Crowdpear Review 2026 – What you need to know about the investment platform

On this page, you will find my Crowdpear review so far. On Crowdpear, you invest in a regulated environment in real estate and business loans, offering an attractive return. The Lithuanian platform is now considered one of the most reputable and stable options in the field.

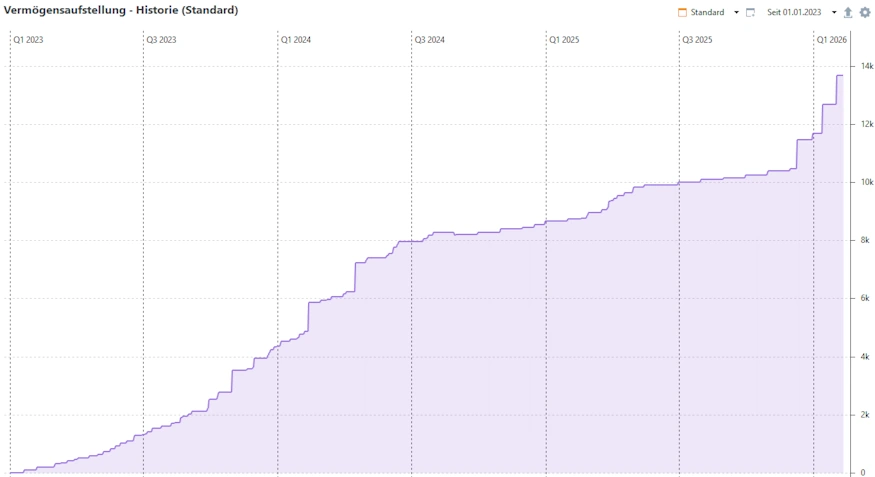

I myself started my investment on Crowdpear 2023 and gradually increased my portfolio as I have known the team behind the platform for many years through my investment on the sister platform PeerBerry. I know that there is a lot of know-how behind it. In addition, the area of “business loans” is still underrepresented in my portfolio.

Have you yourself already gathered Crowdpear experiences, or do you feel any information in this report is missing or outdated? If so, I would appreciate it if you could leave a comment regarding that. You can also find more P2P lending experiences on my blog.

You can find additional tutorials on the homepage of the English section of my blog.

Bonus conditions: The 1.0% extra interest applies to all investments made in the first 90 days and is added to the regular interest on the projects. So if you invest in an 11% loan, it will earn 12.0% in the first 90 days.

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Crowdpear?

- Crowdpear Review – All data at a glance

- Investor Registration

- How does Crowdpear work?

- The Secondary Market

- In which countries am I actually investing my money?

- Is there an Auto Invest feature?

- What kind of projects can you invest in on Crowdpear?

- What costs are incurred for Crowdpear?

- What is the return rate on Crowdpear?

- When will the first interest payments be made on Crowdpear?

- What is the minimum investment amount for Crowdpear?

- Is there a buyback guarantee on Crowdpear?

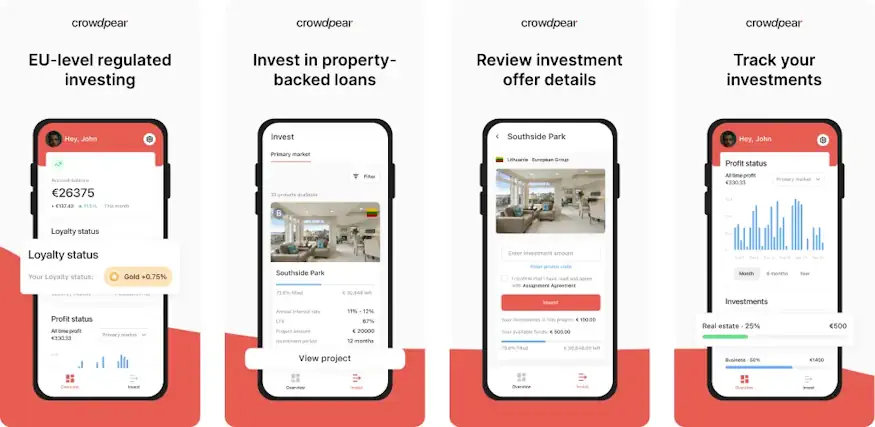

- Is there an app for Crowdpear?

- Can you invest money in other currencies?

- Do I also receive interest for late loans?

- How does the taxation work for Crowdpear?

- Is there a tax certificate for Crowdpear?

- Crowdpear Risk

- Crowdpear in Crisis Situations

- Conclusion of my Crowdpear review

What is Crowdpear?

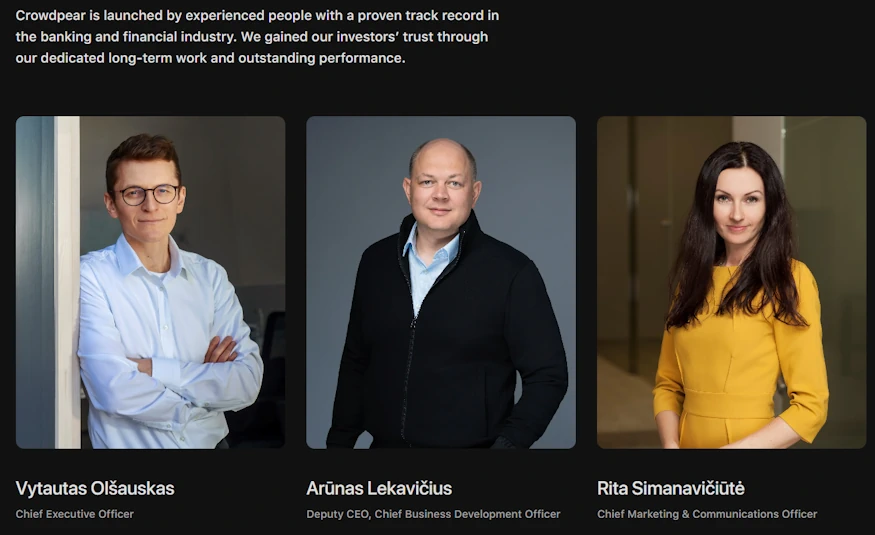

This young P2P crowdfunding platform is a derivative of the well-known and popular P2P platform PeerBerry, where I have been invested for years and which is one of my top platforms in the portfolio. Behind Crowdpear is the same team and equally strong industry knowledge. Additionally, 2 out of the 3 shareholders are the same as on PeerBerry:

Crowdpear Shareholders:

- Vytautas Stražnickas (45%)

- Vytautas Olšauskas (20%)

- Ivan Butov (20%)

- Arūnas Lekavičius (15%)

PeerBerry Shareholders:

- Andrejus Trofimovas (50%)

- Vytautas Olšauskas (25%)

- Ivan Butov (25%)

The reason for launching another platform is the long-term separation of business and consumer loans. While PeerBerry will continue to focus on consumer loans due to the lack of European regulation, future business, energy and real estate projects are to be listed on Crowdpear.

Because here, there is the opportunity to invest in a regulated environment, which will provide many advantages for us investors in terms of security in the long run.

Crowdpear Review – All data at a glance

Before we delve into the details of my Crowdpear review, here are the key facts conveniently presented for you in one place.

| Started: | 2021 (as a product in 2022) |

| Company Headquarters: | Vilnius, Lithuania, registered as UAB Crowdpear |

| CEO: | Vytautas Olšauskas, involved since its establishment |

| Regulated: | Yes, regulated by the Central Bank of Lithuania and holder of the ECSP license. |

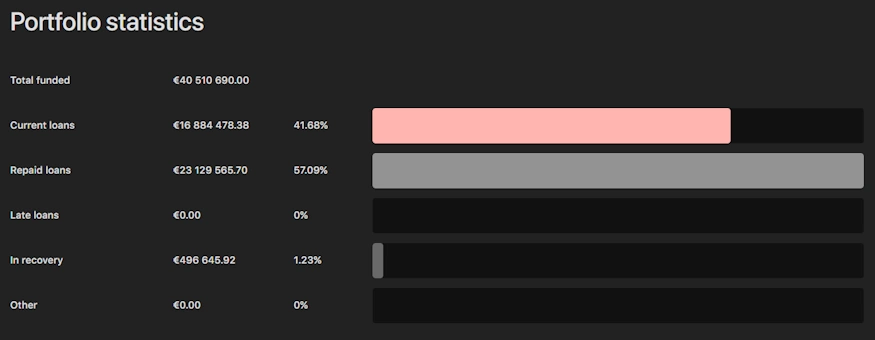

| Assets under Management: | Approximately 17.0 million EUR |

| Financed Loan Volume: | Approximately 40,0 million EUR |

| Number of Investors: | Approximately 9.900 (registered investors, active number unknown) |

| Return on Investment: | 10.69% according to official information on the website. |

| Buyback guarantee: | No (However, projects typically have underlying security) |

| Minimum investment amount: | 100 EUR |

| Auto Invest: | No |

| Secondary Market: | Yes |

| Issuance of a tax certificate: | Yes |

| Investor loyalty program: | Yes (in the form of loyalty categories) |

| Crowdpear bonus: | Yes, there is a bonus of 1.0% cashback* in the first 90 days. |

| Rating: | Place 5 | Refer to the public rating. |

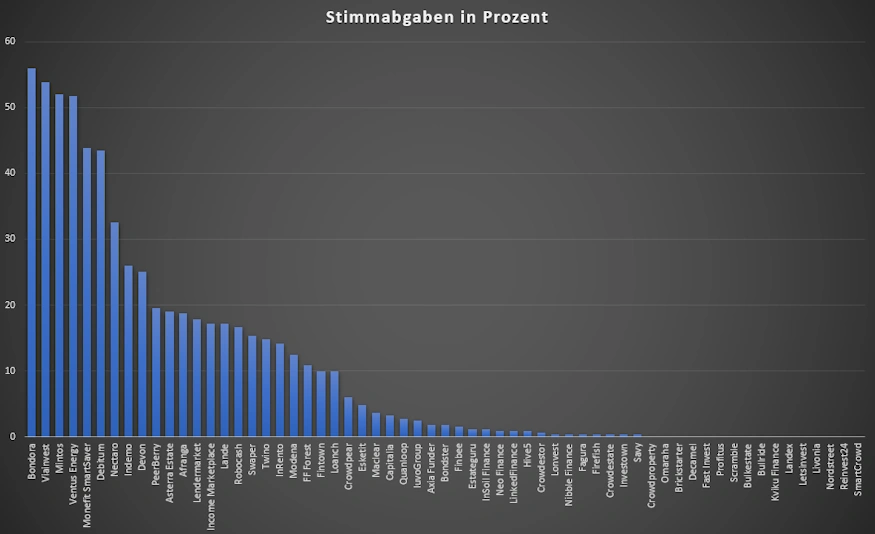

| Community Voting: | Place 24 of 61 | Refer to the Results. |

| Latest annual report: | Audited published 2024. |

Crowdpear experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Crowdpear took 24th place out of 61 with 6% of all votes, which can be considered a satisfactory result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Crowdpear

Investor Registration

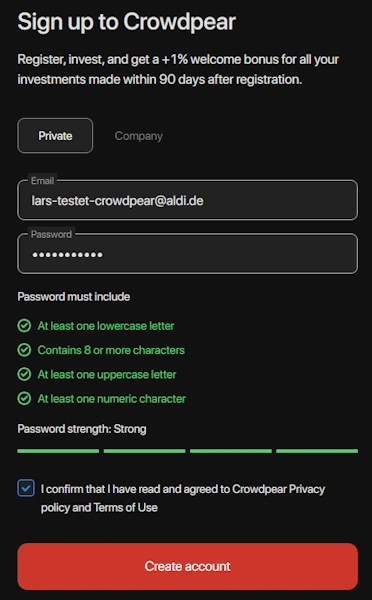

Signing up with Crowdpear is relatively straightforward and involves the following steps:

- Creating an account by entering your email address and password.

- Providing your personal information.

- Verifying your identity (e.g., using your ID card).

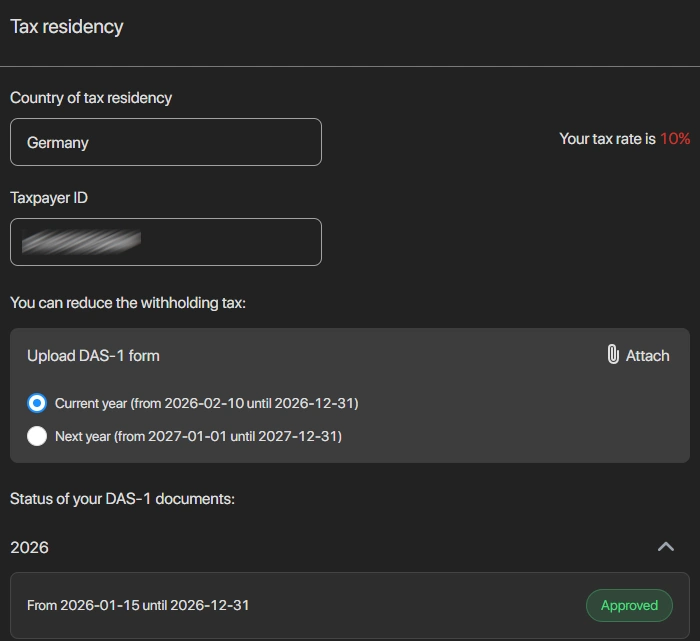

- Lowering the withholding tax to 10% with the DAS-1 form (we’ll cover this later).

After signing up, you’ll be ready to invest in the exciting projects on the platform. You can register with Crowdpear both as a private individual and with your company, if you have one.

Crowdpear Bonus

Via my link* you will receive 1.0% extra interest on all investments you make in the first 90 days after your registration. If there are any time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

How do I deposit money?

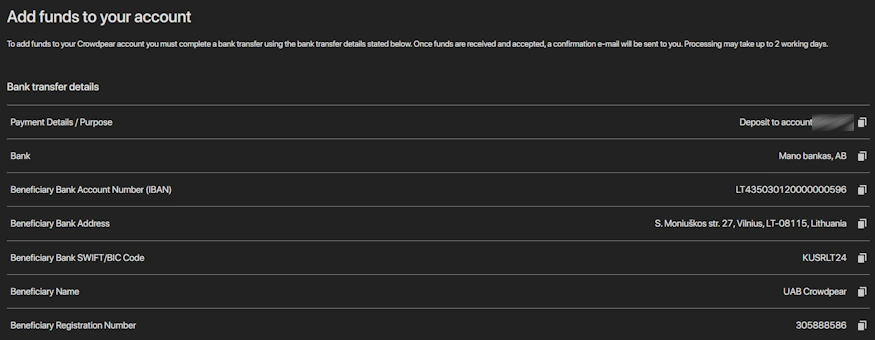

You can make a deposit for Crowdpear within your account. To do this, navigate to the “Deposit / Withdraw” section on the left side of the menu. Then, in the “Deposit” section, you can access the necessary bank details to initiate a transfer.

How do I withdraw money?

You also do this in the same section (“Deposit / Withdraw”), but now you go to the “Withdraw” tab. Here, you can withdraw interest as well as your deposited capital if it’s not invested in projects. Please note that when withdrawing, your personal account with the exact same name as used for deposit must be used.

How long does the deposit take?

Based on my previous experiences, deposits usually arrive on the same day. I’ve used the free Revolut* account for this purpose. Some banks may take 1-2 working days before the deposited amount is available on Crowdpear, but Crowdpear is usually very fast.

Can I deposit and withdraw with a credit or debit card?

Currently, you cannot use credit cards for deposits and withdrawals. Therefore, you must have a bank account in your name for these transactions. However, if you use Wise or Revolut, you can top up these accounts by credit card if you wish. You can then use them to make the transfer to Crowdpear.

How does Crowdpear work?

On Crowdpear, you can browse projects on the primary market. Each project has a comprehensive project profile that provides detailed information about what you’re investing in. You’ll receive the following information about each project:

- Interest rate

- Payment schedule

- Security

- Duration

- Project location

Once you’ve familiarized yourself with the project and made an investment decision, you can quickly invest your money.

The Secondary Market

Investors have the option to both purchase assets from the Secondary Market and also divest from their investments prematurely. The Secondary Market is free for buyers, while sellers incur a 2% fee on the sale price. Discounts and premiums can also be applied in transactions on Crowdpear’s Secondary Market.

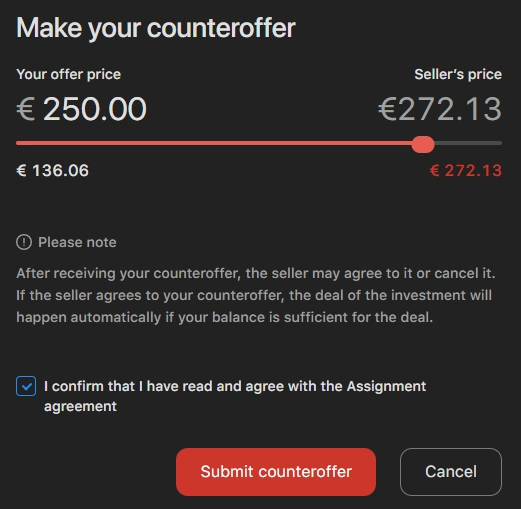

Uniquely, Crowdpear also offers a feature called “Counteroffer.” Counteroffer allows investors to propose their own price for a loan listed for sale on the Secondary Market. The seller of the loan can choose to accept or reject the counteroffer they receive.

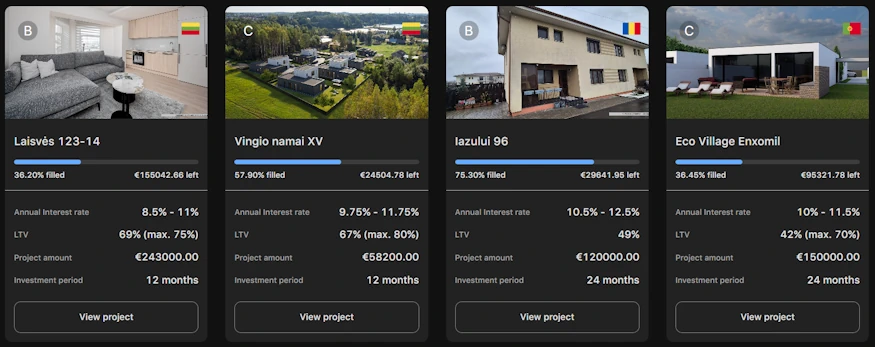

In which countries am I actually investing my money?

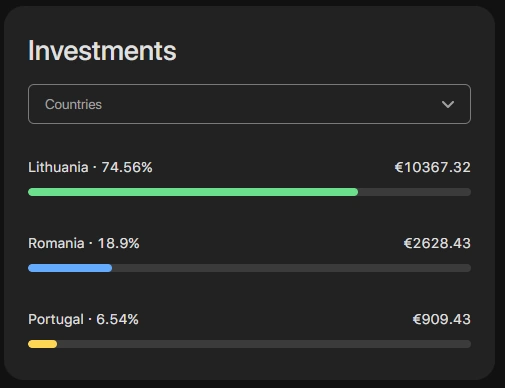

Investors on Crowdpear currently invest mainly in Lithuania (the platform’s home country) and Romania. There are also a few projects from Portugal. You can view an overview of the countries you are investing in at any time in your account.

Is there an Auto Invest feature?

No, it’s important to understand the individual projects and their risks. That’s why there is currently no Auto Invest feature on Crowdpear.

What kind of projects can you invest in on Crowdpear?

You invest exclusively in commercial projects on Crowdpear. The platform has announced projects from three sectors:

- Real Estate (e.g., development loans)

- Energy (e.g., wind turbines)

- Business Loans (e.g., business expansions)

What costs are incurred for Crowdpear?

As an investor, you currently do not incur any costs on Crowdpear, unless you are active as a seller on the secondary market.

What is the return rate on Crowdpear?

The return reported by the platform is between 10 and 11 percent. My own return is currently around 10%; you can view the latest figures in my statistics. You can often increase your return on a project-specific basis (depending on the investment amount, as stated in the project profile) and there is also a loyalty programme that allows you to generate additional returns.

When will the first interest payments be made on Crowdpear?

Traditionally, interest on projects on Crowdpear is paid quarterly. However, interest is calculated from the day you make your investment!

What is the minimum investment amount for Crowdpear?

The minimum investment amount is 100 EUR, which is reasonable for this type of projects as they generally have significantly higher volumes than consumer loans.

Is there a buyback guarantee on Crowdpear?

No, there is no buyback guarantee on Crowdpear. Due to regulatory reasons, it is not allowed to provide any “guarantees” in Lithuania, which, from my perspective, is entirely appropriate. This means that you could potentially experience a total loss of your investment.

However, there is typically real security for the project. For example, it could involve a property (the most important component), company shares, or a personal guarantee from the borrower. If the loan defaults, this security can be used for liquidation. You can identify and assess the security in the project profile. However, based on my own experience, the platform does an excellent job in this regard.

Can you invest money in other currencies?

No, you exclusively invest in euros on Crowdpear. I also don’t anticipate this changing in the foreseeable future.

Do I also receive interest for late loans?

Yes, additional interest of 5% per annum is paid to investors for the period of delay (for each day of delay).

How does the taxation work for Crowdpear?

It’s important to know that you pay a 15% withholding tax on the platform. You can reduce this to 10% by completing the DAS-1 form and uploading it to your profile. You can offset the remaining 10% against your capital gains tax in your tax return.

Crowdpear Risk

From my previous Crowdpear experiences, the Lithuanian platform appears to be a good and reputable option in the business loan sector. However, investing on Crowdpear still involves risks that can materialize at any time, and we will now discuss them in the following section.

How does Crowdpear make money?

Crowdpear makes money from the borrowers who list projects on the platform. You can find a detailed price list here to get an idea of what borrowers have to pay. Currently, there are no additional sources of income. However, due to the team’s experience, I have little concerns about this.

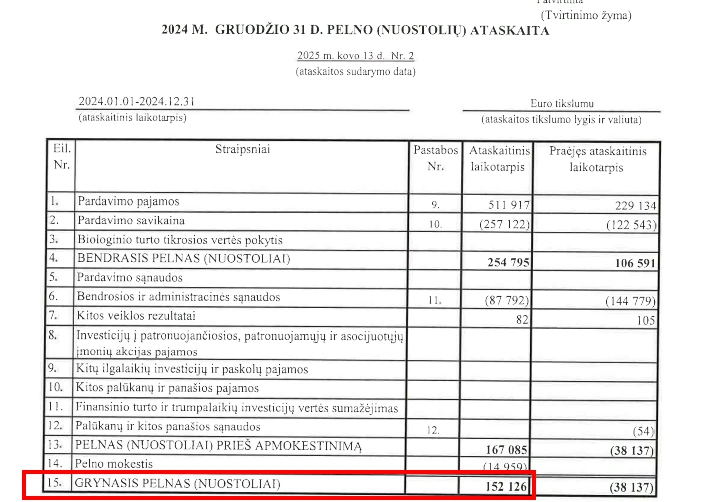

Is Crowdpear operating profitably?

Yes, Crowdpear has been profitable since 2024. The first audited annual report can be found on the platform in Lithuanian.

What happens if Crowdpear goes bankrupt?

If something were to happen to the platform, it initially won’t affect your investment, and it will continue to operate. In the event of bankruptcy, an insolvency administrator will take over the liquidation of the remaining projects and payments, distributing the funds accordingly.

From past experiences, we know that these processes can be lengthy and opaque. However, none of the previous platform failures have occurred under the oversight of a regulator. While the insolvency of Crowdpear poses a potential risk to your funds, I consider the likelihood of this occurring to be low due to the nature of the business model.

How reliable is Crowdpear?

Even though the platform Crowdpear appears new, the team is already a well-known entity in the industry and operates the sister platform PeerBerry. Since I have known the team there for years and regularly communicate with the responsible individuals, it is safe to consider Crowdpear as a reliable company.

It is also regulated at European level and holds an ECSP licence. In addition, it is monitored by the Lithuanian central bank and has received various awards for transparency and security. I would even go so far as to say that Crowdpear is currently one of the most reputable investment opportunities in the entire industry. This is also reflected in the P2P platform rating, where Crowdpear is among the top 5 platforms.

How secure is Crowdpear?

An investment always carries the risk of not receiving back a portion or the entirety of the invested funds, and this is no different with Crowdpear. However, the backing of real assets such as real estate significantly reduces this risk.

However, please note that the recovery of assets can still take months or years. This applies not only to Crowdpear, but to any P2P platform that works with real assets as collateral. The reasons for this are regulations, court proceedings, waiting times, etc. You can check the collateral for each project yourself using documents.

Are there any defaults on Crowdpear?

The first defaults have now occurred on Crowdpear. So far, reporting has been extremely transparent and professional. You can check the current default rate at any time in the statistics. It is usually around a very good 1-2%.

Is there a deposit guarantee on Crowdpear?

No, definitely not. Crowdpear is not a bank and therefore does not fall under any deposit guarantee. All funds you invest on the platform are exposed to the risk of default.

Crowdpear in Crisis Situations

Investors on Crowdpear have remained relaxed during the crisis, as the platform started operating only during the Ukraine conflict in 2022. Therefore, it has no connections to Russia or Ukraine, nor does it list projects from those regions.

Advantages and Disadvantages of Crowdpear

Before we reach a final conclusion about the P2P platform, here’s a summary of my pros and cons based on my Crowdpear review.

Advantages

- Possible total loss, no buyback guarantees..

- Minimum investment of 100 EUR per project.

- You are required to pay withholding tax in Lithuania.

- No Auto Invest feature.

Disadvantages

- Strictly EU regulated Lithuanian platform.

- Trust bonus due to PeerBerry background.

- Good returns over 10%.

- Carefully selected projects.

- Real underlying securities.

- Interest calculation starts from the day of investment, eliminating waiting time.

Conclusion of my Crowdpear review

So far, the Crowdpear platform has delivered on its promises. There are hardly any defaults and a solid return of 10% or even a little more. I am now investing in the five-figure range and plan to increase my investment further. With Crowdpear, we have an exciting and reputable player in the business loan market.

Since its launch in 2023, the platform has been constantly developed and raised to an extremely professional level. This is evident not only in boring things like documentation (which often no one reads anyway), but also in practical terms in the failure rates, which are very low for a platform of this kind.

With the addition of Romania, another market has been created, which naturally offers us investors a certain degree of diversification outside the Baltic region, which can never be a bad thing. I am very excited to see where Crowdpear will be in a few years’ time.

Is there a Crowdpear forum for discussions?

There are various places where you can interact with other investors and gather Crowdpear experiences. The primary destination for this is the international investors group on Telegram where you can engage in discussions.

Is there a Crowdpear bonus or a referral program at the beginning?

In general, there is a 1.0% starter bonus for all new investors in the first 90 days. This means you’ll receive 1.0% extra interest on your investments during this period. Additionally, both the referrer and the referred person will each receive 20 EUR if they use the “Refer a Friend” link. However, a minimum of 300 EUR must be invested within the first 60 days after registration to qualify for this.

So, if you’re interested in investing and found the information here valuable, I would appreciate it if you use my referral link. This won’t disadvantage you in any way!

What alternatives are there to Crowdpear?

As an alternative to Crowdpear, platforms specializing in business crowdfunding are particularly suitable. A reputable and experienced platform in this sector could be Capitalia*.

Long-term, Crowdpear also competes with local real estate platforms (e.g., InRento & Profitus) as well as international ones (EstateGuru).

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Crowdpear Review 2026 - Secure Business Loans at 10% p.a.

European regulated crowdfunding platform with an experienced team behind it. Absolutely solid performance and good returns.

5