Indemo Review 2026 – Investing in unusual real estate (15% return)

On this page you will find my Indemo review so far. On Indemo you invest in real estate loans and already defaulted loans in a regulated environment!

I’ve been familiar with the concept of the platform since 2021, and it finally launched in 2023. Since then, I’ve also been invested and have steadily increased my investment. This real estate platform is quite unique in its concept. On the one hand, this makes it very interesting, but on the other hand, you have to understand exactly what you’re getting into.

You can find additional tutorials on the homepage of the English section of my blog.

(Until March 31, 2026, in addition to the 0.5%, another 2.5-5.0% cashback for new and existing investors. More information here. Please note that a minimum investment of EUR 250 is required.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Indemo?

- Indemo Review – Key Data at a glance

- Registration for investors

- How does Indemo work?

- Is there a secondary market?

- Is there an Auto Invest?

- In which countries can you invest?

- What kind of projects can you invest in on Indemo?

- What are the costs on Indemo?

- What is the return on Indemo?

- What is the minimum investment amount on Indemo?

- Is there a buyback guarantee on Indemo?

- Is there an app for Indemo?

- Can I invest money in other currencies?

- How does the taxation work for Indemo?

- Is there a tax statement on Indemo?

- Indemo Risk

- Indemo in times of crisis

- Advantages and disadvantages of Indemo

- Evaluation of my Indemo review

What is Indemo?

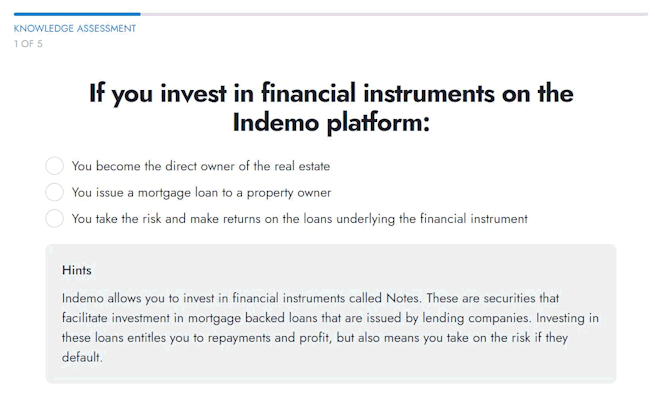

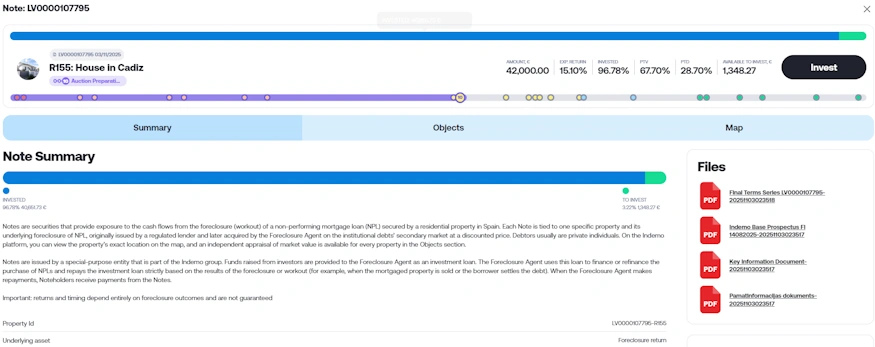

Indemo is a real estate platform from Latvia with some special features that you won’t find on other platforms. First of all, the platform is regulated by Latvia’s central bank and packages properties into so-called notes. In these notes there is one single estate property. All notes have a securities identification number (ISIN) of Nasdaq Baltic. All notes are also part of a SPV (Special Purpose Vehicle) and are managed by Indemo.

On the other hand, there are not only the classic real estate loans (mortgage loans), but also so-called DDIs. DDI stands for “Discounted Debt Investment” or, in other words, loans that have already defaulted. Indemo takes over these loans, buys them at a discount and tries to sell them at a profit in order to achieve an excess return in which we as investors can participate.

The current focus is mainly on Spain, although Indemo could also be active in other countries with its license and probably will be in the future.

Indemo Review – Key Data at a glance

Before we delve into the details of my Indemo review, here are the most important data points for you in one place.

| Founded: | 2022 (launched in 2023) |

| Headquarters: | Riga, Latvia, registered as SIA Indemo |

| CEO: | Sergejs Viskovskis, involved since inception |

| Regulated: | Yes, by the Central Bank of Latvia |

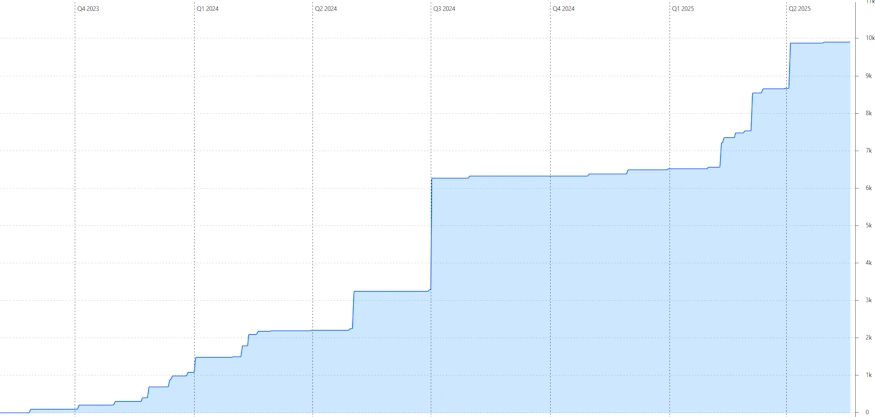

| Assets under Management: | 25.2 million EUR |

| Financed Loan Volume: | 28,3 million EUR |

| Number of Investors: | Over 19,000 (registered investors, active number unknown) |

| Return: | 21,9% according to official information on the website |

| Buyback Guarantee: | No (However, projects typically have collateral) |

| Minimum Investment Amount: | €10 |

| Auto Invest: | Yes |

| Secondary Market: | No |

| Issuance of Tax Certificates: | Yes |

| Investor Loyalty Program: | Yes |

| Signup Bonus: | No. |

| Rating: | Place 12 | Refer to the public rating. |

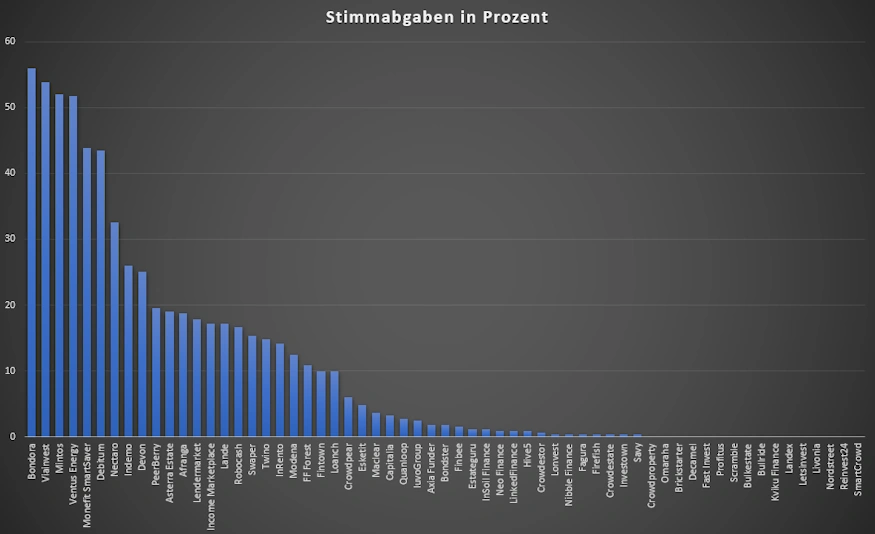

| Community Voting: | 8th place out of 61 | See results (in German). |

| Last Business Report: | The last audited annual report dates from 2024 (view). |

Indemo experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Indemo took 8th place out of 61 with 26.0% of all votes, which can be considered a good result.

- Crypto.com Visa* (Krypto Kreditkarte mit vielen Vorteilen + 25$ Startguthaben*, Infos hier)

- Divvydiary* (professionell Dividenden und das Portfolio tracken)

- Ventus Energy* (Investieren in Energieprojekte mit bis zu 16% Rendite) –> vollständige Anleitung zum Produkt

- LANDE* (Besicherte Agrarkredite mit über 10% Rendite und 3% Cashback) –> vollständige Anleitung zum Produkt

- Monefit SmartSaver* (Liquide verfügbare Anlagealternative mit 7,50 – 10,52% Rendite und 0,50% Cashback + 5 EUR Startguthaben auf die Einzahlung) –> Meine Monefit SmartSaver Erfahrungen

The history of Indemo

Registration for investors

Signing up with Indemo is simple, but a bit more tedious than with other platforms. The following steps need to be completed.

- Creating an account by entering your email address and password.

- Entering your personal data.

- Verifying your identity (e.g. with your ID card).

- Answering the questions of the product suitability test.

You don’t have to do it all at once, you can do the rest after creating the basic account. Keep in mind that the answers to the product suitability test will determine the tools you can use on the platform, so take a few minutes to do it.

After complete registration, you’ll be ready to invest in the first exciting projects on the platform. By the way, always pay attention to bonus promotions of the platforms to give you advantages. You can find a constantly updated list of all bonuses in my P2P platform comparison.

Indemo Bonus

You can register with Indemo via my link* and receive an additional 0.5% bonus. There are also regular limited-time promotions. If there are any time-limited bonus promotions for the platform, these will always be listed promptly in my P2P platform comparison.

How do I deposit money?

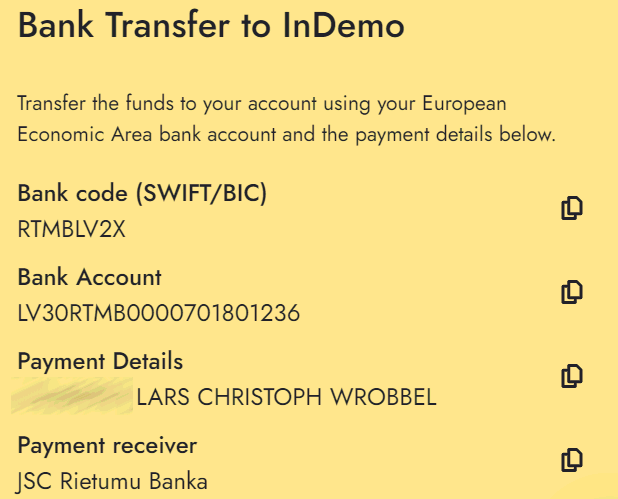

You can make the deposit for Indemo in your account. To do this, go to the “Add Funds” section that you can find in your profile. After that you will be able to see both your previous payment history and the bank account to which you can transfer money. Note that this must come from a personal account with your name!

How do I pay out money?

You do this in the same area, but now you go to the “Withdrawal” tab. Here you can withdraw interest and also your deposited capital, if it is not invested in projects. Please note that for the withdrawal you must use your personal account with the identical name that was used for the deposit.

How long does the deposit take?

According to my previous Indemo experience, the deposits arrive on the same (business) day. I used the free Revolut* account for this purpose. If you use another method, it may take 1-2 business days until the deposited amount is available on Indemo.

Can I deposit and withdraw with credit card?

At the moment you cannot use credit cards for deposits and withdrawals. Therefore, you need to have a bank account that is in your name.

How does Indemo work?

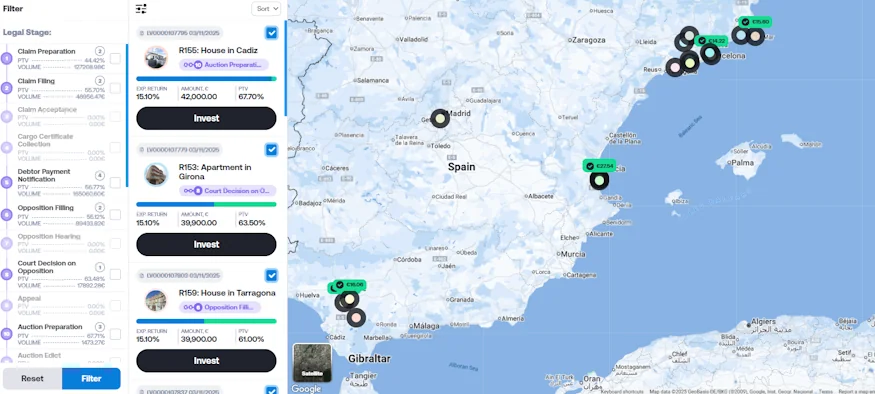

On Indemo you can invest via the primary market or via Auto Invest. On the primary market you will see a large map with the location of the different projects and to the left the notes on offer. On the map, you can filter by various criteria on the map, depending on what is important to you

Within the note view, you will then see the components of the selected note and can find out more about your investment.

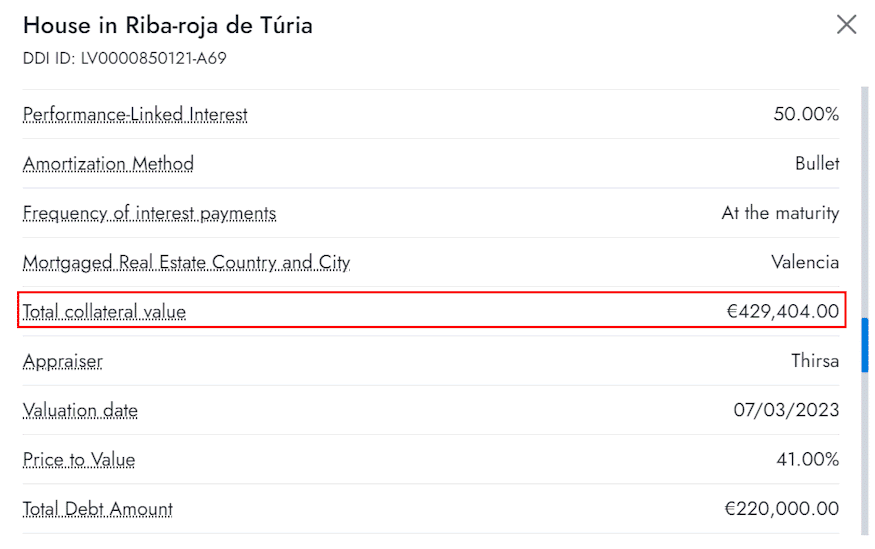

Unlike traditional real estate loans, the decisive factor for DDIs is not LTV (loan to value) but PTV (price to value). This refers to the price paid for the discounted real estate at its actual value and ultimately determines the return.

Once you have decided on a note, you can invest in it and are then bound to your investment until it is completed. As soon as the project is finished, you will receive your money and the return generated. You can see the status transparently and clearly in a pretty awesome flow overview.

Is there a secondary market?

No, at the current time there is no secondary market on Indemo. However, this is currently being planned for 2026.

Is there an Auto Invest?

There is a rather rudimentary Auto Invest on Indemo. You activate it in your main overview as well. You can specify an investment target and also tell it whether you want to reinvest only the principal amount or also the interest. You can also specify the investment category, i.e. DDI or Mortgage Loan.

However, especially in the beginning I recommend you to deal with the projects a bit and not to use Auto Invest. To activate the Auto Invest you need to have money in the account, which is not the case in my example, because I have already invested it 🙂

In which countries can you invest?

Investors on Indemo currently invest exclusively in Spain. However, other countries are possible in principle according to the license. Whether and when these will come is unclear.

What kind of projects can you invest in on Indemo?

On Indemo you invest in 2 different forms of notes and asset backed securities:

- Mortgage Loans (Classic Real Estate Development Loans). The mortgage loans are not yet available.

- DDIs, which stands for Discounted Debt Investments (defaulted real estate loans that are bought cheaply and whose collateral is sold at the highest possible prices).

What are the costs on Indemo?

As an investor you do not have to bear any costs on Indemo at the moment.

What is the return on Indemo?

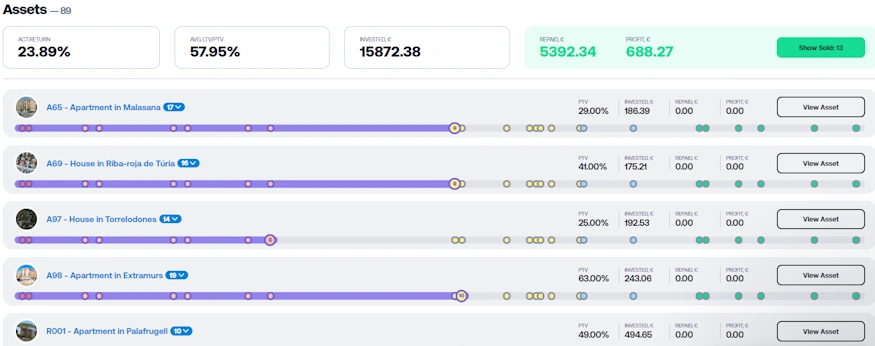

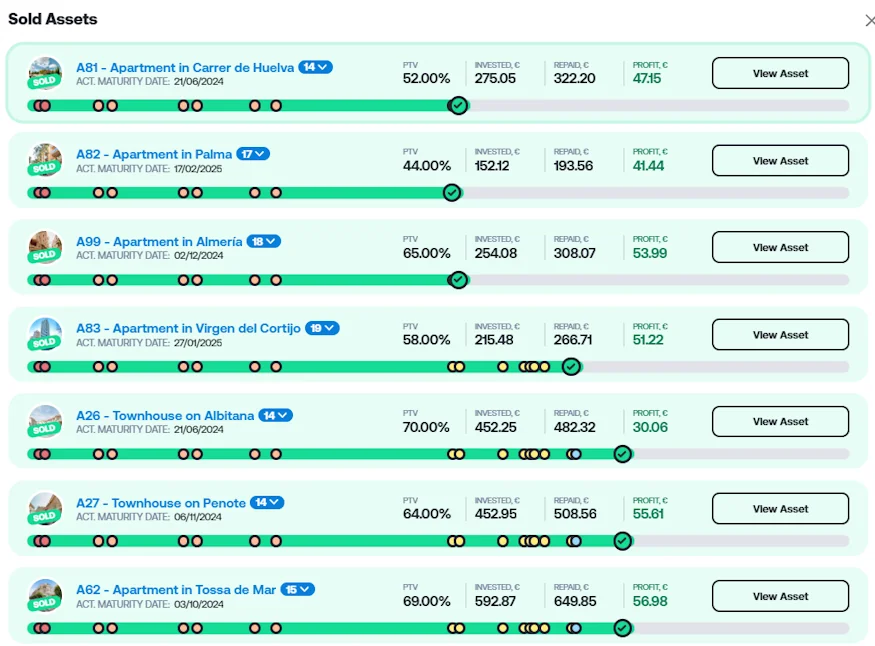

Indemo itself states a return of around 10% for mortgage loans and 15% for DDIs. The average return currently achieved on properties already sold is over 20%, which is extremely good. However, it should be noted that there are no interim payments. The overall return when investing in many projects can be and is therefore much lower, and many investors are disappointed because they lack the patience to wait.

Since 2024, however, projects have been returning regularly with returns of up to over 100%, depending on when you invested. These results are verifiable, as I have invested in many of them myself.

What is the minimum investment amount on Indemo?

The minimum investment amount is only 10 EUR, which is extremely low for a real estate investment.

Is there a buyback guarantee on Indemo?

No, there is no buyback guarantee on Indemo. So you can suffer a total loss of your investment. However, there is always a real security for the project, namely a real estate, which usually has a higher value than a buyback guarantee. You can see the value of the collateral in the respective project profile and evaluate it for yourself.

Is there an app for Indemo?

No, there is currently no app for this platform, and it doesn’t make much sense given the complexity of the information and displays.

Can I invest money in other currencies?

No, you invest on Indemo exclusively in Euro. I don’t think that will change in the foreseeable future.

How does the taxation work for Indemo?

You are responsible for reporting your earnings to the tax authorities in your jurisdiction. But, 5% withholding tax will be withheld! However, due to the double taxation agreement, you can fully deduct this tax from your capital gains tax. If you are not resident in the EU, you pay 25.5% withholding tax which can be lowered to 10% with a tax residence certificate.

Indemo Risk

As a result from my actual Indemo review so far, the Latvian platform seems to be a good, reputable and most importantly unique option in the real estate sector. However, investing on Indemo still comes with risks, which can be realized at any time and which we will now discuss below.

How does Indemo earn money?

Indemo earns money from the sale of the properties, if it comes to that Currently, there are no other sources of income and not much can be gathered from the annual reports yet.

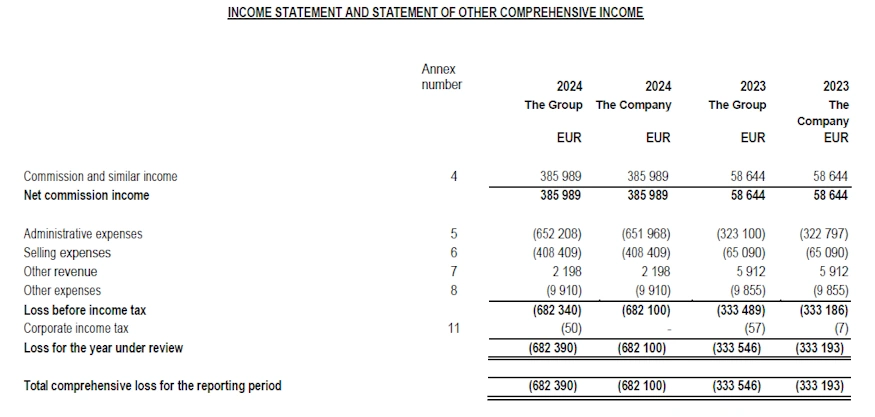

Is Indemo operating profitably?

No, Indemo is still very young and is not yet profitable. An unprofitable platform can become a risk in the long term. In the case of Indemo, however, there is no rush here as the platform is still under construction. In 2024, the loss has increased again compared to 2023. However, this is still completely normal at this stage of the company’s development. You can view all the annual reports on the website.

What happens if Indemo becomes insolvent?

If something happens to the platform, it will not affect your investment for the time being and it will continue to run. In case of insolvency, an insolvency administrator will then take over the processing of the remaining projects & payments and distribute the funds accordingly.

However, we know from past experience that these processes are lengthy and non-transparent. However, none of the previous platform bankruptcies have taken place under the umbrella of a regulator. An insolvency of Indemo is a potential risk for your money, but I consider the probability of occurrence to be low here due to the business model.

How reputable is Indemo?

Right from the start, Indemo is one of the most serious platforms I have seen on the market in recent years. A lot of time has been put into the preparation and the requirement of the regulator. That alone shows that Indemo is not a company that is concerned with making money quickly. Otherwise, they could have launched much earlier and unregulated. However, they have chosen the right path.

How safe is Indemo?

An investment always carries the risk of not getting back some or all of the funds invested, and Indemo is no different. However, the security provided by real assets such as real estate, lowers this immensely. In addition, Indemo purchases the properties at a significant discount, which should further reduce the risk. To date, this concept has worked without any problems.

Are there defaults on Indemo?

In Indemo’s case, this is a funny question because the DDIs are based on defaulted loans. You see, this question makes at best sense for the mortgage loans. To date, however, Indemo has not experienced any losses.

Is there any deposit guarantee on Indemo?

No, definitely not. Indemo is not a bank and therefore does not fall under any deposit guarantee. All the money you invest on the platform is exposed to a risk of default!

However, thanks to the license held by Indemo, there is a state capital guarantee for 90% of your cash assets up to a maximum of EUR 20,000 should the platform turn out to be a scam. How and whether the whole thing works in practice is not yet known, so I would not rely on it.

Indemo in times of crisis

Indemo investors have been relaxed through the crisis so far, as the platform did not officially start operations until 2023.

Advantages and disadvantages of Indemo

Before we come to a final conclusion of the P2P platform, here is a summary of my pros and cons based on my Indemo review.

Disadvantages

- Total loss possible, there are no buyback guarantees.

- Extremely young company.

- Withholding tax of 5% to be paid.

- You need to be very patient. Projects can take 2-3 years to sell.

- The DDIs have no predictable cash flow (only the mortgage loans).

Advantages

- Only 10 EUR minimum investment

- Strictly regulated Latvian platform.

- Good returns in the real estate sector with over 15%.

- Carefully selected projects including collateralization.

- Real collateral in the background.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

Evaluation of my Indemo review

Indemo is still very young, but the initial results of my Indemo experience look excellent. Nevertheless, the platform is still at a very early stage. However, the omens are good that with Indemo we will have an exciting and serious player in the real estate market in the future. I would even go so far as to say that this platform is one of the most exciting we have seen in recent years.

That’s also the reason why I joined right from the start. The plan is to let my portfolio grow bit by bit and to take every project with me to gain experience. I assume a minimum return of 10%.

Is there a Indemo forum where you can exchange experiences?

There are various places where you can exchange ideas with other investors and gain experience with Indemo. The first address for this is an international investor group on Telegram where you can discuss.

Is there an Indemo Bonus or Refer a Friend program to start with?

Yes, you receive EUR 25 from an investment of EUR 100 by the referrer. The referrer also receives EUR 25. However, you must first be registered to use the program.

What are the alternatives to Indemo?

There is no alternative to Indemo for the DDIs, the discounted notes. For the mortgage loans, however, there is. Here one could mention Estateguru, Profitus or even Crowdpear as alternatives. Devon and Asterra Estate also fall into this category.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.

Indemo Review 2026 - Over 15% return possible?

Great platform for diversifying within an asset class (real estate).

5