Freedom24 review 2026 – International broker with numerous opportunities

On this page you will find my Freedom24 experiences so far. Freedom24 gives you access to many international financial instruments. Reason enough to take a closer look at this broker.

On my blog, you will also find additional tutorials about other platforms.

(Until 30.04.2026 up to 20 free shares worth between 3 and 800 US dollars each on deposit! More information here)

Please note my disclaimer. I do not provide any investment advice or make any recommendations. I am personally invested in all the P2P platforms I report on. All information is provided without guarantee. Past performance is not indicative of future results. All links to investment platforms are usually affiliate/advertisement links (possibly marked with *), where you can benefit, and I earn a small commission.

Inhalte

- What is Freedom24?

- Freedom24 Review – All the important at a glance

- Investor registration

- How do I deposit money?

- How do I withdraw money?

- How long does the deposit take?

- Can I deposit and withdraw with a credit or debit card?

- What costs are incurred for Freedom24?

- What is the minimum investment amount for Freedom24?

- Is there an app for Freedom24?

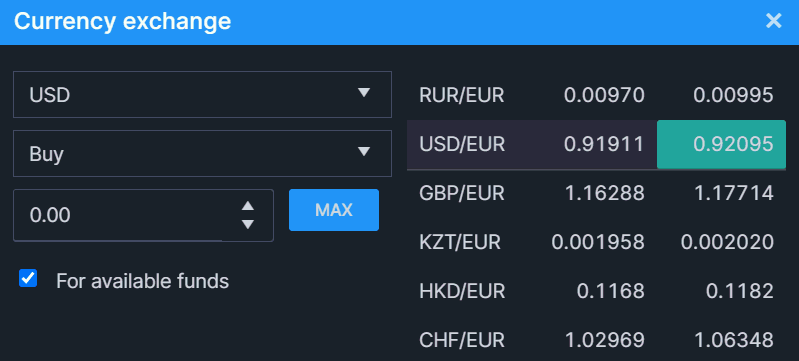

- Can you invest money in other currencies?

- How does the taxation work for Freedom24?

- The risk of Freedom24

- Conclusion of my Freedom24 review

What is Freedom24?

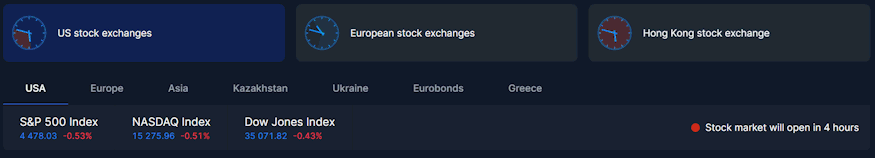

Freedom24* is an authorized online broker in the EU that offers a wide range of investment opportunities in over 40,000 stocks and 1,500 ETFs from leading exchanges in Europe, Asia, and the USA.

The company Freedom24 is part of the Freedom Holding Corp and is listed on Nasdaq. It is operated by Freedom Finance Europe Ltd., which is regulated by the Cyprus Securities and Exchange Commission.

With Freedom24, you can invest in a variety of stocks and ETFs from exchanges like NASDAQ, NYSE, CME, HKEX, Euronext, LSE, Deutsche Börse, and others.

Freedom24 Review – All the important at a glance

Before we delve into the details of the Freedom24 review, here are the key facts summarized for you in one place.

| Started: | 2008 |

| Headquarters: | Cyprus |

| CEO: | Timur Turlov, Founder & CEO |

| Regulated: | Yes |

| Market capitalization: | EUR 4.5 billion |

| Security: | No |

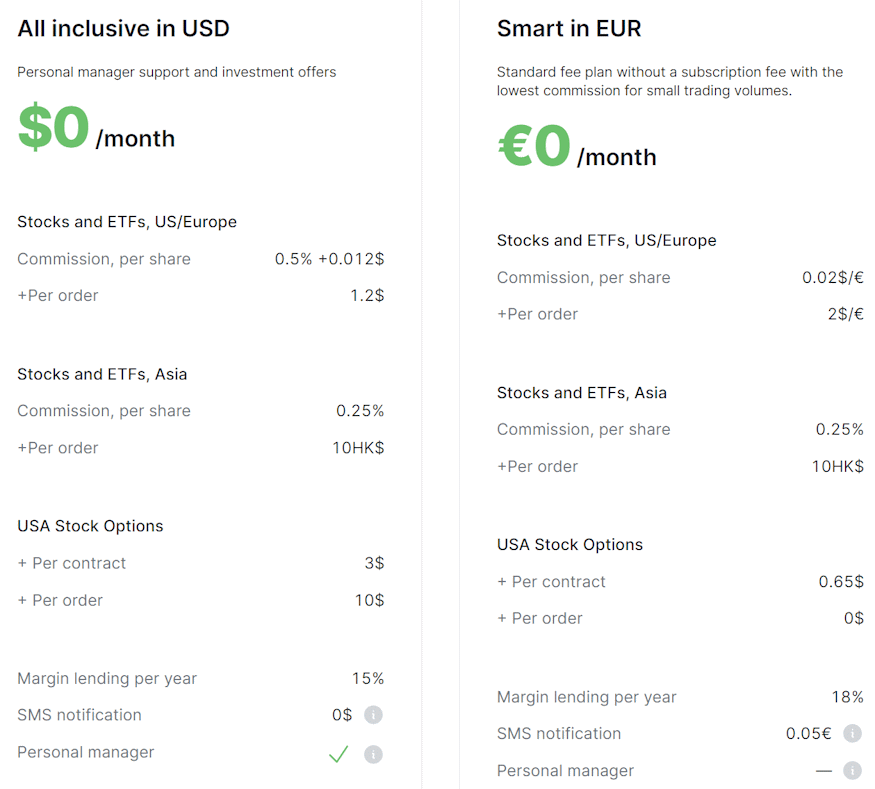

| Trading Fees: | From €0.008 per share, depending on the trading plan |

| Minimum investment amount: | No |

| Account Management: | Free |

| Investor loyalty program: | Yes, there are advantages from EUR 100,000! |

| Freedom24 bonus | Yes, up to 10 free stocks. Further information here. |

| Latest annual report: | You can find the latest reports here. |

- Crypto.com Visa (Crypto credit card with many benefits + 25$ starting bonus, info here)

- Freedom24 (International broker with access to almost all shares worldwide –> guide to the product).

- LANDE (Secured agricultural loans with over 10% return and 3% cashback) –> Complete guide to the product.

- PeerBerry (right now one of the best P2P platforms in my portfolio) –> Complete guide to the product.

- Monefit SmartSaver (Liquid and readily available investment alternative with 7.50 – 10.52% return and 0.50% cashback on deposits + 5 EUR startbonus) –> Complete guide to the product.

Investor registration

Signing up with Freedom24 is relatively straightforward and similar to any other broker:

1. Create an account by entering your email address and password.

2. Verify your identity (e.g., with your ID card, passport, or residence permit).

After registering and verifying, you’re ready to start investing in the exciting stocks you’ve added to your watchlist. Of course, you’ll also need to deposit funds to do so.

How do I deposit money?

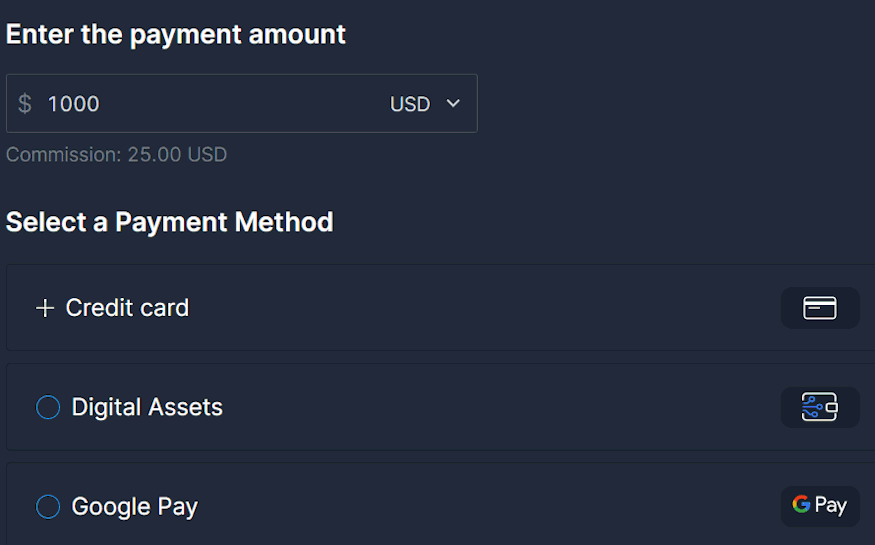

You can make deposits on Freedom24 through your account. To do this, go to the “Deposit” section and then choose your preferred deposit method (credit card or bank transfer). Afterward, you transfer the desired amount of money.

How do I withdraw money?

To withdraw funds, you proceed to the “Withdraw” section. In order to take action here, you need to initiate a “secure session.” To do this, you’ll receive an SMS code on your smartphone. Then, you return to the “Withdraw” option in the menu and can specify an account where the withdrawal should be sent. Please note that Freedom24 charges 7 EUR per withdrawal request.

How long does the deposit take?

The deposit into the investment account takes 1-2 business days. However, if you use services like Revolut*, it is usually available faster. If you use the credit card deposit option, the money is available immediately.

Can I deposit and withdraw with a credit or debit card?

Yes, on Freedom24, you can also deposit new funds using your credit card. Please note that this incurs a 2.5% commission. In addition to the credit card option, you can also deposit using Google Pay.

What costs are incurred for Freedom24?

Account management itself is free, but Freedom24 does have a range of costs for various services. These can be viewed on the respective page to get a clear picture and make comparisons with other brokers.

Some costs can be reduced through monthly memberships. Each investor needs to calculate whether this could be worthwhile for them or not. I am currently in the free “Smart EUR” tariff, which is automatically activated.

Memberships can quickly pay off if you trade frequently.

What is the minimum investment amount for Freedom24?

There is no dedicated minimum investment amount for Freedom24.

Is there an app for Freedom24?

Yes, there is an app for Freedom24 that allows you to conveniently manage your broker transactions right from your smartphone.

How does the taxation work for Freedom24?

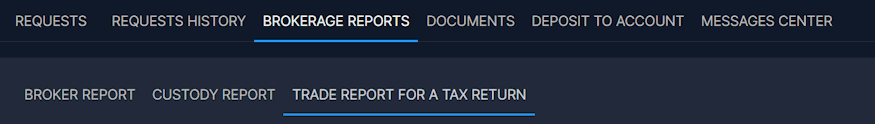

As an international broker, Freedom24 logically doesn’t withhold taxes for you, except potentially deducting withholding tax on dividend payments. You need to take care of this yourself. The necessary information is provided by Freedom24, and you receive detailed information on every financial transaction for tax purposes. To do this, you download the “Trade Report for A Tax Return” from the member area.

Please note that at least one year must have been completed for tax purposes. If you need information on transactions prior to that, you can use the “Broker Report”.

The risk of Freedom24

Like all investments, Freedom24 carries risks! You should always keep these risks in mind.

- The deposit protection is limited!

- The company can become insolvent.

- Withdrawals may be limited, due to various reasons.

To summarize once again: You can lose your entire investment!

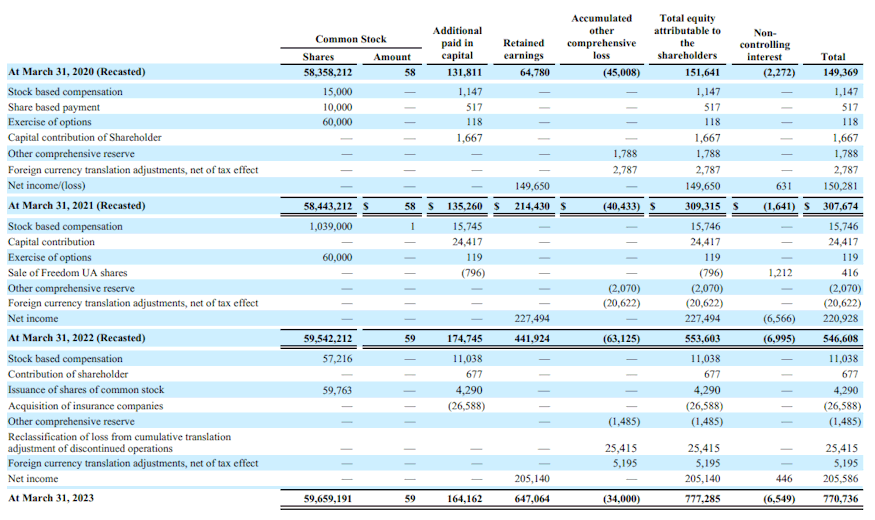

Is Freedom24 profitable?

Freedom24 is a subsidiary of the Freedom Holding Corp., whose financial reports are publicly accessible. It’s important to review how profitability has been evolving. Recently, they have been profitable.

What happens to my stocks if Freedom24 goes bankrupt?

When you buy stocks through Freedom24, they are held in your name at a custodian bank. This means that you are the legal owner of the stocks, not Freedom24. If Freedom24 goes bankrupt, you still have the right to your stocks and can reclaim them from the custodian bank. Your stocks are not part of Freedom24’s bankruptcy estate and cannot be seized by creditors.

However, there might be a period during which you cannot access your stocks until the bankruptcy administrator for Freedom24 is appointed. You would then need to contact the bankruptcy administrator in writing and request the release of your stocks. This process can take several months, and during this time, you would not be able to trade with your stocks.

How reputable is Freedom24 as a company?

Freedom24 appears to be a reputable online broker due to its presence and parent company, offering customers a variety of trading opportunities. However, one should also be aware that there are certain risks and drawbacks, such as the limited deposit protection. Moreover, there was also a recent report by the short seller Hindenburg Research that casts serious doubts on the integrity of the parent company.

Each investor must draw their own conclusions from this information. After my personal Freedom24 review and because of the fact, that I can transfer my stocks somewhere else if needed, the risk is fine for me.

Is there deposit protection?

Yes, there is deposit protection on Freedom24. Deposit protection safeguards customer capital against a potential broker failure. At Freedom24, customer funds are protected up to an amount of 20,000 euros, even in the event of the broker’s insolvency.

Advantages and Disadvantages of Freedom24

Before we reach a final conclusion about the broker, here’s a summary of my pros and cons based on my Freedom24 review.

Disadvantages

- Controversial research from Hindenburg Research has damaged the reputation.

- No deposit protection beyond 20,000 EUR.

- The interface is not particularly beginner-friendly.

Advantages

- Access to more than 40,000 stocks on over 20 exchanges in Europe, the USA, and Asia.

- Regulated by CySEC.

- Cost-effective conditions.

Conclusion of my Freedom24 review

Freedom24 is a broker that specializes primarily in trading stocks and options. For me, it landed on my radar mainly because of the access to CEFs, as I could otherwise only buy them from the expensive broker Swissquote. Thanks to Freedom24, I was able to avoid the costs for a while. Unfortunately, this is no longer possible today.

To summarize my Freedom24 review. You can expect a broker that is more suited for experienced investors who are particularly interested in exotic stocks and want to benefit from the advantages of an international broker.

However, it’s important to also consider the disadvantages of Freedom24, especially the lack of deposit protection beyond 20,000 euros and the potential fees that might not be immediately obvious.

What alternatives are there to Freedom24?

As an international alternative, I personally like to use CapTrader*, a reseller of Interactive Brokers. Here, too, you have access to many exchanges worldwide and can trade at very low costs.

Then take a look at my P2P platform comparison now. There you will find more information and/or articles about the platforms where I invest.

About the author

Hi there! I’m Lars Wrobbel, and I’ve been writing on this blog about my experiences with investing in P2P loans since 2015. I also co-authored the German standard work on this topic with Kolja Barghoorn, which became a bestseller on multiple platforms and is regularly updated.

In addition to the blog, I host as well Germany’s largest P2P community, where you can exchange ideas with thousands of other investors when you need quick answers.