Monefit SmartSaver Review 2026 – 7.50 – 10.52% and fast availability?

Translated form the German original “Monefit SmartSaver Erfahrungen“

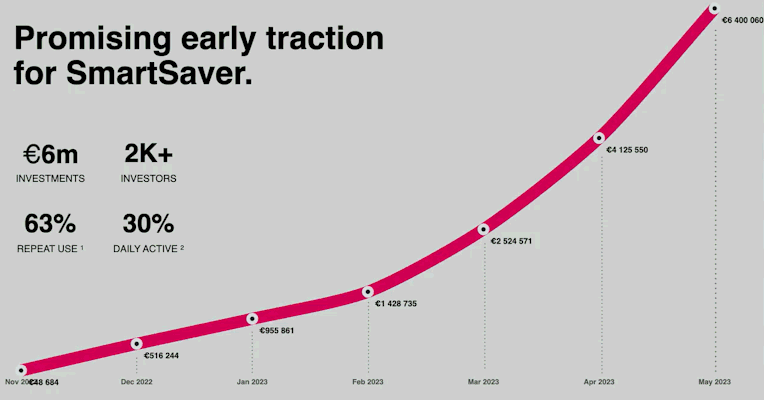

In my Monefit SmartSaver review, you will learn everything important about this product. In 2022, the established credit company Creditstar, which is also behind the platform Lendermarket, introduced a new product for investors, allowing them to earn a 7.50% return with daily payouts and quick access to their money.

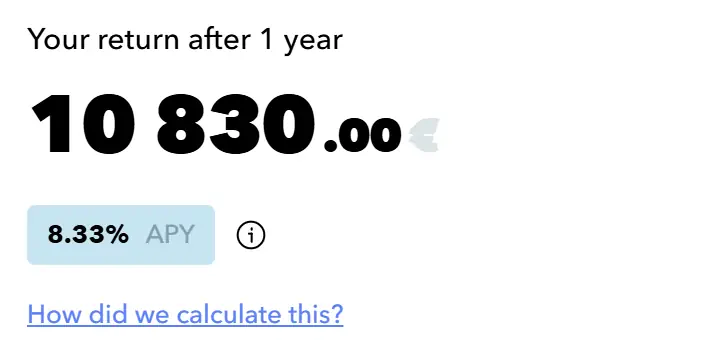

Since 2024 you can also increase your interest rate to 8.33% – 10.52% with fixed-term deposits (Monefit SmartSaver Vault) in the 6-24 month range.

Since there was also a 2% cashback on all deposits, I signed up directly, deposited a little money and checked out how it all feels. You can’t make money much easier than that. Furthermore, it’s worth exploring whether Monefit SmartSaver can serve as an alternative to the established products Bondora Go & Grow.

You can find additional tutorials on the homepage of the English section of my blog.

Sign up now for Monefit SmartSaver and get 0.50% cashback + 5 EUR start bonus!*

(The €5 starting credit will be credited immediately, the first 0.25% will be credited after 5 days, and the second 0.25% after 90 days.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Monefit SmartSaver?

- Monefit SmartSaver Review – All important at a glance

- Investor registration

- How does Monefit SmartSaver work?

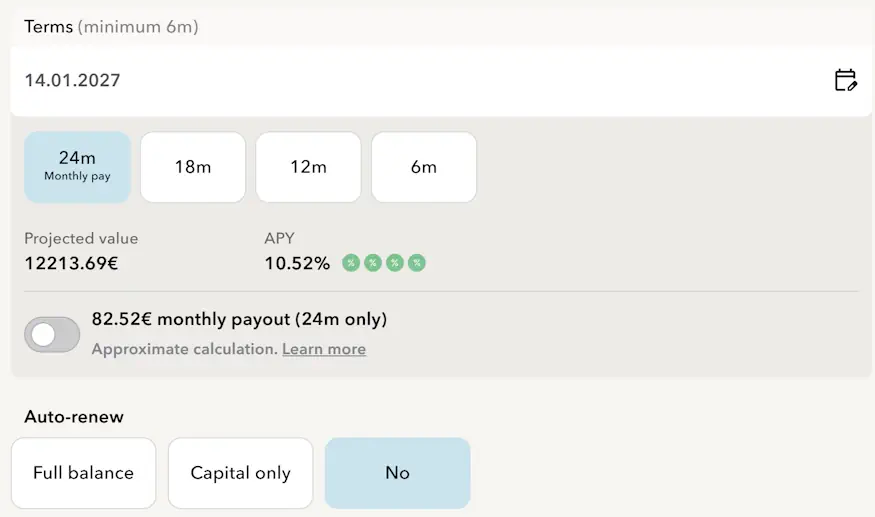

- What is the Monefit SmartSaver Vault?

- Monefit SmartSaver experience: Using the Vault cleverly

- In which countries am I actually investing my money?

- In what type of loans am I invested?

- What costs are incurred for Monefit SmartSaver?

- What is the return on investment with Monefit SmartSaver?

- What is the minimum investment amount for Monefit SmartSaver?

- Is there an app for Monefit SmartSaver?

- Can you invest money in other currencies?

- How does the taxation work for Monefit SmartSaver?

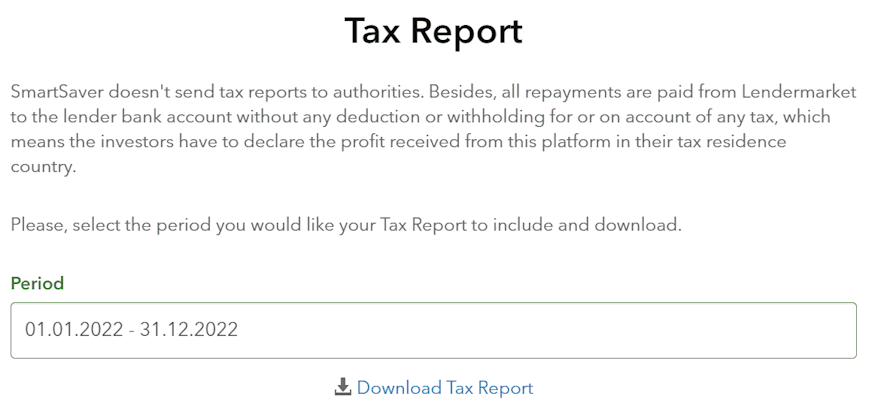

- Is there a tax certificate?

- The risk of Monefit SmartSaver

- Conclusion of my Monefit SmartSaver review

What is Monefit SmartSaver?

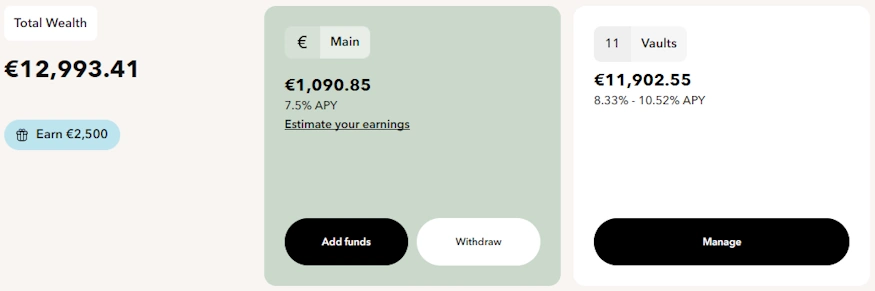

Monefit SmartSaver is a fully automated investment product from the Creditstar Group that has been on the market since the end of 2022. Investors invest directly in the company’s loan portfolio and receive daily interest of 7.50% to 10.52% p.a. in return.

The concept is very similar to Bondora Go & Grow – but with higher interest rates and additional features such as the “Vault” (fixed-term deposit function).

The most important features at a glance:

- Daily interest credit from day one

- Returns of 7.50–10.52% p.a., depending on the product and term

- Automated reinvestment with full compound interest effect

- Automatic interest payment (passive income mode)

- High liquidity: payouts usually possible within 10 days (1,000 EUR per month immediately!)

- Fixed-term deposit options (Vaults) with terms of 6 to 24 months

- Flexible return structure through fixed-term deposit ladder

- Low entry barrier: Investments possible from as little as €10

- Easy deposit: Also possible by credit card or instant transfer

Here is a video from the company itself, which explains how Monefit SmartSaver works very well.

Returns & products at a glance

The following overview shows all current Monefit SmartSaver variants with returns, terms, and availability.

| ProduCt | Yield (APY) | Term | availability |

|---|---|---|---|

| SmartSaver | 7,50 % | no commitment | max. 10 days |

| Vault (6 months) | 8,33 % | 6 months | no early termination |

| Vault (12 months) | 9,42 % | 12 months | – |

| Vault (18 months) | 9,96 % | 18 months | – |

| Vault (24 months) | 10,52 % | 24 months | Monthly interest payments possible |

Who is Monefit SmartSaver suitable for?

Monefit is ideal for anyone who:

- Prefer liquidity and ease of use

- Want to invest automatically and broadly diversified

- Are looking for an alternative to Go & Grow with better interest rates

- Are willing to forego deposit protection

Not suitable for:

- Investors with zero tolerance for risk

- Investors who expect complete transparency regarding each individual loan

What is Creditstar?

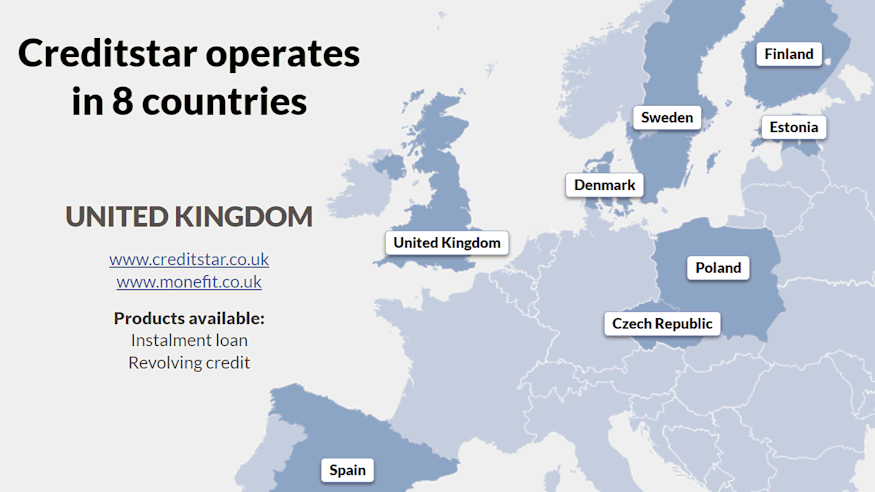

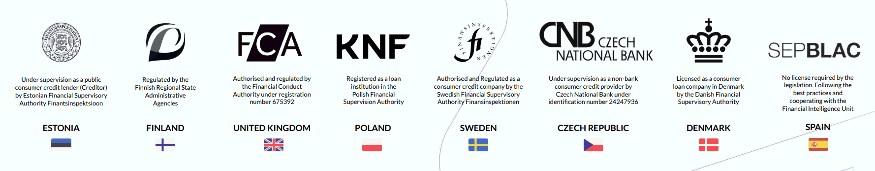

Creditstar is one of the largest and best-known lenders in the Baltics. It has been in operation since 2006 and is licensed and active in many European countries (we will be joining soon).

SmartSaver was created to allow the group to build another financing channel to diversify and secure income streams. They also went down this route with Lendermarket at the time and the platform, although controversial, has since established itself in the market.

Monefit SmartSaver Review – All important at a glance

Before we delve into the details of the Monefit SmartSaver review, here are the key facts summarized for you in one place.

| Started: | 2022 |

| Company: | Monefit Card, part of the Creditstar Group, which has been operating since 2006. Headquartered in Tallinn, Estonia. |

| Product manager: | Kashyap Shah, joined in 2022 |

| Number of investors: | Over 30.000 (active investors) |

| Regulated: | Yes, as a lender in multiple countries, not as a platform. |

| Assets under Management: | Unknown |

| Financed loan volume: | Approximately 302 million EUR. |

| Return on investment: | 7.50 – 10.52 percent p.a. |

| Buyback guarantee: | No |

| Minimum investment amount: | 10 EUR (normal) 100 EUR (Vault) |

| Issuance of a tax certificate: | Yes |

| Investor loyalty program: | Yes (see further down in the article) |

| Monefit SmartSaver bonus | 0.50% cashback after 90 days (Claim it here, no code needed*) + 5 EUR start bonus. |

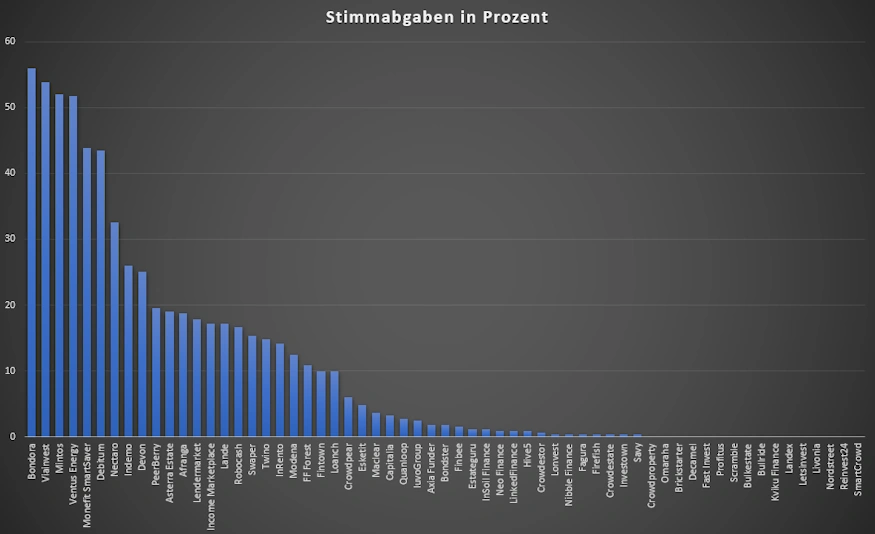

| Rating: | Place 22 | See public rating. |

| Community Voting: | 5th place out of 61 | See results (in German). |

| Latest annual report: | Audited & last published in the year 2024. (Available for inspection) |

Monefit SmartSaver experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Monefit SmartSaver took 5th place out of 61 with 43.8% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Monefit SmartSaver

Investor registration

The registration process for Monefit SmartSaver is relatively straightforward. On the homepage, click on “Sign up” and go through a multi-step process:

- Create your account: You will need to define your email address and password.

- Enter personal information: You will need to provide some details about yourself, such as name, address, etc.

- Document verification: At the end, you will need to verify your identity with your ID card or passport.

After registration, you are ready for the first deposit.

Monefit SmartSaver Bonus

Via my link* you get 0.50% cashback on all deposits you make in the first 90 days after your registration + 5 EUR starting bonus. The first 0.25% will be credited within 5 days, the second 0.25% after 90 days, and you will receive the starting credit immediately.

From time to time there are also time-limited bonus promotions at Monefit. These are always listed promptly in my P2P platform comparison.

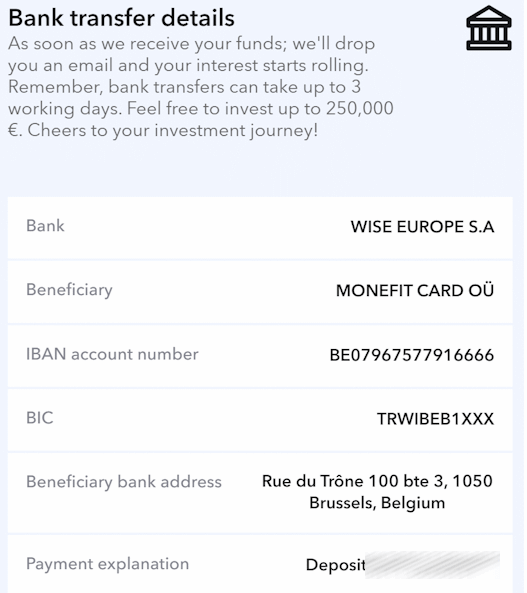

How do I deposit money?

After setting up your account, you can transfer the initial funds to a provided bank account. If you use bank accounts with instant transfers, such as Revolut* or Wise*, the money will be on the account often much faster.

It is crucial to provide the correct reference number when making the transfer; otherwise, your payment cannot be allocated. Additionally, there is an account limit of 500,000 EUR, so you cannot invest more than that amount. Since 2025, you can also use automated savings plans via credit card.

Please also note that Monefit SmartSaver does not allow deposits from joint accounts if, for example, the account is registered to you but has two names on the transfer account.

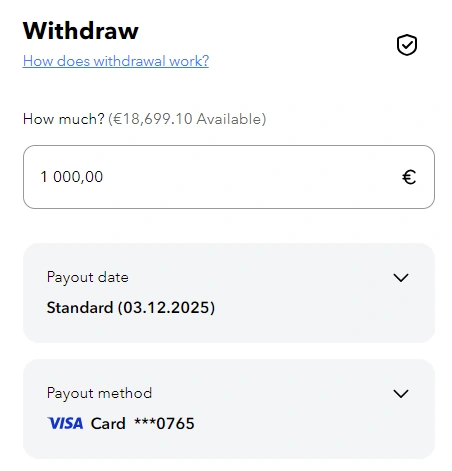

How do I withdraw money?

In your dashboard, you will find the menu item “Withdraw.” Clicking on it allows you to withdraw funds to the bank account you used for depositing. If you want to register a new account, you need to make an initial transfer from that account.

Monefit states that your withdrawals will be processed within 10 days. I have tested this, and the withdrawal was initiated on the 9th day. During the time from your withdrawal request to the actual payout, interest continues to accrue. For the withdrawal, there is a minimum amount of 50 EUR. If your balance is generally below that amount, you can still withdraw your entire account.

Since November 2025, it has also been possible to pay out funds of up to EUR 1,000 to the account in real time and to schedule payouts.

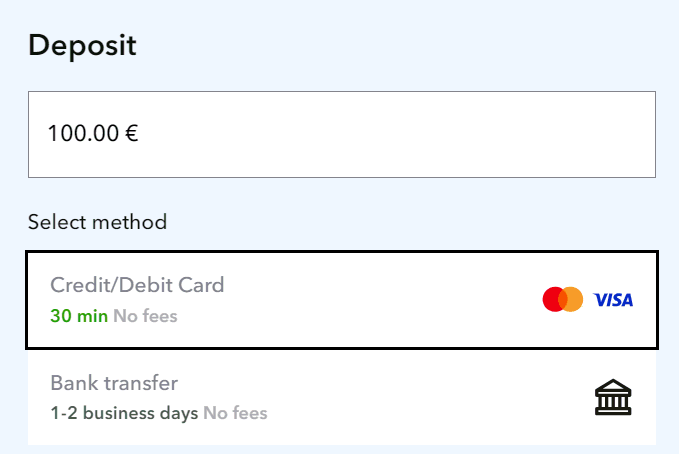

Can I deposit and withdraw with a credit or debit card?

Yes, starting from August 2023, you can also deposit funds into Monefit SmartSaver using a credit card (debit card). In this case, the money is typically available immediately. However, this service incurs a 1% fee.

How does Monefit SmartSaver work?

The beauty of the product and one of the reasons why it is appreciated by many is the fact that after the deposit, you don’t have to do anything at all. Monefit SmartSaver takes care of the entire management in the background! Deposit your money and that’s it. Your only task is to check your interest regularly because, just like with Bondora Go and Grow, the interest is credited daily.

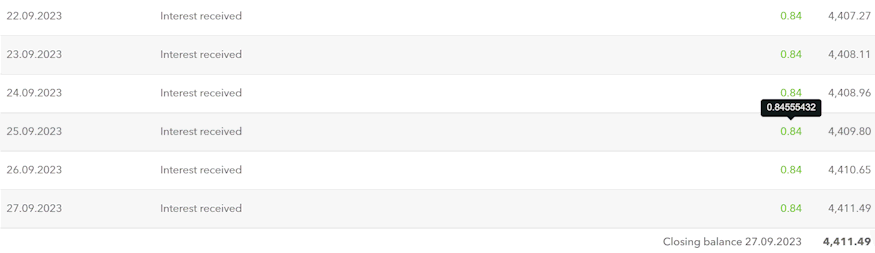

You can track your interest in a relaxed and convenient way in your account statements. Here you can also experience the compound interest effect! You can track the interest to the decimal place by hovering your mouse over the interest credited.

What is the Monefit SmartSaver Vault?

In 2024, Monefit SmartSaver was then expanded to include the “Vault”. This product allows you to invest your money more fixed. In return, you earn more interest, basically like a fixed-term deposit. You have 4 predefined options:

- 6-month term at 8.33%

- 12-month term at 9.42%

- 18-month term at 9.96%

- 24-month term at 10.52%

Here, too, the interest accrues daily, but you only get your money and accrued interest back after the term (apart from the 24-month vault, see below). If you want the money before then, you can do so, but you will then lose the right to the interest. You can use Monefit SmartSaver Vault and your normal SmartSaver account in parallel.

Since 2025, you can also create individual terms of between 6 and 24 months and basically decide for yourself when your vault ends. The interest rates are also flexible. It should also be noted that you can have the interest paid out monthly for a term of 24 months.

Monefit SmartSaver experience: Using the Vault cleverly

Used correctly and with a little more patience when paying out, you can increase your interest by simple means. The technique is called the “fixed-term deposit staircase”. To help you understand, the whole thing is shown in a simple table.

| Month | Vault NR. | Vault | Deposit | Interest rate |

|---|---|---|---|---|

| 1 | 1 | 6 months | 1.000 EUR | 8.33% |

| 2 | 2 | 6 months | 1.000 EUR | 8.33% |

| 3 | 3 | 6 months | 1.000 EUR | 8.33% |

| 4 | 4 | 6 months | 1.000 EUR | 8.33% |

| 5 | 5 | 6 months | 1.000 EUR | 8.33% |

| 6 | 6 | 6 months | 1.000 EUR | 8.33% |

| 7 | 1 | 6 months | 1.040,52 EUR (Vault from month 1 + yield) | 8.33% |

| 8 | 2 | 6 months | 1.040,52 EUR (Vault from month 2 + yield) | 8.33% |

| 9 | 3 | 6 months | 1.040,52 EUR (Vault from month 3 + yield) | 8.33% |

| 10 | 4 | 6 months | 1.040,52 EUR (Vault from month 4 + yield) | 8.33% |

| 11 | 5 | 6 months | 1.040,52 EUR (Vault from month 5 + yield) | 8.33% |

| 12 | 6 | 6 months | 1.040,52 EUR (Vault from month 6 + yield) | 8.33% |

The idea behind this is to create vault after vault and invest money month after month until the first vault comes back. From this point (month 7 in the example), you can create a new 6-month Vault and money will still be returned each month. However, with an interest rate of 8.33% and not the 7.50% that Monefit SmartSaver has without a vault.

Of course, the whole thing also works with 24 months and 10.52% return. I myself have been practicing the technique in exactly the same way since the vaults were introduced. In the investor dashboard you will also find a simple calculator where you can calculate everything.

Tip: If Monefit adjusts the vault interest rate, you can keep the old interest rate if you automatically extend the vaults.

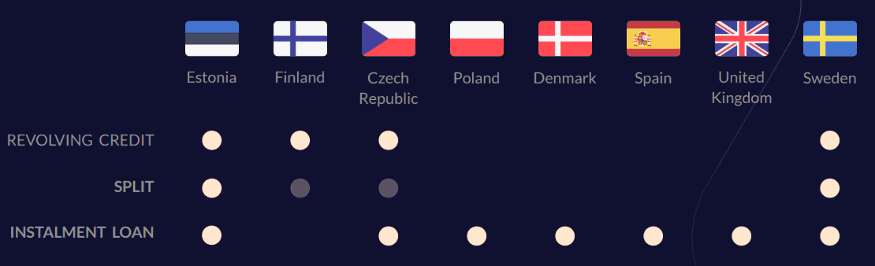

In which countries am I actually investing my money?

If you invest in Monefit SmartSaver, your money is used to finance loans from the Creditstar Group. The Creditstar Group is currently active in the following countries:

- Sweden

- Denmark

- England

- Poland

- Spain

- Czech Republic

- Finland

- Estonia

In what type of loans am I invested?

The Monefit SmartSaver portfolio consists exclusively of consumer loans. There are two types of loans:

- Classic Instalment Loans: Customers have a fixed payment schedule until the loan is fully repaid.

- Credit Line (Revolving Credit, Creditline): Customers have a limited credit limit that they can use, and the repayment frequency is variable.

You can also find out more about the portfolio directly on the Monefit website in a special blog article on the portfolio structure.

What costs are incurred for Monefit SmartSaver?

One of the fundamental principles of Monefit SmartSaver is not to impose any additional fees on investors and savers. Therefore, there are none. This counts as well for all deposits & withdrawals. The only exceptions are credit card deposits and withdrawals, as these also cost the company money.

What is the return on investment with Monefit SmartSaver?

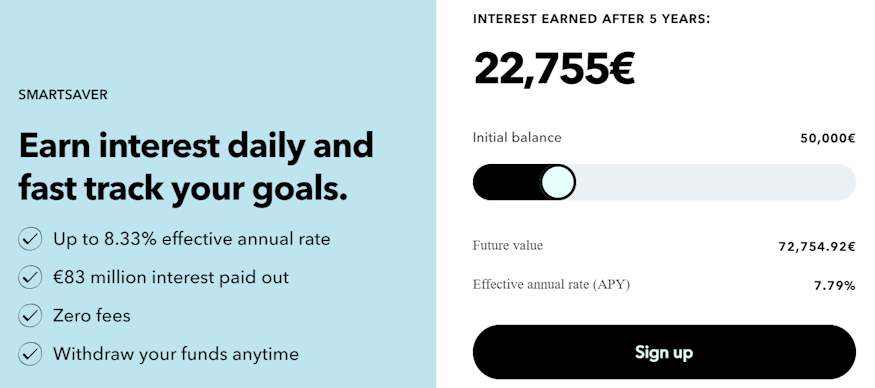

The yield of the product is currently 7.50 – 10.52% per annum. Due to the daily interest payment, which was implemented a few months after the launch, compound interest works strongly for you here.

Please note that this interest rate is subject to change. On the homepage, you can play around with the calculator to see how wealth accumulation behaves. Interest is credited daily.

What is the minimum investment amount for Monefit SmartSaver?

The minimum investment amount is 10 EUR. So, you can start with small sums, which makes the product perfect for beginners in this area.

The minimum amount for Monefit SmartSaver Vault is 100 EUR per vault.

Is there an app for Monefit SmartSaver?

No, there is currently no app for smartphones. The product is still relatively new, and I could imagine that we might see one in the future.

Can you invest money in other currencies?

No, with Monefit SmartSaver, you can only invest in Euros.

How does the taxation work for Monefit SmartSaver?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

The risk of Monefit SmartSaver

Like all investments, Monefit SmartSaver carries risks! You should always keep these risks in mind.

- Monefit is not a bank, and therefore, there is no deposit protection.

- The company can become insolvent.

- The credit portfolio in the background may become unprofitable.

- Withdrawals may be limited, as it has happened with Bondora Go & Grow in the past.

- This is an investment and not a savings account!

- What happens with the money behind the scenes is not known!

To summarize once again: You can lose your entire investment!

How reputable is Monefit as a company?

Monefit is not an unknown brand; it has been providing credit line loans for many years, and that service is still available through the same platform. Additionally, now you can also invest your money as an investor through Monefit SmartSaver.

Behind all this is the team of the P2P platform Lendermarket, which in turn is backed by the Creditstar Group, a well-known player in the P2P universe. Creditstar has been in the market for 16 years, serving over 1.5 million customers, and operating in 8 different countries. Hence, you can expect that investing with Monefit is in a reputable company. As a lender, you are also regulated in each active country.

However, Creditstar’s payment behavior is known to be not the best. On the Lendermarket platform, they push pretty much every limit they have, and investors who had invested in Creditstar loans on Mintos were kept waiting for months, with the blame being shifted more or less to Mintos (see Creditstar Interim Business Report Q3 22, page 5).

That’s not the smart thing to do and also their own investors on the sister platform Lendermarket also had to wait months for stuck funds. However, all debts have now been repaid on Mintos (EUR 8 million) and also on Lendermarket (total unknown).

Why another brand?

But if there is already a P2P platform, why create another brand and website? The reason likely lies in the target audience. While Lendermarket is tailored to traditional P2P investors who want to play around a bit, Monefit SmartSaver focuses on complete automation and customers who want little involvement in platform management. Deposit money and done, similar to Bondora Go & Grow, but with a higher interest rate and a different background story.

Is Monefit SmartSaver save?

Even though I have already been able to collect a lot of information for my Monefit SmartSaver review, the product is still very young. However, it has so far offered good growth and has a growing reputation in the community.

In the end, however, everything depends on the parent company, the Creditstar Group. It will only get exciting when many investors want to withdraw their funds from the platform at the same time.

According to the platform, however, it is prepared for this eventuality and has a corresponding buffer.

Is Monefit SmartSaver a savings account alternative?

Like Bondora Go & Grow, Monefit SmartSaver is often compared to a savings account. This is mainly because the basic properties of the products are the same. You deposit money and receive interest credits. You can also access your money within a short period of time.

However, the comparison is flawed, as there is a major risk that Monefit SmartSaver has that savings accounts do not. The risk of total loss: You can lose all of your money, as there is no deposit insurance.

So use the product with caution, and it can be a nice income-generating addition to your wealth and can be used for many purposes.

Advantages and disadvantages of Monefit SmartSaver

Before we come to a final conclusion about the product, here is a summary of the advantages and disadvantages for this Monefit SmartSaver review.

Disadvantages

- Relatively low return compared to general P2P competitors where I am invested.

- No deposit protection.

- Lack of transparency; you are not sure exactly what happens with your money in the background.

- Monefit SmartSaver is still a very young product.

- Creditstar in the background is a solid company, but known for poor payment behavior.

Advantages

- With Creditstar, there is a company in the background that has been on the market for many years.

- High availability of your money (up to EUR 1,000 even in real time).

- Good opportunity to park your money.

- Possibility to build passive income.

- Good interest rate compared to Bondora Go & Grow.

Monefit SmartSaver vs. Bondora Go & Grow

Monefit SmartSaver feels like a Bondora Go & Grow clone. The exact differences between both products are shown in the following table.

| Category | Monefit SmartSaver | Bondora Go & Grow |

| Return | 7.50 – 10.52 % p.a. | 6,00% |

| Interest Crediting | Daily or after a fixed term (Vault) | Daily |

| Availability | After a maximum of 10 days (however, EUR 1,000 immediately!) or 6 – 24 months (Vault) | Daily |

| Deposit Protection | Not available | Not available |

| Minimum Investment | 10 EUR | 1 EUR |

| Maximum Investment | 500.000 EUR | Not limited |

| Deposit Limit | None | None |

| Product Track Record | Available since 2022 | Available since 2018 |

| Results (Points) | 3 | 7 |

Even though Monefit SmartSaver offers a higher return here, Bondora can still come out on top. However, not every point where Bondora is better may be important for you. So, check what is crucial for you and make your own Monefit SmartSaver review if necessary.

Please also note that Monefit SmartSaver Vault offers additional options that Bondora does not.

Conclusion of my Monefit SmartSaver review

Monefit SmartSaver came as quite a surprise to me at the time. I hadn’t expected Creditstar to come around the corner with another source of funding alongside Lendermarket. Of course, the yield of 7.50 – 10.52% is significant, which is well above the Estonian competition from Bondora Go & Grow and can be seen as a clear challenge.

While Crowdestor Flex was merely a poor copy that could never compete with Bondora Go & Grow, Creditstar, with its solid track record, can provide a genuine alternative with Monefit SmartSaver. I welcome this development because otherwise, Bondora with its excellent product would be completely dominant in the market. As they say, competition enlivens the business.

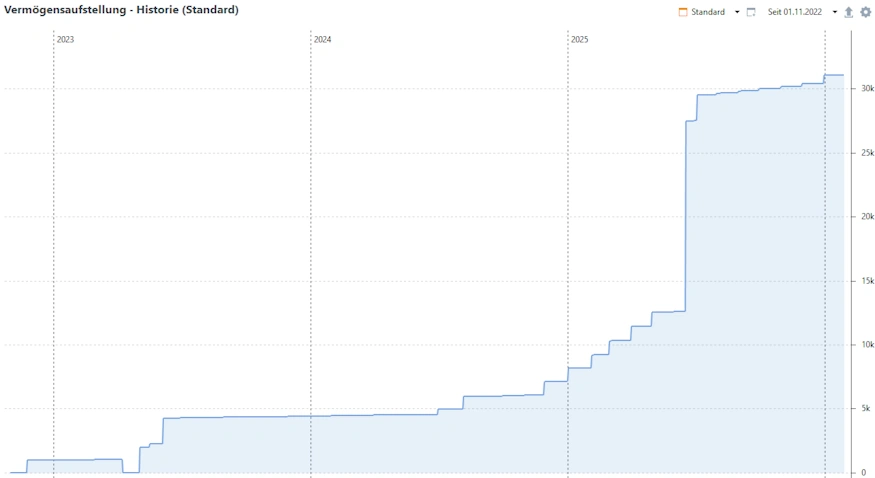

I started here immediately with my own money to see where the journey would take me. Now, in 2026, my portfolio is approaching EUR 40,000, which is also the plan for this year.

In principle, there’s nothing to stop me from withdrawing a few funds from my large Bondora account and investing them in Monefit SmartSaver. If you are aware of the risk of the Creditstar Group in the background, Monefit SmartSaver can be a really interesting product for parking liquidity.

Is there a Monefit SmartSaver bonus or cashback?

Yes, when you start with Monefit SmartSaver, you can enhance your investment with 0.50% cashback after 90 days + 5 EUR star bonus if you register through the button below. You will receive this bonus on all deposits up to the personal limit of 500,000 EUR! Additionally, you can also refer friends, and both the referrer and the referred person will also receive 0.5% cashback after 90 days.

Sign up now for Monefit SmartSaver and get 0.50% cashback + 5 EUR start bonus!*

(The €5 starting credit will be credited immediately, the first 0.25% will be credited after 5 days, and the second 0.25% after 90 days.)

What alternatives are there to Monefit SmartSaver?

There is only one alternative in the market for this product, which is the much older and established Bondora Go & Grow. Here, you have a lower interest rate of 6%, but the assurance that it is a crisis-tested business model, which Monefit SmartSaver still needs to prove. You can find other possible alternatives in the higher-yielding range in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Monefit SmartSaver Review 2026 - Up to 10.52% interest

In my Monefit SmartSaver review, I'll show you how you can easily park your money and earn attractive interest rates (7.50 - 10.52%)

4