Esketit Review 2026 – 11% return on investment and a serious company in the background

Are you looking for an exciting new P2P platform with solid returns? Then Esketit might be worth your attention! Since its launch in 2021, the platform has quickly gained traction – thanks in part to its connection with an established loan originator from the Mintos ecosystem.

This guide will give you everything you need to know about Esketit: How does it work? What are the risks and opportunities? And most importantly – is it worth investing in? I’ll share my personal experiences to help you make an informed decision.

Esketit has already received positive feedback in the P2P community. But what’s really behind the name, which translates to “Let’s get it”? Let’s take a closer look at the platform!

You can find additional tutorials on the homepage of the English section of my blog.

(1% extra cashback until 10 March 2026. Further information here.)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Esketit?

- Esketit Review – Key Data at a glance

- Investor Registration

- Esketit Review – How does the platform work?

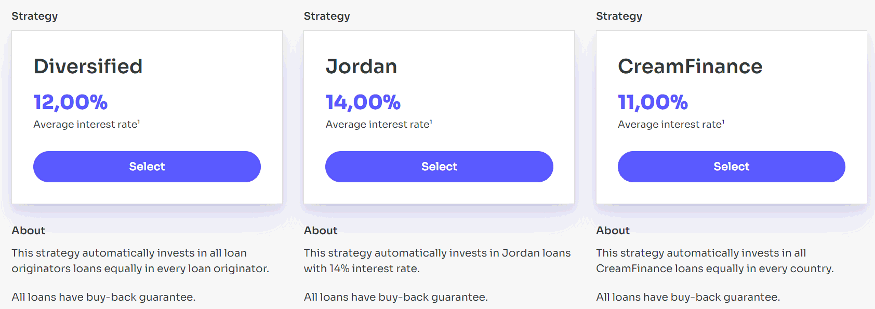

- The Esketit Auto Invest

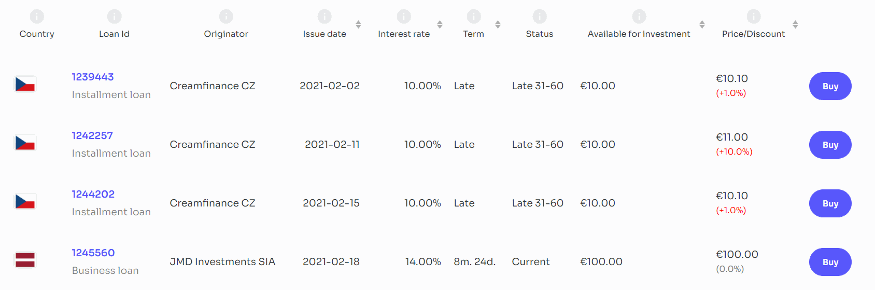

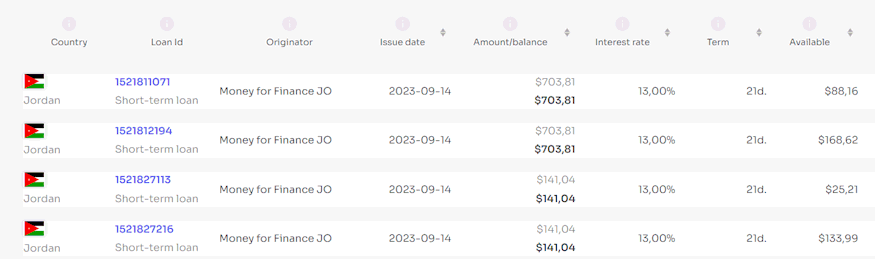

- In which loans you can invest in on Esketit?

- In which countries can you invest?

- What fees are charged on Esketit?

- What is the return on Esketit?

- Do I also receive the interest for late loans?

- What is the minimum investment amount on Esketit?

- Is there a buyback guarantee on Esketit?

- Is there an app for Esketit?

- Is there an Secondary Market of Esketit?

- Can I invest in other currencies?

- How does the taxation work for Esketit?

- Is there a tax statement on Esketit?

- Esketit Risk

- Esketit Review in crisis situations

- Advantages and disadvantages of Esketit

- Evaluation of my Esketit Review

What is Esketit?

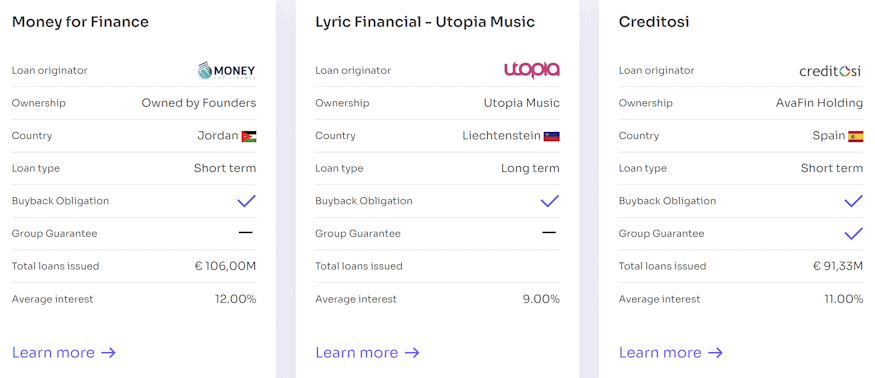

Esketit is a P2P platform based in Riga but registered in Croatia. Its business model is similar to that of the Lendermarket platform, which we have already reviewed here on the blog. As with Lendermarket, there was a larger corporate group behind it (though not as shady). CreamFinance or the new brand AvaFin, a well-known and established former Mintos lender.

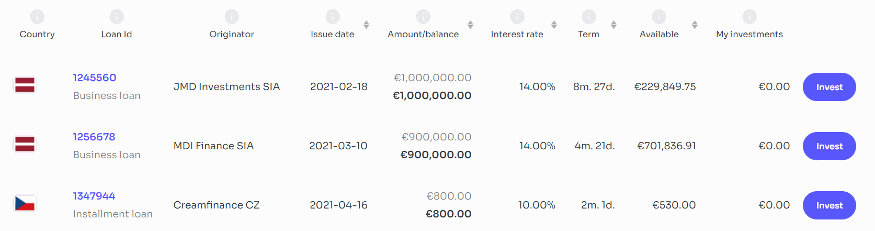

According to my Esketit review so far, the P2P platform is aimed at private investors and currently offers short-term P2P loans (consumer loans) from its parent company CreamFinance / AvaFin.

However, business loans are also occasionally available on Esketit. CreamFinance/AvaFin has been in existence since 2012 and employs 400 people from around 15 countries. It combines several loan brands under one roof. In addition, the company announced in 2023 that it would open its platform as a marketplace and bring the first external lender on board. In the meantime, the product range has been significantly expanded.

In 2025, AvaFin decided to withdraw from the P2P business, and Esketit has been standing on its own two feet ever since.

Esketit Review – Key Data at a glance

Before we delve into the details of my Esketit review, here are the most important data points for you in one place.

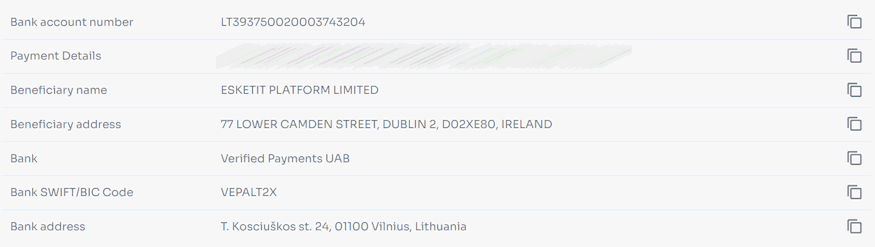

| Founded: | 2020 as Esketit Platform Limited in Ireland (active since 2021), renamed Esketit Platform d.o.o. in Croatia in 2025. |

| Headquarters: | Croatia, Zagreb (team located in Riga, Latvia) |

| CEO: | Ieva Grigaļūne, joined in 2025 |

| Regulated: | No |

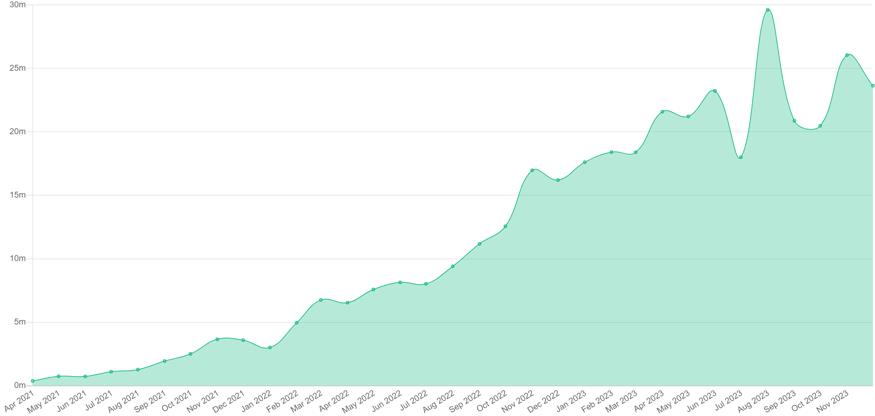

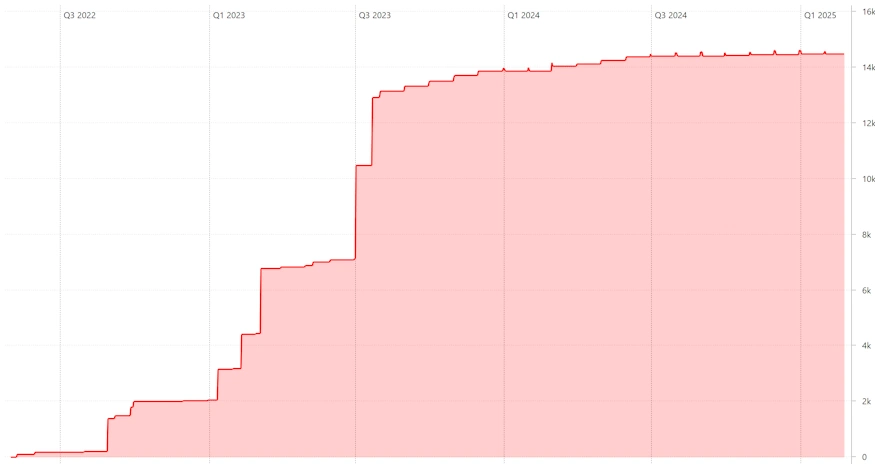

| Assets under Management: | Approximately 46,3 million EUR |

| Financed Loan Volume: | Approximately 966,6 million EUR |

| Number of Investors: | Approximately 28,600 (registered investors, active number unknown) |

| Return: | Approximately 11.83% according to official information |

| Buyback Obligation: | Yes (business loans generally do not have it) |

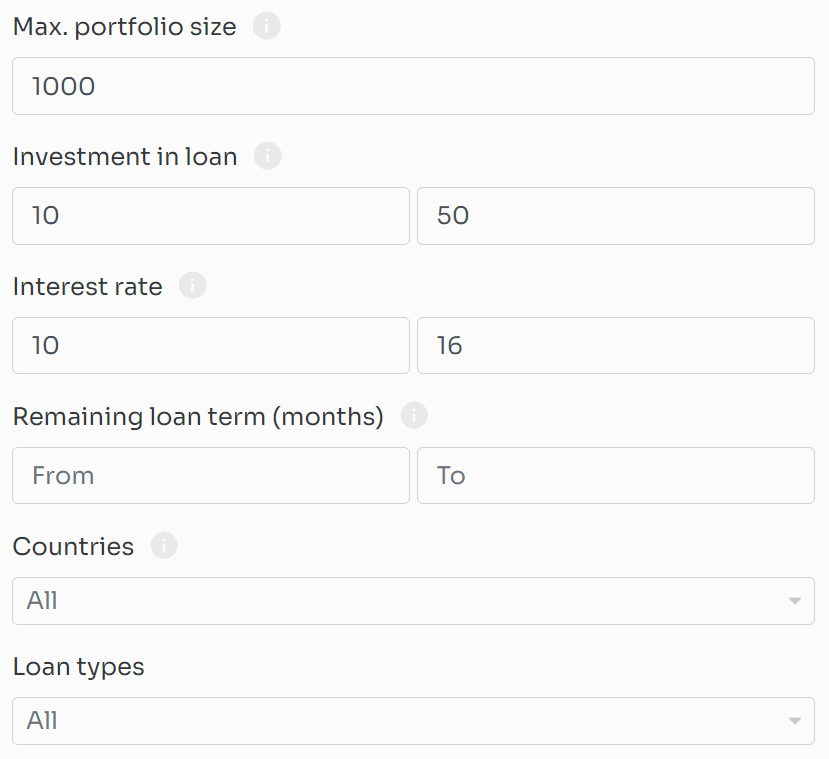

| Minimum Investment Amount: | 10 EUR |

| Auto Invest: | Yes |

| Secondary Market: | Yes |

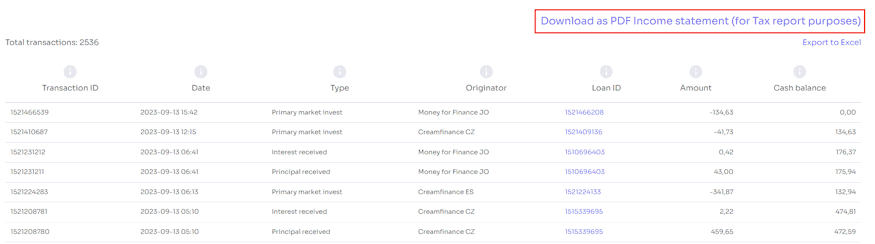

| Tax Certificate Issuance: | Yes, you can download an account statement in Excel. |

| Investor Loyalty Program: | Yes, up to 1.0 percent more. |

| Starting Bonus: | Yes, 0.5% cashback after 90 days through this link* |

| Rating: | Place 17 | See public rating. |

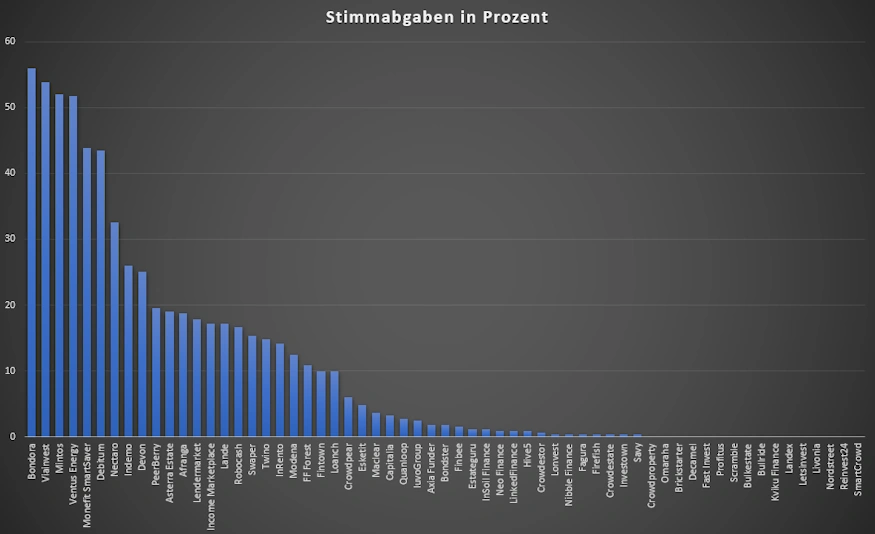

| Community Voting: | 25th place out of 61 | See results (in German). |

| Last Annual Report: | Latest audited annual report of the AvaFin Group from 2023 (not relevant anymore). |

Esketit experiences of the community

Once a year, I ask our community for their top 5 P2P platforms. In 2025, Esketit took 25th place out of 61 with 4.8% of all votes, this represents a sharp decline compared to the previous year.

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.