LANDE Review 2025 – Secured agricultural loans with over 10% return?

On this website, you’ll find my LANDE Review. LANDE (formerly LendSecured) is a relatively young platform in the P2P sector, specializing exclusively in secured capital investments in agricultural sector. They were founded in late 2019 in Riga, just before the onset of the COVID-19 pandemic.

I’ve been invested here with a small test amount since the beginning, but officially added the platform to my portfolio in early 2022. I have now invested over EUR 10,000. On this page, you’ll learn everything about the Latvian platform that you need to know to get started.

You can find additional tutorials on the homepage of the English section of my blog.

(up to 2% extra cashback possible until December 31, 2025)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is LANDE?

- LANDE Review – Key Data at a glance

- Investor Registration

- LANDE Bonus

- How does LANDE work?

- The Secondary Market

- The LANDE Auto Invest

- In which countries can you invest?

- In which projects you can invest in on LANDE?

- What fees are charged on LANDE?

- What is the return on LANDE?

- What is the minimum investment amount on LANDE?

- Is there a buyback guarantee on LANDE?

- Is there an app for LANDE?

- Can I invest in other currencies?

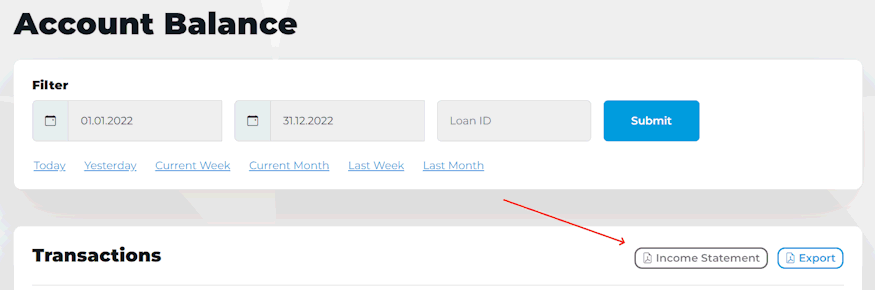

- How does the taxation work for LANDE?

- Is there a tax statement on LANDE?

- LANDE Risk

- LANDE Review in crisis situations

- Advantages and disadvantages of LANDE

- Evaluation of my LANDE Review

What is LANDE?

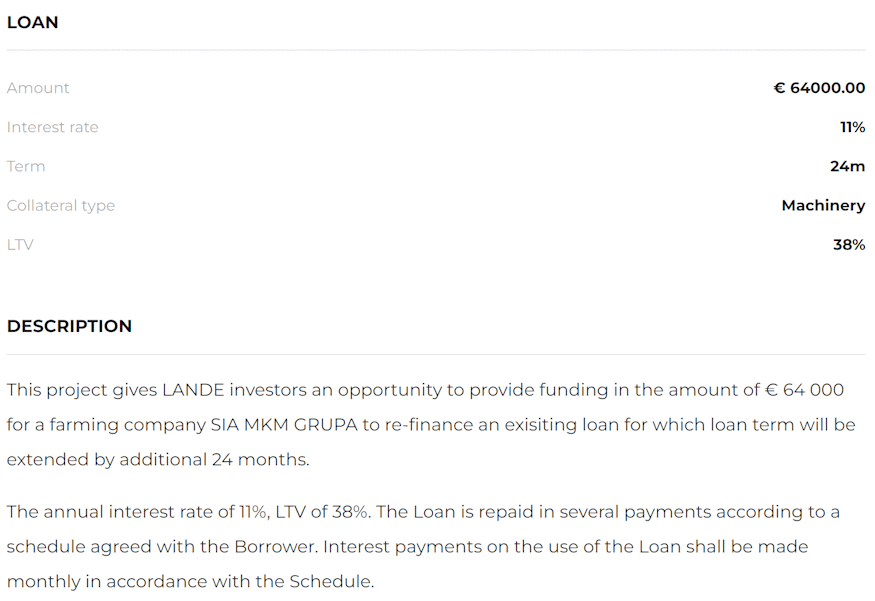

Unlike platforms such as Bondora or Twino, LANDE (formerly LendSecured) doesn’t offer consumer loans and doesn’t rely on a buyback guarantee. Instead, you finance projects here that are always secured with real collateral. If a project defaults, there’s always an asset that can be sold as security. Real estate platforms with similar concepts also show that this concept fundamentally works.

However, unlike Real estate platforms, the Loan-to-Value (LTV) ratio here is only around 42%, whereas Estateguru’s average is nearly 60%. From an external perspective, the projects on LANDE can be considered even safer. Additionally, LANDE funds 5% of each loan itself, aligning its interests with those of the investors. This concept is often referred to as “Skin in the Game.”

LANDE’s project focus lies in the “Agriculture” sector, which might be missing in many investor portfolios. Therefore, the platform can be a valuable addition, as I’ve mentioned in my article “How I Would Invest 10,000 EUR in P2P Loans Today” (in German).

LANDE Review – Key Data at a glance

Before we delve into the details of my LANDE review, here are the most important data points for you in one place.

| Founded: | 2019 |

| Headquarters: | Riga, Latvia, operates under “SIA LANDE“ |

| CEO: | Nikita Goncars, with the company since its founding |

| Regulated: | Yes (notice of the nactional bank) |

| Assets under Management: | Approximately 25,8 million Euros |

| Financed Loan Volume: | Approximately 43,5 million Euros |

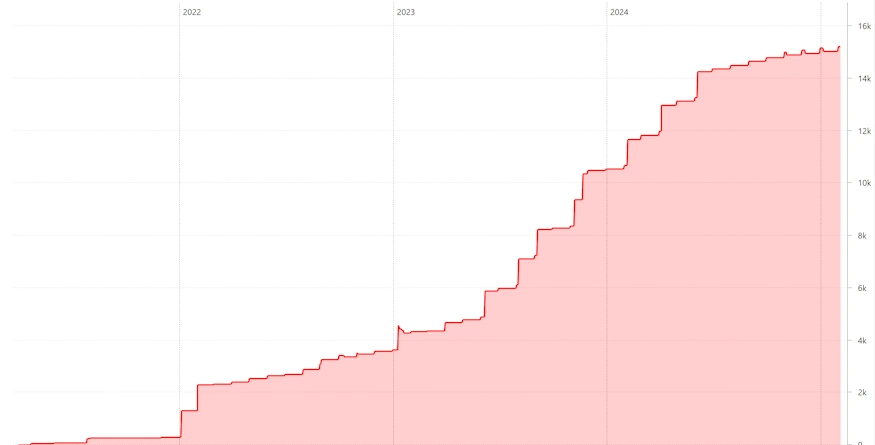

| Number of Investors: | Approximately 9,500 (registered investors, active number unknown) |

| Return: | 11.2% according to official platform data |

| Buyback Guarantee: | No, but all loans are secured with real assets. |

| Minimum Investment Amount: | 50 EUR |

| Auto Invest: | Yes |

| Secondary Market: | Yes |

| Issuance of Tax Certificate: | Yes |

| Investor Loyalty Program: | No |

| Starting Bonus: | 3% cashback after 30 days via this link* |

| Rating: | Place 4 | See P2P Platform Rating |

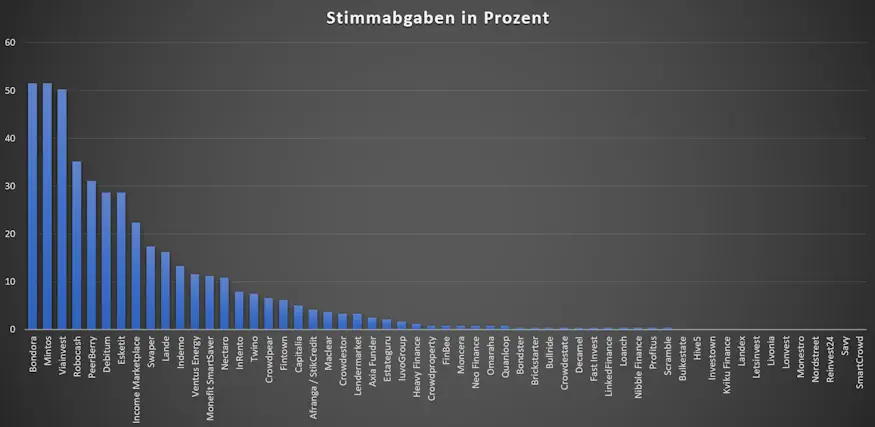

| Community Voting: | 10th place out of 57 | See results (in German). |

| Last Financial Report: | The last one was published their 2024. |

LANDE experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2024, LANDE took 10th place out of 57 with 16.2% of all votes, which can be considered a good result.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

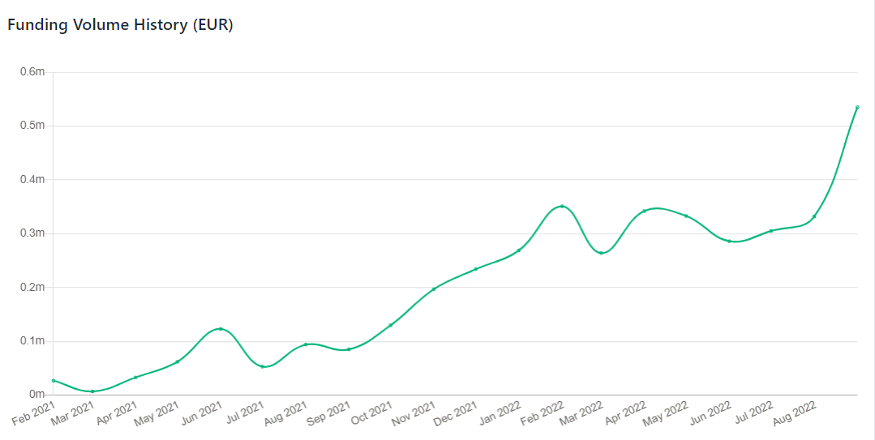

The history of LANDE

Investor Registration

The registration process on the P2P platform is not particularly complicated. To register, you will need a passport or identity card as proof of identity. If you want to link an IBAN account for withdrawals, you’ll also need to provide the recent account statements of the respective account as confirmation that the account belongs to you.

The registration requirements at LANDE are relatively strict. This is mainly due to the separation of investor funds, which are managed through the payment service provider LemonWay. However, these requirements should not be a problem in most cases. After registration and deposit, you are ready to invest in P2P loans on the platform.

LANDE Bonus

Via my link* you will receive 3% cashback on all investments you make in the first 30 days after your registration. If there are any time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

How to deposit funds

Depositing funds is the simplest step when investing. In your account, you’ll find a “Add funds” button. Clicking on this button will display the necessary bank information for your deposit. Please note that the initial transfer must come from a personal bank account, which will also be verified for future withdrawals.

LANDE uses the payment solution LemonWay, which maintains a clearly separate bank account for investor funds. This means you’ll transfer your money to LemonWay, not directly to LANDE, providing an additional layer of security. Additionally, you’ll have a VIBAN, a virtual IBAN within the LemonWay pool, further enhancing the security of your transactions.

How to withdraw funds

If you wish to withdraw capital or excess interest from the P2P platform, you can use the “Withdrawal requests” button located directly below the deposit option. Here, you also have the option to register a personal IBAN account for withdrawals.

How does LANDE work?

Once you’ve signed up on LANDE, there are three different ways to invest on the platform:

- Through the Primary Market

- The Secondary Market

- Using Auto Invest

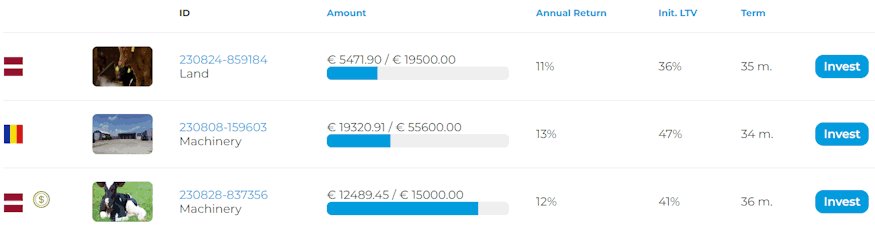

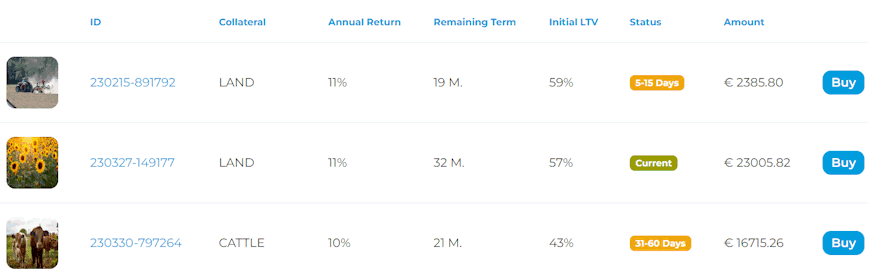

Once you’re logged into LANDE, you can click on “Projects” to access the project overview. Here, you’ll find all the projects available on the Primary and Secondary Markets that you can invest in.

Of course, you can also take a closer look at each project. There, you’ll find detailed information about the loan itself, the repayment schedule, the borrower and the security.

The LANDE Auto Invest

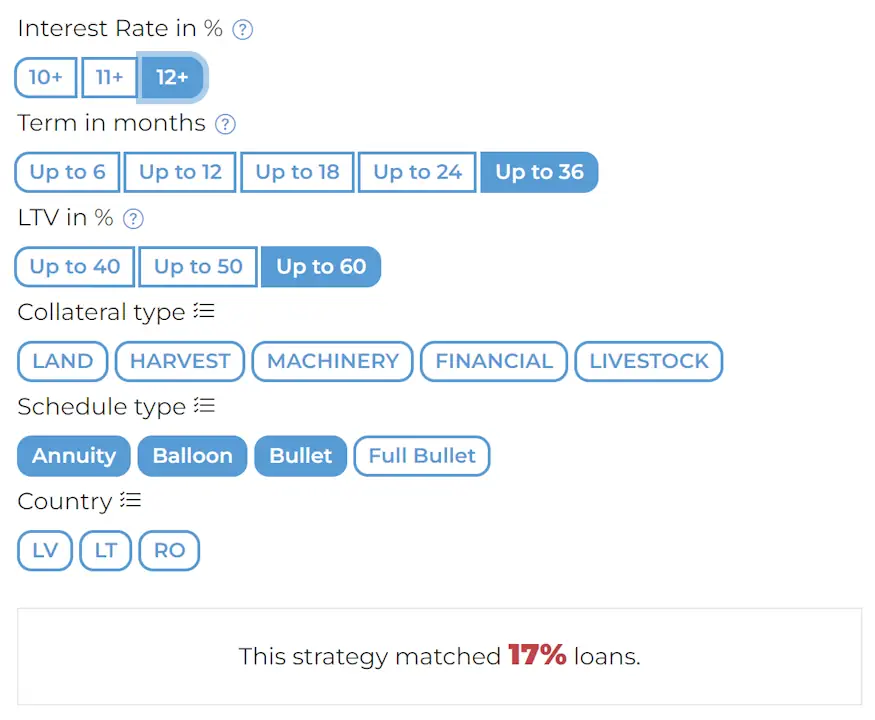

The third way to invest (and this is my personal preference) is through the Auto Invest feature. LANDE introduced this in 2021 and offers it in two different forms:

- Basic Auto Invest: You can invest from 50 EUR

- Advanced Auto Invest: You can invest from 100 EUR

The difference between the two versions lies in the customization options.

With Basic Auto Invest, you can only set the investment amount per project, while with Advanced Auto Invest, you can also specify the interest rate, loan term, LTV (Loan-to-Value ratio) and the type of collateral pledged. It’s important to note that the Auto Invest feature will only invest in newly listed projects. If you activate it and there are already projects on the marketplace at that time, it will ignore them.

In which countries can you invest?

On LANDE you can currently invest in the following countries:

- Latvia (the home market of LANDE)

- Lithuania

- and Romania (not launched until 2023)

With the European Crowdfunding License (ECSP), more countries will certainly be added in the future.

In which projects you can invest in on LANDE?

As an investor on LANDE, you mainly specialize in three areas:

- Grain Loans

- Machinery Loans

- Land

On my YouTube channel, you can see in detail who you are lending your money to, as I have visited one of LANDE’s borrowers. The largest shares in the project mix are machinery loans and land.

The following videos are directly from Latvia. I made them for my German community, however, the content is in English, so that you can enjoy them as well. Have fun!

What fees are charged on LANDE?

There are no fees for investors on the primary or secondary market investments.

What is the return on LANDE?

The return you can achieve on LANDE is individual for each investor. You can always see the current monthly value in the table at the top section of the page. Currently, it ranges between 11 and 12 percent. You can find my own return achieved over the individual years in my statistics (German).

What is the minimum investment amount on LANDE?

On LANDE, you have three different minimum investment amounts:

- Primary Market: 50 EUR

- Secondary Market: 2 EUR

- Auto Invest: 50 EUR (Advanced 100 EUR)

Is there a buyback guarantee on LANDE?

No, there isn’t a buyback guarantee on LANDE. However, each project comes with a real collateral that can be auctioned off in case of default to compensate for any losses. In my experience, this holds more value than a buyback guarantee.

Is there an app for LANDE?

No, LANDE does not offer a smartphone app.

Can I invest in other currencies?

No, at LANDE you invest exclusively in euros.

How does the taxation work for LANDE?

The platform doesn’t deduct any taxes on your behalf. You are responsible for reporting your earnings to the tax authorities in your jurisdiction.

LANDE Risk

From my LANDE review so far, the Latvian agricultural platform appears to be a low-risk addition. Keep in mind, however, that I am only referring to the external numbers and my own experience here.

How does LANDE make money?

According to my research, the company has three sources of profit:

- Project success fee, which is paid by the borrower.

- Support fee, which is the spread between interest rates for investors and borrowers.

- Penalty fee for late loans. Unlike many other platforms, LANDE does not pass this on to the investors, but collects it itself.

Does LANDE operate profitably?

There are audited documents available for inspection. According to these figures, the platform has been operating profitably since 2024, which is a sign of the project’s sustainability. The current figures look very good.

What happens if LANDE becomes insolvent?

If the P2P platform runs into financial difficulties or has to file for insolvency, there is currently no defined plan for how to proceed. Presumably, projects will continue to run in the background as usual and a third party will take over the handling of these.

How secure is LANDE?

Like many P2P platforms, LANDE is as secure as your diversification. This is also the key to your success. However, LANDE follows a strategy with a very low historical LTV, which means additional security for you as an investor.

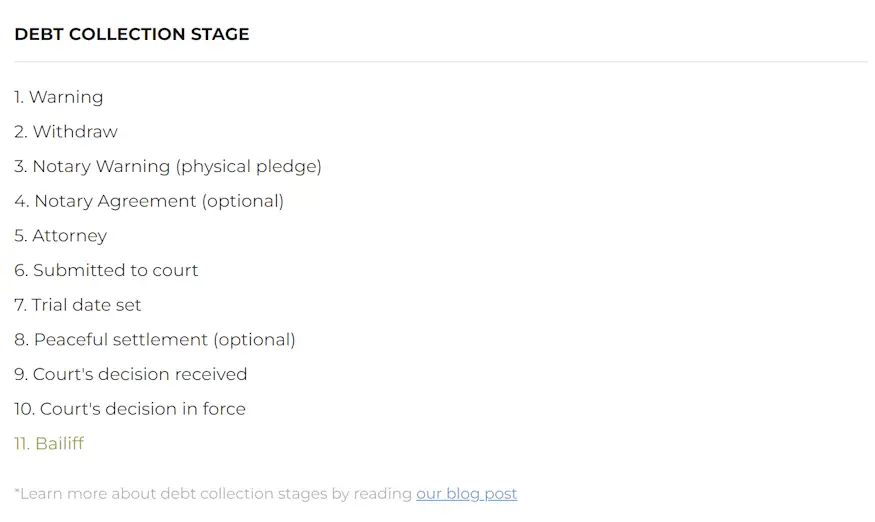

Are there any defaults on LANDE?

There are defaults on LANDE regularly. However, due to the low LTV (Loan-to-Value ratio), investors’ capital wasn’t really at risk so far. You can check the actual default numbers in the statistics.

The recovery efforts are very well documented by LANDE. If there is a failure, you can not only see the status of the loan, there is also an update on the current situation every 30 days.

Does LANDE have a deposit guarantee?

No, although LANDE uses an external payment solution to segregate investor funds, there is no deposit guarantee in place. LANDE is also not a bank and therefore does not fall under any European deposit guarantee schemes. All funds invested on the platform are at high risk of default. However, investor funds are clearly separated from company funds via Lemonway, which provides additional security.

LANDE Review in crisis situations

Investors on the P2P platform have not experienced any problems in crisis situations to date.

LANDE in the COVID-19 crisis

The Latvian agricultural platform was founded just before the COVID-19 pandemic and faced its first major test right away. However, investors experienced no problems.

Advantages and disadvantages of LANDE

Before we come to a final conclusion about the P2P platform, here is a summary of my advantages and disadvantages based on my LANDE review and my external observations.

Disadvantages

- The hurdle of opening an account is significantly higher than you are used to due to the submission of bank statements.

- The company is still a very young platform on the market and does not yet have a track record of more than 5 years.

- Since the platform has picked up a certain momentum, IT has often reached its limits, which leads to annoyance on the investor side.

Advantages

- Unique selling point through focus on the agricultural sector.

- Real separation of investor funds through payment provider LemonWay.

- The LTV is very low, so the projects you invest in are correspondingly safe.

- LANDE is itself involved in each project with 5%.

- The LANDE management team already has a lot of experience.

- To ensure the financing of projects, the platform uses so-called “anchor investors“. These are investors who ensure the financing of projects, should the investor community not be able to finance the project by the end of the project.

Evaluation of my LANDE Review

LANDE is now a five-figure position in my P2P portfolio. With further growth & further establishment of the platform, I could imagine increasing the investment further. I will observe the platform in the coming years and see how it develops before deciding on a larger commitment.

Agricultural projects are also extremely exciting, as they don’t often exist in this form and are still rather underrepresented in my portfolio. I would like to develop this topic further in the future, away from LANDE.

My LANDE on-site Review

In May 2022, I visited LANDE on-site as part of my “P2P Lifestyle” project and took a look at the work of the platform. The purpose of this project is to work with the platforms for 1-2 weeks and accompany them in their daily work. Feel free to take a look at my on-site report. The main part of the video is in English.

Is there a LANDE forum where you can exchange experiences?

There is an international investors’ group on Telegram where you can discuss.

Is there a bonus or friends-refer-a-friend program to start on LANDE?

Yes, there is a general start bonus of 3% after 30 days on the platform through my link. You can also refer friends to LANDE. If you are referred by me, we will both receive 1% of your investment in the first 90 days.

What are the alternatives to LANDE?

There are currently hardly any alternatives to LANDE on the market. The only serious alternative is HeavyFinance from Lithuania. It is also active in the agricultural and land sector. You can find further possible alternatives in my P2P platform comparison.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

LANDE Review 2025 - Secure Investment & 11% Return?

LANDE Review: Here you'll find everything you need to know about the Latvian P2P platform, along with my personal experiences.

5