Income Marketplace Review 2026 – Returns, Risks & My Honest Opinion

Welcome to my Income Marketplace Review! If you’re wondering whether this platform is worth investing in, you’ve come to the right place.

Income is a relatively new P2P marketplace where I’ve been investing since 2021. Initially, I started cautiously, but over time, my investment has grown into five figures – a strong sign of my confidence in the platform.

But what makes Income Marketplace stand out? While it operates as a marketplace, it is fundamentally different from Mintos. Stay with me, and I’ll explain exactly why in the following sections!

You can find additional tutorials on the homepage of the English section of my blog.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Income?

- All important data at a glance

- Registration for investors

- How does Income Marketplace work?

- Manual investing

- Investing with the Income Auto Invest

- Is there a Secondary Market?

- In which countries can you invest?

- Which loans can you invest in on Income Marketplace?

- What costs are incurred on Income Marketplace?

- How high is the return on Income Marketplace?

- Will I also receive interest on late loans?

- What is the minimum investment amount on Income?

- Does Income offer a buyback guarantee?

- What is the Junior Share?

- What is the Cashflow Buffer?

- What is “early buyback”?

- Is there an app for Income?

- Can you invest money in other currencies?

- How exactly do taxes work on Income?

- Is there a tax statement on Income?

- Income risk

- Income Marketplace in crisis situations

- Advantages and disadvantages of Income

- Conclusion of my Income review

What is Income?

Unlike Bondora or Twino, for example, Income is a so-called P2P marketplace. This means that Income does not grant P2P loans itself, but rather loan originators who in turn grant the loans. Income merely acts as an intermediary between investors and lenders, who are often referred to as loan originators.

The lenders on Income also offer the popular buyback guarantee, where the loan originator buys back the loan if the borrower is late on their loan payments. In itself, this is a great idea until the lender defaults.

This is exactly where Income has created two tools to prevent this from happening. This makes Income fundamentally different from other P2P marketplaces and makes it highly interesting for an investment. We will come back to the details later. First, let’s take a look at the platform itself.

All important data at a glance

Before we go into the details of the Income Marketplace review, here is the most important data for you in one place.

| Founded: | 2020 |

| Headquarters: | Tallinn, Estonia, operating as Income Company OÜ. |

| CEO: | Lavrenti Tsudakov, with the company since 2023 |

| Regulated: | No |

| Assets under Management: | Approx. 25,8 million euros |

| Financed Loan Volume: | Approx. 216,6 million euros |

| Number of Investors: | Approx. 10,600 (registered investors, active number unknown) |

| Yield: | 13.78% on average according to official platform data |

| Buyback Guarantee: | Yes (and cash flow buffer + junior share) |

| Minimum Investment Amount: | 0.01 EUR (10 EUR recommended) |

| Auto Invest: | Yes |

| Secondary Market: | No, but planned |

| Issuance of Tax statement: | Yes, you can create it yourself. |

| Investor Loyalty Program: | No |

| Starting Bonus: | es, 1% cashback after 30 days, when you register as a friend*, use the code HKJWPH and invest. |

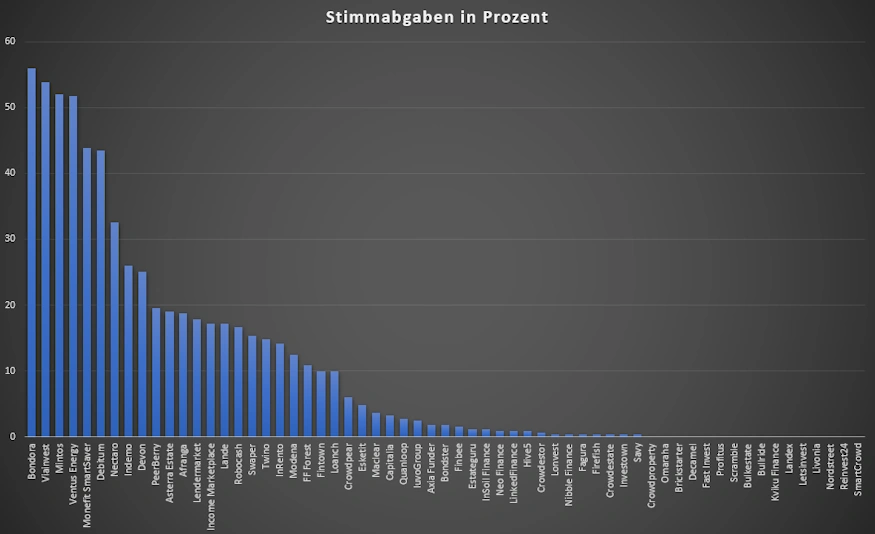

| Rating: | Position 13 | Refer to the public rating. |

| Community Voting: | 15th place out of 61 | See results (in German). |

| Last Financial Report: | Last report for 2024 (unaudited). |

Income Marketplace experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Income Marketplace took 15th place out of 61 with 17.2% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Income Marketplace

Registration for investors

Registering on the P2P platform is not particularly complicated. In addition to your name and e-mail address, your physical address is also required. A further identity check will take place later on.

Incidentally, a very convenient feature of Income is that you can log in with your Apple, Google or Facebook account in addition to the classic email/password combination.

By the way, always pay attention to bonus promotions of the platforms to get advantages. You can find a constantly updated list of all bonuses in my P2P platform comparison.

Income Marketplace Bonus

Via my link* you will receive 1.0% bonus interest on your investments for the first 30 days, with a minimum of EUR 10 and a maximum of EUR 500. The bonus will be credited after 40 days. If there are time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

How do I deposit money?

Depositing money is, as always, the easiest step when investing money. In your account, you will see a small wallet next to your name. If you hover over it, you will see the “Deposit funds” option. If you click on this, you will be shown the transfer details that you can use after selecting the desired currency (currently only available in EUR) and the transfer type.

Please note that the first transfer must come from a personal bank account. This will also be verified for subsequent payouts.

How do I withdraw money?

If you want to withdraw capital or excess interest from the P2P platform, follow the same procedure as for depositing, but click on “Withdraw funds”.

You will not be charged a fee for withdrawing the funds. The funds can only be withdrawn to the bank account from which the deposit was made. If you wish to register a new account for the withdrawal, you must make a new deposit from a new personal account.

Can I make deposits and withdrawals by credit card?

At the moment you cannot use credit cards for deposits and withdrawals. These must be made with a bank account. Depositing via a bank account is also used for identification purposes.

How does Income Marketplace work?

After registering on Income, you generally have 2 options for investing your money.

- You can configure your own Auto Invest.

- Or you can invest completely manually on the marketplace.

I would always recommend the first option, as I am an advocate of passive income. Manual investing takes time and will only improve your results in exceptional cases. We’ll take a look at auto invest later on.

Manual investing

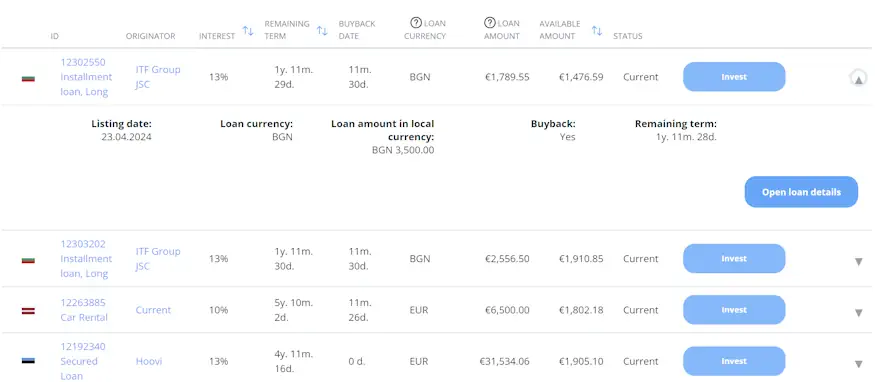

If you invest manually in P2P loans, you will need Income’s primary market. Here you can hand-pick your loans and view all the details of the loan.

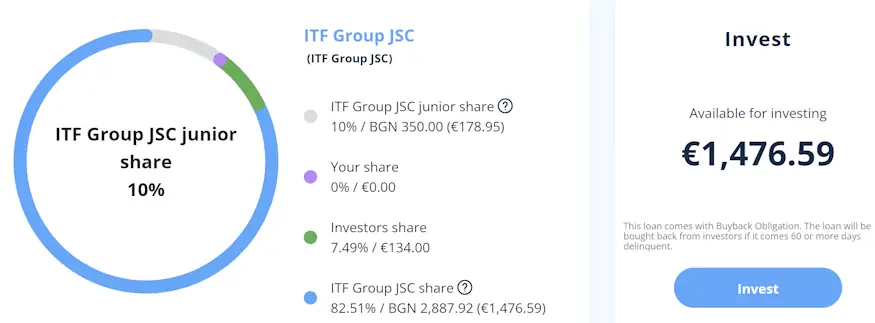

The detailed display of P2P loans is also well worth reading and unusually comprehensive compared to the competition. For example, you can see here what interest rate the borrower has to pay on the other side. Or how the distribution between junior share (we’ll get to that), investor share etc. is.

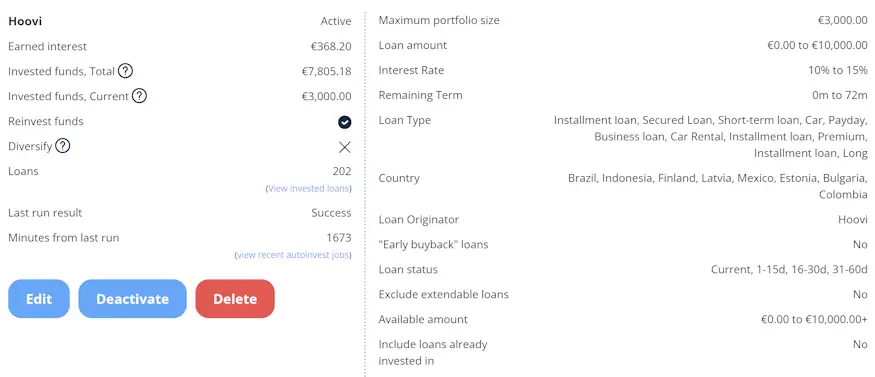

Investing with the Income Auto Invest

As mentioned at the beginning, Income also offers an Auto Invest. This allows you to make detailed configurations as to what you want to invest in later. The most important things from my point of view are

- Remaining term = loan term

- Loan type = Type of loan

- Loan Originator = The company behind the loan

- Include already invested loans = Also invest in loans that have already been serviced by another strategy.

- Maximum portfolio size = The size of your portfolio

- Reinvest = Reinvest returns

- Investment in one loan = Maximum investment in a single loan

Is there a Secondary Market?

No, Income Marketplace does not currently offer a secondary market. However, this has been under development for some time.

In which countries can you invest?

Income is still a very young marketplace and there are not yet as many lenders as on Mintos, for example. A total of 8 lenders from 7 different countries are currently active. These currently include

- United Kingdom

- Spain

- Indonesia

- Estonia

- Lithuania

- Latvia

- Kosovo

- and Bulgaria

As the platform continues to grow, more loan originators will be added. You can always view the current list directly at Income. Please note that this list shows all loan originators, but not all are active!

Which loans can you invest in on Income Marketplace?

Investors in P2P loans currently generate most of their returns from short-term loans and traditional installment loans. Here is an overview of the current loan originators and their areas of activity. You can also check the current list directly from Income and conduct further research there.

What costs are incurred on Income Marketplace?

Investors do not incur any fees for investments on the primary market. There are also no costs for other actions on the platform.

How high is the return on Income Marketplace?

The return you can earn on Income is individual for each investor, depending on the settings you choose. You can always see the current average yield updated at the top of the platform factsheet or directly on the statistics page at Income. It is currently between 13 and 14 percent.

In August 2022, the cap on the yield was raised from 12 to 15%, which is why there was a nice increase. Lenders can therefore offer higher-interest loans, which could give the yield a further boost in the long term. My own return can be found in my own statistics (German) and is almost 13%.

Will I also receive interest on late loans?

Yes, if a loan is delayed or defaulted on, you will also be credited interest for the delays. Regardless of the status of the loan, interest is calculated on a daily basis.

What is the minimum investment amount on Income?

It is recommended to invest EUR 10 per loan. But it is also possible to invest as little as EUR 0.01 in the loans. However, due to rounding differences in the interest crediting, this is not recommended.

Does Income offer a buyback guarantee?

Yes, all loan originators offer a buyback guarantee. However, unlike most marketplaces and classic P2P platforms, this is not a hollow promise. Because to really secure the buyback guarantee, Income uses 2 revolutionary techniques in this area. The “cash flow buffer” and the “junior share”. In the end, these make it possible to provide an actual buyback guarantee that is worthy of its name and to minimize risks on the loan originator side. There were various risks in the past:

- Regulatory risk (e.g. license revocation, which occurred with Varks, Mintos, 2020)

- Disruptions in operations (e.g. account blocking, occurred at Cash Wagon, Mintos, 2020)

- Crash (e.g. corona crisis, occurred in 2020)

- Problems with refinancing and liquidity (occurred with many lenders in the context of the coronavirus crisis)

Income also offers the so-called “early buyback”, which makes it easier for loan originators to make long-term loans more attractive. Let’s take a closer look at the techniques.

Let’s start with the junior share, which is the first security in the event of a loan originator default. This works as follows: Let’s assume a lender has a junior share of 10% in a loan. In the event of a default, this 10% will affect the investors’ share, for example if it is 90%. The investors’ 90% is repaid first and only then does the loan originator get his share back. If there is nothing left, the loan originator gets nothing back. This technique therefore puts the investor in a privileged position, making a total default virtually impossible.

Let’s think this through on a larger scale: Let’s assume we have agreed a junior share of 20% with the loan originator and the loan originator has now placed EUR 1,000,000 in loans on Income and these are fully invested up to the permitted amount (80%). This means that the Income investors have invested EUR 800,000 and EUR 200,000 remains with the loan originator. The 20% is subordinated in favor of the investors, i.e. if Income has to take over the EUR 1,000,000 portfolio due to a default of the loan originator and starts collecting, they will try to collect the full EUR 1,000,000 and use it to repay the EUR 800,000 to the investors and only if the proceeds exceed EUR 800,000 will the loan originator get some of it back, namely EUR 200,000.

The junior share is always different and can be viewed in the corresponding detailed view of the loan, which you have already seen above. In addition, the framework is generally contractually defined for each loan originator.

What is the Cashflow Buffer?

Next we come to the cash flow buffer. Again, an example for easy understanding: Let’s say a loan originator has placed 1,000 loans on Income and defaults, then these 1,000 loans are taken over by Income and they do the collection on behalf of the investors. For this purpose, existing contracts have been concluded with local debt collection companies.

P2P loans where the final borrower repays on time are of course covered by the borrower’s repayments. The loans where the borrower does not repay are covered by the cash flow buffer (as there is no longer a functioning “buy-back guarantee” due to the loan originator default).

So if there are 1,000 loans, 800 of which are performing normally and 200 of which are not, the junior share and the surplus from all 1,000 loans are used to cover the 200 non-performing loans according to the original plan. In this way, everyone gets their investment back simply and fairly. At least that’s the plan, because the worst-case scenario has not yet happened.

Junior Share and Cashflow Buffer therefore work together to protect the investor from a total default.

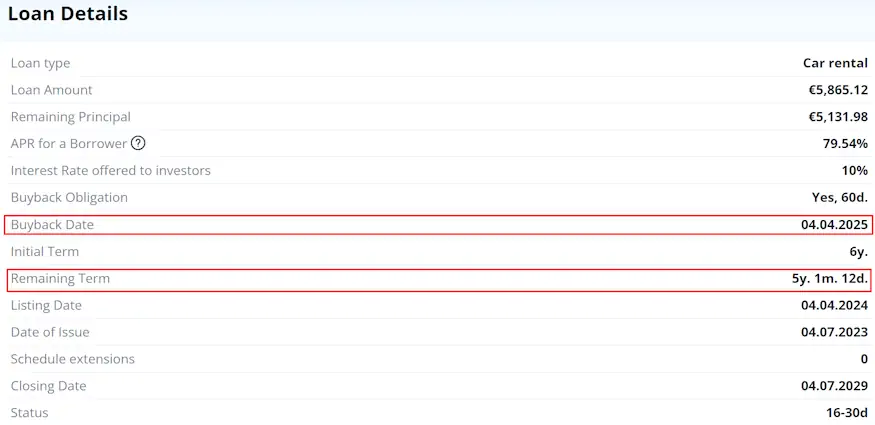

What is “early buyback”?

The early buyback feature allows loan originators to repay the loan early, allowing investors to recover their invested capital and accrued interest earlier than with a regular loan term. This option increases flexibility for both parties and allows investors to make their portfolio more dynamic by being able to access their capital earlier.

An example: A loan from the loan originator ITF has a term of 3 years. With the early buyback, ITF reduces this term to 1 year, buys it back and puts it back on the market with a term of 2 years. For the loan originator it is the same loan 3 times, but for the investor it is 3 shorter-term loans.

The repurchase date is always visible in the loan and there is also a filter for these loans in particular.

Can you invest money in other currencies?

No, on Income you invest exclusively in euros.

How exactly do taxes work on Income?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Income risk

From my previous Income Marketplace experience & research, the Estonian P2P marketplace is certainly one of the most exciting opportunities we currently have on the market. The cash flow buffer and junior share are designed to protect the investor side in a way that no platform has done before.

But of course there are also operational risks with the Income marketplace itself. And it is also questionable whether the security techniques really work.

How does Income earn money?

Unlike many traditional P2P platforms, Income does not earn from the spread between the loans shown to the investor and the actual interest rates for the borrower. Income is a marketplace, which means that the lenders pay a corresponding fee to Income in the background for placing the loans (approx. 2.5% of the outstanding balance per month).

In addition, there are costs for the initial setup on the marketplace + basic fees for the security structure. Apart from this fee model, which is the main source of income, there is currently no other source of income as far as I know.

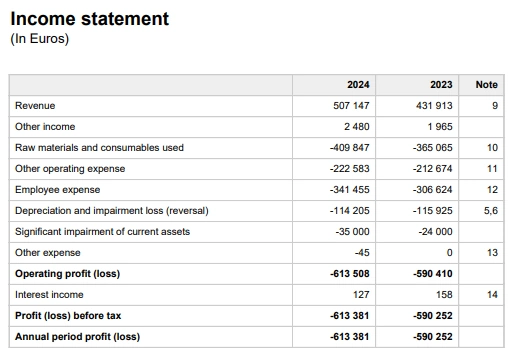

Is Income profitable?

As a recently launched P2P platform, it is not yet operating profitably. However, as soon as the first audited annual report has been published, you will find it here. At the moment, the decision has been made not to have this prepared. However, as Income is an Estonian company, you can access this data publicly from the Estonian company register.

In order to be able to operate at all, Income is working with the money from several crowdfunding rounds (several million euros). The aim is to achieve profitability.

What happens if Income becomes insolvent?

In the event that the P2P platform gets into financial difficulties or has to file for insolvency, the company will be wound up as planned by a third party (the insolvency administrator). Existing loans from loan originators will continue to run. The insolvency administrator will take care of the transfer of all investments and loan servicing.

How reputable is Income?

Income is still a young marketplace. I have already spoken to CEO Kimmo very often and from what I see and hear, I consider the platform to be absolutely reputable.

How secure is Income?

Like all P2P platforms, Income is as secure as your diversification. This will also be the key to your success on the platform if more lenders come onto the platform (as is the case with Mintos). However, there is a much higher certainty that you will get your money back, even if you bet on the wrong lender.

In addition, as with any P2P platform, there is of course the risk of the platform itself becoming insolvent. Income Marketplace lenders and their business figures are listed in our Premium Rating. This should make your research a little easier.

Are there defaults on Income?

There are certainly regular defaults on the P2P platform, it would be strange if there were not. However, the defaults of individual P2P loans are covered by the buy-back obligation, so we are not aware of them. According to information from the platform, the current default rate is between 20 and 25%, depending on the loan originator.

So far, only ClickCash 2022 can be considered a loan originator default. However, the outstanding amount was negligible and it is very likely that 100% of the funds will be returned.

Do the “new” techniques work in practice?

In its still young career, the marketplace has already had 3 problem cases:

- ClickCash, Brazil (buyback guarantee not honored)

- Vivus, Mexico (bank transfer problems)

- Juancho Te Presta, Colombia (technical problems)

At ClickCash, it turned out that the loan portfolio was “too small” for the big hammer. A classic repayment plan was agreed here. Vivus was resolved elsewhere and Juancho Te Presta did not return after the technical problems.

The cash flow buffer and the junior share have therefore not yet been used for any problem cases. The only case where it could have been used was ClickCash, but this was not done as the outstanding amount was very small. So we still don’t know whether these techniques work or not.

Is there deposit protection on Income?

No, definitely not. Income is not a bank and is therefore not covered by any European deposit protection scheme. All funds that you invest on the platform are exposed to a high risk of default.

Income Marketplace in crisis situations

Investors in Income have come through the crisis relaxed so far.

Income during the Covid-19 crisis in 2020

Income was founded during the crisis, so to speak. I am not aware of any problems. However, in a personal call with the CEO, I was told that loan originators were being monitored closely at the time in order to be able to react quickly to potential problems. The marketplace Debitum did something similar, screening its lenders on a monthly basis at the time instead of quarterly.

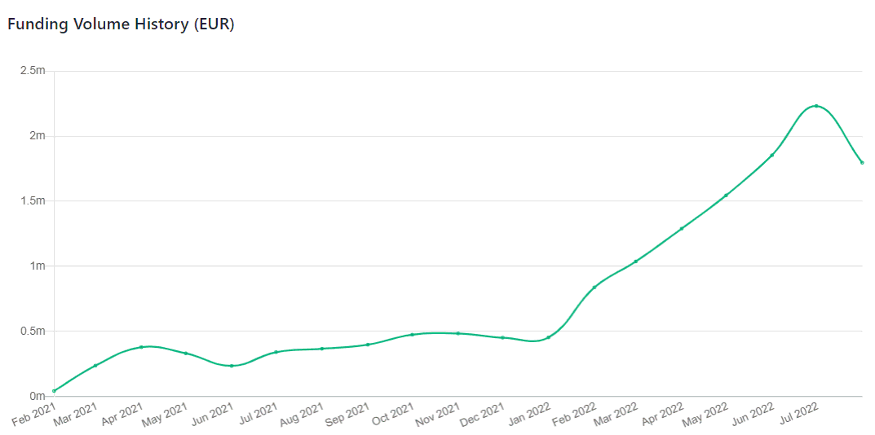

Income during the war in Ukraine in 2022

Unlike on other marketplaces, the volume of loans on Income also increased at the beginning of the war. This is mainly due to the fact that no loan originators from Russia or Ukraine operated on Income. However, Income canceled a crowdfunding campaign planned for mid-2022 due to the uncertain economic situation.

Advantages and disadvantages of Income

Before we come to a final conclusion about the P2P platform, here is a summary of my pros and cons based on my Income Marketplace review.

Disadvantages

- Income is still a young marketplace.

- Only a few loan originators compared to Mintos.

- Not yet profitable.

- No audited annual report has been published yet.

- As a marketplace with different countries, it is often more affected by economic downturns than traditional P2P platforms.

- Not yet regulated.

Advantages

- New security system for loan originators that does not yet exist anywhere else.

- Diversification across several countries possible.

- Comparatively high returns.

- Passive income virtually from day one.

- If something goes wrong with a loan originator, Income represents the interests of investors.

- All loan originators offer a buy-back guarantee.

- Income is a very transparent platform right from the start.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Conclusion of my Income review

Income was initially an exciting new contender in the “P2P sky”, but also struggled to grow like most other platforms. The Cashflow Buffer and Junior Share in particular still have to prove themselves. Unfortunately, the problem cases that Income has had in the past could not be used for this.

However, I hope that many investors will support the marketplace because of this security concept alone, so that Income has time to grow.

P2P platforms simply need to understand that the buyback guarantee is only worth something if it is structured as such. Otherwise, it is at best a promise, which does not necessarily have to be kept.

With the Cash Flow Buffer & Junior Share, Income puts investors in a contractually privileged position, which should have a clearly positive impact in the event of lender insolvency.

As I myself would also like to support this concept as a signal to other platforms, I started an investment with Income myself at the time. In the meantime, this has become a five-figure investment.

Is there a Income forum where you can exchange ideas?

There are various places where you can exchange ideas with other investors and gain Income experience. The first address for this is the international Income Marketplace Telegram Community.

Is there a bonus or refer a friend program to start on Income?

You can refer friends to Income or have them refer you. Both partners benefit from a 1% cashback of the new investor’s invested funds after 40 days, but they both get at least 10 EUR, no matter what is invested (at least 1 EUR).

I would of course be very grateful if you would use my link to appreciate the information you have found here. Alternatively, you can also use the registration code “HKJWPH”. This will only give you advantages, not disadvantages!

What alternatives are there to Income?

All P2P marketplaces that do not issue loans themselves should be mentioned here. First and foremost, of course, Mintos, the IUVO Group, Bondster or Peerberry (although this is not a pure marketplace). But Esketit, Lendermarket and Loanch would also be interesting candidates. However, none of the alternatives have a similar security system to Income. You can find other possible alternatives in my P2P platform comparison.

Income vs. Mintos?

Many people keep asking me how certain platforms compare to Mintos and whether they are an alternative. Income is still very small, but could definitely become an alternative in the future. The cash flow buffer & junior share make them the better P2P platform in purely structural terms, but of course they don’t have what Mintos has to offer. Time will tell how the situation develops.

Based on my Income Marketplace review, it can’t hurt to build up a position here and monitor it in the long term.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Income Marketplace review 2026 - 15% incl. protection

Income Marketplace Review: Here you can find everything you need to know about the Estonian P2P platform ✚ my personal experience.

4.5