Lendermarket Review 2026 – More than 14% return from Estonia?

On this website you will find my Lendermarket review. I was invested in Lendermarket myself between 2022 and 2024. The platform was always on my shortlist due to the high interest rates, but I never had much confidence in the platform, which is why I was very cautious. A good decision! On this page, you can find out everything you need to know about the Irish platform with Estonian roots to get started.

You can find additional tutorials on the homepage of the English section of my blog.

(Every registration receives 1% cashback on all investments made during the first 90 days.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Lendermarket?

- Lendermarket Review – All Data at a Glance

- Investor Registration

- How to deposit Funds

- How does Lendermarket work?

- The Lendermarket Auto Invest

- Is there a Secondary Market?

- In which countries can you invest?

- What types of loans can you invest in on Lendermarket?

- What fees are charged on Lendermarket?

- What is the return on Lendermarket?

- What is the minimum investment amount on Lendermarket?

- Is there a buyback guarantee on Lendermarket?

- Is there an app for Lendermarket?

- Can you invest money in other currencies?

- How does the taxation work for Lendermarket?

- Do I pay withholding tax on Lendermarket?

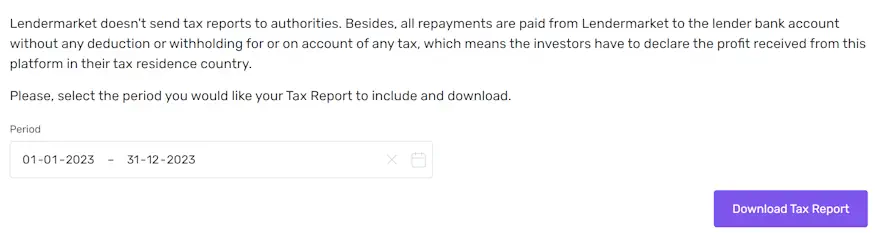

- Is there a tax certificate on Lendermarket?

- Lendermarket Risk

- Lendermarket in Crisis Situations

- Pros and Cons of Lendermarket

- Conclusion of my Lendermarket review

- Lendermarket vs. Mintos

What is Lendermarket?

Lendermarket is a P2P lending platform from Estonia, though it is registered in Ireland. Since 2019, it primarily offers P2P loans in the “Consumer” sector. The P2P platform was what’s called a “Spin Off,” providing virtual access to a traditional lender, similar to Twino. In this case, the underlying lender is the Creditstar Group, which is also listed on platforms like Mintos. Lendermarket is known for offering very high interest rates, which makes it a popular investment choice within the community.

The Creditstar Group is considered one of the more stable but not necessarily the most reliable lenders in Europe. However, in early 2022, the platform underwent a fundamental change, transitioning into a marketplace. They started bringing in companies beyond the Creditstar Group onto the P2P platform to create a broader foundation. Lendermarket, along with the relatively new product Monefit SmartSaver (a kind of Bondora Go & Grow clone), serves as financing tools for the group.

Lendermarket Review – All Data at a Glance

Before we delve into the details of my Lendermarket review, here are the key facts conveniently compiled for you in one place.

| Founded: | The Limited was founded in 2016, but has been operational since 2019 |

| Headquarters: | Dublin, Ireland, registered as Limited |

| CEO: | Carles Federico, since 2023 |

| Regulated: | Yes, holder of the ECSP license since 2025. |

| Assets under Management: | Approx. 61,1 million EUR |

| Financed Loan Volume: | Approx. 614,8 million EUR |

| Number of Investors: | Approx. 21,000 (registered investors, active number unknown) |

| Yield: | 13.46% according to the platform’s official data |

| Buyback Guarantee: | Yes |

| Minimum Investment Amount: | 10 EUR |

| Auto Invest: | Yes |

| Secondary Market: | No |

| Issuance of Tax Certificate: | Yes, download in the form of a PDF is possible |

| Investor Loyalty Program: | No |

| Starting Bonus: | Yes, 1% bonus on all investments made during the first 90 days via this link*. |

| Rating: | Included in the Premium Rating, further information in the public Rating. |

| Last Financial Report: | The latest audited report was published in 2024. |

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

The history of Lendermarket

Investor Registration

Registering on the P2P platform is not overly complicated. In addition to your name and email address, your phone number and address are required. Another identity verification will then take place using the online service Veriff, for which you will need your passport or ID.

After registration and deposit, you are ready to invest in P2P loans on the platform. By the way, always pay attention to platform bonus promotions to gain advantages. An always up-to-date list of all bonuses can be found in my P2P platform comparison. Lendermarket, in particular, is renowned for cashback promotions.

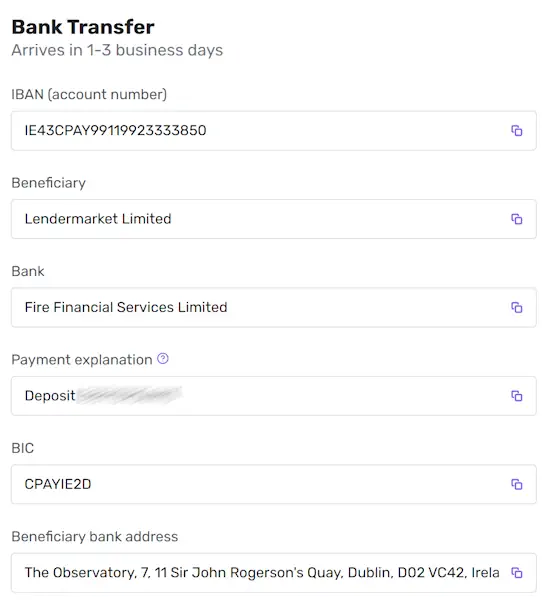

How to deposit Funds

Depositing funds is, as always, the easiest step in investing. In your account, you will see a “deposit” button. When you click on it, you will be provided with transfer details that you can use. You can set up a payment template with your bank for this purpose, just like I have done with many other platforms. Please note that transfers must come from a personal bank account. These will also be verified for future withdrawals.

An investor also reported to me that it’s not possible to open an account if you have a joint account. This should be considered during registration.

How to withdraw money

If you want to withdraw capital or excess interest from the P2P platform, you can use the “withdraw” button in the bottom right corner of your account summary. There are no fees for withdrawing funds.

The funds can only be withdrawn to the bank account from which the deposit was made. If you wish to register a new account for withdrawals, you need to make a new deposit from a new personal account. Please note that there is a withdrawal minimum of 50 EUR on the platform.

How long does the deposit take?

Based on my Lendermarket review, deposits usually take 1 to 2 business days to appear in your investor account. However, if you use services like Revolut*, the transfer often takes only a few minutes.

How does Lendermarket work?

After registration, you have two options to invest your money.

- You can manually invest money on the primary market.

- You can build your portfolio completely automatically using the Auto Invest feature.

As a passive investor looking to save time, the automatic option would be preferable here, as always.

The Lendermarket Auto Invest

On Lendermarket there is an Auto Invest and you can even create more than one and sort by priority.. With Lendermarket’s automatic portfolio builder, you can specify the countries and interest rates you want to invest in. Additionally, the setup process is very straightforward. You can define the following:

- Portfolio size

- Minimum and maximum amount per loan

- Whether you want to reinvest or not

- Interest rate

- Loan term

- and the lenders

Is there a Secondary Market?

No, as of now, Lendermarket does not offer a secondary market. You also don’t have the option to exit your investments early. However, the secondary market is announced. A specific release date has not been provided yet.

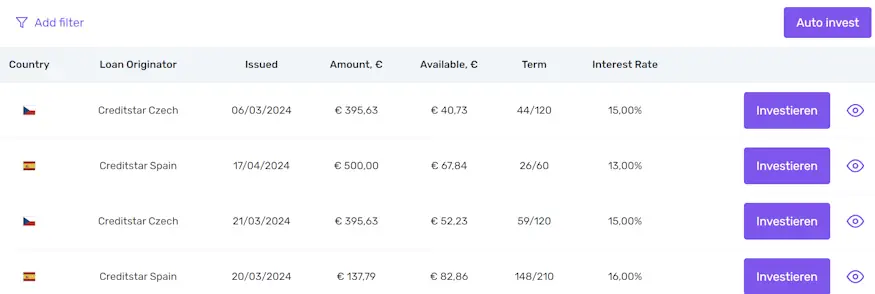

In which countries can you invest?

You primarily invest in P2P loans from the Creditstar Group, which operates in 7 countries: Czech Republic, Finland, Poland, Spain, Estonia, Denmark, and Sweden. In addition, there are now other external lenders available, allowing you to invest in additional countries as well. You can find the complete list of loan originators directly on Lendermarket.

What types of loans can you invest in on Lendermarket?

Investors in P2P loans here primarily earn their returns from loans in the consumer sector. Borrowers directly take loans from the Creditstar Group, which are then listed on the platform, and we, as investors, can allocate funds into these loans.

The business models of external lenders are different. Here, too, there are consumer loans, but also real estate loans.

What fees are charged on Lendermarket?

There are no fees for investors related to investments or other actions on the platform.

What is the return on Lendermarket?

The return you can achieve on Lendermarket is quite substantial. You can always find the officially communicated average in the table above, updated monthly. You can check the statistics of my own portfolio for my numbers. Currently, it’s quite feasible to get loans with 16% interest.

What is the minimum investment amount on Lendermarket?

You need to invest at least 10 EUR per loan.

Is there a buyback guarantee on Lendermarket?

Yes, the P2P platform provides a buyback guarantee. If the borrower is overdue with their payment for 60 days, the loans, including the accrued interest up to that point, will be repaid. However, the individual policies of specific lenders need to be taken into account. Loans from the lender Creditstar, for instance, can be extended multiple times, resulting in a total loan duration of up to 240 days.

Furthermore, there’s something called a “group guarantee.” This provides an additional layer of protection. It’s an enterprise guarantee from the Creditstar Group, which means that in the event of a lender’s insolvency, the Creditstar Group covers all liabilities arising from the buyback obligations of that lender. You can always check which lender offers what security on the Lendermarket website under the “loan originator” section.

Is there an app for Lendermarket?

No, there is currently no smartphone app available for Lendermarket.

Can you invest money in other currencies?

No, you always invest in euros here.

How does the taxation work for Lendermarket?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

Do I pay withholding tax on Lendermarket?

No, on Lendermarket all profits go directly into your own pocket.

Lendermarket Risk

Based on my Lendermarket review, the P2P platform could be an interesting alternative in a P2P portfolio, but it also has some risks that you should be aware of! However, it is also one of the riskiest platforms in the P2P environment!

How does Lendermarket make money?

The P2P platform’s revenue comes from fees charged by the Creditstar Group. Since both companies are more or less connected, it can be said that they rely on the parent company’s revenues. However, with the transition to a marketplace model in early 2022, additional income streams are added.

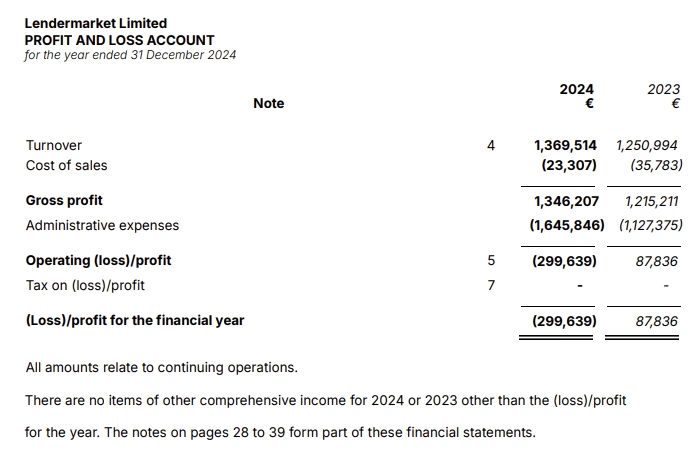

Is Lendermarket profitable?

Since 2020, there are audited financial reports available for Lendermarket Limited, separate from the Creditstar Group. The latest report from 2024 shows a negative result, but it’s important to remember that Lendermarket is a growing startup. So, the result shouldn’t be taken too heavily into consideration. Additionally, they still have the strong backing of the Creditstar Group.

What happens if Lendermarket goes bankrupt?

In the event that the P2P platform faces financial difficulties or has to declare bankruptcy, the company will likely be liquidated by a third party, and existing loans will continue to run. However, it’s important to keep in mind that the P2P platform is part of the Creditstar Group. This aspect further reduces the platform risk.

How reputable is Lendermarket?

Due to the close connection between the P2P platform and the Creditstar Group, which is one of the top lenders on Mintos, it can be assumed that we are dealing with a reputable platform here.

Speaking of Mintos, it’s worth mentioning that in 2022, Mintos investors were kept waiting for many months regarding repayments while the company focused on advancing their own platform. This caused a significant reputation damage that still affects the company.

But that’s not all. In 2023, this game was also played with the company’s own investors, which will continue in 2024. The amount of the outstanding payments is completely unknown. Private investors are definitely not Lendermarket’s or Creditstar’s top priority, you should be aware of that.

How secure is Lendermarket?

Due to its relatively young age, it’s difficult to say much about the security of the company. From an external perspective, everything seems quite solid. Additionally, the Creditstar Group in the background has been in operation since 2006.

However, due to its financial situation, its demise has been predicted for many years. Nothing has happened yet. Nevertheless, if the worst comes to the worst, it will take Lendermarket down with it.

Is there a deposit insurance on Lendermarket?

No, absolutely not. Lendermarket is not a bank and therefore does not fall under any European deposit insurance. All funds you invest on the platform are subject to a high risk of default.

Lendermarket in Crisis Situations

Investors on Lendermarket have been able to navigate through all crises in a relaxed manner so far.

How did Lendermarket perform during the 2020 COVID-19 crisis?

The platform was only founded in 2019, so it doesn’t have much crisis experience. However, the Creditstar Group in the background managed the situation well!

How did Lendermarket fare during the Ukraine crisis in 2022?

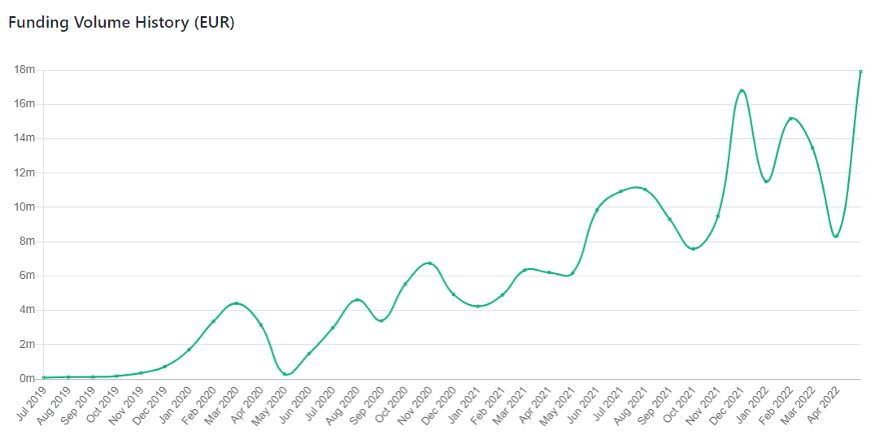

So far, Lendermarket hasn’t shown any signs of problems related to the crisis. However, the yield did increase significantly, which indicates a change in the risk profile of the offered P2P loans. As with most P2P platforms, there was a brief drop in loan volume, but it was quickly recovered.

Pros and Cons of Lendermarket

Before we reach a final conclusion about the platform, here is a summary of the pros and cons of my Lendermarket review:

Cons

- The P2P platform is also listed on Mintos. If you have both platforms in your portfolio and invest in Creditstar loans on Mintos as well, there’s a risk of concentration.

- Although the company behind Lendermarket is 15 years old, the platform itself is quite young.

- Some loans have a rather long duration. Estonian loans on the platform can last up to 7 years.

- Due to the lack of a secondary market, you have no option to exit your investment prematurely.

- The P2P platform is highly non-transparent.

- Communication is definitely not the platform’s strong point.

- It seems that Creditstar is still pulling the strings in the background and Lendermarket has nothing to say in case of doubt.

Pros

- Having the backing of the Creditstar Group provides a partner with over 10 years of profitable operation.

- With an average interest rate of 12 – 14% and even more, investors here can be quite profitable.

- The website is straightforward and easy to navigate.

- All loans come with a buyback guarantee.

- Lendermarket offers loans from relatively low-risk countries.

Conclusion of my Lendermarket review

Lendermarket is still a fairly new P2P platform on the market and it is therefore difficult for me to rate it. However, if I compare it with my other P2P platforms that I started with in 2015, we can already see a significant leap in development here. Unfortunately, they are not making anything of it.

Basically, the way the P2P platform is structured is very reminiscent of Peerberry. They were founded from the Aventus Group and the rest has been a real success story to date. Will we see something similar here?

Unfortunately, the recent past does not speak in favor of this. Hardly any communication, pending payments without repayment plans and a puppet platform of the large Creditstar Group. Lendermarket is unlikely to become a long-term investment (as things stand today).

If you want something simpler and without pending payments, you can also use the Monefit SmartSaver product. It is aimed more at passive investors and works like Bondora Go & Grow, serving many investors as an “overnight money substitute”.

Is there a Lendermarket forum for discussion?

There are several places where you can engage with other investors and gather Lendermarket experiences. There’s also an international investors’ group on Telegram where you can participate in discussions.

Is there a bonus or refer-a-friend program when starting on Lendermarket?

You can refer friends to Lendermarket. Both you and your friend will receive a 1% cashback of your friend’s invested capital after 30 days, up to 3,000 EUR.

What alternatives are there to Lendermarket?

Lendermarket is a P2P marketplace that has grown from a lender on Mintos. You now have to compete with platforms like Mintos itself. Similarly, alternatives include Bondster and Income.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Lendermarket vs. Mintos

I’m often asked by many how certain platforms compare to Mintos or if they are an alternative. In my opinion, both platforms are not directly comparable. The reasons for this are quite simple:

- Mintos is a marketplace with over 60 loan originators, such as the Creditstar Group, in its portfolio. Lendermarket has only recently started adding external loan originators.

- If the Creditstar Group encounters issues with its loans, it’s highly likely that ALL of your P2P loans on Lendermarket will be affected.

- If a similar scenario occurs on Mintos, only a portion of your portfolio will be affected.

As you can see, it’s an “apples and oranges” comparison. However, you can use Lendermarket as a supplement and, for example, remove the loan originator from Mintos from your portfolio.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.