of course, you do not legally own it. Here too, the investment is possible from as little as EUR 50.

In addition to the rental payments, investors also participate in an annual increase in value. The term of the projects is quite long at 10 to 30 years, but rental properties can be sold again at any time via the secondary market.

Each property has its own underlying prospectus, which every investor should study in advance. Investment in rental real estate can be regarded as rather conservative.

Mintos Smart Cash

Smart Cash is a cash management solution that allows you to invest your money in a money market fund, which is then available on a daily basis. Money market funds are low-risk (but not risk-free), highly liquid investments that pay interest. They focus on generating regular income by investing in safe, short-term securities such as bank deposits and government securities. These funds aim to make money while your investment remains stable and can be easily withdrawn when needed.

Mintos uses the BlackRock ICS Euro Liquidity Fund for this purpose. Even though money market funds are very safe investments, it is still an investment and your money is exposed to risk. Interest is calculated daily and added to your available balance at the beginning of each month.

The Mintos solution has a variable interest rate based on the European prime rate and has 0.29% fees (0.1% BlackRock + 0.19% Mintos). The product is perfect for temporarily parking waiting funds.

Is there a Secondary Market?

Yes, Mintos has a secondary market with the option to grant discounts and premiums. For you as an investor, this means that you can also find bargains if you buy on the secondary market. Incidentally, this can also be automated!

On the other hand, you can also give higher discounts on your own loans to get out of your investment extremely quickly. However, the secondary market is more for more experienced investors. Mintos bonds and real estate can also be traded on the secondary market.

In which countries can you invest?

On Mintos you have the broadest P2P loan portfolio you can possibly have. At the moment, you can invest in over 60 countries around the world. However, many loan originators come from Eastern Europe. But there are also investments from Asia, Africa and Central America.

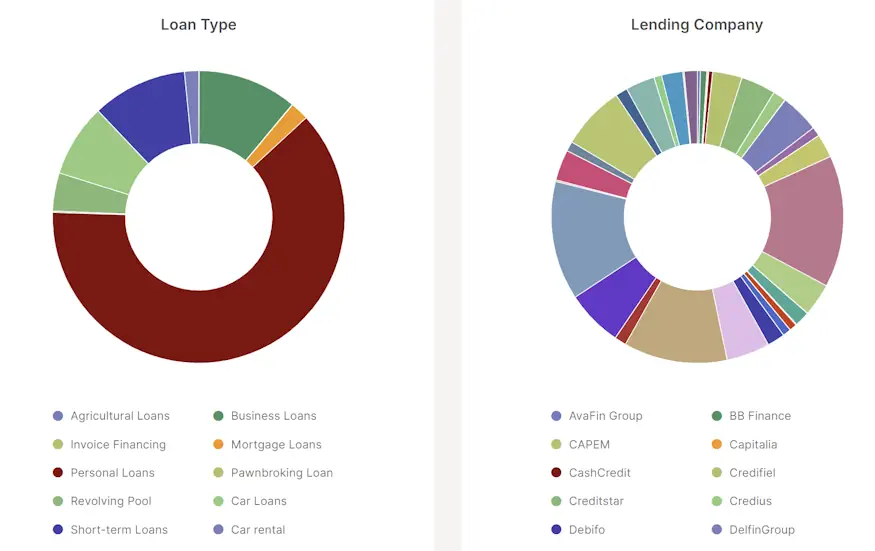

Which loans can you invest in on Mintos?

Those who invest in P2P loans here generate their returns from a colorful bouquet of different types of loans. The following loan types are currently available:

- Agricultural loans

- Car loans

- Car rental

- Invoice financing

- business loans

- Mortgage loans

- Short term loans

- Pawn loans

- Litigation financing

- and consumer loans

From my Mintos experience, the choice of loan type is ultimately of secondary importance.

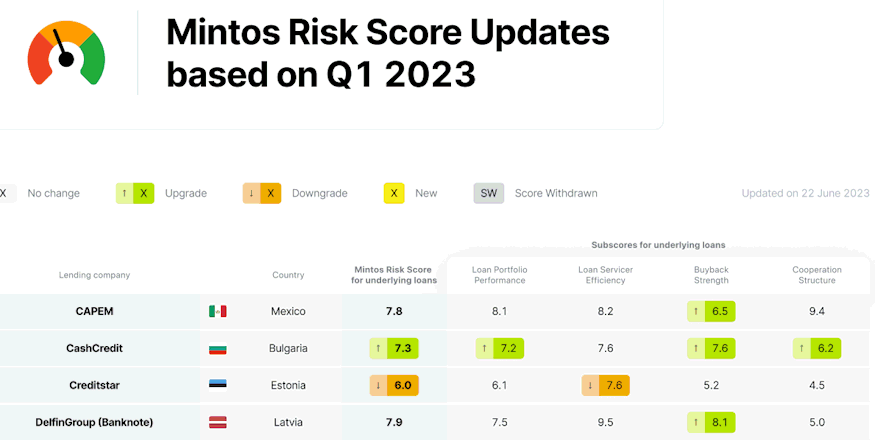

What is the Mintos Risk Score?

The Mintos Risk Score replaces the old Mintos Rating. Here, the P2P platform attempts to evaluate the loan originators and thus their borrowers that are available on the marketplace. This should make it a little easier for us as investors to separate high-risk from low-risk companies. The evaluation is based on four sub-ratings, which are weighted differently. The results are displayed with numerical values that are divided into three risk categories:

- low risk (10-7.5)

- medium risk (7.4-4.5)

- high risk (4.4-1.0)

As an investor, you should not rely entirely on the risk score based on my Mintos experience, but it does provide an initial orientation. However, always remember that you are solely responsible for your investments. The score is updated regularly. You can view any changes on the info page provided for this purpose.

Are there also independent ratings?

Yes, there are, right here on the blog! Together with my colleague Martin, I have created the P2P lender rating. Here you can see how the individual lenders perform. The rating is available in 2 versions:

- A free version (updated quarterly or semi-annually.

- A paid premium version (is constantly updated as soon as we notice something).

We hope that we have provided you with a valuable tool to protect your investment against losses in the best possible way. In the end, however, there is of course never a guarantee.

The rating is designed for the German market. However, the tables are easy understandable international.

What costs are incurred on Mintos?

There are no fees for investors on the primary or secondary market. There are also no costs for other actions on the platform. However, since April 2020, a small fee of 0.85% has been charged for the sale of loans on the secondary market.

In addition, all products managed by Mintos are usually associated with costs. For example, Mintos Core or Mintos Smart Cash. Since 2025, however, also Auto Invest. So make sure you are well informed beforehand.

You also pay a withholding tax in advance, which you can offset against your tax return. All other fees can be found on the corresponding information page at Mintos.

How high is the return on Mintos?

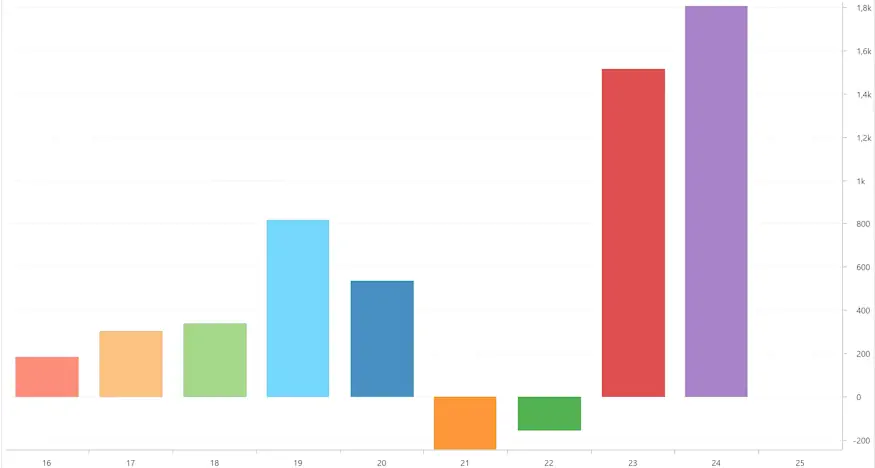

The return you can earn on Mintos is individual for each investor. You can always see the current historical value at the top of the table and my own in the return ranking. You can also call up individual years in my statistics (German). Mintos also provides its own historical data, which you can access at any time.

What is the minimum investment amount on Mintos?

You have to invest 50 EUR per P2P loan or Mintos Note in order to be able to invest. Mintos bonds and real estate also have a minimum investment of EUR 50.

Does Mintos offer a buyback guarantee?

As general, yes. But here, too, you have to check with each lender individually whether they offer it or not, or set the corresponding option in Auto Invest. The rules on when a loan is repurchased can also vary from lender to lender. In general, however, you won’t have any problems finding enough offers here. Incidentally, the buyback guarantee is referred to as a buyback obligation at Mintos, which is intended to make it clear that there can never be a guarantee for a buyback, which is correct.

Again and again I get the question whether there is a share of the company. After all, Mintos is pretty damn big and operates as a Latvian public limited company (AS), among other things. Although there was Mintos Crowdfunding (described below), the shares of Mintos are otherwise not listed on the stock exchange. The majority of the shares are still privately held even after the crowdfunding.

Can you invest money in other currencies?

On Mintos you can invest your money in 10 different currencies.

- CZK (Czech crown)

- EUR (Euro)

- SEK (Swedish krona)

- PLN (Polish zloty)

- KZT (Kazakh tenge)

- DKK (Danish krone)

- GEL (Georgian Lari)

- RON (Romanian leu)

- USD (US dollar)

- MXN (Mexican peso)

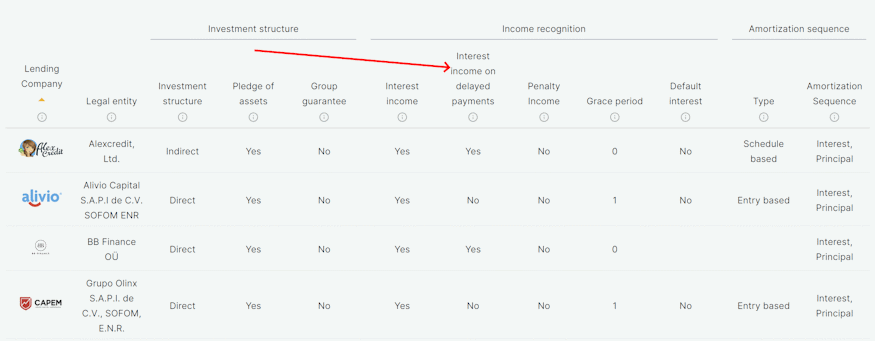

Will I also receive the interest on late loans?

This varies from lender to lender. However, you can find an overview of who offers this function on the lenders’ overview page.

How exactly do taxes work on Mintos?

The platform withholds 5% withholding tax, otherwise it doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Is there a tax certificate on Mintos?

Yes, there is. You can generate a tax certificate at any time by clicking on your profile.

Mintos Review: more about the risk

From my previous Mintos experience, the Latvian P2P marketplace is an exciting but not entirely passive investment in my portfolio.I have been invested here since 2015 and have therefore experienced quite a lot.

How does Mintos earn money?

Unlike many traditional P2P platforms, Mintos does not earn money from the spread between the loans displayed to the investor and the actual interest rates for the borrower.Mintos is a marketplace, which means that the lenders pay a corresponding fee to Mintos in the background for placing the loans on the marketplace.

In addition to this fee model, which is the main source of income, there are many other “sideshows” such as the secondary market fee, inactivity fee and other little things that occasionally flush money into the coffers. The annual report provides a detailed overview of the income streams.

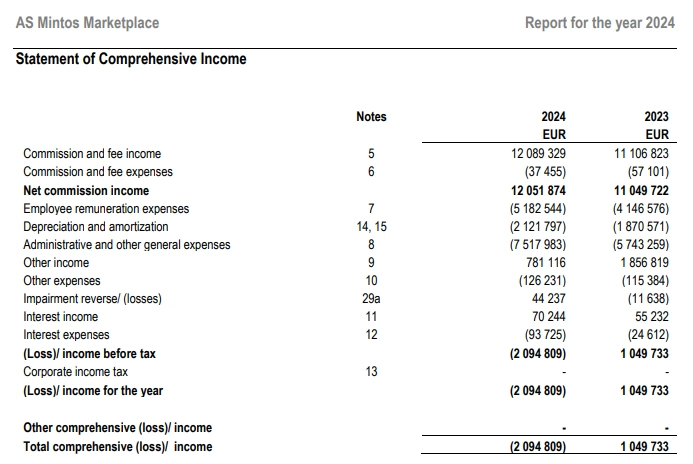

Is Mintos profitable?

Mintos is currently not profitable. Mintos annual reports are audited by an external body.

What happens if Mintos becomes insolvent?

If Mintos were to become insolvent, investors’ rights to their claims and bonds would continue to exist regardless of Mintos’ status.

The insolvency proceedings would be regulated and supervised by the Latvian Central Bank. The appointed liquidator or administrator would take over the duties of the Board of Directors.

In addition, uninvested investor funds would be protected, allowing retail investors to receive compensation amounting to 90% of the permanent loss, up to a maximum of EUR 20,000. However, nobody knows whether and how the whole thing works in practice, as there has never been a case like this.

How reputable is Mintos?

With over 500,000 investors, Mintos is the largest platform on which I invest.

It is also currently the largest P2P platform in the world. Ever since I’ve known the platform, there have been controversies about it from time to time. For example, the largest shareholder of Mintos(Aigars Kesenfelds) often also owns shares in lenders, which regularly leads to discussions. Nevertheless, Mintos can be described as a reputable company.

This is also supported by the fact that the company is now registered as a regulated financial institution with the Latvian Central Bank.

How safe is Mintos?

Like all P2P platforms, Mintos is as safe as your diversification and selection of the right investments.

This is also the key to your success.

Make sure that your portfolio is clean and diversified into predominantly good lenders, then you will have a lot of fun here. As already mentioned, you can find help with this in the P2P rating.

Are there defaults on Mintos?

There are regular defaults on the P2P platform, it would be strange if there weren’t.

However, the defaults of individual P2P loans are usually covered by the buyback obligation. If a lender defaults (which can and does happen), the buyback obligation is of course also voided.

The only thing you can do then is hope that Mintos can get as much of your money back as possible. These processes can often run for years, but Mintos keeps you good informed. To ensure that such defaults affect you as little as possible, you need to ensure good and solid diversification within the platform.

Is there deposit protection on Mintos?

No, definitely not. Mintos is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on the platform are exposed to a high risk of default.

However, there is an investor protection system, which could help to save some funds if the worst comes to the worst.

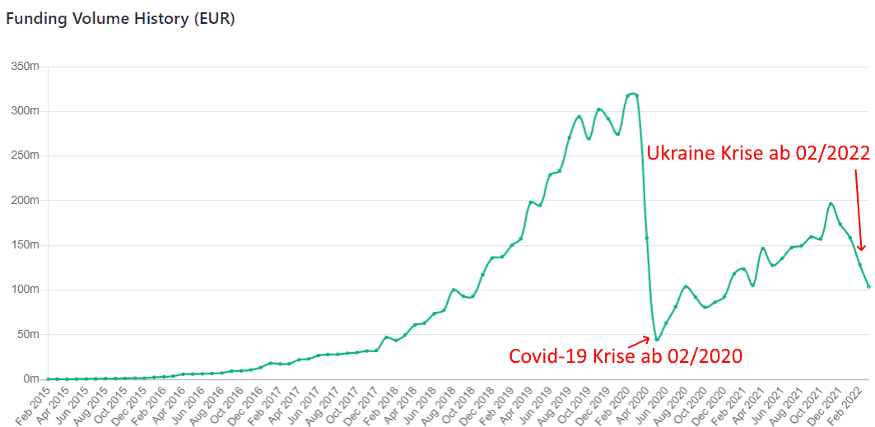

How did Mintos fare during the Covid-19 crisis in 2020?

Mintos was like a ship in a storm during the crisis. They tried to hold together as much as possible. Lenders with poor ratings defaulted in droves in the wake of the shutdown crash and global lockdowns and Mintos more or less just stood by and watched. They did the only thing that made sense. Keeping investors up to date.

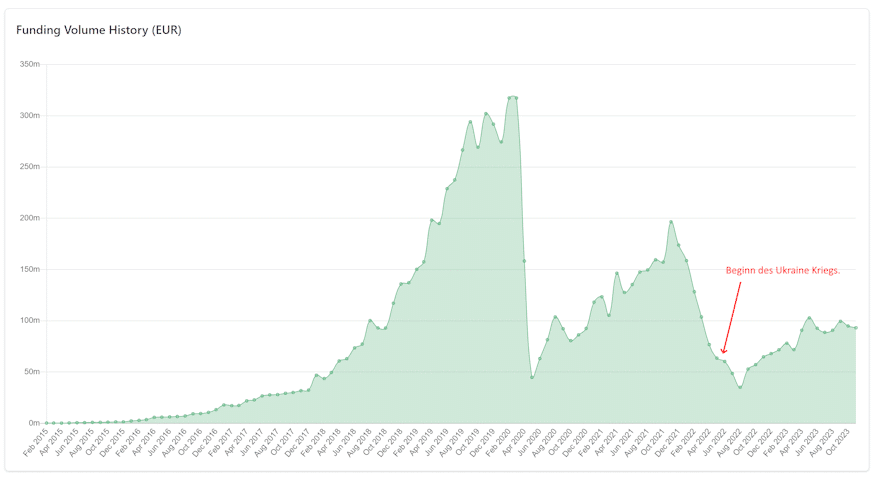

How did Mintos fare during the Ukraine war in 2022?

The Ukraine crisis was the next big blow for Mintos. Funds from Russian lenders were blocked and it is still uncertain when and, above all, how much we will get back. Although Mintos is trying to collect the lost funds, it will still take some time before this works. Another complicating factor was the changeover to Mintos Notes due to regulation. This also cost a massive amount of credit volume for some time.

In the meantime, however, things are on the up again, the Russian repayments are slowly being managed and things are looking up again. It is still a long way from its all-time high.

Is Mintos resistant to crises?

As far as the platform is in question, I would say yes based on my Mintos experience. However, you have to realize that a marketplace with countless connected lenders is likely to be more turbulent than, for example, Twino, a classic P2P platform. Many investors have painfully realized during the crisis that a marketplace also has its pitfalls.

What exactly happened with the Mintos crowdfunding?

Once the first storm had passed, the decision was made later in 2020 to sell company shares and carry out crowdfunding. Mintos wanted to use this to drive growth, expand its offering and also introduce new investment products.

In addition to a new Mintos debit card and the Mintos IBAN accounts, ETFs and bonds were also to be tradable in the future. Mintos ended the crowdfunding campaign with 7.2 million euros, the highest amount ever raised in continental Europe via a crowdfunding platform. Incidentally, I did not invest here myself.

Both bonds and ETFs are now available. However, the debit card is still not available. In 2024 Mintos started again a Crowdfunding Campaign.

Advantages and disadvantages of Mintos

Before we come to a final conclusion about the P2P platform, here is a summary of my pros and cons based on my Mintos experience.

Disadvantages

- If you really want to be successful on Mintos, you have to deal with the lenders.

- As a marketplace, Mintos is often more affected by economic downturns than traditional P2P platforms.

- You invest through Mintos in many different jurisdictions where recovering losses can be difficult.

- There is always a lot of controversy and rumors that can make you feel insecure as an investor.

- The platform is quite complex and features such as Auto Invest can be a bit overwhelming at first.

Advantages

- With over 60 lenders, the Mintos marketplace is the second most diversified product on the P2P market alongside Bondora Go & Grow.

- Even if you have to deal with the lenders, Mintos is pretty low-maintenance once you get the hang of it.

- Passive income from day one.

- If something goes wrong with a lender, Mintos will represent the interests of investors.

- Many lenders offer a buyback obligation and also a group guarantee.

- Regulated company with audited annual reports.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Conclusion of my Mintos Review

Mintos is one of the largest P2P platforms in my portfolio and I have been an investor from the very beginning. For this reason, the crisis hit me much less severely than many other investors, as I was already a few years ahead of them in terms of interest rates.

Many investors fled the platform because there were a lot of critical voices and, of course, losses. But that’s part of the game, so I’ve never turned my back on the P2P platform, which wasn’t a bad decision.

The platform now earns me a good amount every month, which I also have paid out. However, the portfolio build-up there is far from complete, and I plan to invest new funds here in the future.

I now not only have loans in my portfolio, but also bonds and real estate, which I would like to expand. Mintos is a stable pillar in my P2P portfolio and has therefore become bigger and bigger over the years. I think Mintos will have many exciting years ahead of it as a beacon of the industry.

Is there a Mintos forum where you can exchange ideas?

There are various places where you can exchange ideas with other investors and gain Mintos experience. The first address for this is the international Mintos Telegram Community.

What alternatives are there to Mintos?

Mintos is a P2P marketplace, of which there are several. A comparable alternative on the market, where I myself am also invested, is Peerberry. However, Peerberry is only a marketplace to a limited extent, even if it appears to be. A real comparison product is offered by Income, Lendermarket & IUVO, which follow a similar concept.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Mintos Review 2026 - Investing with the market leader

Mintos Review: Here you can find everything you need to know about the Latvian P2P platform ✚ my personal experience.

4